Soft patch done

I took the unusual step of outlining a new, strong view in Friday Speedrun last week because I came to that view around noon (after I had already sent out am/FX). Generally, Friday Speedrun is a summary/roundup, written in my normal voice, while am/FX is more forward-looking, and written in a slightly more professional tone. Anyhoo, I hope you read my view Friday, but in case you did not, this is what I wrote:

Here’s what I see as we enter September:

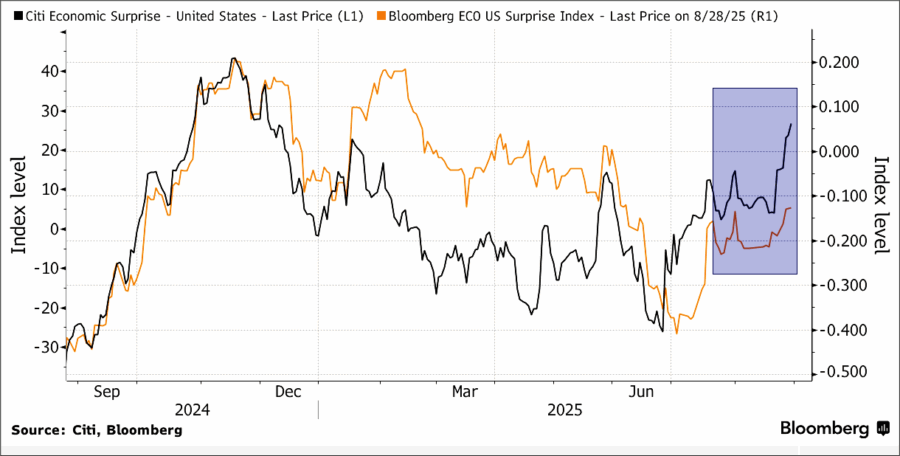

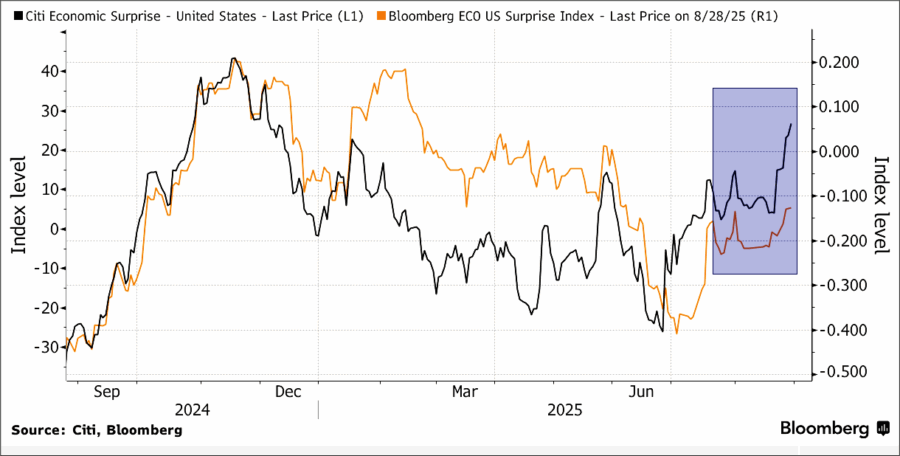

- The US economy is reaccelerating, and US economic data is surprising to the strong side, much as it often starts to do around this time of year.

- The soft patch triggered by US policy uncertainty is over—and it was not dramatic.

- The Fed plans to cut interest rates right into this reacceleration.

- The government is taking over the Fed.

This appears to me to be a textbook short bonds, long gold situation. And I don’t think either trade is at all crowded right now. NFP is a huge wildcard, but if you’re long gold and short bonds, you are kind of hedged for a bad jobs report and might well make money on both if the report is hot. US monetary policy has been predetermined by dovish forces that have nothing to do with conventional economics. Or economics at all. This policy stance is unconditional, not data dependent.

And the positive economic surprises are ramping up.

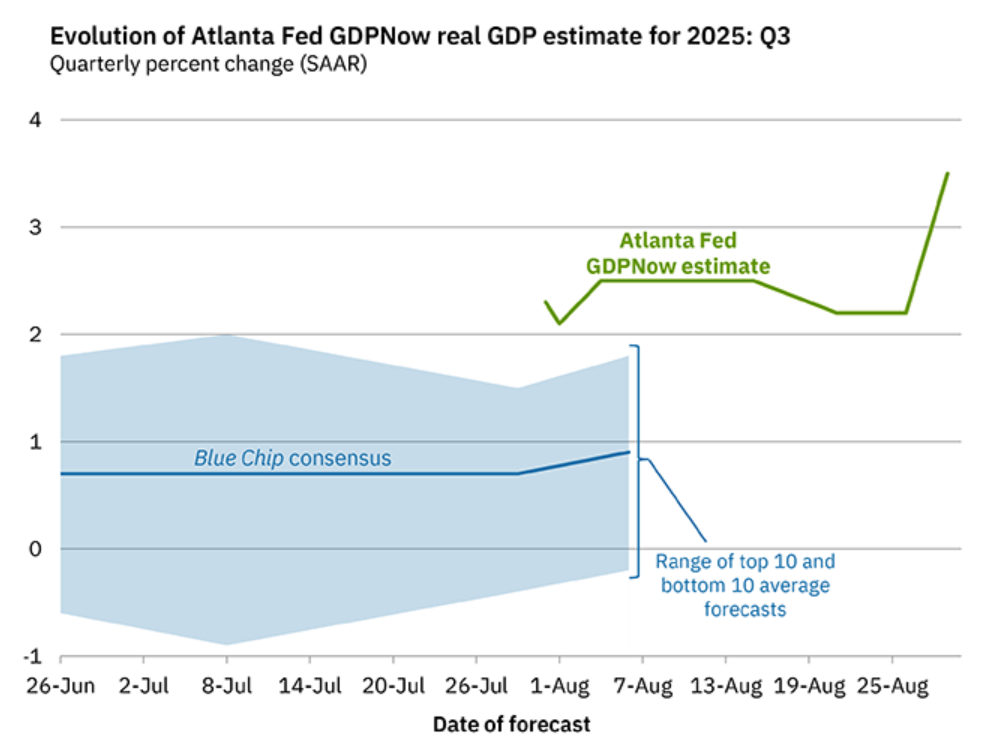

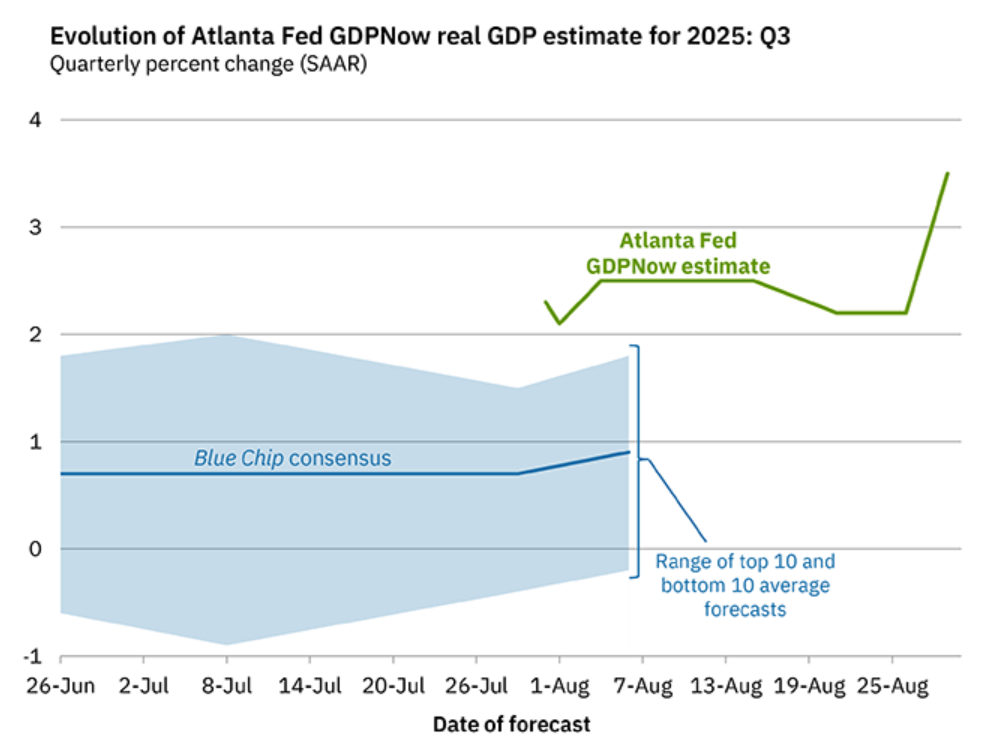

Atlanta Fed GDPNow is ripping (it’s a good measure, despite the fact it gets a lot of hate).

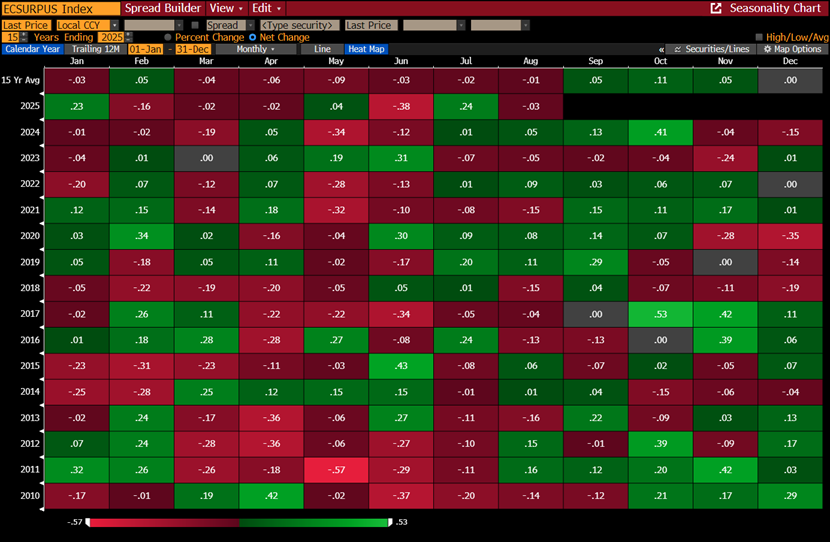

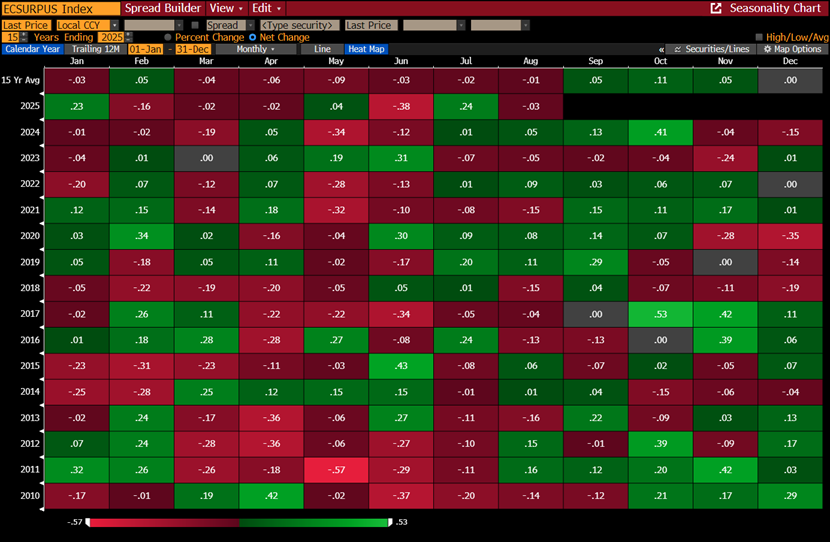

Seasonality of economic surprises is bullish from here:

The story has been brewing for a while, but none of it mattered if the economy slowed. In the case of a slowing economy, the right prescription would be lower interest rates—whether they are lowered by government edict or by an independent central bank. Now, with stronger data here and more possibly on the way, the bat guano is about to hit the fan.

I wrote that I like TLT puts and GLD calls and both have approximately doubled since Friday. I wish I could put those in the sidebar, but that feels a bit like cheating since I track only the official am/FX trades. So, I won’t put those trades in there, but I do believe they will continue to perform this week and the asymmetrical market reaction will come from strong data, not weak.

I have had a bullish EURGBP trade in the sidebar for ages, and I am going to use this rally to get out because I find the fearsome flareups around UK fiscal tend to come and go at random, and thus this is a good opportunity to square up at a small profit. The fiscal sinners are feeling pain today, but the fiscal nervousness narrative ebbs and flows.

Updating the priors

As this week evolves, I will update my views and determine whether my US reacceleration view is real or fake news. The calendar is particularly US-centric this week. My belief is that the angst around NFP deceleration is misplaced as the data shows that both supply and demand for labor are falling, leaving an economy with little slack, sticky inflation, continuing upward pressure on wages, and little room for rate cuts.

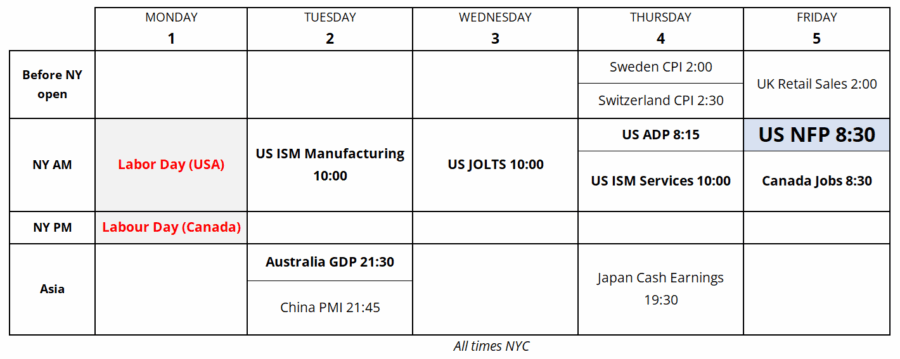

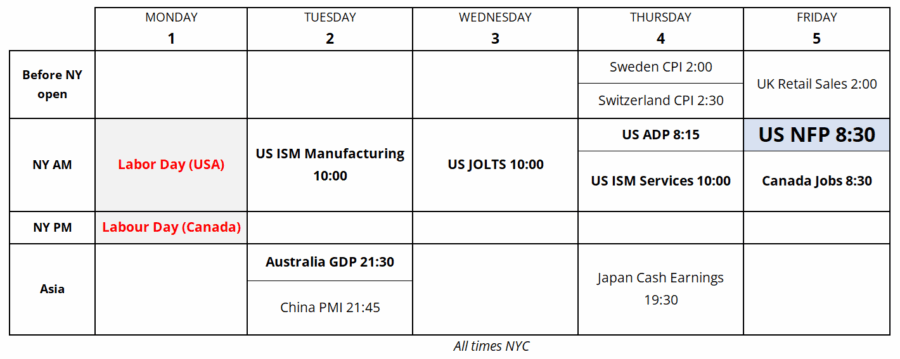

Trading Calendar for the Week of September 1, 2025

Manufacturing ISM is the first release this week (today) and then JOLTS, ADP, ISM Services, and finally NFP. It looks to me like the soft patch triggered by policy uncertainty and tariff angst is over and we are about to see a resurgence of good US data. This week’s flurry of releases should give me pretty quick feedback on that view.

Final Thoughts

1. If the Supreme Court agrees with the prior two court rulings and decides that the US government’s contrived emergency declarations are not sufficient reason to bypass Congress on tariffs, will the US need to refund the tariffs collected so far? Maybe that is why Howard Lutnick’s firm was/has been buying up tariff refunds at a discount? Yuck.

https://www.wired.com/story/cantor-fitzgerald-trump-tariff-refunds/

2. Unorthodox US policy is mixing with fiscal fears in the UK. Here is the UK 30-year yield. Hmm.

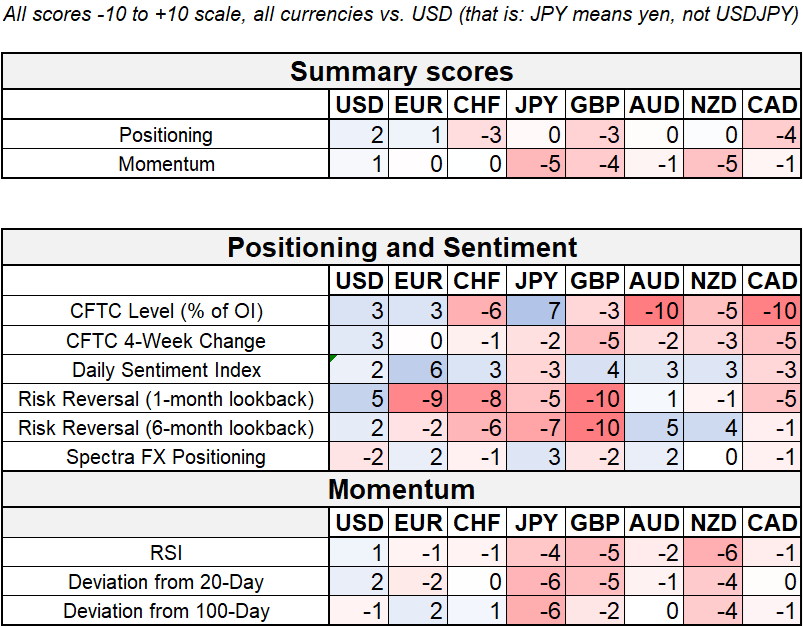

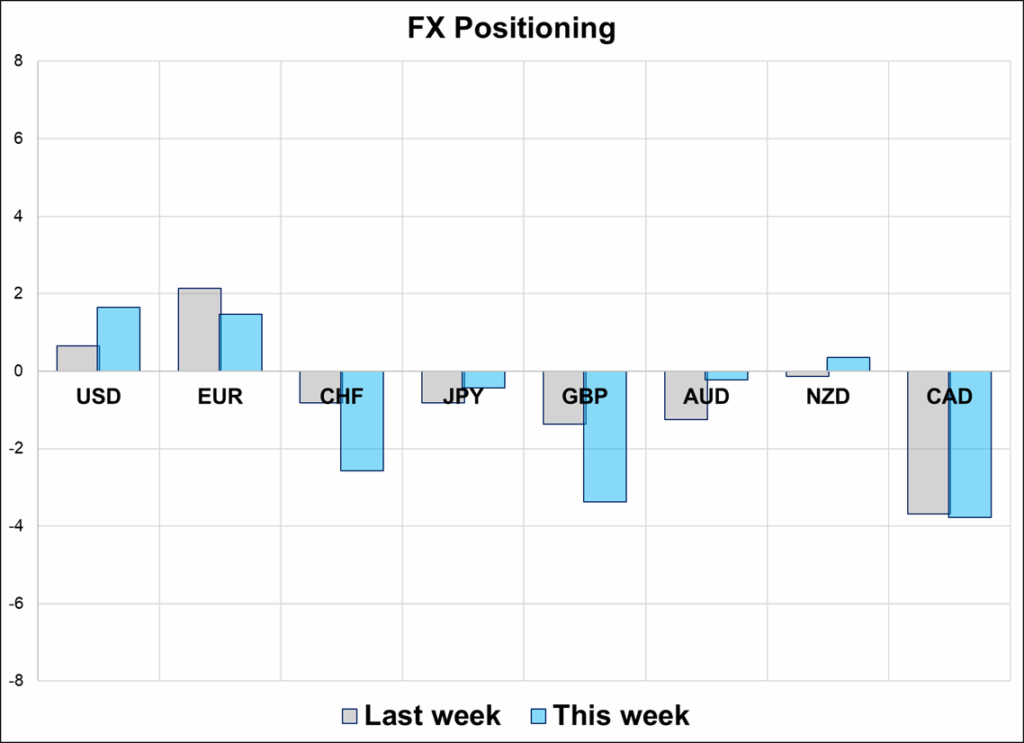

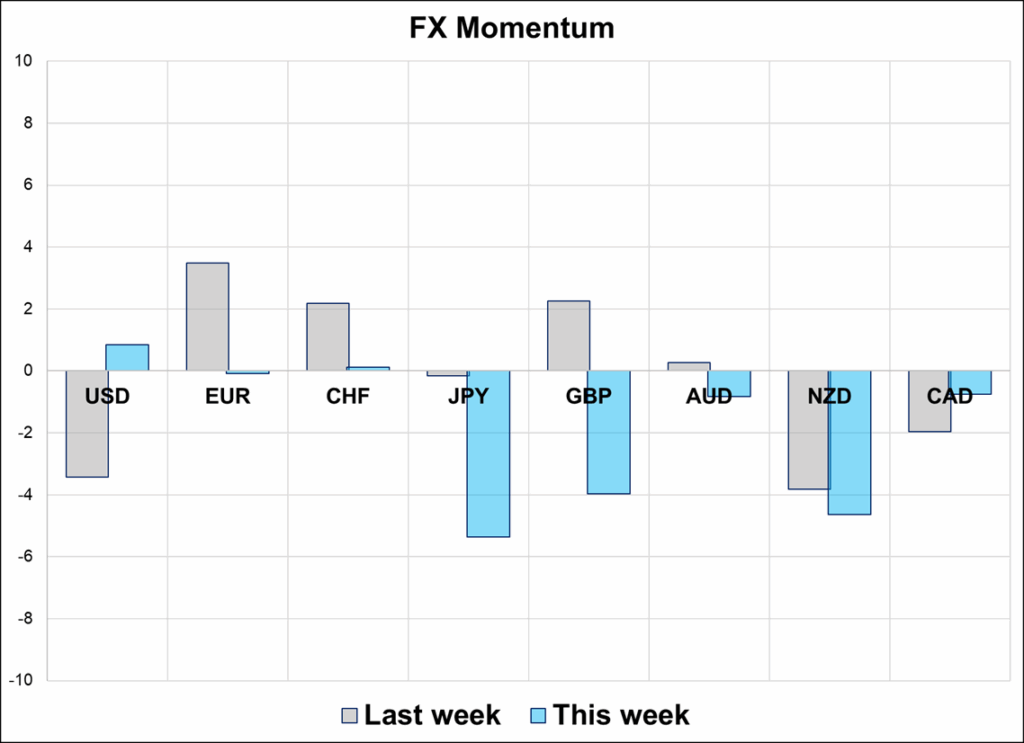

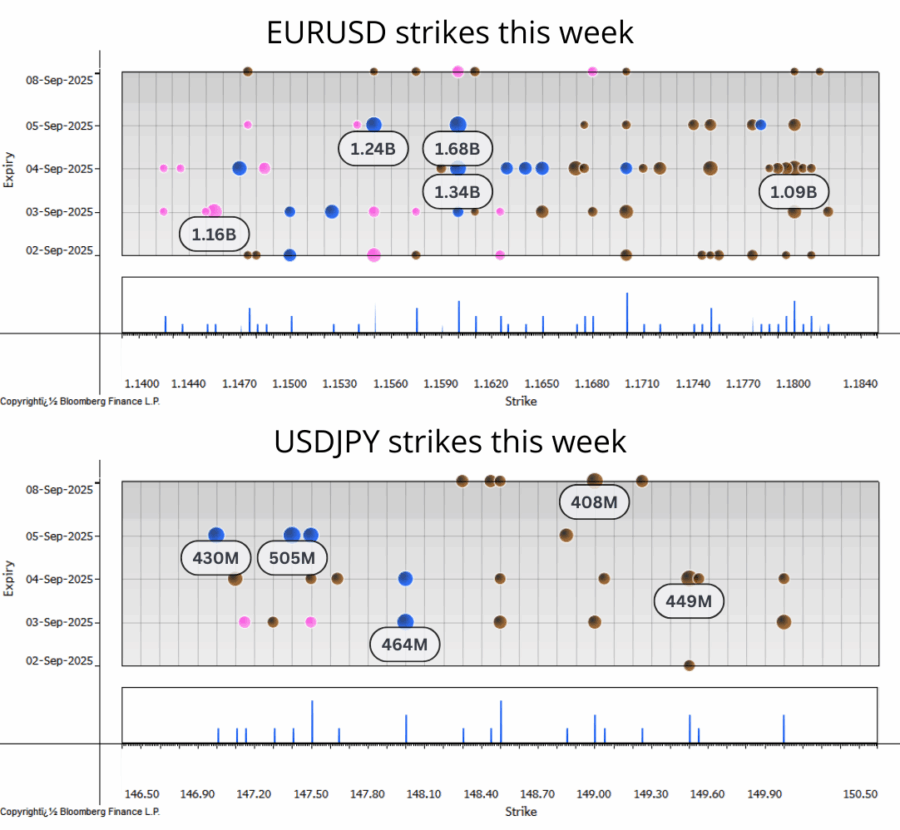

Positioning and the big strikes follow below. We are starting to see a bit of short CHF, short GBP, and short CAD building, but otherwise not much to get excited about in FX positioning news.

Have a 7/10 kinda month (or better).