DOGE promises are sus

Chuck E. Cheese

To calculate the volume of a pizza with radius “z” and height “a”, use this formula:

pi * z * z * a

DOGE promises are sus

Chuck E. Cheese

To calculate the volume of a pizza with radius “z” and height “a”, use this formula:

pi * z * z * a

Long 11MAY 168/163 put spread in CHFJPY

~31bps off 175.25

Long EURUSD 1.1277

(only ½ position size, missed it at 1.1257)

Stop loss 1.1084

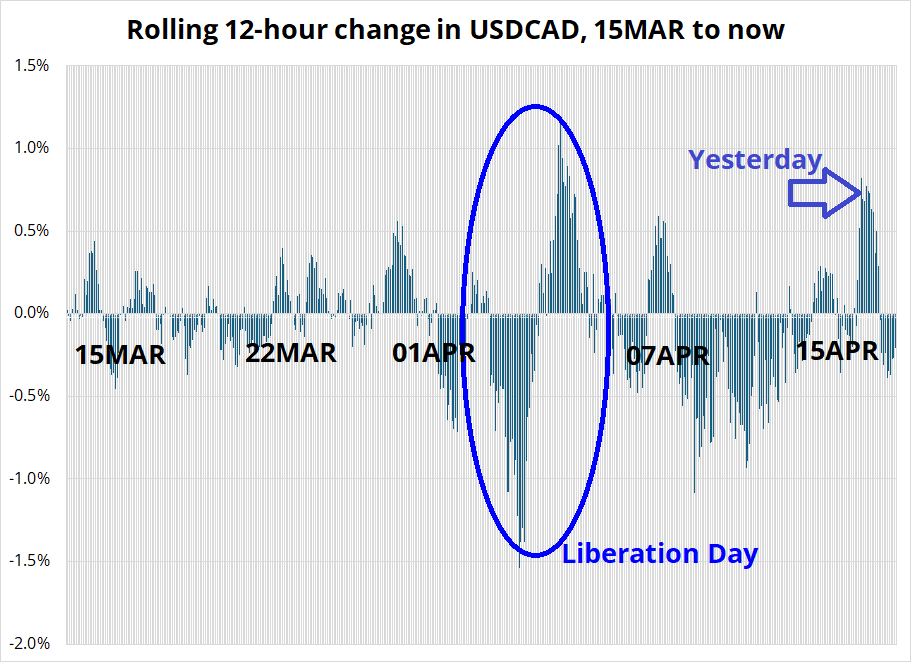

The BoC is a super tough call today. My view is that they cut, but my confidence isn’t super high simply because they have already cut so much and when you read the minutes of the last meeting, the move was a bit hesitant.

That said, since then you’ve had more tariff angst, a weak Business Outlook Survey, a weak jobs report and lower-than-expected CPI. The BoC was talking about less downside CPI risk and yet here we are. I think they can cut today and describe it as insurance.

While Bank of Canada policy hasn’t been a huge driver of CAD of late, the impulsive move higher yesterday makes me think that perhaps there could be a slippy move in USDCAD if they cut. This chart shows the rolling 12-hour change in USDCAD, and you can see that yesterday, despite no real news, we had the first impulsive move higher in a while. A 1% rally on a cut would take us to 1.4065 with a possible overshoot to 1.4100/10.

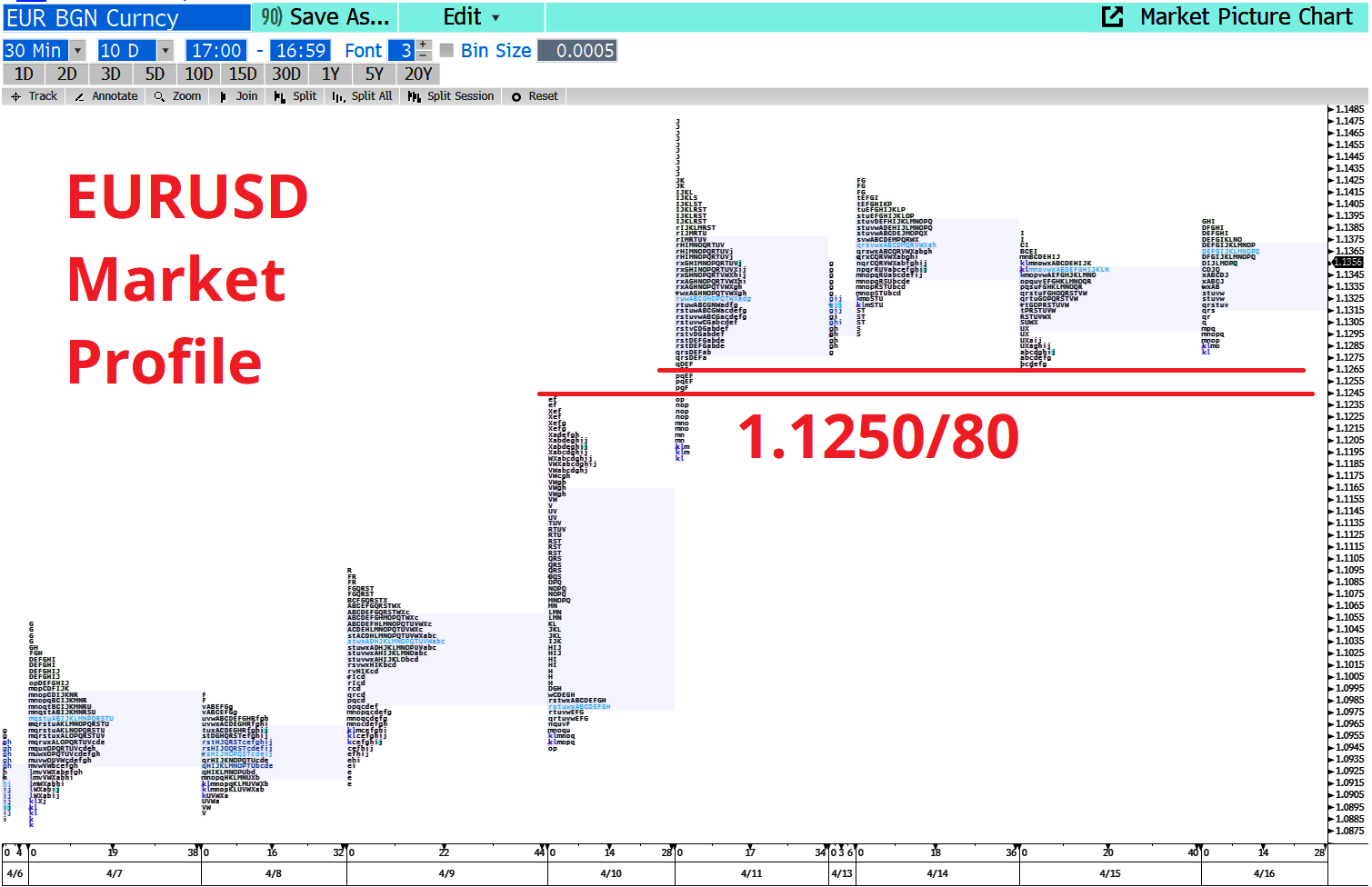

If you are looking to sell USDCAD, the ideal level is 1.4150/70 as you can see in this next chart:

EURUSD held the equilibrium zone perfectly as per the Market Profile chart. This is not hindsight, as I featured this same chart Monday and have been patiently waiting to buy EURUSD at 1.1257 and 1.1277. I guess this is a bit of a win and a loss as I got ½ long and missed the other ½ by 7 pips (the low yesterday was 1.1264). Anyway, sidebar is updated. I removed the 1.1257 bid and will stay 50% long from 1.1277. For now, the stop is 1.1084, but I will probably move it up tomorrow.

GDX is max overbought. If you like catching skyward-zooming knives, this one is interesting. GDXD is the 3X short GDX ETF. It trades at $3.66, so make sure you buy enough shares to make it worthwhile if you take the shot. Not investment advice.

In case you missed it, the DOGE savings estimates have been cut from $2T to $1T and now most recently to $150B in 2026. This is less than the increase in the defense budget for 2026 and so deficit cutting dreams are quickly fading. Bessent’s 3/3/3 plan might see something closer to 0/7/0 in 2026. The plan to reduce the deficit appears to be a low priority. Something to think about.

I think the tariffs on China might be 245% now.

Powell at 1:30 p.m. As we find out whether he repeats 4th April comments (no rush, hawkish) or echoes Waller (let’s focus on the tariff growth risks).

Thanks to everyone that completed my survey yesterday, I have more than 1000 responses already, which is awesome. In case you missed it: If you are a trader / risk taker and if you have about 90 seconds to complete a very short survey, please click here. The survey is anonymous.

Have an animatronic day.

To calculate the volume of a pizza with radius “z” and height “a”, use this formula:

pi * z * z * a

Full name: Charles Entertainment Cheese. For real.

Chuck E. Cheese animitronic. Definitely not terrifying.