The Moody’s downgrade offers no new information but plays to the market’s narrative bias

Congratulations to Matt and all the Palace fans

The Moody’s downgrade offers no new information but plays to the market’s narrative bias

Congratulations to Matt and all the Palace fans

Flat

I am a bit surprised that the market reacted this much to the Moody’s news as it’s not exactly new information that the USA is going deficit crazy. S&P caught on early by taking the leap in 2011 and while that downgrade was a bit shocking, surely this one, coming 14 years later, isn’t very eye opening?

2011:

S&P announces negative outlook

S&P downgrades from AAA to AA+

Fitch announces negative outlook

2013/14

Fitch warns of downgrade

Fitch upgrades outlook

2023:

Fitch goes to negative watch

Fitch downgrades from AAA to AA+

Moody’s outlook change from stable to negative

2025:

S&P warns of potential further downgrade

Moody’s downgrade from Aaa to Aa1

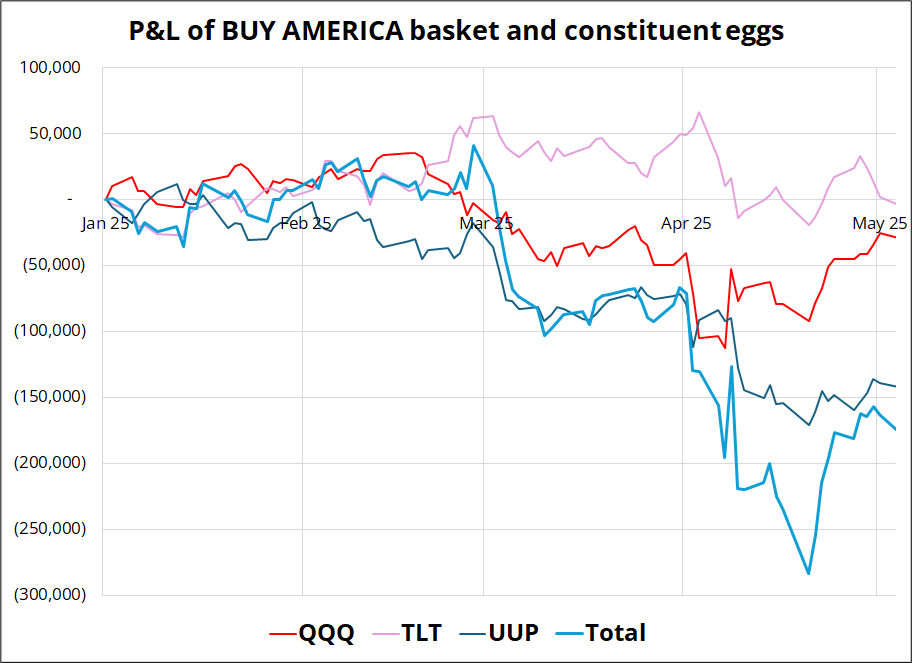

It matters when it matters. The market had exited a good portion of the SELL AMERICA basket, so there was some room to add back, I suppose. Here’s the evolution of BUY AMERICA this year. Stocks and bonds are virtually unchanged in 2025, so while this SELL AMERICA theme has made a lot of headlines, it hasn’t generated much P&L. The USD short has worked, but it stopped working April 21. Despite the overnight drop, the DXY is still 2.5% off the YTD low.

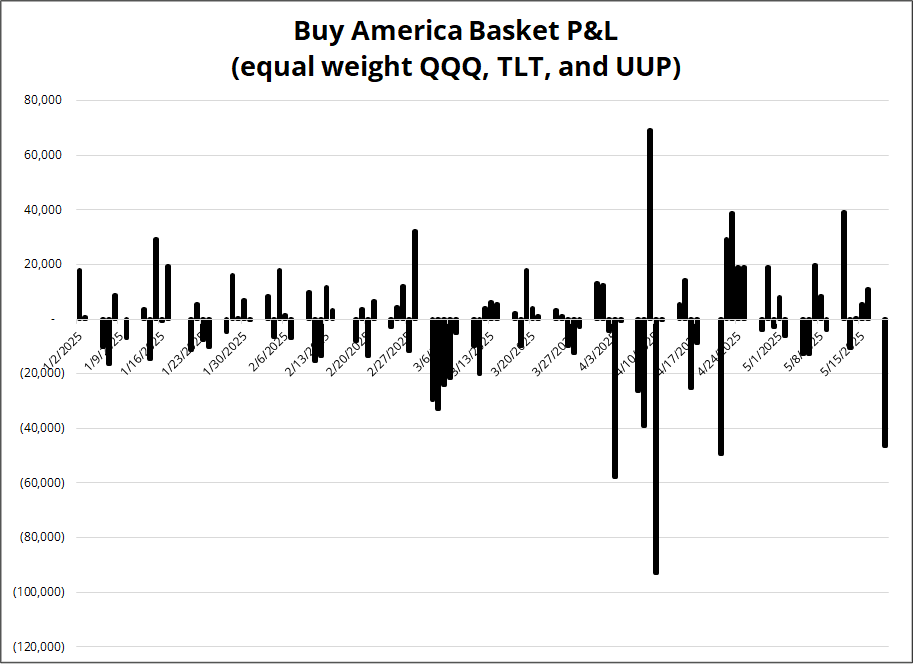

And here’s how the daily P&L of the BUY AMERICA basket has evolved this year. Same data, just showing the daily progression…

I continue to believe that the USD down trade is the clearest, while the sell bonds theme will come and go and equities are impossible to handicap at current levels as institutions remain underweight, retail is all in, and new information is likely to be sparse until we near the July 9 x-date for the 90-day tariff pause. Trade deals are not coming fast and furious, so far, but deadlines have a funny way of helping things get done.

I suppose the most notable feature of the EURUSD chart right now is the way it goes down slowly in a grinding fashion when US equities rebound and the way it rips in impulsive fashion when they are soft. Up fast down slow.

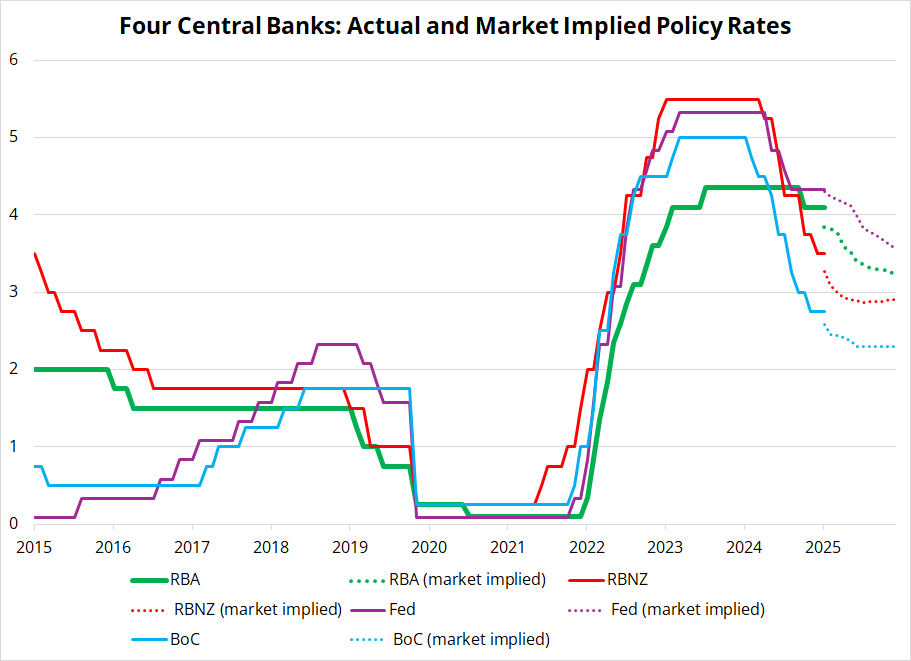

There is nothing on the calendar that looks particularly intriguing until Thursday’s flurry of PMIs. We get the RBA tonight, and the combination of softening inflation and still OK labor market means a cut is assured. The market is leaning towards a hawkish cut tonight. In fact, all five previews I just read lean towards a hawkish outcome and bullish AUD.

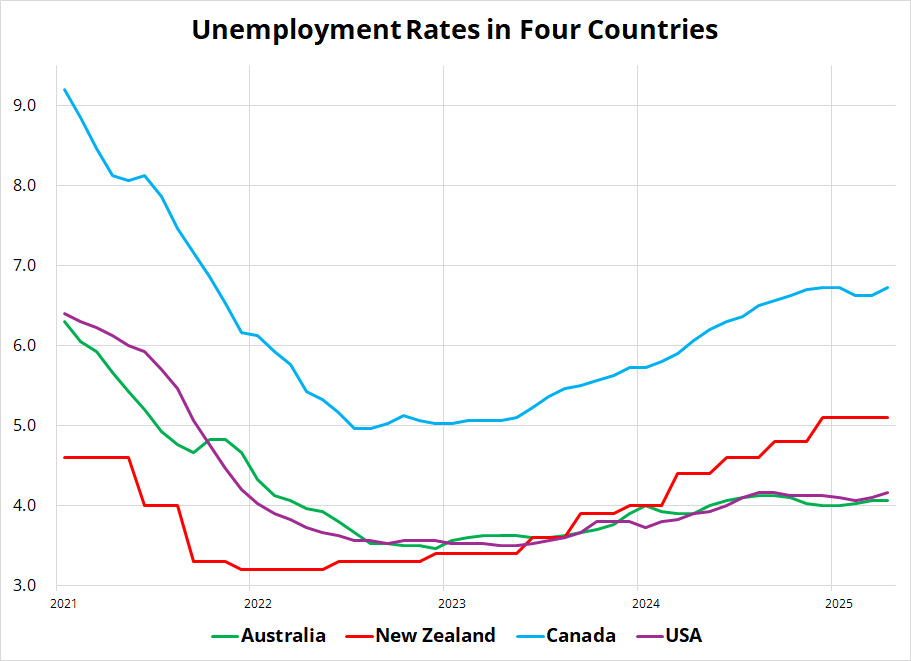

But the RBA’s recent history hasn’t showed much hawkish appetite. They kept rates lower than peers in 2018 and 2019, and again post-COVID. If you look at where the BoC and RBNZ have gone, pricing two more cuts after this one from the RBA doesn’t seem particularly aggressive to me given the uncertainty around global trade and the fact that the RBA’s policy rate is restrictive and inflation is back in the target band in Australia.

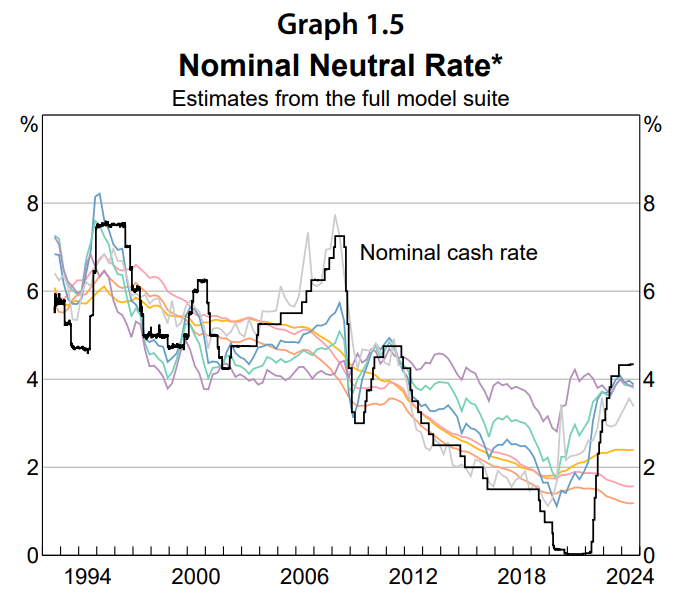

The RBA has a suite of models that estimate neutral, and while they are all over the place, the average is somewhere in the 3.0% to 3.5% area. It makes sense the market is pricing a return to neutral.

I don’t have a strong view that the RBA will be mega dovish, but my observation is that the market is long AUD (and particularly bullish AUDNZD) and almost everyone is looking for a hawkish outcome—so the risk is a dovish disappointment. I am handicapping the market, not the RBA. There will be plenty to chew on in the Statement on Monetary Policy as the last one came out in February and a lot has changed since then. The RBA’s assessment of the Trade War is obviously key. On the hawkish side, the Unemployment Rate in Oz looks more like the USA (UR pinned near the lows) than Canada or NZ (much higher UR).

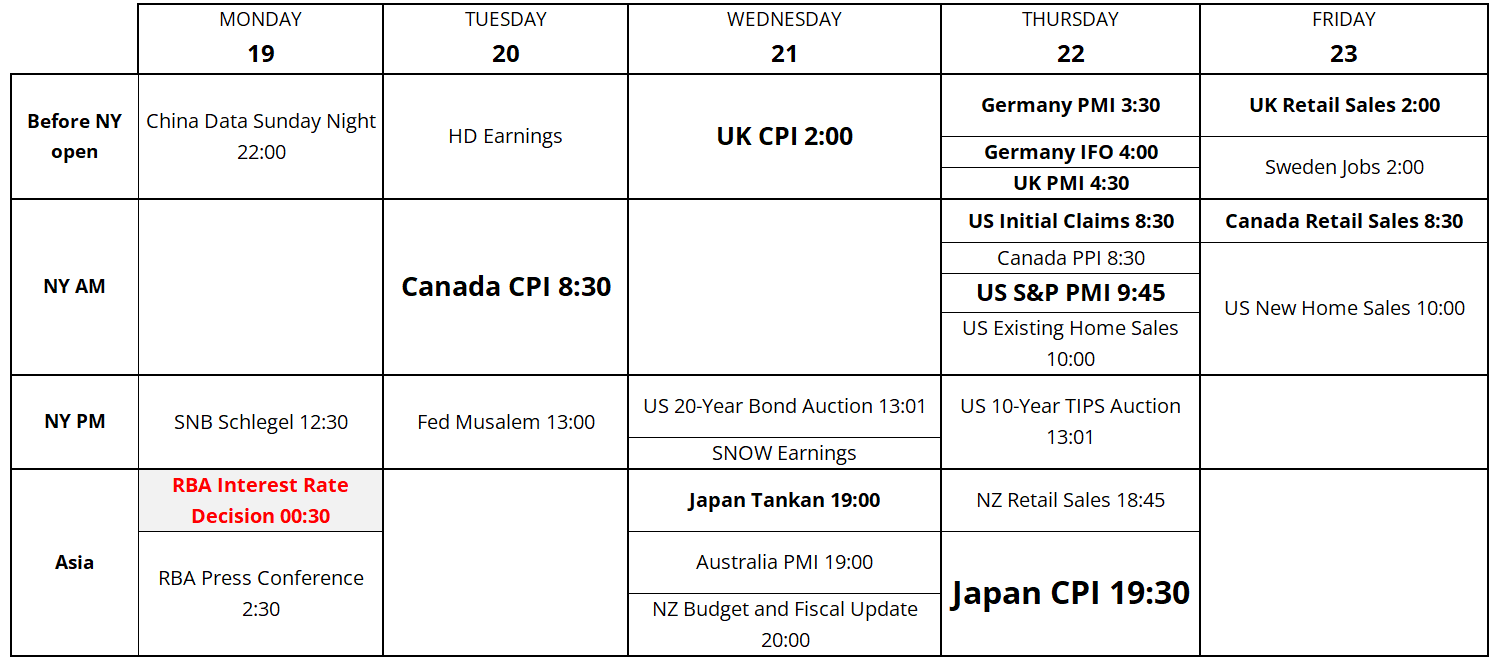

What a ride by Umberto Rispoli! Right on the line between courageous and reckless. Next week’s calendar is below. Have a 1-0 day.

Calendar for the week of May 19