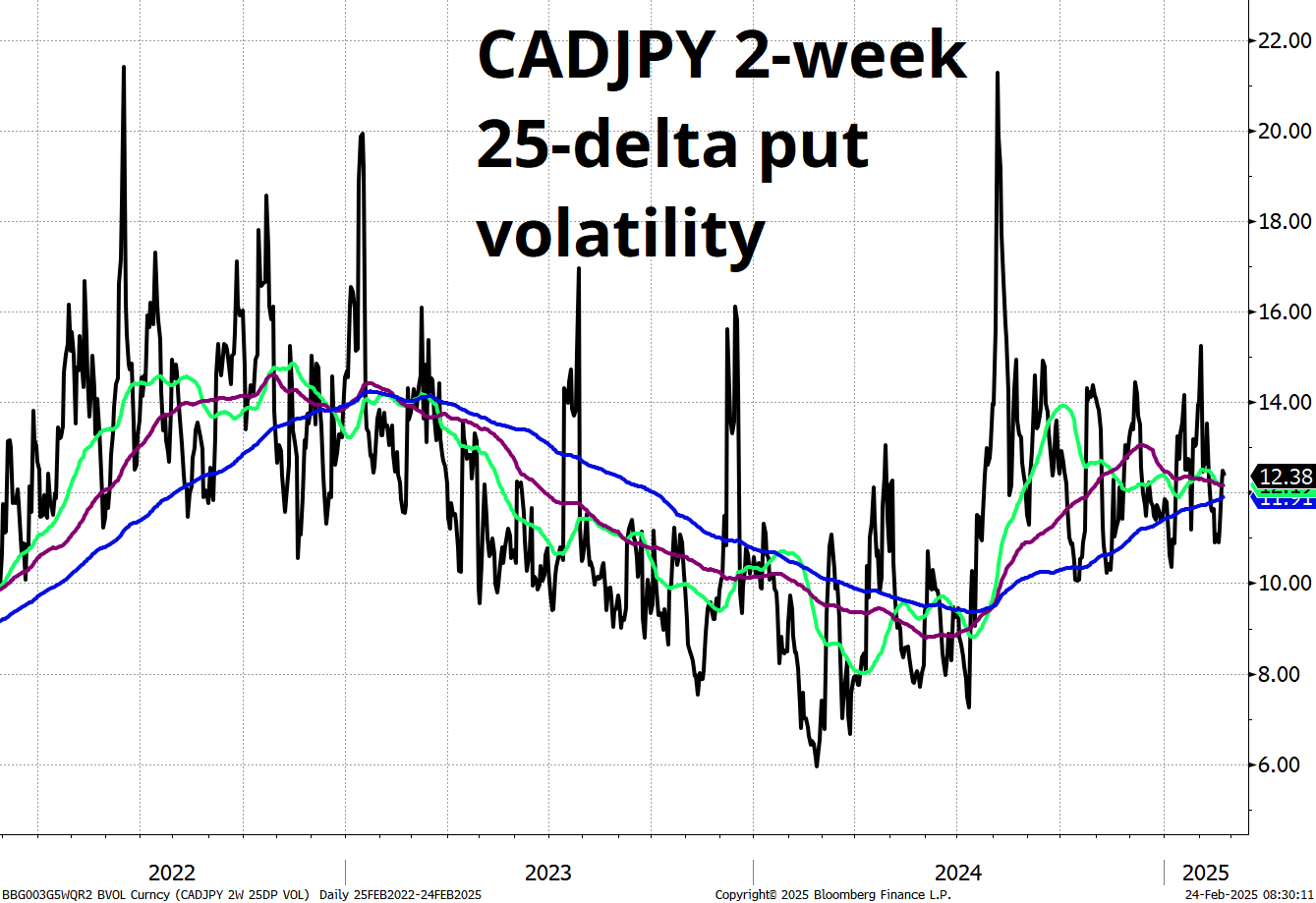

In contrast to last time, CAD vol now shows complacency

Skulking loafers begone!

Via Phil V.

In contrast to last time, CAD vol now shows complacency

Skulking loafers begone!

Via Phil V.

Long 10MAR 104.30 CADJPY put ~64bps

Trade gamma if we get to strike before end of the month.

Short gold at 2940

Stop loss 3011

Take profit 2805

In the next two weeks we get:

The market has been completely desensitized to the tariff threat and so 2-week CADJPY volatility is trading right around its multi-year average.

That seems wrong to me. There should be a premium for tariff risk going into the March 4 deadline and there is none. I like buying 2-week 104.30s, thinking that the market will run CAD and cross/JPY lower into the imminent tariff deadline and into perceived asymmetric risks around US jobs data.

2-week 104.30s cost around 60bps and if we get down there before March 4, you have excellent gamma for the tariff announcement and NFP. In other words, if we get to the strike, you can buy half the notional and then whether the tariffs are punted or enacted, you are very likely to make money.

So, I’m adding that to the sidebar trades: Buy 10MAR 104.30 CADJPY put for ~64bps. The plan is to be proactive if spot gets down there before the end of the month.

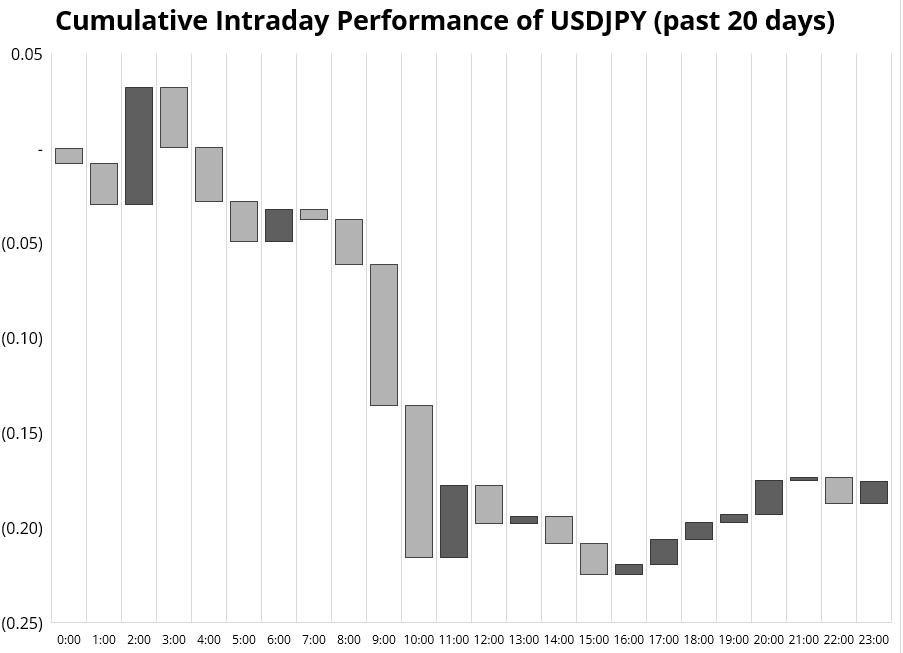

The biggest disappointment for JPY bulls so far as USDJPY has gone lower has been the lack of JPY buying in Japan time. Here’s the cumulative intraday performance of USDJPY over the course of the last 20 days (x-axis shows NY time). Cross/JPY charts look similar. For mega downside to unlock in USDJPY, you would ideally have US 10-year yields to 4.10% or so and a switch to JPY buying in Japanese time. That would indicate that Team Japan (GPIF, Kampo, etc.) are switching out of foreign bonds and into now-somewhat-juicy JGBs.

I am not a huge fan of reading analysts who always have the same view because they tend to filter all new information through the lens of their priors. If someone always calls for recession, their logic in continuing to call for a recession is likely to be soiled by confirmation bias. If someone has been bearish stocks for the last ten years, that’s awesome, but no matter how smart they sound, their view is probably too biased to be useful.

I say all this because Torsten Slok, who has been adamant and correct on the US economy for a long time (bullish) is turning more cautious and I think that’s worth paying attention to.

https://www.apolloacademy.com/downside-risks-intensifying/

It’s hard to say when the DOGE stuff will show up in the economic data, but the plunge in the S&P PMI on Friday might be a tell. Services PMIs have held up well throughout this cycle and are now turning lower as manufacturing PMIs rebound. Given services dominate the US economy, policy uncertainty has spiked, the US equity momentum trades have cracked, and inflation remains sticky, I think Q2 growth worries are legit.

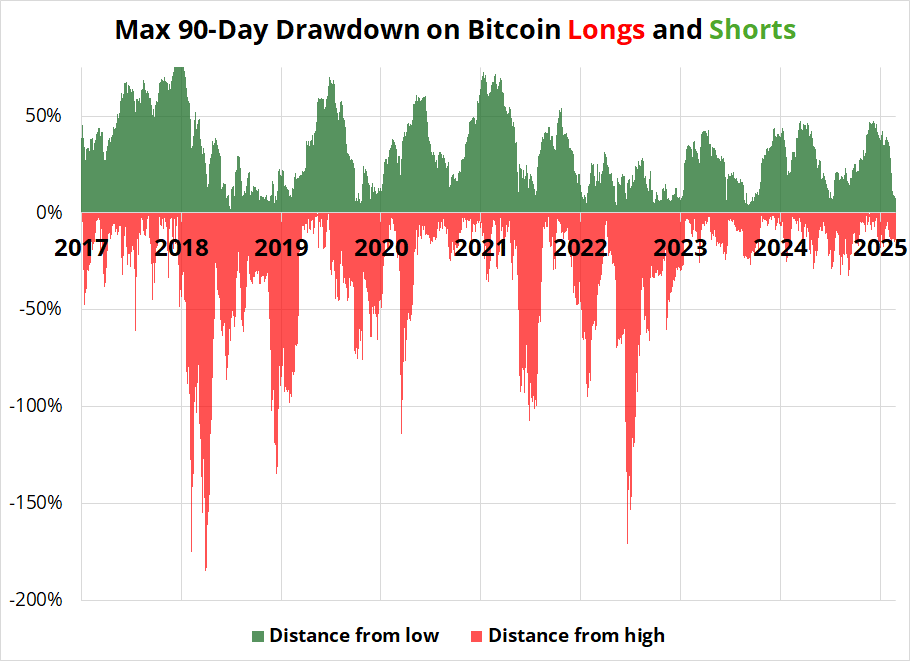

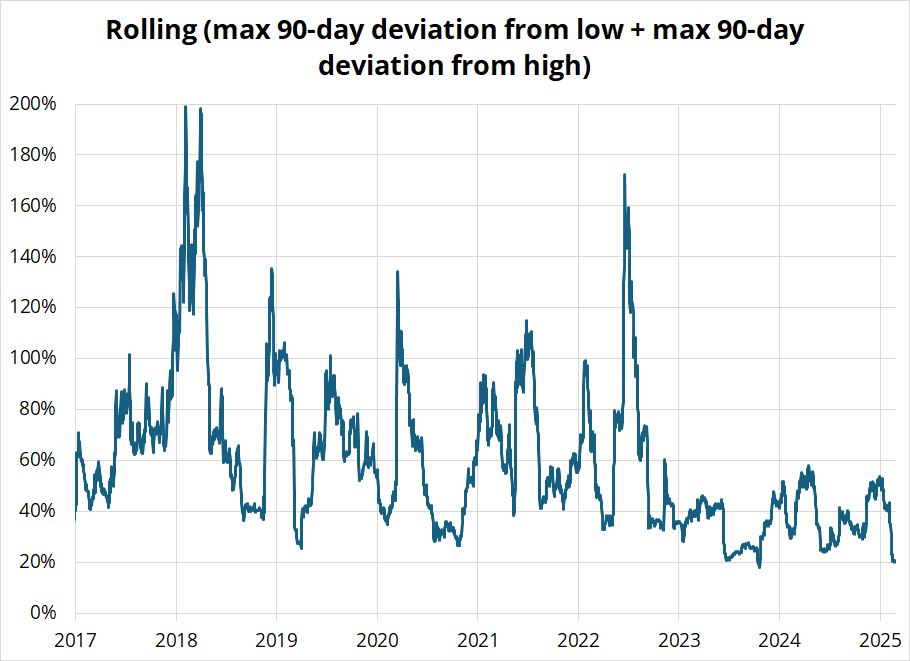

The most notable feature of crypto in the past few months has been the lack of volatility. After ripping post-election, BTC has found its happy place and has been rangebound since November 12. The first chart here shows you 90-day max drawdown on longs and shorts. The second chart shows the sum of the two (which is a proxy for deviation from equilibrium). Obviously that second chart is similar to just plotting 90-day realized volatility, but it’s mildly different math as it shows not movement per se, but movement away from min/max.

A break of the 90-day high or low is something to watch carefully now. Those levels are 109,200 and 89,300.

There isn’t much to chew on until Wednesday.

6 yards or so of EURUSD strikes expiring 1.0460/70 today, FYI. I hope you do not have a flea-bitten week.

via Phil V.