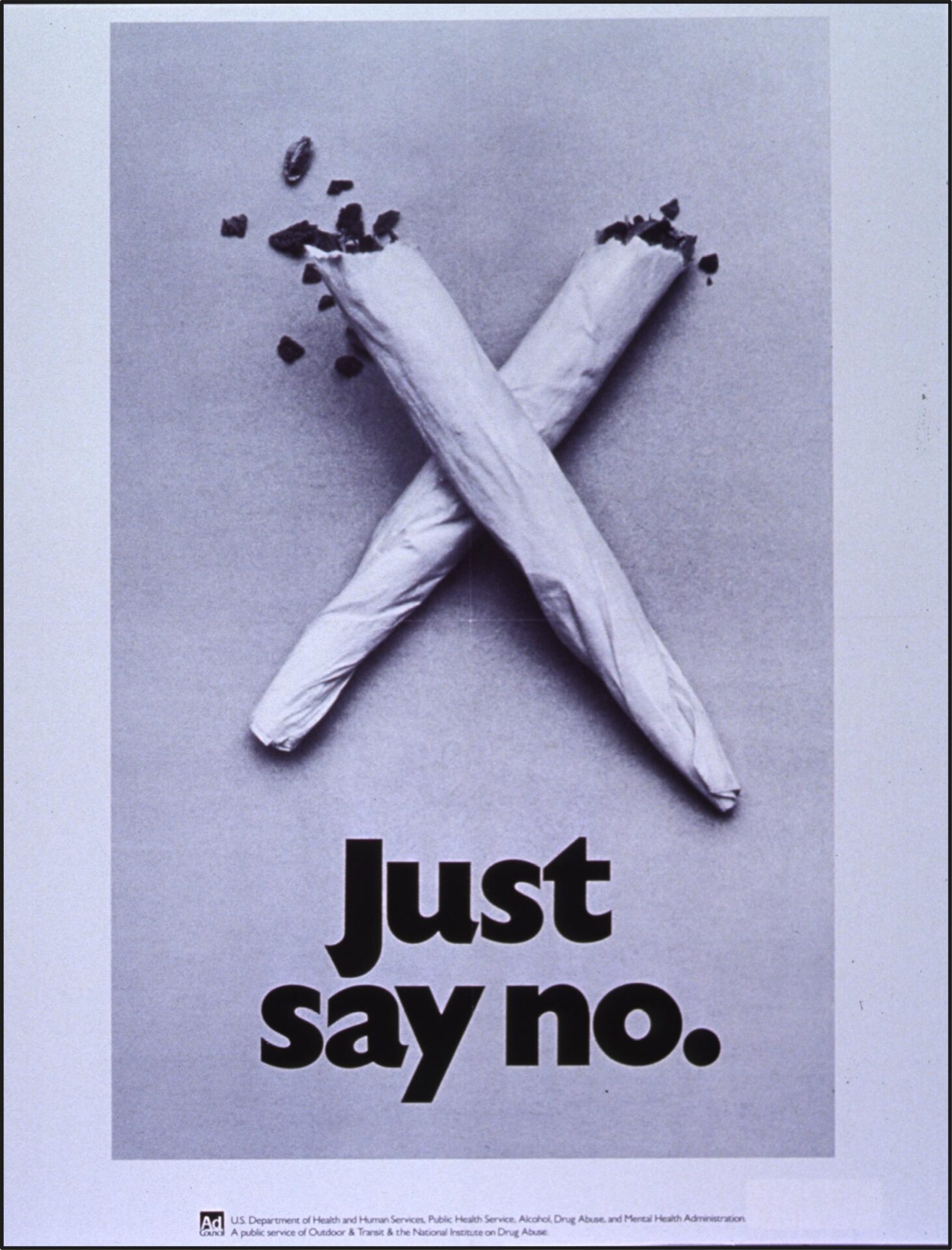

President Nixon’s War on Drugs began on this day in 1971

Current Views

Flat

Fed

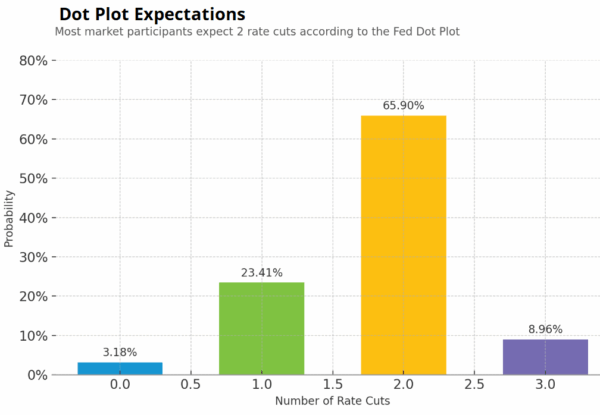

Thank you to the 346 respondents in yesterday’s Fed survey. Here are the results, with a bit of commentary. First, expectations for the dot plot are centered on two cuts in the dot plot with 23.4% of respondents looking for a move to just one cut. Three cuts and zero cuts got some votes, which is mildly surprising.

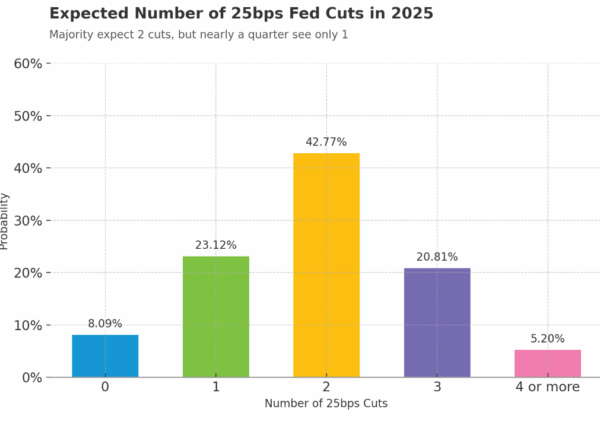

The second question asked for views on how many rate cuts will actually come through from the Fed this year. The distribution is a bit flatter, with two cuts still the most-loved scenario, but one and three cuts seen as possible too.

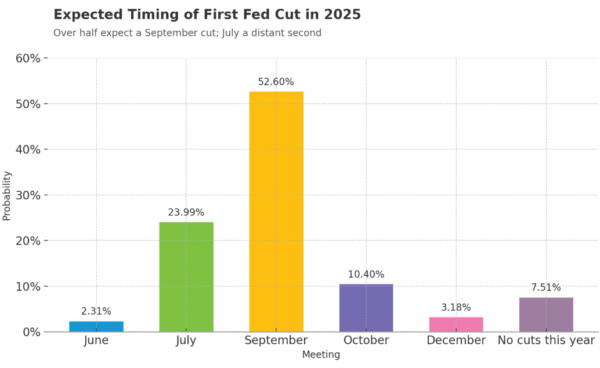

The third question is obviously correlated to that last one.

It asked about the timing of the first cut. Logically, given the modal response for number of cuts is two, the modal timing for the first cut is September.

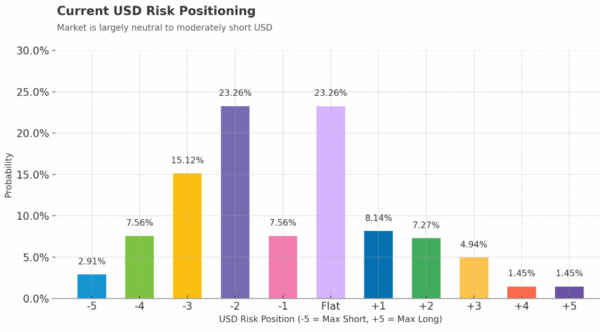

Finally, I was curious about current USD positioning, so I threw that question in. Results are consistent with what I would have guessed. Modest short USD.

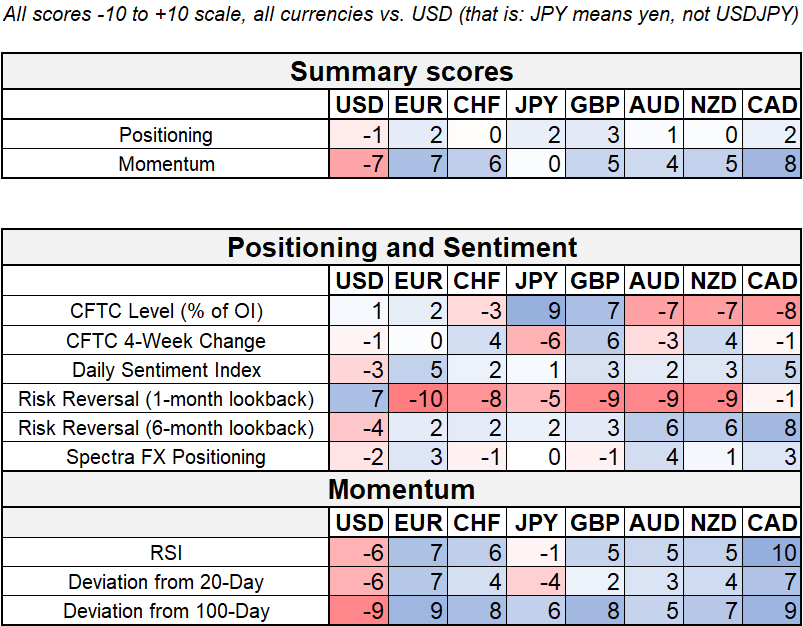

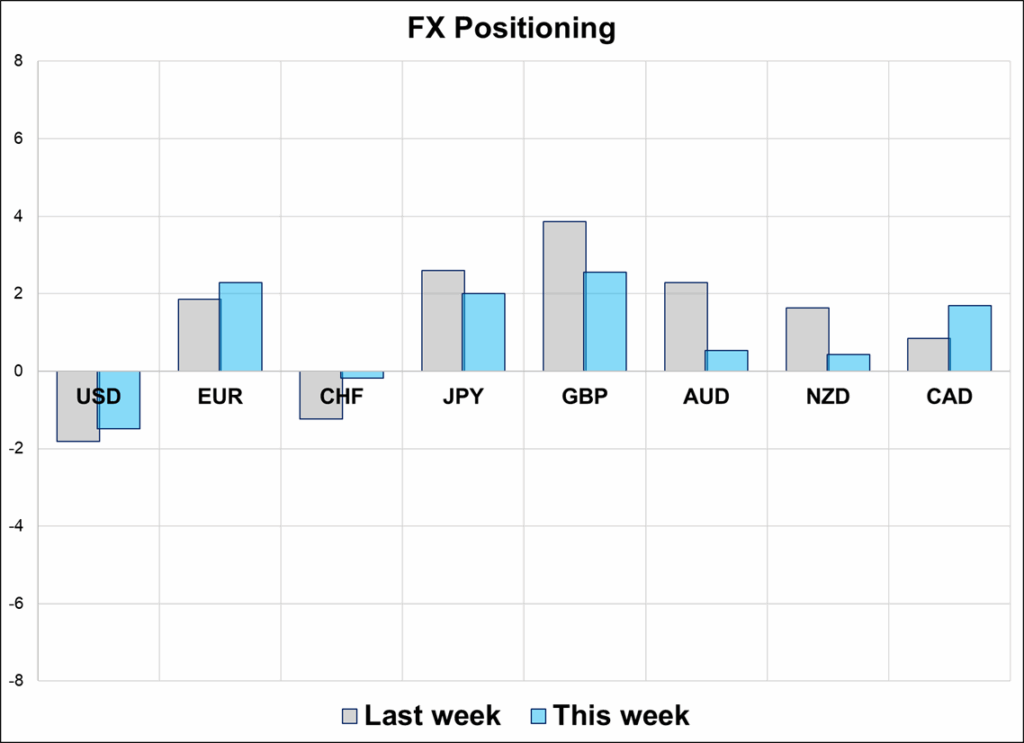

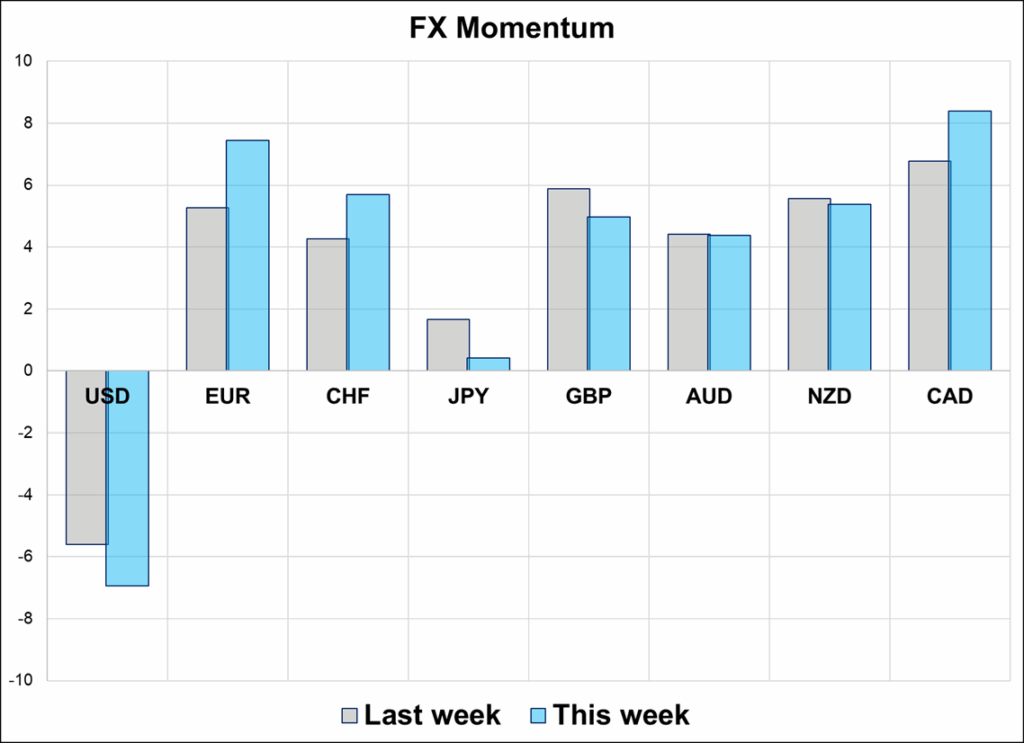

I might as well toss the Positioning Report in here, instead of posting it after the main note, given we’re talking about positioning anyway.

G10 FX Positioning and Momentum Scores

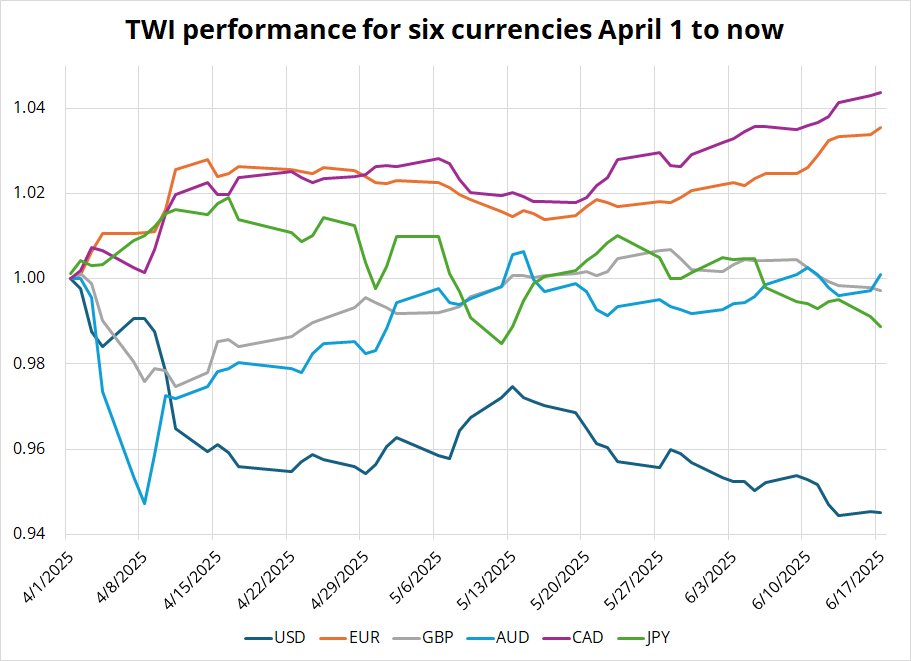

You can see that positioning remains modestly short USD. The slow, choppy grind in EURUSD and repeat rejections in AUDUSD have left the market with much less delta over time, while USDJPY has been a disappointment yet again and CAD, the most-hated currency going into Liberation Day, shines bright like a diamond. Here are six TWIs, indexed to 1.0 on April 1, 2025.

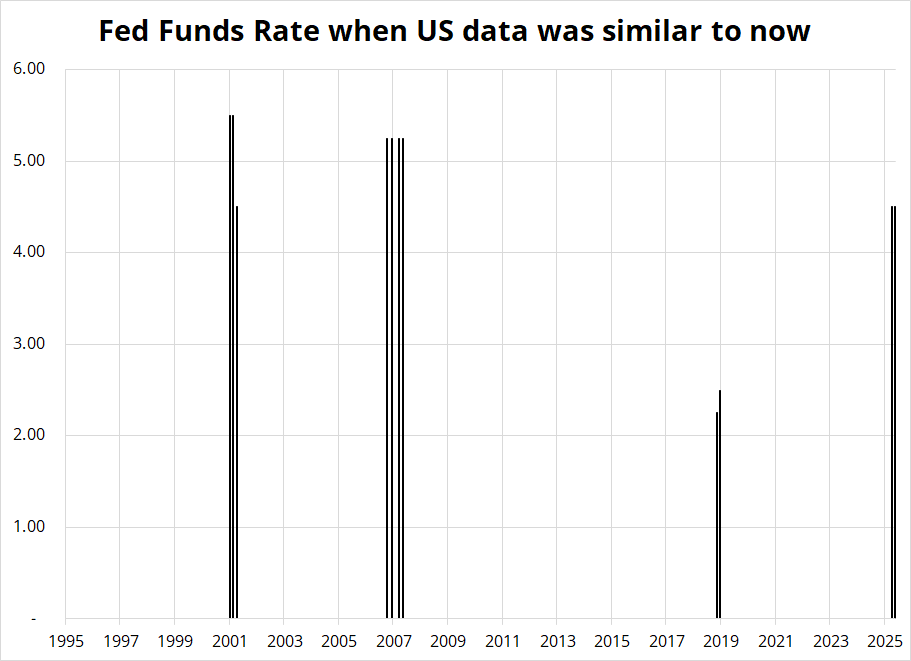

One last point on the Fed. Tim Power of Spectra FX pointed out that last time we were in this zip code for both the Unemployment Rate and Core PCE, the Fed Funds target rate was around 2%. This brings to mind the question: Were the 2010s and the Secular Stagnation that dominated that decade an aberration? Or could we go right back there as AI deflates, and massive government debt eventually proves to be disinflationary once deficits stabilize? It’s an important question because if you go further back, the other periods with similar UR and Core PCE saw Fed Funds above 5%. I filtered for: Is UR below 4.5% and Core PCE between 2.0% and 2.9% and then checked where Fed Funds was and got this chart:

Filter is: UR < 4.5% and Core PCE between 2.0% and 2.9%

Final Thoughts

- The United States has signed one trade deal out of 195 or so trading partners. Talks are not evolving much if we are to assume that most of the information leaks out or is tweeted or repeated by one side or the other. July 9th is sneaking closer. The EU look particularly unresponsive to the stick Trump is waving around. And they are unlikely to receive any carrots. It’s difficult to estimate how much markets even care about the tariffs anymore, but I presume the approaching deadline will take some of the zip out of topside for markets. If we can’t get through the 22300/22400 after the Fed, it will be a more convincing setup to take a shot at short equities for the fear trade into July 9. For now, I am still bullish stocks because I lean towards a dovish FOMC tomorrow.

- The latest from Sam Altman is a good look at some possible futures. He reminds me a bit of Locke from Ender’s Game.

- Thursday is a holiday in the USA and stocks and bonds are closed. I did not put this in the calendar that I published yesterday. Juneteenth.

- Freddie Mercury is of Indian descent and was born: Farrokh Bulsara.

May today take you to new highs.

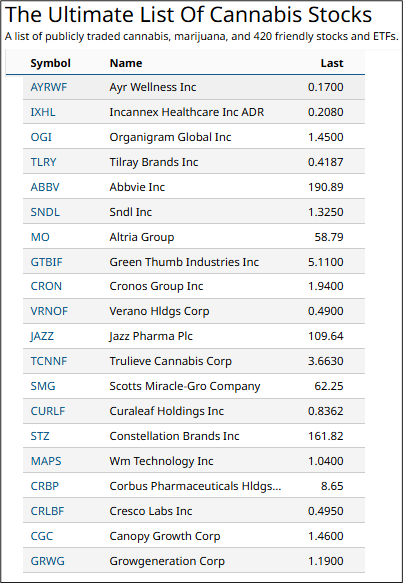

Nixon officially declared the War on Drugs on this day in 1971.

What a long, strange trip it’s been.