Next week is big.

Days of Thunder

Current Views

24JAN 158 EURJPY put

31bps off 160.30 spot

24JAN 21.10 USDMXN call

55bps off 20.80 spot

07FEB 1.46 USDCAD call

33bps off 1.44 spot

Eerily Complacent

I don’t quite know how to square the total lack of fear or even mild concern in the market with the fact we are three or so days away from a reordering of the global trading system. Sure, we have been talking about this for ages, but the market has not fully discounted it.

As per normal, I’ll keep it short because it’s Friday. I am putting on a two-trade tariffs basket as I think the market is still underpricing the Week One tariff threat.

Trade 1: Buy 1-week 158.00 EURJPY put for about 31bps off 160.30 spot.

Tariffs on EU autos, tariffs on China, tariffs on anyone are all bullish bonds and bearish cross/JPY. I like EURJPY and CADJPY particularly, but I already have the USDCAD option. There is also the runup to BOJ with this trade so if tariffs happen, then the BOJ balks because of the turbulence, you have some great gamma.

Trade 2: Buy 1-week 21.10 USDMXN call, 55bps off 20.80 spot.

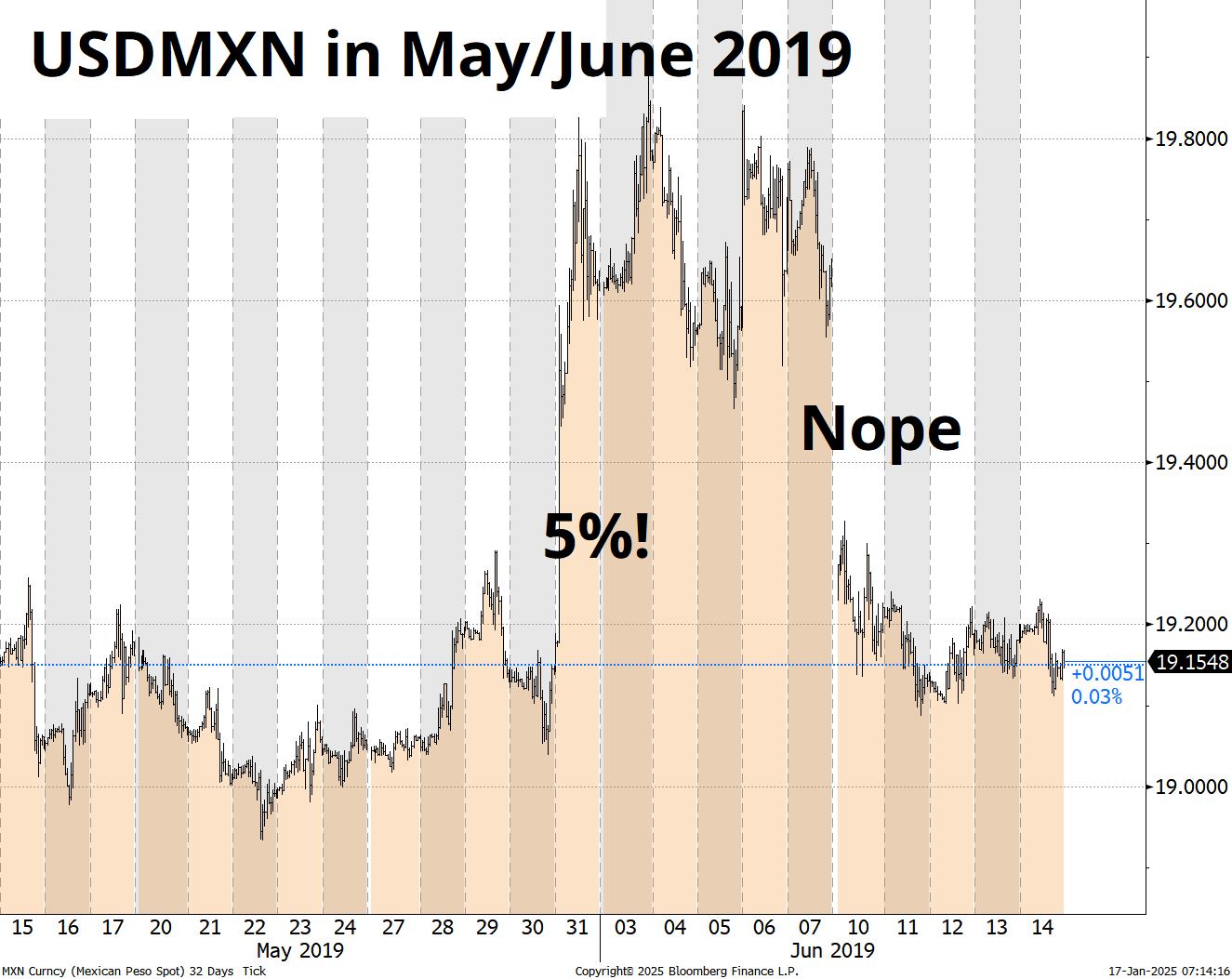

We could get a repeat of Trump’s Emergency tariff announcement in May 2019. See the announcement here. He threatened 5% tariff with 5% increases. Then, he folded two weeks later. USDMXN chart here.

Trump ready to bypass Congress on Tariffs

Steve Bannon Days of Thunder article from 14JAN

I just don’t see why the market is so doubtful of Day One tariffs, and these options can easily pay 3:1 or maybe more if the tariffs arrive next week. Short-dated VXX calls or EEM puts also look logical to me.

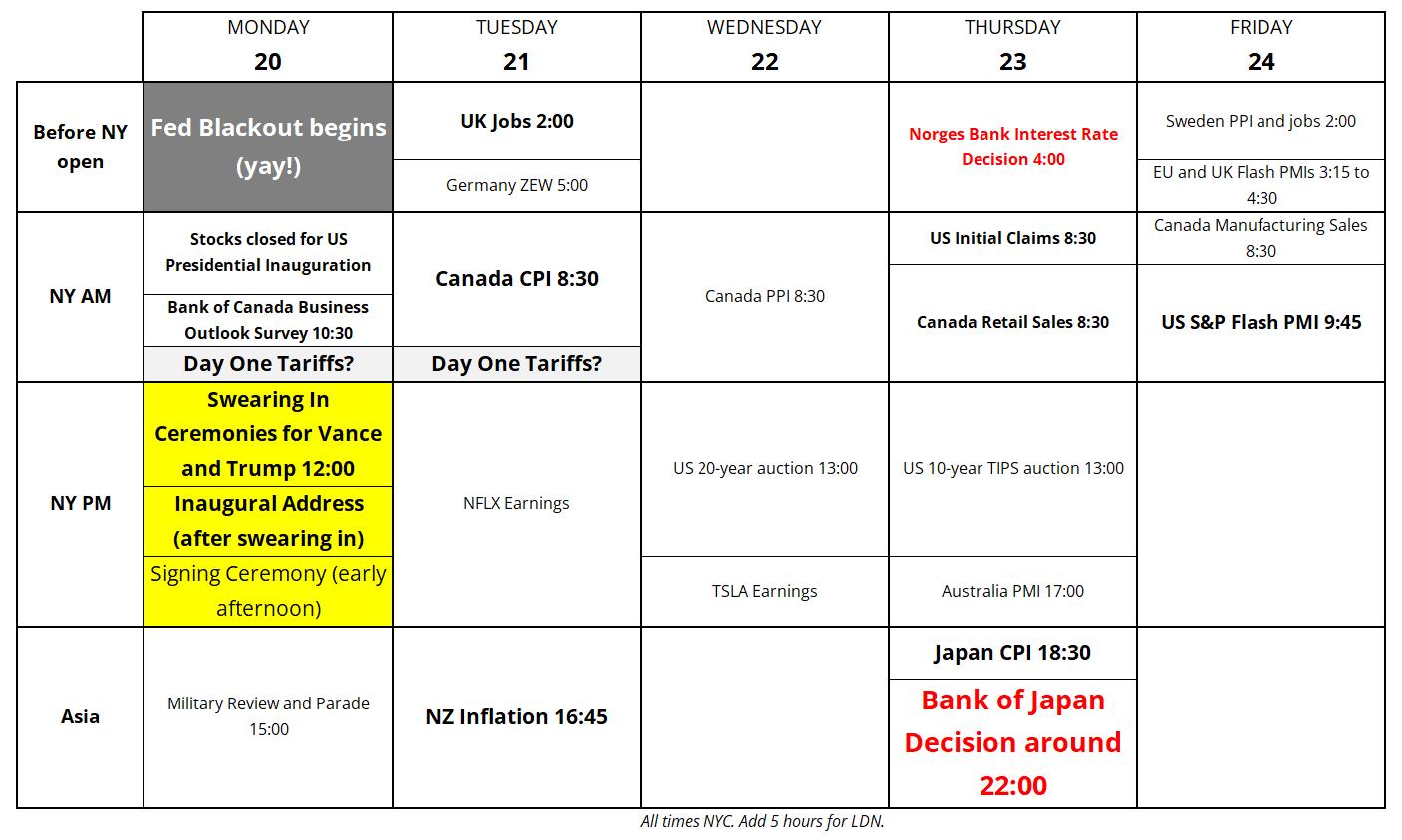

Calendar

The key window Monday is noon to 3 p.m. Canada, NZ, and Japan Inflation next week plus the BOJ.

Final Thoughts

This article overstates a single factor as it tries to explain a much more complicated bond move, but still, it’s an interesting take and probably a good partial explanation for the recent rise in yields.

https://westonnakamura.substack.com/p/la-wild-fires-are-burning-the-bond via Wally T.

China in depression? Article from WSJ Beijing.

FYI, if you trade with Spectra, I’ll be here all day Monday to help you.

Have a sporty weekend.

Sports pictures of the year

https://www.worldsportsphotographyawards.com/winners-and-shortlists-per-year/winners?rmxv=1736859897

HT ClarkR <3