Global yields chugging higher again

The currency in Space Quest IV (released in 1991 by Sierra Games) is called the Buckazoid, and its symbol is…

The bitcoin symbol.

Fun.

Global yields chugging higher again

The currency in Space Quest IV (released in 1991 by Sierra Games) is called the Buckazoid, and its symbol is…

The bitcoin symbol.

Fun.

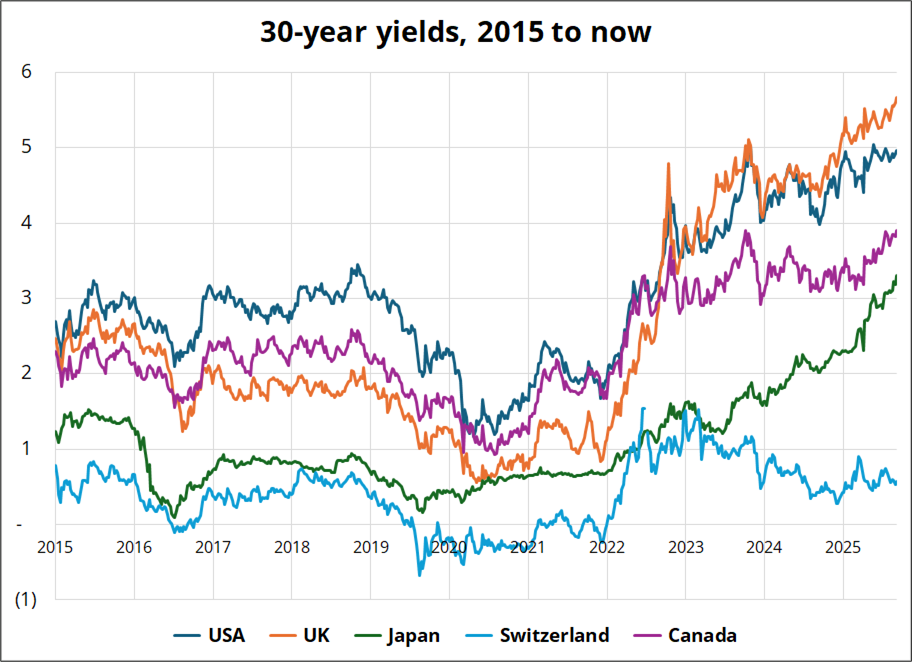

Bearish bonds, bullish gold until further notice, as per 29AUG’s Friday Speedrun

I missed a few items in my calendar this week. We have Beige Book today at 2:00 p.m. Wall Street time and then Fed’s Williams at 12:05 p.m. tomorrow (and Goolsbee at 7 p.m. tomorrow too). Williams’ last speech (August 25) was a navel-gazing piece on r-star with no practical relevance to markets. In July, he spoke on the economy and forecast a 4.5% unemployment rate by the end of 2025. More recently, he was on CNBC on August 27th and offered something like “on the one hand rates are a bit restrictive but on the other hand inflation is coming down pretty slowly.” It would be interesting if he showed a clear preference for cut vs. hold as he presents a luncheon speech at the Economic Club of New York tomorrow. But he probably won’t as his public comms have been super hedged all year. There will be a Q&A.

The UK budget is scheduled on the late side, for November 26th. This gives Reeves almost three months to find ways to rearrange the deck chairs while the bond vigilantes circle. I don’t think this UK fiscal theme is tradable in FX for now as that 26NOV date puts too much time on the clock. There could be leaks and newsflow that is tradable in the interim, but what I mean is that I don’t think the economics of sitting here short GBP or long GBP puts are positive EV given the long wait.

The most interesting outcome for markets would be a US reacceleration turbo-charged by government-requisitioned rate cuts. Given the situation at the Fed right now (government takeover), strong data should be bullish gold from now on, not bearish as it was in the past. If the monetary response to strong data is rate cuts, that’s bearish the back end of the bond market and bullish gold. Buy dips in gold if it sells off on any strong data this week.

If you knew nothing other than the fact that the President of the United States recently fired the head of the BLS after a weak jobs report and replaced her with the Chief Economist from a right wing think tank… Would you expect the next jobs number after that to be strong, or weak? Normally, the jobs report output is the result of a survey-processing machine. Now, maybe not?

I am open minded and maybe EJ Antoni III delivers an honest jobs report, even if it shows a weak outcome. But he may also feel that in order to keep his job and keep his benefactor happy, he might have to find some… Adjustments?

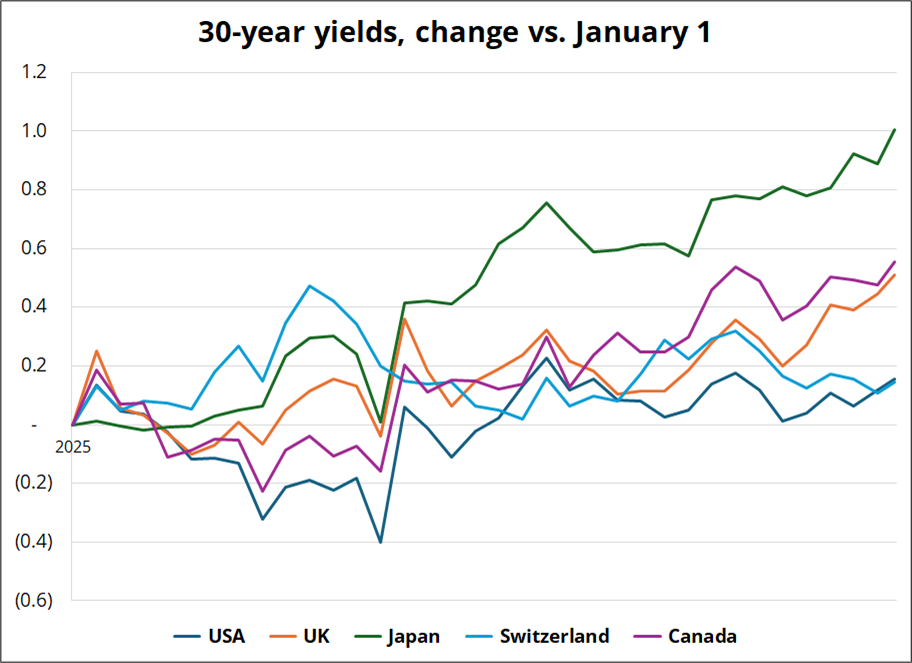

Rising Japanese yields are not generating significant rotation into JGBs and so you are getting rising yields in Japan and a weaker JPY. Kind of amazing. Even Canada is seeing a selloff in the back end despite negative GDP growth, debt/GDP below scary levels, and rising unemployment. Global pension funds surely should be salivating at the opportunity to buy strong fiscal stories at these yields, but if there is a global inflation problem, maybe not.

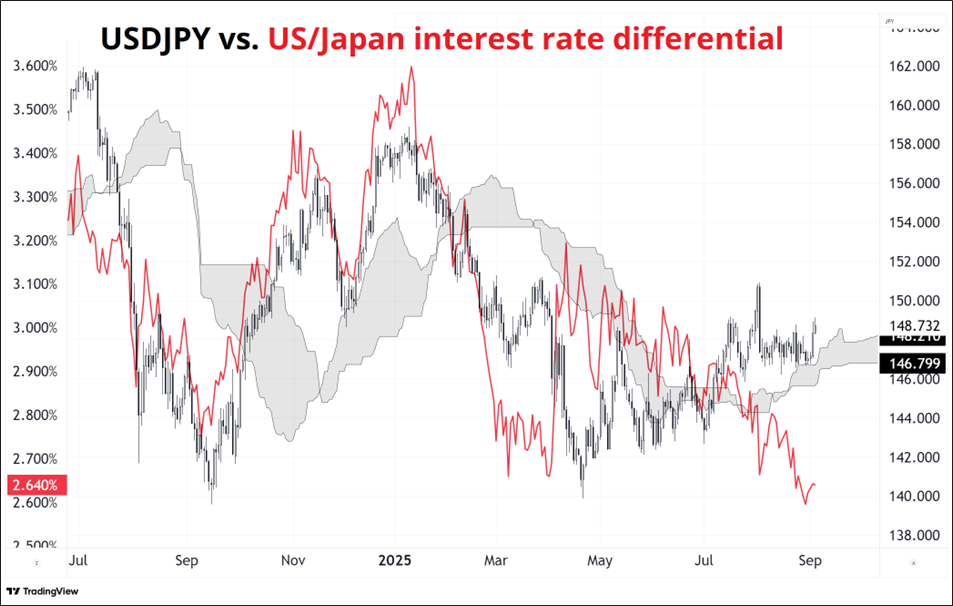

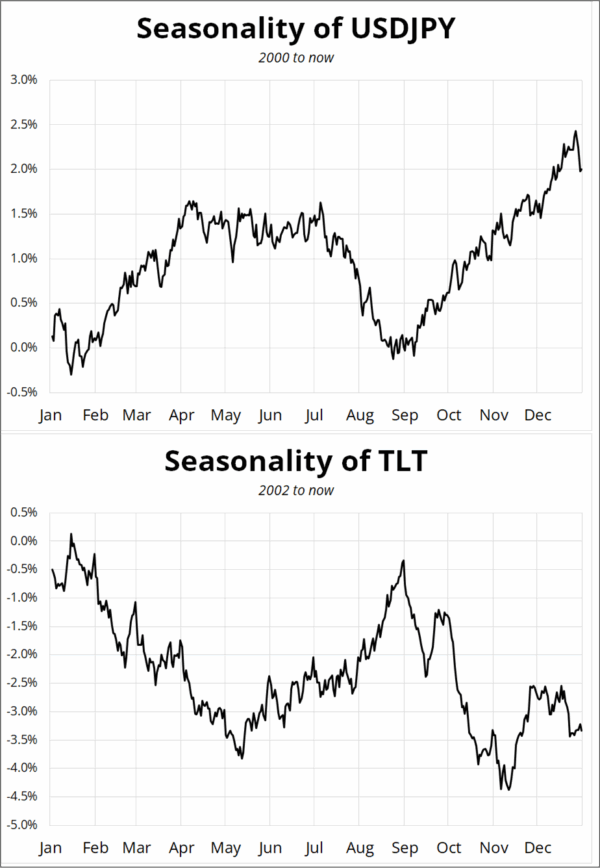

There is a lot going on with bonds right now as inflation is sticky, the Fed is losing independence, seasonality is bearish due to resumption of issuance after the summer lull, and deficits are irresponsibly large despite a long period of mostly pretty OK growth in many countries. It’s making for tricky FX trading as USDJPY seems to care more about the cloud than about interest rate differentials.

It’s a frustrating scenario for yen bulls because one would think given hedging costs, falling nominal spreads, narrowing real interest rate spreads, the Japanese government’s mild preference for a stronger JPY, the US government’s mild preference for a weaker USD, generationally-high inflation in Japan, ripping gold prices, evisceration of Fed Independence, and historically cheap yen (REER, etc.)… There would be a long JPY macro trade. But there is not. It’s weird.

I am open to the possibility that this dreamy macro JPY cocktail will deliver at some point. But for now, technicals, positioning, and corporate flow dominate. And while seasonality has been useless this year as news shocks have trumped seasonal flow patterns, I share the USDJPY seasonality and TLT seasonality below in case you wanted it.

A strong NFP this Friday would be enough to trigger a final mass capitulation higher in USDJPY and then maybe we can start to think about starting to think about taking the other side. I am not sure what is going to reassure or further goose the bond vigilantes in the short run as their reappearances (and subsequent extended disappearances) feel kind of random and arbitrary. They are capricious!

1. While the neutral rate is procyclical, unobservable, and mostly a product of the bias of the economist determining it, we still have to care about it because central bankers care about it. So here are two more papers published in the last 24 hours.

A Cleveland Fed paper on the neutral rate.

An RBNZ paper on estimating the neutral rate and its drivers.

2. The third installment of the TRON movie series comes out October 10. Trailer here. Soundtrack by NIN.

Get excited. Here’s a fun screenshot of the Tron Deadly Discs videogame I played on Intellivision when I was 9. Video game graphics have improved since 1981!

The box design is still pretty sweet.

https://www.thecoverproject.net/view.php?game_id=3449

Have an 8-bit day.

The currency in Space Quest IV (released in 1991 by Sierra Games) is called the Buckazoid, and its symbol is…

The bitcoin symbol.

The game is called “Roger Wilco and the Time Rippers”.

Fun.