The market is taking the Middle East in stride for a change.

I am not sure what these are for but I would like some.

To put on the bar near spilled drinks?

The market is taking the Middle East in stride for a change.

I am not sure what these are for but I would like some.

To put on the bar near spilled drinks?

Flat

—

Before we get started, please complete this super short 4-question survey on the FOMC. It will take you 16 seconds total.

—

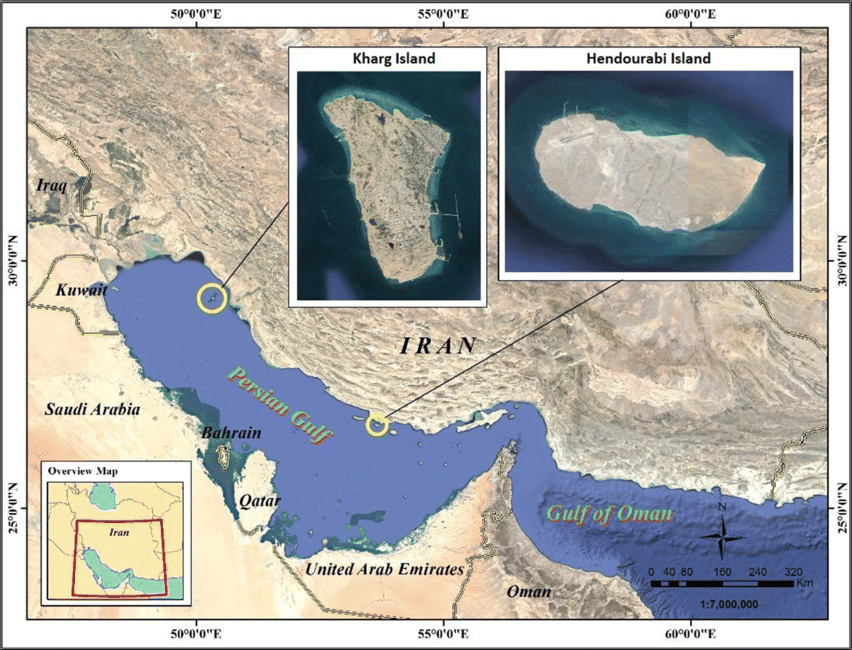

They say that finance has no memory but it does feel like the markets are starting to remember that Middle East dustups have no impact on US equity values, other than for one or two days. It almost makes me a bit nervous how complacent we are, but unless one of the following happens, the focus will soon turn to the Fed:

This article is a good explainer of worst case scenarios.

For now, the blasé response from markets makes sense, even as we expect more Israeli strikes daily. For real-time assessments, see here:

https://polymarket.com/event/israel-strike-on-iran-on?tid=1750022887865

https://polymarket.com/event/israel-x-iran-ceasefire-before-july

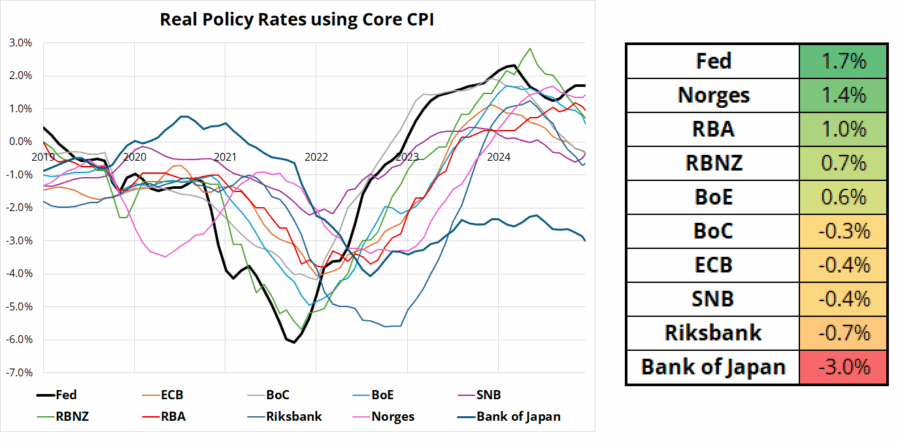

As mentioned, we get FOMC this week. Views are all over the place as a decent cohort expects the Dots to move from two cuts to one. I strongly disagree with this as I think the Fed is dying to cut but couldn’t before and probably can now use May CPI and expected soft Core PCE data as cover to move closer to, not further from cuts. July is 18% and September is at 75% right now and if there is a surprise, I think it will be that this FOMC meeting is so dovish that it brings July into play. Receiving July looks like excellent risk/reward to me into the meeting as worst case you go from 18% to 10% and best case you go from 18% to 65%/70% one week from now.

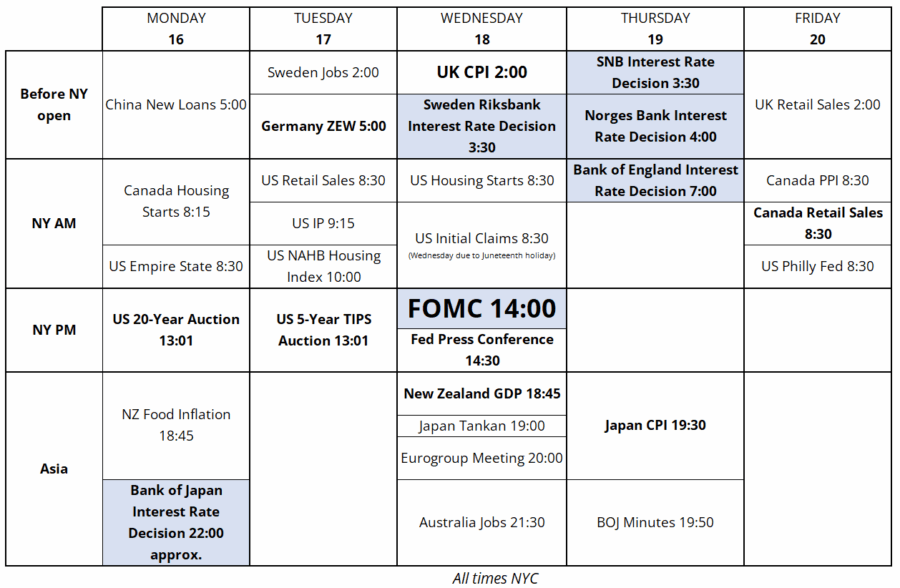

This week features a panoply of economic and central bank events as we will get six major central bank releases and a flurry of mostly-second-tier data. Tonight we will get the Bank of Japan decision. Nobody is expecting anything on rates from the BOJ, but the question of bond purchases will come up and there is a wide range of expectations for that.

Current Plan: Reducing purchases by ¥400 billion per quarter since August 2023. Targeting a halving of bond purchases by Q1 2026 (from ~¥6 trillion/month pre-QT).

Options Being Considered:

Market Expectations from Bloomberg Survey:

USDJPY, like US bond yields, has slipped into a bit of a random walk of late and I am not sure this BOJ meeting will change that. But those are the things to watch for, along with verbiage on future hikes.

Don’t forget to please complete this super short 4-question survey on the FOMC. It will take you 16 seconds.

Have a tiny, adorable day.

Trading Calendar for the week of June 16, 2025

I am not sure what these are for, but I would like some.

To put on the bar near spilled drinks?