Calls are hot and puts are not

Larger, more detailed graphic bottom of page

Calls are hot and puts are not

Larger, more detailed graphic bottom of page

Flat

Programming note: I am travelling for the next two weeks. am/FX returns July 7.

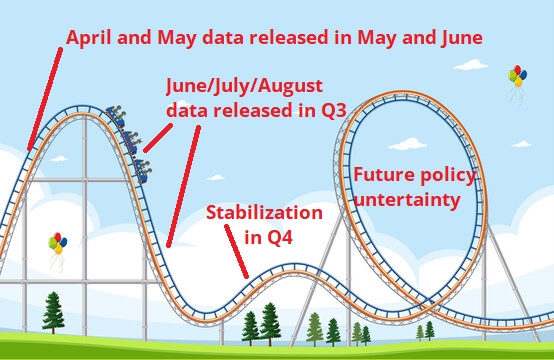

Stocks remain antifragile as bombs drop nightly in Iran and July 9th is creeping closer. I guess people have completely forgotten about tariffs as we continue to wait to see any impact on any data other than erratic survey responses that simply follow the S&P 500 up and down. I was of the view that the bad sentiment data would flow into bad hard data at some point, but the process is so paleolithically slow that it’s hard to hold onto much conviction. Inflation may go up due to tariffs, but there is also a non-zero chance that price hikes will be small enough that they don’t show up as they’re offset by services disinflation.

Claudia Sahm’s writeups are always excellent and in her latest, she opens the door for the possibility that tariffs will be offset by disinflation while still acknowledging the base case is probably that we just haven’t waited long enough yet.

https://stayathomemacro.substack.com/p/what-are-inflation-surprises-telling

On April 25, I posted this custom graphic, and it remains relevant. The problem is market time is slower than economic data time. Each day markets go up and down and news comes out and algorithms interact with fearful and greedy humans, and each month feels like a year and each year feels like a decade. We can’t wait around for confirmation of a thesis—tariff uncertainty will freeze hiring and boost inflation—that might not ever come true. We need evidence of recession or stocks drift higher.

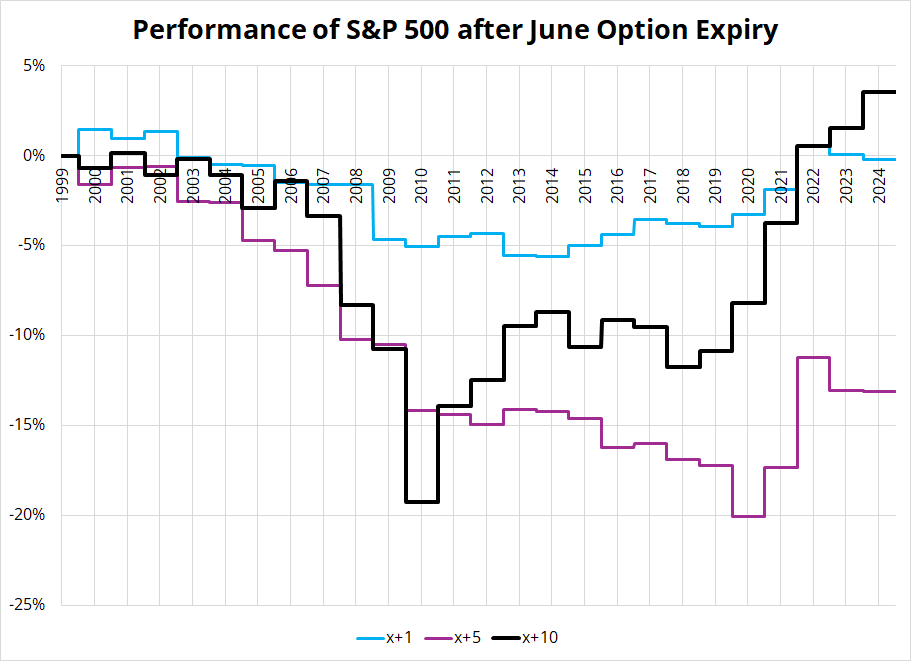

There used to be this theory that stocks sell off after the major option expiry dates because portfolio managers and such need to reload their puts as part of a properly hedged book and/or speculators love to be bearish and so they need to rebuy the (usually worthless) puts they bought last quarter. There has been a massive change in market dynamics post-COVID, though, as calls are the drug of choice for speculators, and “Stocks only go up” has become an unironic investing strategy.

If you look at the performance of the S&P 500 after June expiry, you can see that pre-COVID, the price action was generally bearish and post-COVID, it flipped bullish. This chart shows running P&L of long S&P 500 at the close on June options expiry, closing it out 1, 5, or 10 days later.

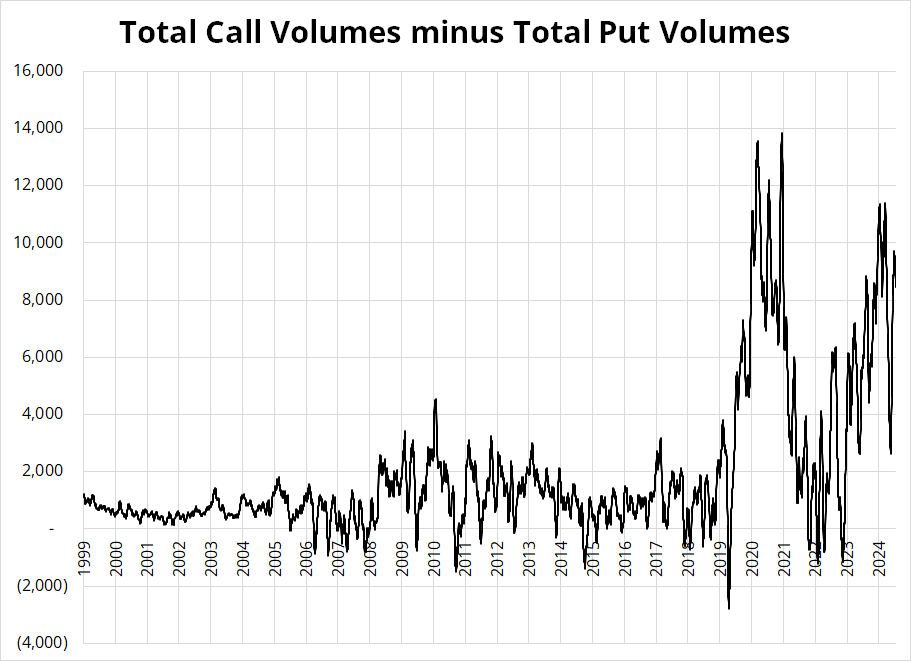

Confirming evidence of a switch in the supply/demand dynamic for puts and calls can be seen if you look at total call volumes relative to total put volumes on all US exchanges. Everyone has seen the chart of call volumes exploding from lower left to upper right, but this is a bad metric. You need to look at the relationship between call and put volumes because put volumes have also exploded.

The more short-dated options people trade, the larger the overall volumes are going to be because short-dated options have lower nominal price tags (despite higher IV) and so even if the world was spending the same amount of money on options (they’re not!) … You would see higher volumes if speculators moved to shorter and shorter dates. What’s actually happening is that interest in options has exploded and most of that interest in the very front end.

Also note that the demand for calls is highly procyclical and contributed to the bubbles in 2021 and the maybe-bubbles right now in stuff like CRWV, PLTR, and CRCL.

Hard to get super excited about long stocks at the all-time highs with the July 9th tariff deadline approaching and missiles crisscrossing the night sky in the Middle East. But that’s why it will probably work.

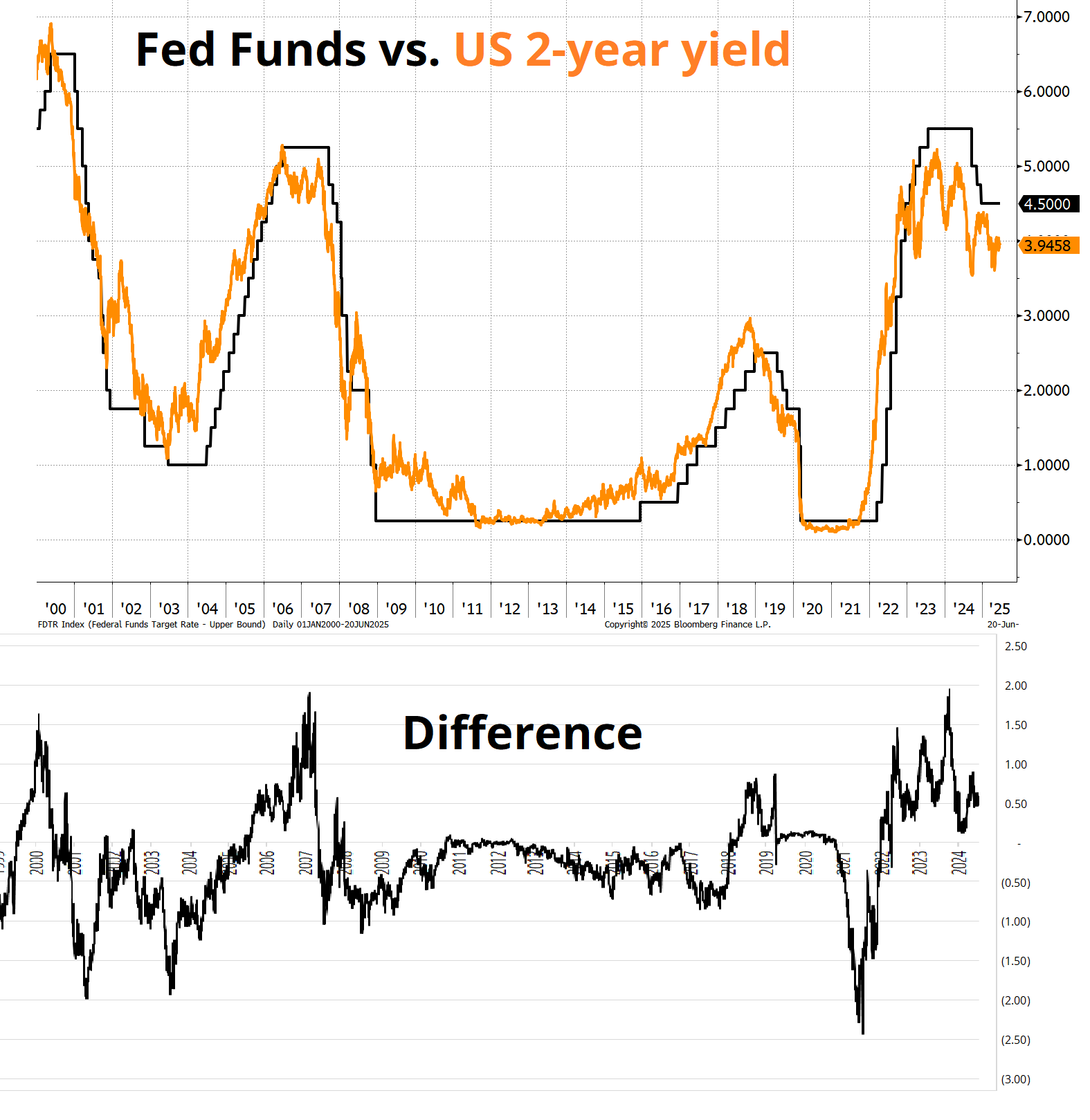

Chris Waller has decided to head a strongly dovish charge at the Fed, even as the rest of the committee seems more interested in a wait-and-see approach.

*FED’S WALLER: COULD CUT RATES AS EARLY AS JULY MEETING

His thinking might be that if there is a bit of flex in July FOMC pricing, that creates a feedback loop where the psychology of the Fed is amenable to at least thinking about thinking about a cut. If July FOMC is priced at 14% chance of a cut, the Fed won’t cut. It’s circular as they can guide the market or the market can guide them, depending on the circumstances. You can see 2-year yields lead on the way up (orange line) because the Fed hates hiking and only does it when it’s absolutely forced to do so. Fed Funds and the 2-year yield go down in synch because the Fed leads the way ‘cuz they love to cut.

Anyway, Waller continues to lead the dovish camp, but I am not too sure how many others are with him at this point. He’s like Jerry Maguire standing up in the middle office yelling: “Who’s coming with me?” I guess in this analogy Austan Goolsbee is Renée Zellweger.

PS: I have a selfie with Waller. And I am one win away from 9000 trophies in Clash Royale: An achievement almost nine years in the making.

The FOMC meeting was dovish dots and hawkish talk, and the July pricing is unch. Next week’s calendar is a bit uninspiring though we are likely to move into a period where we get more tariff headlines. Perhaps Trump extends the deadline to August 9th as he realizes something everyone else knew in April: Real trade deals don’t take days or weeks.

If you are looking for a super intimate (8-seat) high-end omakase experience, Takeda is great. Went last night. It’s the best sushi I’ve ever eaten outside Tokyo. Run by a husband and wife from Osaka.

I am travelling for the next two weeks so am/FX returns July 7. Be good.

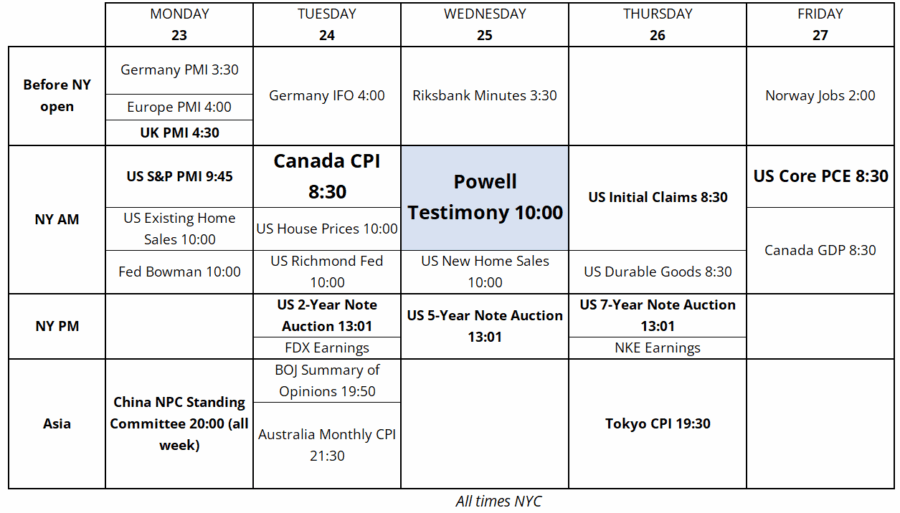

Trading calendar for the week of June 23, 2025