They’re all that matter right now

They’re all that matter right now

Long NZDCHF @ 0.4770

Stop loss 0.4689

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Hedge 1.8140/90 (35% so far)

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

Before we get started today, I ask you to please take 80 seconds to complete a short survey. Given the subjective nature of the outcome of Powell’s appearance at Jackson Hole, I am finding it hard to determine exactly what I think is priced in.

Some are looking for what I am expecting: A hawkish, data-dependent view stressing that there is not so much slack in the labor market as falling supply intersects with falling demand. Others expect a more dovish outcome that acknowledges weakness in recent labor market demand, opening up a surefire September cut and more.

The survey is here. I will post the results in chat tomorrow morning at 7:30 a.m. for clients, and on Twitter, in case am/FX doesn’t come out before the 10:00 a.m. speech. Thanks.

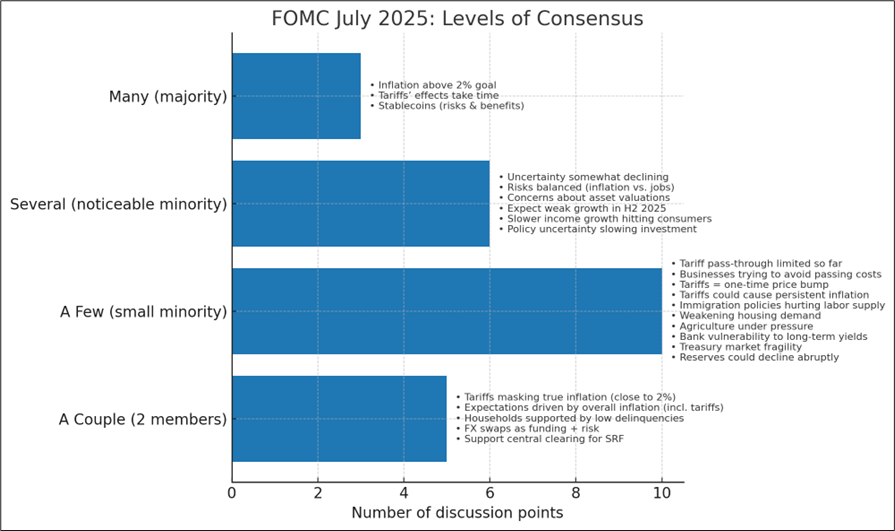

A majority of people in the market, or at least many, or perhaps several or at least a couple, believe that the FOMC Minutes are edited after the fact to send a specific message. If you believe this, then the message going into Jackson Hole is hawkish. Here are the key points from the minutes.

“A majority of participants judged the upside risk to inflation as the greater of these two risks, while several participants viewed the two risks as roughly balanced, and a couple of participants considered downside risk to employment the more salient risk.”

“Several participants noted concerns about elevated asset valuation pressures.”

“In terms of timing, many participants noted that it could take some time for the full effects of higher tariffs to be felt in consumer goods and services prices. Participants cited several contributors to this likely lag. These included the stockpiling of inventories in anticipation of higher tariffs; slow pass-through of input cost increases into final goods and services prices; gradual updating of contract prices; maintenance of firm–customer relationships; issues related to tariff collection; and still-ongoing trade negotiations.”

Here is a table of FOMC views, sorted by most consensus at the top to least consensus at the bottom.

If Powell is hawkish, the FOMC Minutes will have appeared to telegraph it. By the way, here’s a cool chart from Fred Goodwin. With the angst around AI percolating again, NVDA takes on even epicker[1] importance next week.

What a segue! In case you missed it, there is an MIT article going around that pooh poohs the utilization and productivity gains from AI. It came out two days ago, but similar to DeepSeek, the market is slow to digest the implications. We also could be backfitting a story to the price action a tad here, but I think there is something to be said for the fact that the insane levels of capex mean that any whiff of “it’s not gonna pay back” is terrifying. The market is terrified of a 2000 repeat as capex is inherently cyclical and the payback on optical fiber capex (for example) during dotcom was not sufficient to justify the investment.

Here’s the article (thanks be to Chuck for the link):

https://web.archive.org/web/20250818145714/https:/nanda.media.mit.edu/ai_report_2025.pdf

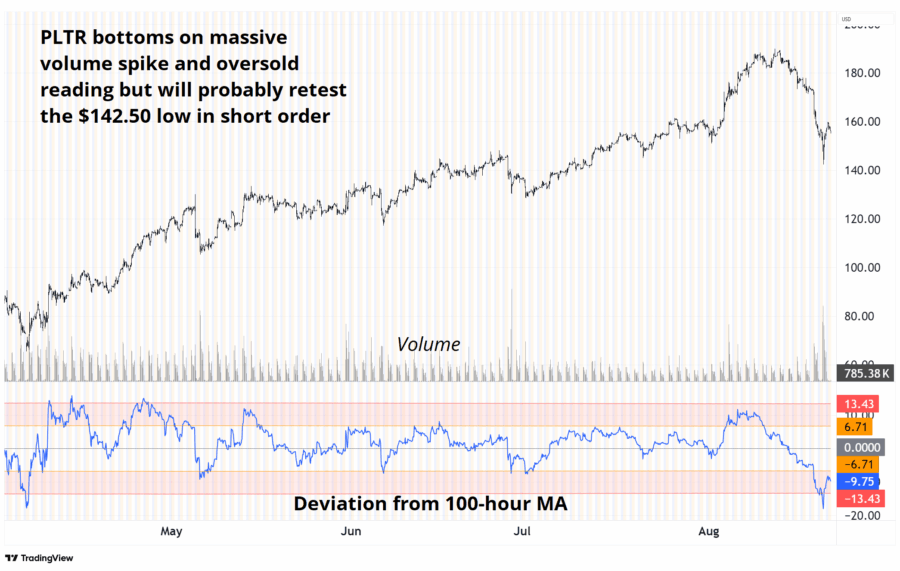

It’s a good read. MSFT and PLTR would be particularly vulnerable if you believe the content of the report. Sam Altman also said he thinks AI is in a bubble over the weekend, so that probably didn’t help either.

https://www.investors.com/news/technology/artificial-intelligence-stocks-ai-stocks-mit-study/

Have a light, nectar-rich, and fast-flying day.

—

[1] Epicker (ˈepik-kər) adjective: More epic. Possessing even greater epictude than other epic things.