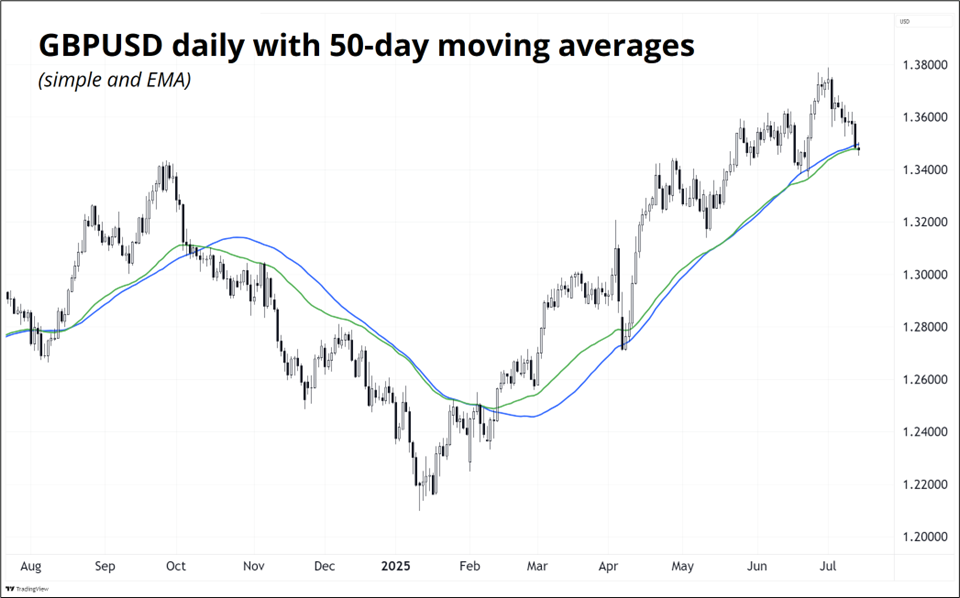

So many potential GBP catalysts this week just as the pound breaks down.

Leo Margets takes down JJ with QQ and to be the first woman to make the final table at the WSOP since 1995

So many potential GBP catalysts this week just as the pound breaks down.

Leo Margets takes down JJ with QQ and to be the first woman to make the final table at the WSOP since 1995

Long 18JUL 1.3410 GBP put

for ~25bps off 1.3470 spot

GBPUSD is breaking down through the moving averages that have defined the trend in both directions since mid-2024. Right into a huge week for the pound. We get US CPI, of course, plus Bailey’s Mansion House speech, UK CPI, and UK Jobs. The jobs report becomes a particular focus as Bailey specifically referenced it today.

BANK OF ENGLAND COULD CUT BASE RATE IF JOBS MARKET CONTINUES TO SLOW

I like buying Friday GBPUSD puts as you get a myriad of catalysts for your money and the vol isn’t overly expensive (see sidebar). I don’t have a super strong view for CPI, but the way Japanese bonds are trading, and given the complacency around tariff-related inflation, I think the convexity will come from a strong CPI. That would be the more “uh oh” result, while a weaker CPI is more easily shrugged off as the narrative remains “It’s probably too early to see tariffs in the CPI data.”

Meanwhile, we continue to watch the increasingly-ridiculous series of tariff threats and delays and new threats and delays and negotiations, etc. Everyone was right to question the idea that trade deals could be signed in such a short time.

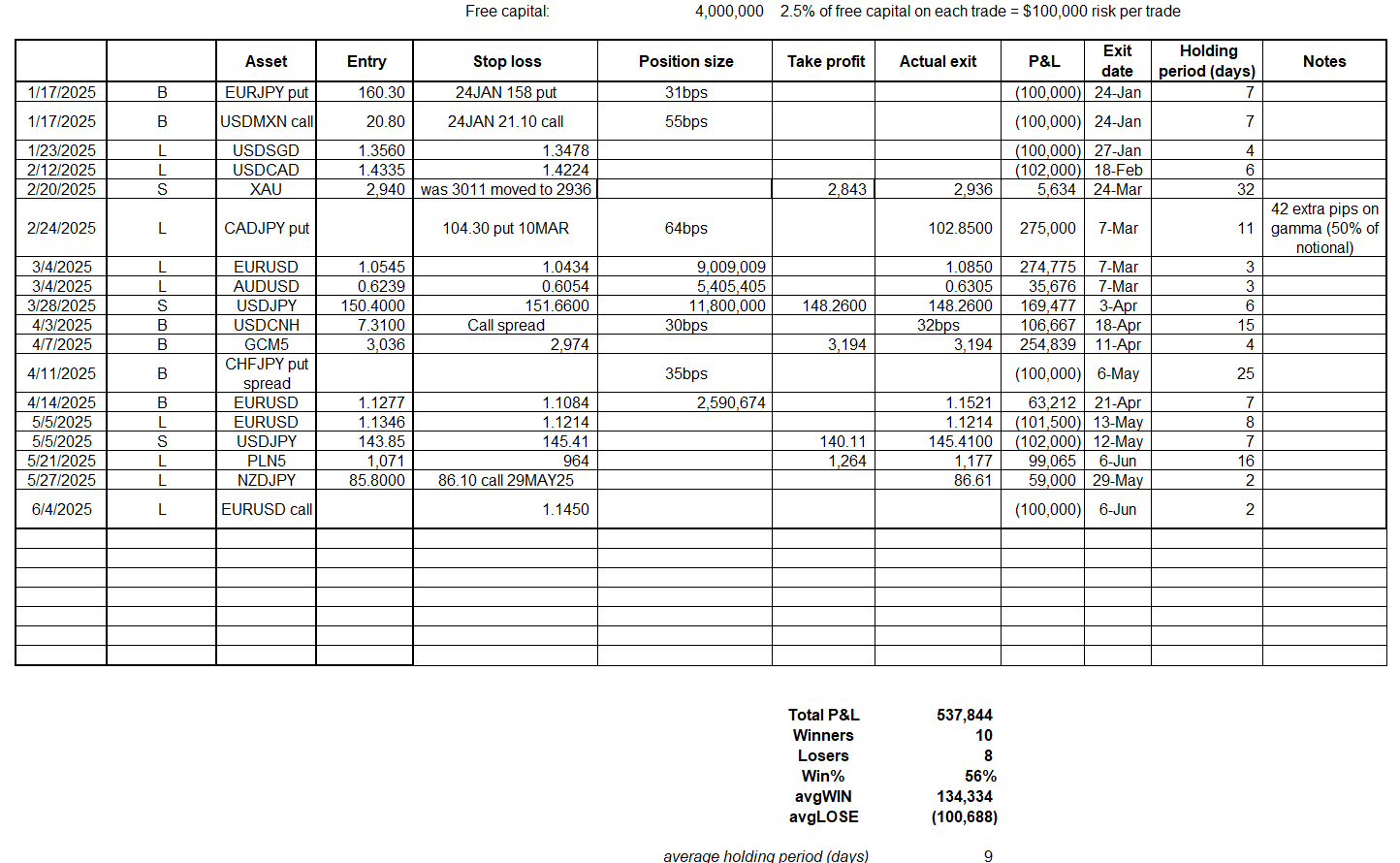

Today is my trade ideas recap for H1 2025. On October 24th, 2017, I wrote the following after reading Philip Tetlock’s excellent book Superforecasting:

One of Tetlock’s big beefs, which is a pet peeve of mine too, is the litany of forecasts that stream daily on CNBC, Bloomberg and the internet without any scrutiny or follow-up. Specifically, the relentless stream of “Crash Imminent” predictions is a complete joke. These inaccurate, one-way forecasters are not called out, they are instead deified as “the famed economist who correctly predicted the collapse of 2000 and 2008” etc.

Most analysts that get credit like this predict a crash every year or two and then claim credit in the very few years their call is right. There is no verification (and many forecasts are so open-ended they are impossible to verify) so anyone can make any prediction and it is more important how famous they are, not how accurate they are. I don’t mean to pick on a specific website or forecaster—As an industry, Wall Street is simply terrible at following up on the flood of forecasts we make every day.

It is pretty weird how we don’t even have much data on who is good at forecasting the main US economic data, when this is easily verifiable with a bit of work. Anyone know the Brier Score of the top 10 forecasters of US economic data? Is their forecasting skill persistent? There are many reasons not to follow up on forecasts but most of them suit the forecaster not the users of the forecast.

For example, people sometimes ask me to publish my trade idea outcomes. I hesitate for four reasons:

The thing is, though, after reading Superforecasting I feel it’s lame and disingenuous to make forecasts and then not follow up. So, I will collect and publish my trade idea results. Caveats: My real-world trading P&L can differ dramatically from the P&L of the “Current Views”. Also: I cannot guarantee the accuracy of the data (though I present it, in full, on the next page and I’m pretty sure it’s accurate). Past performance does not guarantee future results. Ask your doctor if AM/FX is right for you.

Next, you will find a detailed sheet that shows my trade ideas since the last update (which was in am/FX on July 11, 2024). In order for the trades to be comparable, I assume a portfolio with a $4m stop loss that risks $100,000 on each trade (2.5% of free capital).

The $ amounts are not the point; the point is just to normalize the trades because reporting % returns on trades makes no sense. What makes sense is to normalize risk based on how wide the stop loss is. Tighter stops = bigger positions and vice versa. So, to be clear: I risk $100,000 on each trade, backing out the position size from the difference between the entry point and the stop loss. This is all fully explained in Chapter 11 of Alpha Trader. The main point of this results exercise is: transparency and accountability.

am/FX trades 09JAN25 to now

Takeaways

The half started out poorly with four straight losers and ended with three of five losers but there were tons of goods ones in the middle. I have not been active in the trade ideas section of late as I was off for two weeks plus I think I’ve been a bit gun shy and thinking more about consolidation and short vol trades of late as the USD bear trade fizzles. Non-directional trades, like selling the AUD one touch I suggested a while ago, don’t generally make it to the sidebar. Long EURUSD, long gold, long platinum, and short CADJPY made most of the money.

Have a suited day.

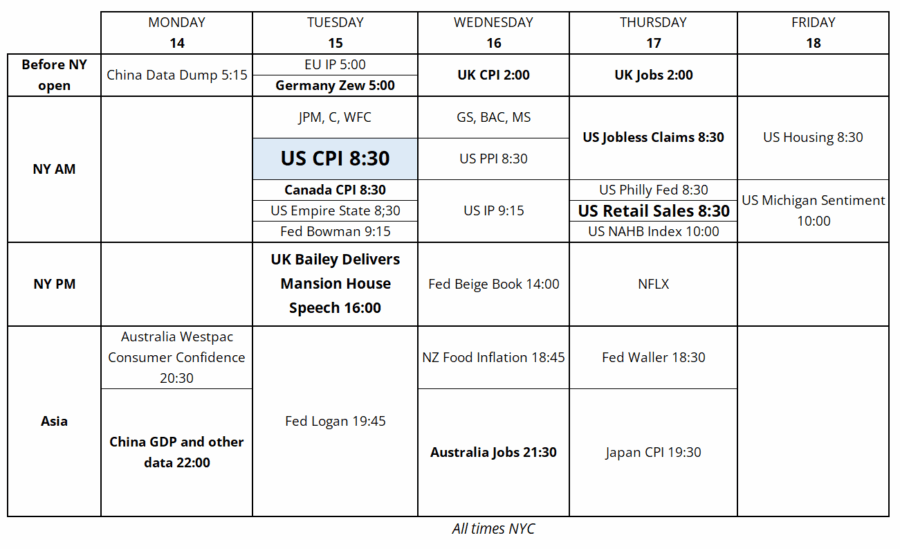

Trading Calendar for the Week of July 14, 2025

Leo Margets of Spain is the first woman to make the final table at the WSOP since 1995.