They can matter a bit, even though we are blasé about them

I tried to do this with all the digits of pi, but then realized it was irrational.

They can matter a bit, even though we are blasé about them

I tried to do this with all the digits of pi, but then realized it was irrational.

Long USDCAD @ 1.3815

Stop loss 1.3693

Take profit 1.3998

Long USDJPY @ 148.15

Stop loss 146.93

Take profit 149.98

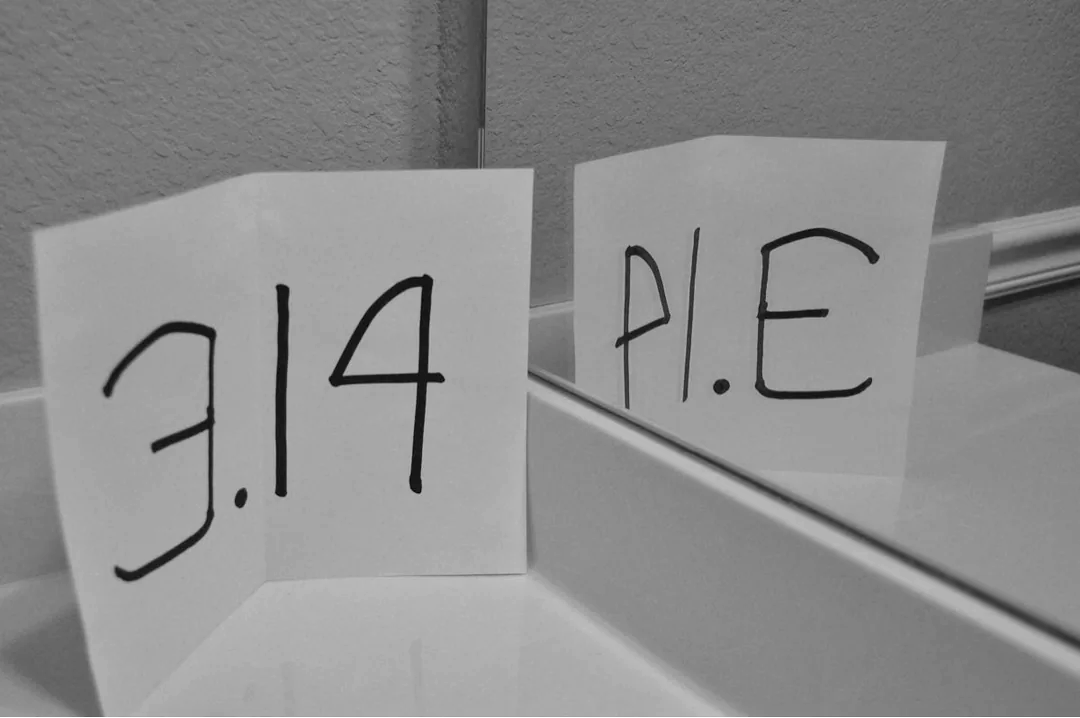

Government shutdown odds are rising as Republicans could only muster 44 of the 60 votes needed to pass a spending bill in the Senate last week. Two Republicans voted against the bill and eight Republicans were absent and thus did not vote.

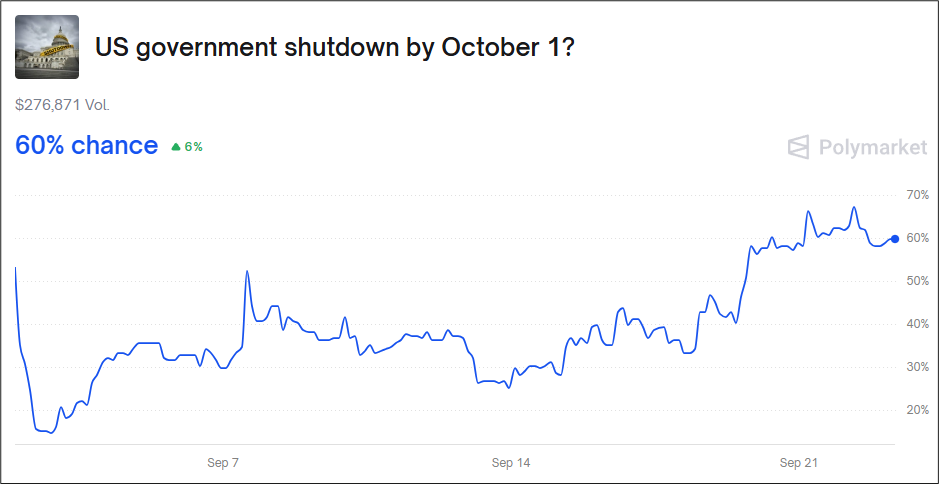

Government shutdowns are a boring and tedious feature of the US geoeconomic landscape, and rarely do they have a meaningful impact on the economy. They can, however, have temporary but meaningful short-term micro impacts on markets as people get nervous given the unknown length of the shutdowns and economic data gets delayed because the government workers can’t work. Here I show what USDJPY and 1-week realized USDJPY vol did across the last two shutdowns.

You can see USDJPY sold off into both shutdowns and rallied thereafter. Questions of fiscal drag arise but are waved off by the time the government reopens a few weeks later. Volatility falls as reopening appears likely.

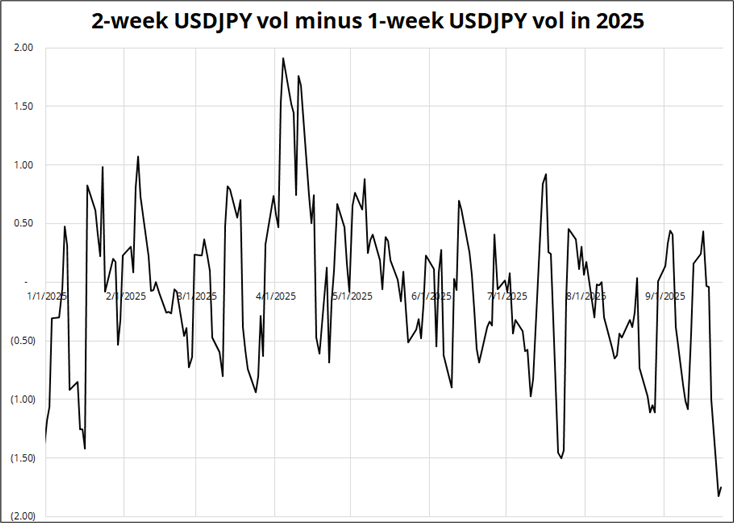

This is especially interesting today because the gap between 1-week and 2-week USDJPY is wide with NFP (03OCT) the marquee release these days and the LDP Leadership Election (04OCT) the next day. Here’s the spread.

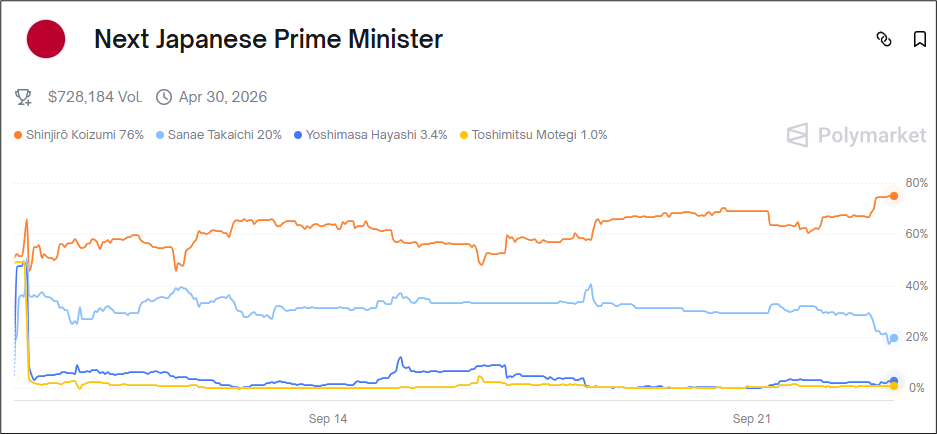

You could potentially short the 2-week vol, guessing that NFP will be cancelled, though you would still be exposed to weekend risk around the LDP election. Probably safer to just avoid being long, although I will say the market is getting bored of this LDP story somewhat. If Takaichi surprises, USDJPY will move higher on the open on Sunday October 5, but Koizumi is a boring and vol-negative outcome. So net-net, selling the 2-week makes sense.

For reference, you can make a bet that USDJPY will be inside 146/149 two weeks from now that pays 1:1. That is, a digital range, an option that says USDJPY will be inside 146/149 in two weeks, trades for around 50%. Hit me up if you want to do the trade. This trade would fit my base case which is: USDJPY rallies this week then sells off next week, then Koizumi wins and we are right here unchanged in two weeks. It’s a nice “nothing ever happens” trade. I am long USDJPY right now and hope to get out on or before Friday morning into corporate month end given the risk that USDJPY gets nervous into the weekend over a possible government shutdown.

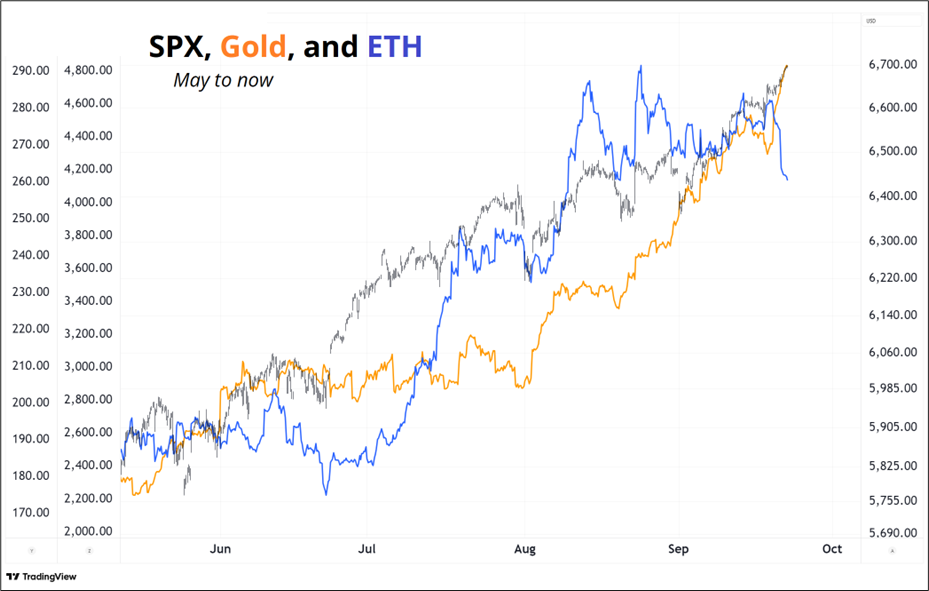

I don’t fully understand what is going on with gold as the USD is stable, and crypto has headed south for the winter. I suppose gold and equities are the same trade these days as both are liquidity sponges / debasement proxies, but with Asian equities turning lower and crypto dumping, it’s not a 100% all-clear liquidity message from markets.

For now, I suppose crypto is a mild yellow flag for the current 2025 sequel to 2021’s “The Everything Rally.”

The current monthly RSI of 89 for gold might also raise a few eyebrows! Not normal. The only other times we have seen an RSI above 88 was the peak in 1980 and during the price discovery around the repricing of gold after the depeg in the early 1970s.

There are plenty of yellow flags out there, and NVDA providing ~100 yards of vendor financing to OpenAI is another one, I suppose. Will be interesting to see if NVDA sellers can hold the line at 185. That has been a huge distribution top for more than two months, including the spike high on earnings.

I am getting tired of invoking the infamous words of Chuck Prince, but they are so apt that I must.

Have a day full of reflection.

I tried to do this with all the digits of pi but then realized it was irrational.

HT StephT