Happy Friday and Happy December to everyone

There’s a little black spot on the sun today

There’s a blind man looking for a shadow of doubt

Happy Friday and Happy December to everyone

https://x.com/greg_payne24/status/1861958284682440859

“There is a man who collects pictures of hitters who hit walk-off home runs. He says he does it because this is how he views us entering heaven.

Look at the faces of his teammates waiting to welcome him home. Look at their excitement. They can’t wait to celebrate with him. Look at the fans. Arms raised, big smiles, maybe even hugs for a perfect stranger.”

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1216

Close 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long 06DEC

Taking profit on 12DEC 109 / 107.50 CADJPY put spread today

First up, I am taking profit on the CADJPY put spread. The annoying feature of ITM put spreads is that they tempt you to hang on, even when you know you should be taking profit, because instead of bleeding theta as expiry nears, they accrue money as the short strike decays faster than the long strike. But the decision to stick with it or cut it or roll it should be based on the directional view, not the temptation of some positive carry. And my guess is this yen rally is about to stall.

The trade was a bit lucky as the repatriation theme I was playing for kicked in thanks to the blowout in OATS (which I did not predict), and the Trump tariff threat hammered CAD out of nowhere. Note that Polymarket has a tradeable probability for those tariffs. Quoting their terms for the contract:

This market will resolve to “Yes” if Donald Trump signs any federal legislation or performs any executive action enacting a general 25% or greater tariff on imports into the United States from Mexico or Canada by January 31, 2025, 11:59 PM ET. Otherwise, this market will resolve to “No.”

Also on the JPY trade: The probability of a BOJ hike goes down a bit as the JPY strengthens because one of the policy targets is to avoid a rapidly weakening yen while also avoiding the sort of mega JPY rally and financial instability triggered in August. So at 150, the odds of a BOJ hike + hawkish verbiage are a bit lower than they were at 155. Also, while EURJPY is cratering somewhat on the OATs selloff, French spreads have narrowed today. Note in the calendar down below that there is flurry of OAT auctions next Thursday at 4:50 a.m. NY time. I have been in markets for ~10,770 days now, and never once cared about an OAT auction. But we might care about the OAT auctions next Thursday!

If this probability is correct, USDMXN is probably way too high. I would think where USDMXN will be on January 31, 2025 is incredibly binary right now. It’s either 21.00+ on tariffs or it’s sub-20.00 on no tariffs. Highly doubtful it’s 20.41. There are ways to play this via options, of course.

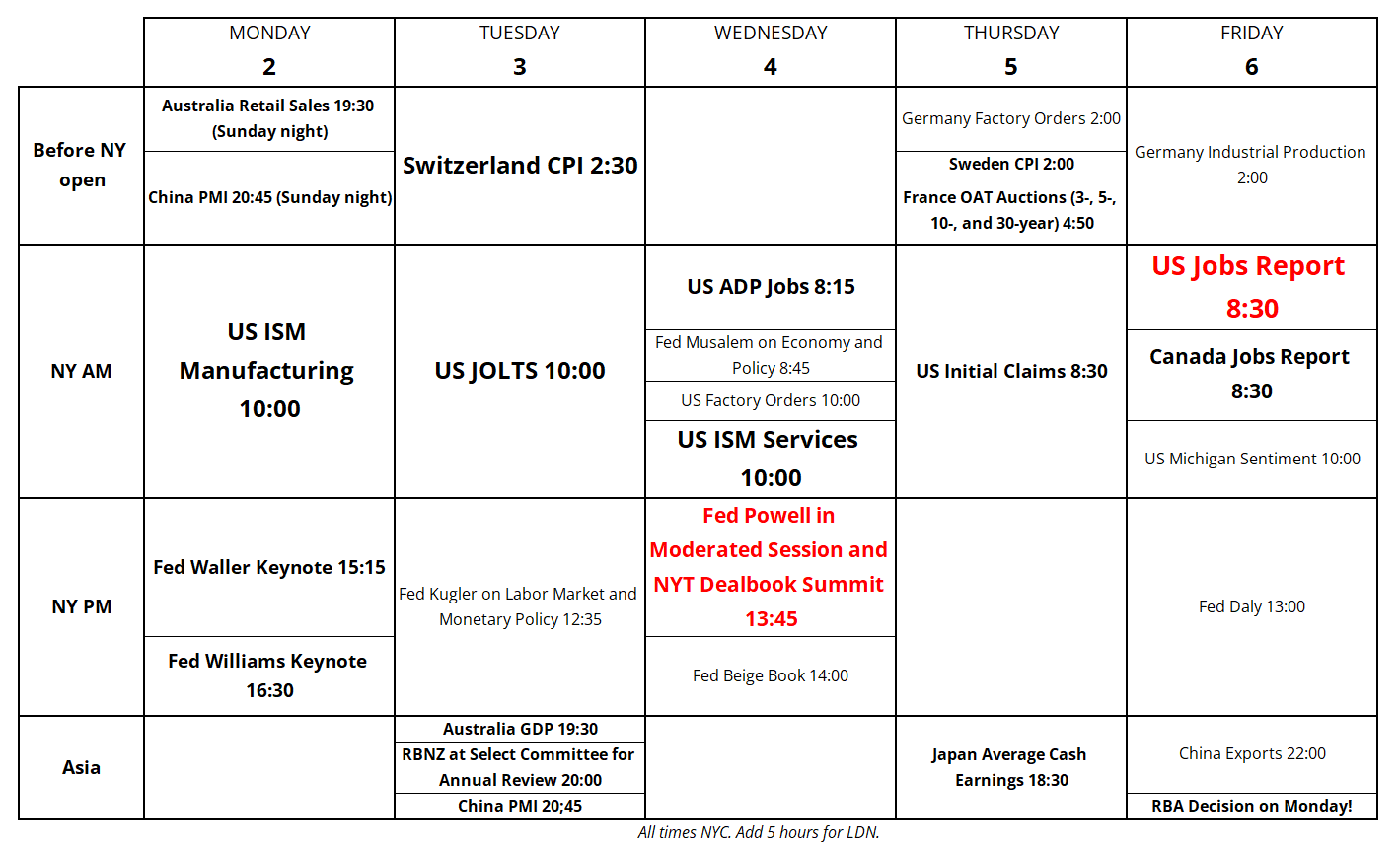

Next week’s calendar is decent with ISM, Swiss CPI, Waller, Williams, Powell, and Jobs on the docket. Swiss CPI is especially interesting as deflation and the dreaded ZLB could soon be in play again in Switzerland. I will write about Swiss CPI on Monday.

Interesting how EURUSD touched the 1.0590/1.0600 key resistance level perfectly but could not take it out. I still find it hard to get excited about short EURUSD as OATs have reversed a bit and seasonality in December has historically been bullish EUR. It feels a bit like the bad Europe story is priced in for now and risk/reward looks neutral. 1.0470/1.0600 expected range for now.

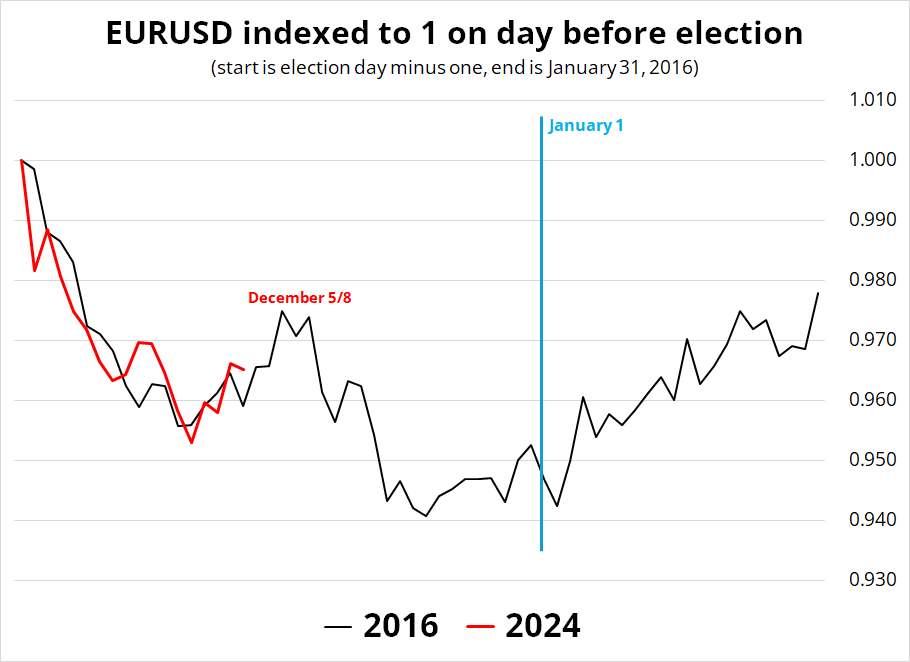

EURUSD has been following the 2016 pattern perfectly so far as you can see at right. These analogs are good for tracking similarities between similar macro periods, and the USD rally after Trump won in 2016 feels similar to now. If we followed the 2016 playbook perfectly, we will peak at 1.0625 or so between December 5 and December 8.

I had expressed some skepticism about how important French bond spreads should be for EUR, but I suppose there are two channels for transmission. One, which we are probably seeing right now, is Japanese exits from French debt and into JGBs (repatriation). Two, as suggested by Phil, we need to add risk premium as we approach the point where accelerating European economic weakness leads to higher French yields—and thus monetary policy transmission breaks down or shifts into reverse.

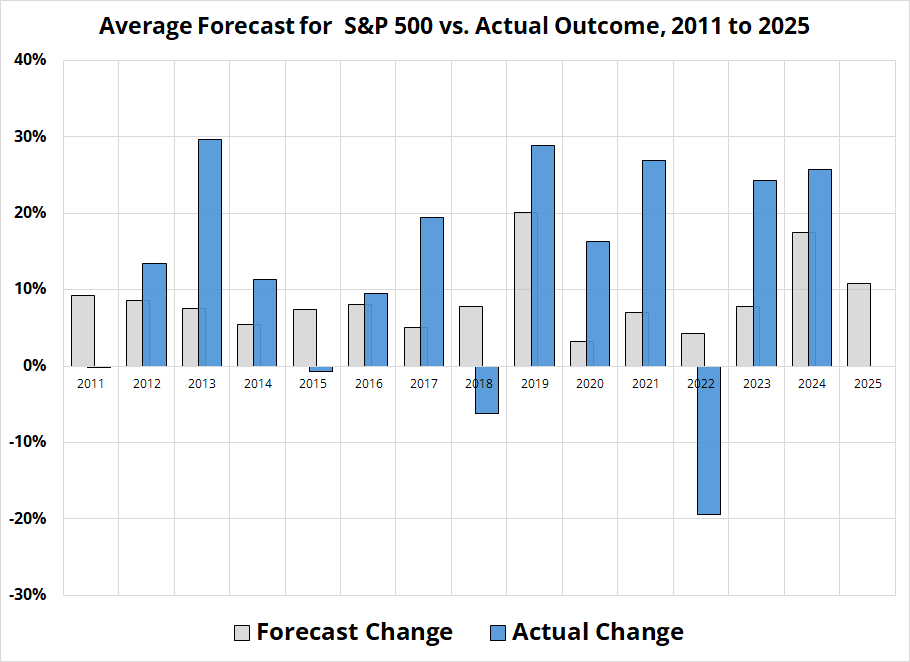

Everybody is almost always bullish stocks into the new year, and that makes sense since stocks normally go up. That said, the consensus forecast is rarely more than 10% above spot. This next chart shows the forecast vs. actual change for the past 14 years. The gray bars are the forecast change and you can see that this is the third highest forecast increase and you can ignore 2018 because forecasts are collected in early December and the S&P tanked into Christmas Eve 2018, rendering the forecasts stale.

There isn’t much information here, other than confirmation that everyone everywhere is as bullish as can be into 2025. This is confirmed by the epic Conference Board reading, CTA data, crypto and memecoin froth, and conversations with clients. In my opinion this sets up for a wobbly Q1 for equities as we are priced for absolute perfection. But hey, that’s one month away so keep dancing.

Hope you hit it out of the park in December.

https://x.com/greg_payne24/status/1861958284682440859

“There is a man who collects pictures of hitters who hit walk-off home runs. He says he does it because this is how he views us entering heaven. Look at the faces of his teammates waiting to welcome him home. Look at their excitement. They can’t wait to celebrate with him. Look at the fans. Arms raised, big smiles, maybe even hugs for a perfect stranger.”

Growing up, baseball and music were the closest thing I had to religion.

HT a-chops

There’s a blind man looking for a shadow of doubt

Every month jobs seem to come in as expected—with downward revisions!