Attention was on non-U.S. macro and U.S. tech. This week we pivot to U.S. Macro.

Attention was on non-U.S. macro and U.S. tech. This week we pivot to U.S. Macro.

Flat

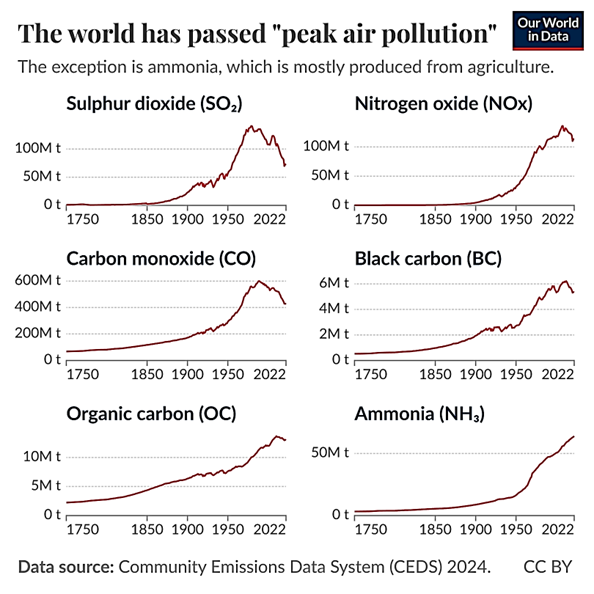

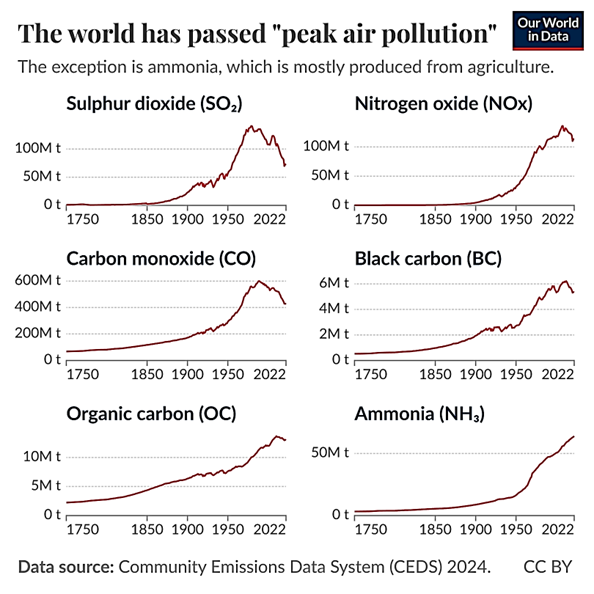

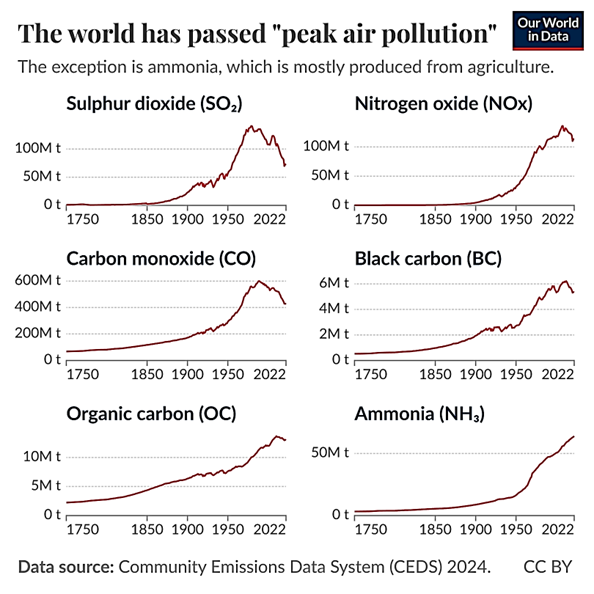

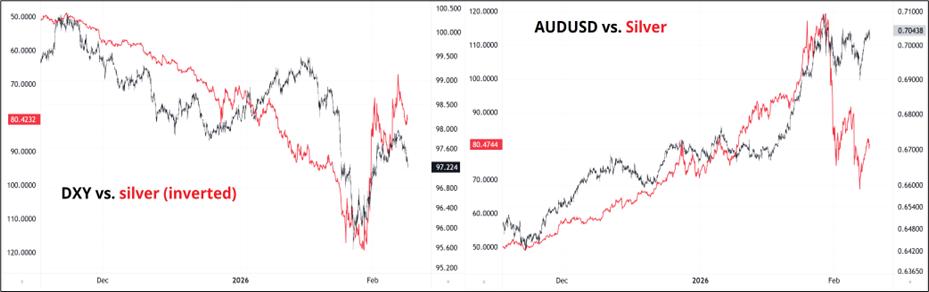

The silver bubble has burst, and the dollar has rebounded from the blowoff bottom after the Trump benign neglect comment and Bessent walkback at the end of January. The extreme correlation between precious metals and the dollar has subsided somewhat as you can see here.

AUDUSD has seen two wicked corrections off the critical 0.7100 level but has managed to hold in extremely well. Meanwhile, the JPY trades pretty okay despite a landslide victory for the LDP. You can argue that the Takaichi victory was mostly priced in, but the margin she secured was surely a bit of a surprise and yet USDJPY made a feeble attempt to take out 157.50/90 in early Wellington trading, then quickly buckled. The sell JPY and sell JGBs trade are tired.

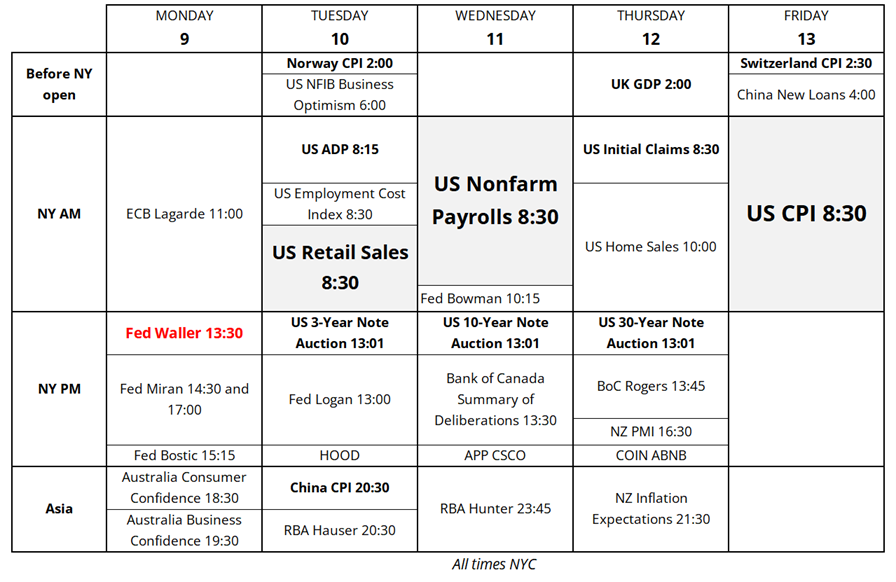

While much of the focus has been on the Hedge America theme and activity in foreign markets (RBA hike, Japan election, etc.) this week is all about ‘Merican Macro as we get a flurry of Fed speakers and U.S. Retail Sales, NFP, and CPI. Sure, there was a headline about Chinese corporates minimizing UST exposure, but that headline could have run in 2016 or 2019 or 2022. China’s distaste for US treasuries is not new.

The market already went all-in on the “US is running it hot” trade, then degrossed in a panic last week. Are we going to simply go back to that trade again, or will the U.S. data point in a different direction? Given the lack of impulsive selling in U.S. bonds, I think the asymmetry this week is towards weak data. We had a huge selloff in the “debasement trade” on a “hawkish Warsh” and yet yields never budged. If the market was nervous about owing U.S. bonds, it had plenty of reason to sell them last week. This week we get a U.S. data dump, three government auctions, and a huge issuance by Google, so it will be another important test that might unsettle the catatonic volatility in bonds one way or the other.

I plan to write about NFP tomorrow, but for now I will say that potential weakness in health care and software hiring make me think that the risks are to the downside for the January data, especially after that December JOLTS release. Also this lol:

The erasure of value in silver, software, crypto, and unprofitable tech was a perfect storm of degrossing, retail unwinds, and macro panic as most-loved momentum trades continue to crater under the weight of dejected liquidation while software is the new brick and mortar / legacy media trade a la 1999. Crypto has no coherent story these days as its chameleon-like ability to change narrative colors is in jeopardy here as the world of digital coins completely decoupled from the rally in risky assets and gold but sold off aggressively in sympathy during the bloodbath.

The crypto use cases outside self-referential applications like DeFi and stablecoins remain niche more than 17 years after the genesis block was mined, and nobody can exactly put their finger on what problem crypto is trying to solve at this point. It’s not a currency; it’s not a risky asset; it’s not digital gold. Stablecoins are good for frictionless money transfer, but pay no yield. Institutions and ETF buyers went all in bitcoin at an average of 90k. Saylor is in the red despite seeing the way early and starting his epic buys at $11,000. The OGs are getting out. Vol is low and falling. It all feels wintry still. I will write more about the state of crypto later this week.

The jury is still out on silver. Looks to me like it was a bubble and the blowoff top is in. I say that with extremely low confidence, however, as the shortage of assets concept remains front of mind for me and if people want less U.S. exposure, they are going to continue to buy precious metals. Given the insane levels of retail participation in silver and SLV options, I would think gold is just a much better thing to own than silver if you are worried about people being worried about where to put their money.

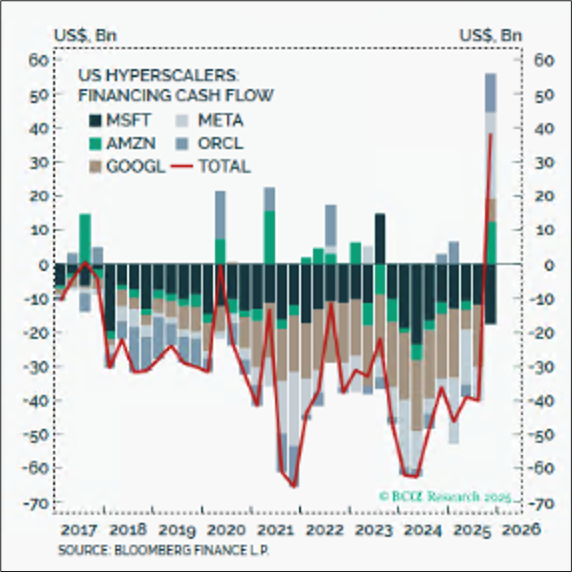

Millions of words have been written about the SaaS apocalypse over the past few days and there appear to be two very obvious realities taking hold. One has been obvious for a while: Capex-heavy industries deserve lower multiples than capex-light ones and capex paid for with debt is not the same as capex paid for with free cash flow. Oracle’s stock price got this joke months ago and we were discussing this issue as far back as October, but the rest of the megatechs are starting to get the memo now too. Capex heavy companies that spend more than they earn and have no money for buybacks should trade at lower multiples than free cash flow printing money machines that are constantly buying back stock. The exception to that rule is that if AI is the most important technology ever, a narrow group of winners take all and they can trade to infinity. That’s the bet the market is making on Google right now, though it’s worth saying that the market was making the exact opposite bet on Google less than two years ago.

So the narrative now is:

https://steve-yegge.medium.com/the-anthropic-hive-mind-d01f768f3d7b

Quick excerpt:

If you have an Atom Moat, then you stand a pretty good chance of weathering the storm, if you execute well. Just a chance, mind you: It’s a moat, not a force field. But atoms are a pretty good moat. If you make beer, or work with humans, or ship stuff, say, then you’ve got a bit more time to work with, maybe, to find your feet in the AI era.

If you have a strictly online or SaaS software presence, with no atoms in your product whatsoever, just electrons, then you are, candidly, pretty screwed if you don’t pivot. I don’t think there are any recipes for pivoting yet; this is all new, and it’s all happening very fast.

A regime switch is upon us:

The problem here is that everyone has been talking about many of these themes since last October. I posted this chart in am/FX on October 30, 2025, for example.

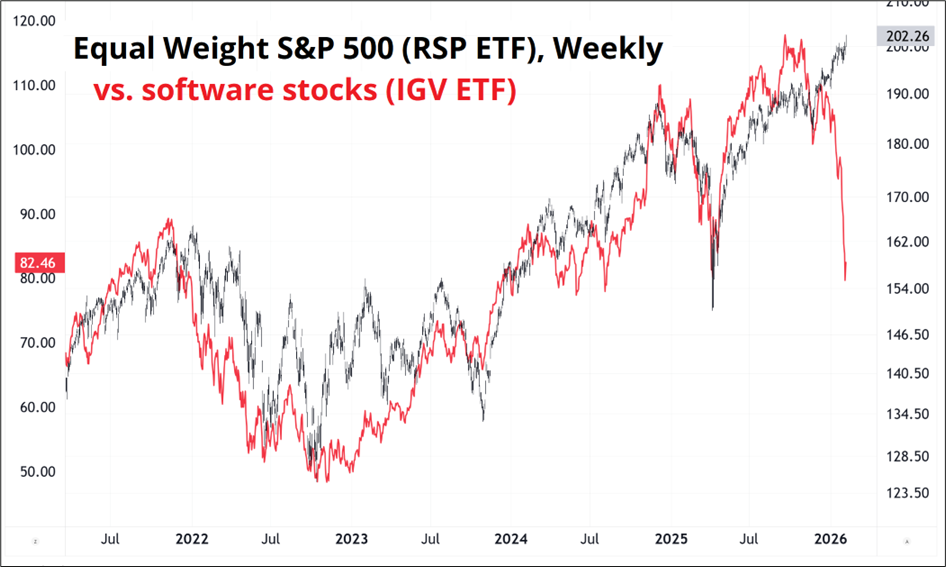

The Claude Code moment here is a bit like the DeepSeek moment where the market suddenly wakes up to something known and goes wild and instapivots from underreaction to overreaction in a few hairy days. Oracle has gone from 340 to 140 now. IGV has dropped from 118 to 82 in three months. But overall equity market performance has been solid. While the RV traders get rich or die trying and the old heavyweight favorites are all way below their Halloween 2025 highs, the equal weight S&P 500 is making new all-time highs.

I get the angst around software, but in a degrossing event you are going to see a lot of healthy babies thrown out with the bathwater. There are probably opportunities to dumpster dive for companies that have been smashed but who are not in jeopardy from Claude’s Cowork plugins. I am not a single name expert, but you can get some ideas from an excellent ex-Bridgewater fella right here. I am also contemplating TTWO as I want to be long at some point soonish ahead of the marketing blitz for GTA 6. That game will be the biggest selling video game of all time ($3 to $7B in first year, $15B in total sales) and there is enough worry about the launch date (November 2026) that it will be seen as bullish if and when the marketing starts. They won’t spend marketing dollars until launch is assured so I would expect a big runup in TTWO in late spring or early summer. This dip feels like an opportunity to get ahead of that. For perspective, the top grossing movie of all time (Avatar) took in around $3B. GTA 6 could take in double that in its first 60 days. And personally, I don’t think AI-generated video games are going to compete with human-generated games for years, if ever. TTWO beat and raised last week but the stock is in the toilet on last week’s degrossing event and the Gemini Genie scare. Here’s a good article on the topic:

https://www.bloomberg.com/news/newsletters/2026-02-06/why-the-gaming-stock-ai-panic-makes-no-sense

Something like TTWO December 18, 2026 $250 calls make sense to me. Not investment advice! I will put these in the medium-term trade ideas sheet, along with the TLT long initiated in early January. I said I would update the medium-term trade ideas once/month but TLT basically hasn’t moved and it’s the only medium-term trade I have listed so far in am/FX this year, so I won’t bother for now. As usual, the shorter-term stuff will always be in the sidebar.

My point here is not necessarily about TTWO specifically. My point is that after a degrossing / contagion event like the one we saw last week, you need to find the assets that sold off in sympathy for no reason and buy them. A few key upcoming software earnings releases: APP 11FEB PANW 13FEB CRM 24FEB.

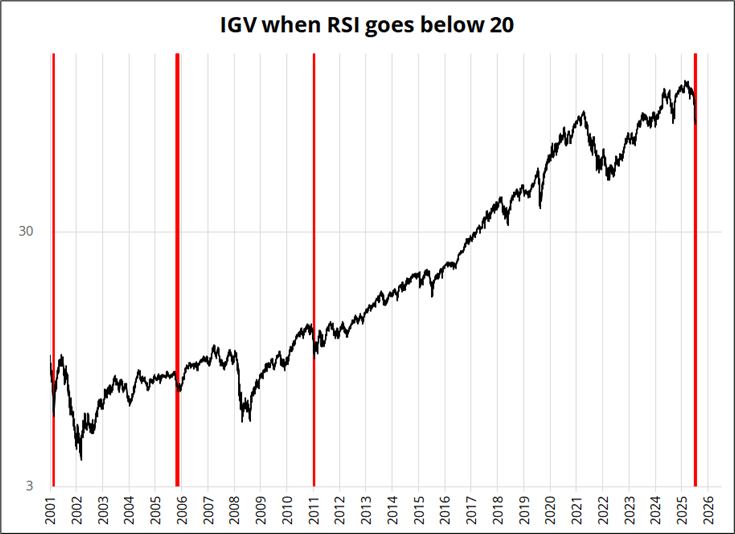

Also, simply looking at IGV, you can see that it’s rare for the RSI to go below 20 and when it does, it has marked a major bottom every time. I am not willing to bet that the software scare is over, but picking selective winners inside the group makes sense given the extreme selloff.

Every ad during the Super Bowl was AI, gambling, or weight loss. Super Bowl ads are an excellent filter if you are looking for industries that are so flush with cash, they can’t think of ways to spend it wisely. 2023 and 2024 saw a diversified group of companies advertising at the Super Bowl, while 2022 was textbook: All crypto firms advertising right before the FTX and BTC collapse. Super Bowl ads have a colorful history of marking tops for overhyped industries. If the absolutely insane AI capex numbers were not enough of a red flag for you, it’s safe to add Super Bowl LX to the list of reasons to worry about AI overspending.

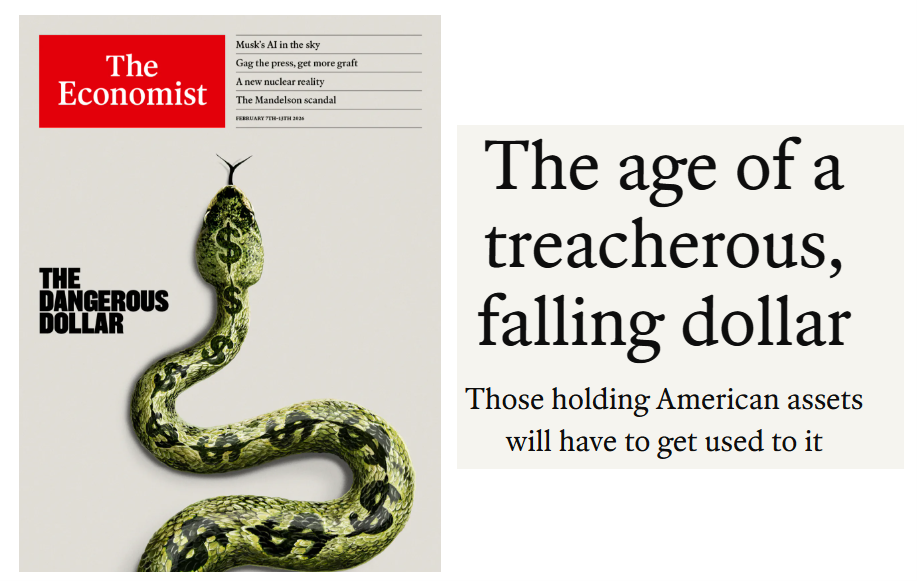

Meanwhile, The Economist is worrying about the falling dollar:

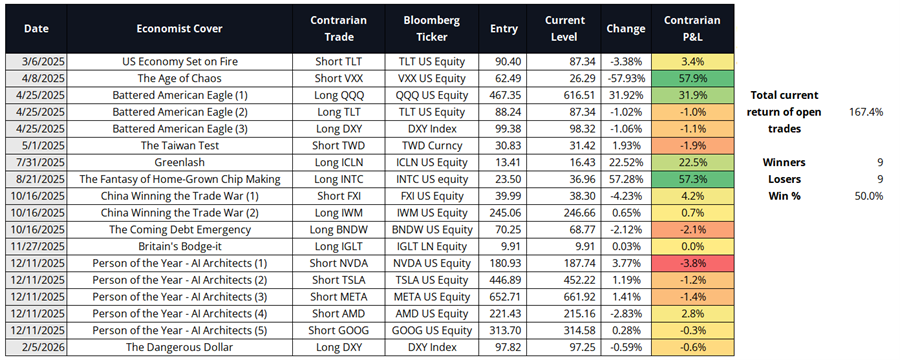

It’s not my view, but my view doesn’t matter so we will add a long DXY to the Magazine Cover Capital sheet. The cover came out Thursday afternoon so I will use the level of the DXY at that time for the mark to market. See new trade at bottom of the Magazine Cover Capital spreadsheet here:

This week’s calendar features three Tier 1 releases from the U.S. and a flurry of Fed speeches. With Fed policy appearing to have found its happy place, there is room for a repricing if the Fed talk and the U.S. data surprise in the same direction. As mentioned, I think I am biased to the weak side for NFP. I will write about that tomorrow.

https://x.com/hamptonism/status/2020194527898919181

Have a blue-sky day.

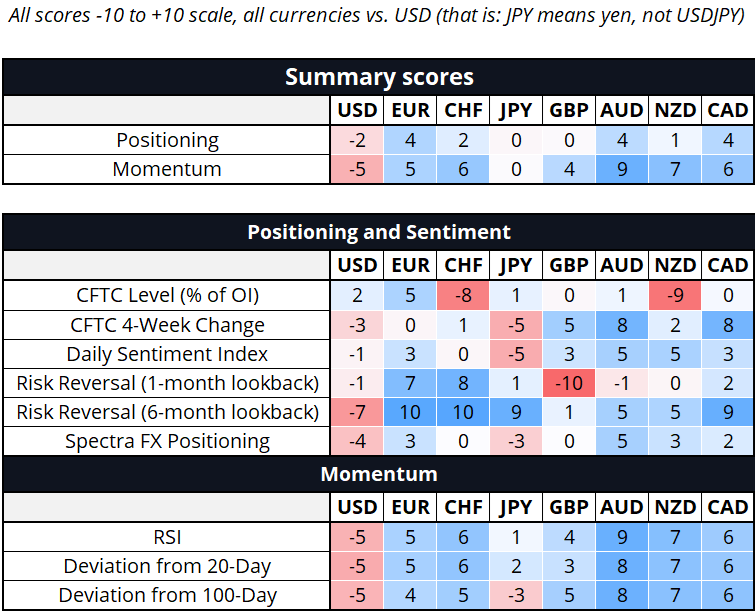

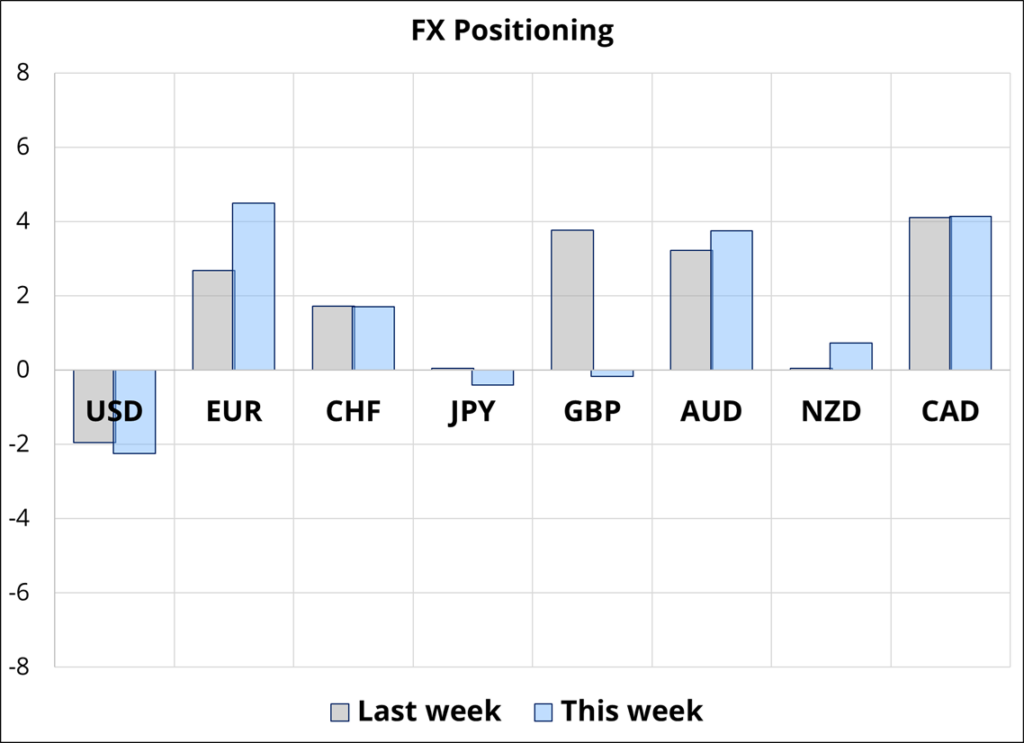

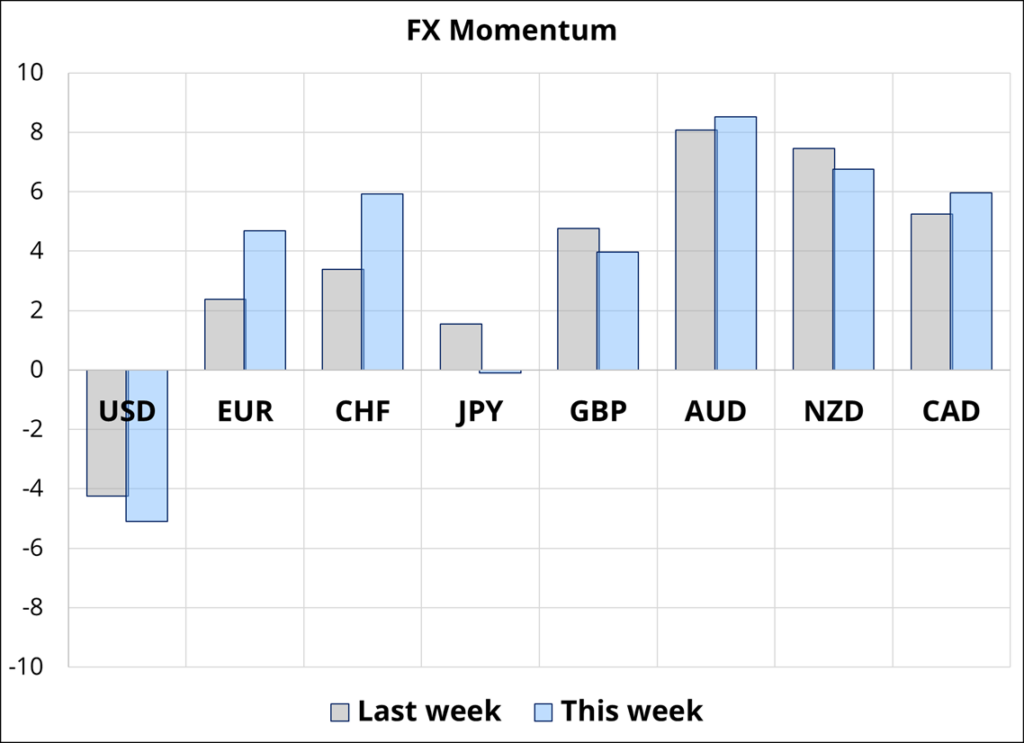

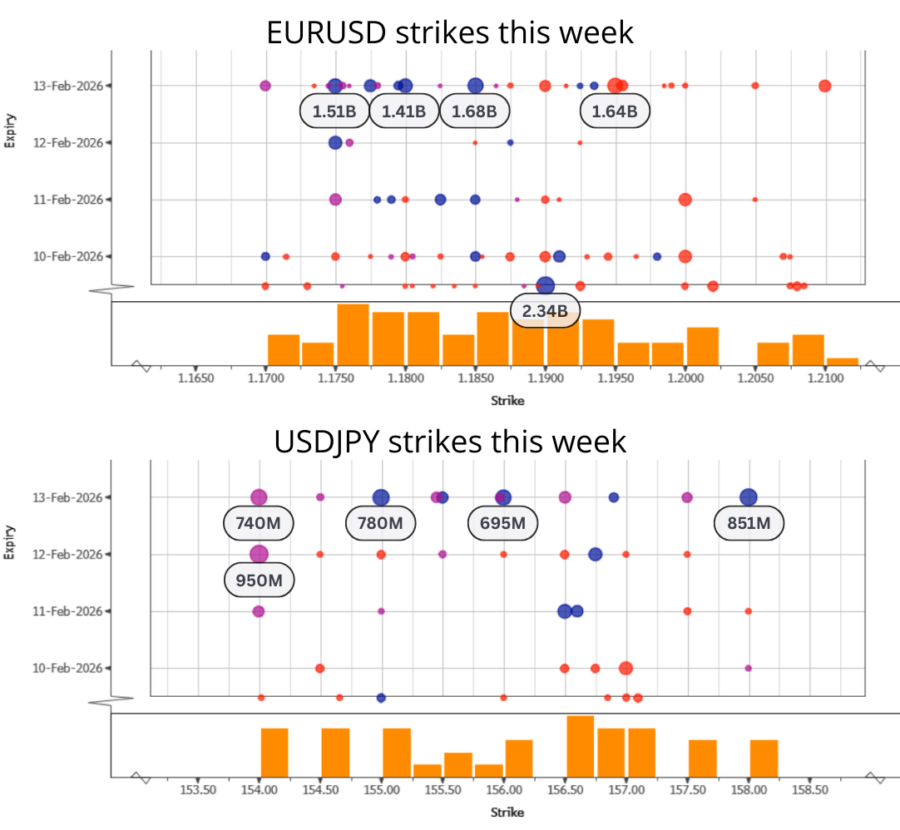

Hi. Welcome to this week’s report. The USD bear story is not showing up as aggressively as I would have expected in this week’s numbers. The market is long EUR, AUD, and CAD, but flat JPY and GBP and so overall we have a consensus across currencies (short or flat dollars). Mega 1.19 expiries today in EURUSD.