Stable

I am back after two weeks, and every G10 currency other than NOK and JPY is within 50bps of where I left it. Hmm.

The market is in limbo, awaiting the April 2nd tariff announcement and it seems like nobody knows what to do with the USD. The EURUSD trade has petered out, as have the massive move in rate differentials and relative equity performance.

You can see in the first chart today that those drivers of EUR are still holding most of their gains but have pulled back and lost momentum.

With corporate month end Thursday and Japanese fiscal year end (bullish USDJPY) in force right now, there is no huge rush to reload the short USD trade.

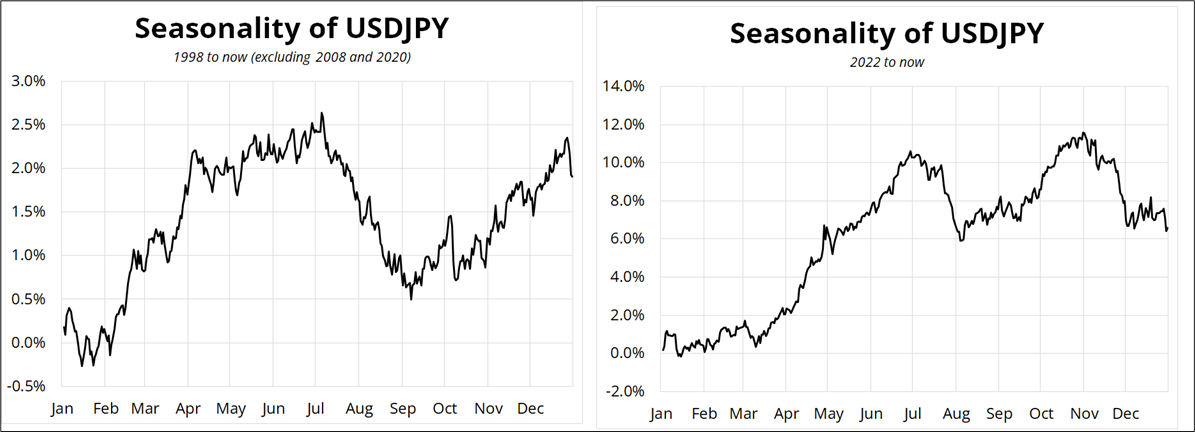

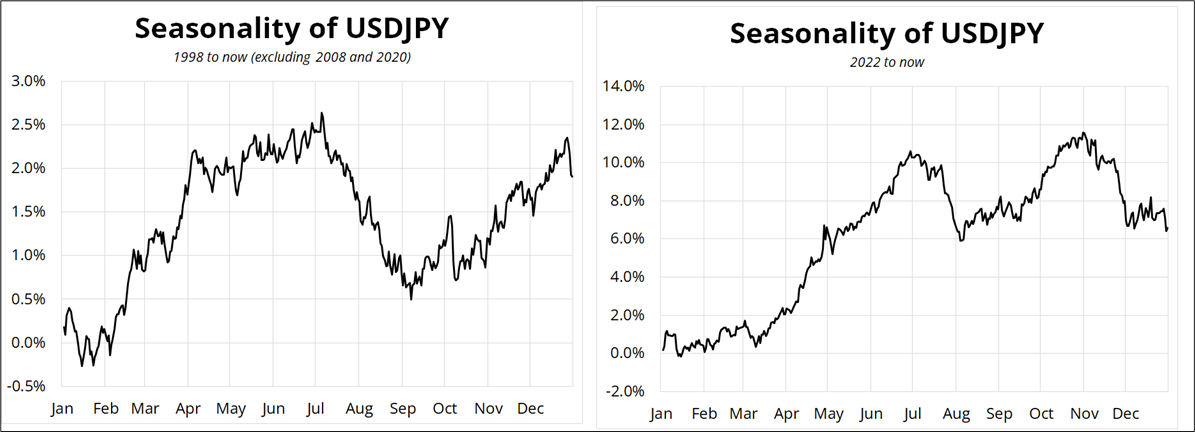

One might guess that Japanese agents would be switching out of foreign bonds and into JGBs now with 10-year Japan at 1.5%, but rising JGB yields did not help the yen in 2022, 2023, or 2024. Those years still saw the fiscal year end ramp in USDJPY.

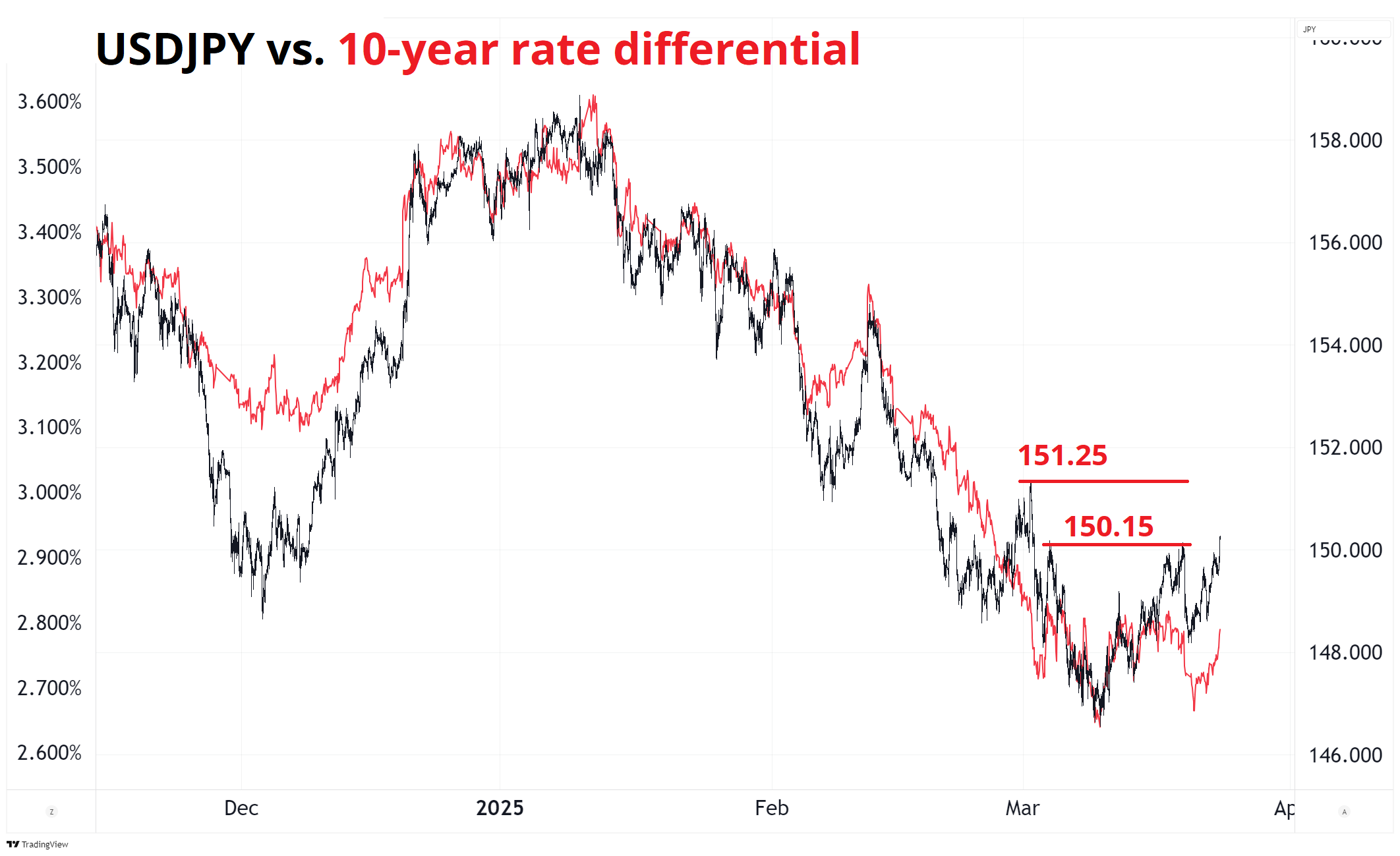

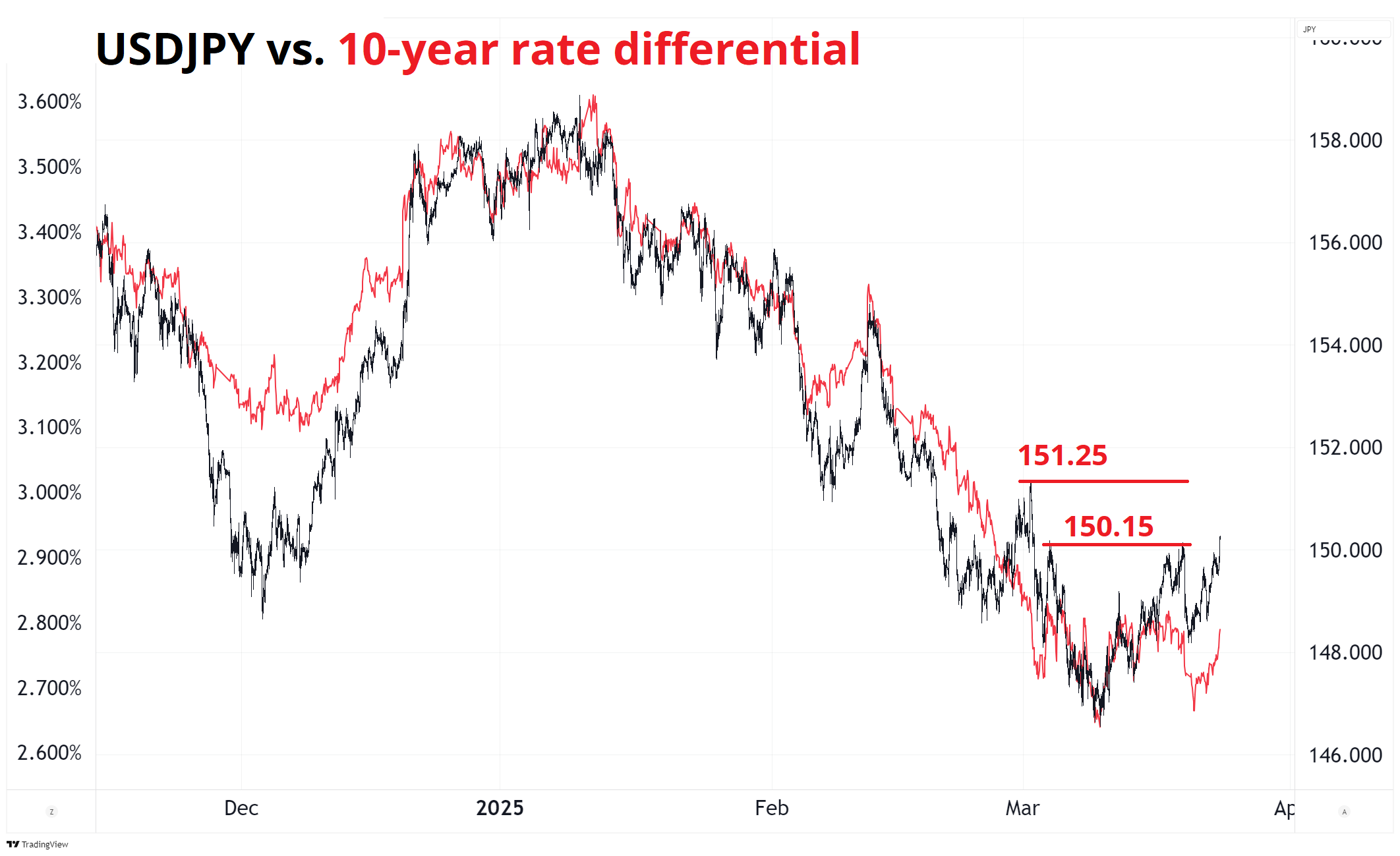

Fiscal year end was neutral or bullish USDJPY in recent years, with a particularly aggressive rally in 2022. Then again, rate differentials were supportive in those periods, and they are not supportive now, so any rally towards 150.00 will struggle to maintain momentum unless US yields get up off the mat. You can see in the next chart that 150.15 was a double top this month and 151.25 is the spike high on the morning of March 3. The S&P PMI has now taken us through that double top.

I don’t think there is a trade here in USDJPY as long makes little sense given yields and nearby technical resistance, while short makes no sense given the seasonal flows from both Japanese and US players are likely to be RHS.

Canada

I was in Canada last week and talking to friends and family who own businesses paints an interesting picture. Export business is booming right now as customers are rushing to get product ahead of the tariff deadline. My friend who owns a packaging machine export business, for example, is running full tilt right now exporting to US customers as his product is USMCA compliant and tariff free for now. On the other hand, he will probably shut down April 3rd and lay off all his employees if his products are tariffed. This is likely emblematic of what is going on globally and so we are left with a confusing setup where the economic data is distorted and meaningless until tariffs go into effect (or don’t). That means we won’t know the real economic story in the US or elsewhere until the April data is released in May.

The view that tariffs are unambiguously bullish USD has been challenged by the price action in 2025, and so even when we get the information on what tariffs look like next week, it will be hard to know what we are supposed to do. The data for the post-April 2 period will be critical in assessing whether Canada, the EU, and other tariff victims will enter some kind of economic malaise.

The vibe in Canada is something like this. Picture your best friend from childhood, who you have been through many good and also difficult times with over many, many years. Now imagine he or she suddenly texts you, out of nowhere: “I don’t like you anymore. We are NOT FRIENDS. You have been RIPPING ME OFF for years. I am going to burn down your house.” A mix of anger, confusion, paralysis, and sadness. Canadians are cancelling trips to the USA, avoiding US products, and there is a huge surge of Canadian patriotism like nothing I have ever seen.

At the grocery store, they mark all the Canadian products with little Canadian flags. Every ad on TV touts companies’ Canadian roots and domestic production credentials. Here are some signs I photographed at Loblaws:

And here, the granola bar shelf (note the Canadian products are sold out, the American ones are plentiful).

Hard to say if any of this matters for US companies, but I would bet border towns, Disney and other popular tourist destinations will have a rough 2025. Around 5% of Disney World guests are Canadian, so it’s not a game changer, though EU and other travelers are also avoiding the USA reflecting general displeasure and fear over rare but dramatic border incidents.

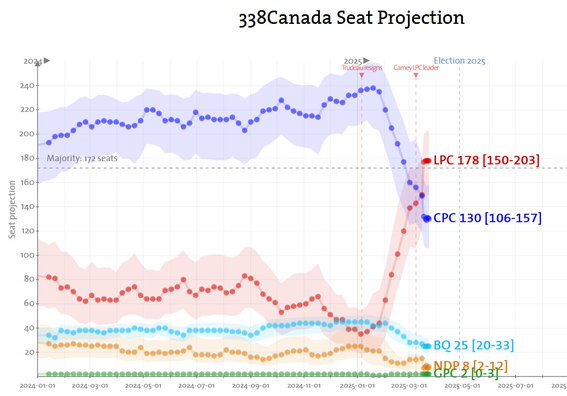

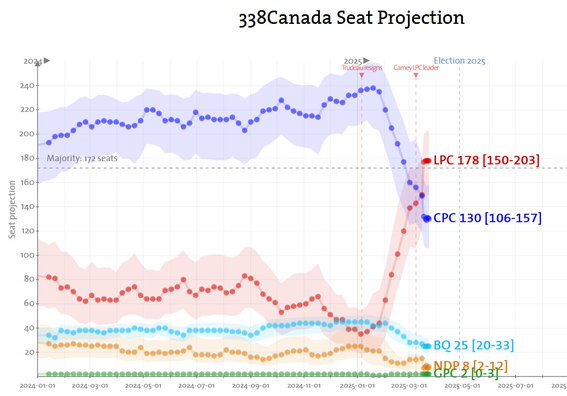

Mark Carney has huge momentum and has called a Canadian federal election for April 28. Carney’s Liberals, who were 26 points behind just a few months ago, are now in the lead. Carney is viewed as a voice of reason, whereas Poilievre’s rep as Trump-lite was a huge asset until January 20th and has now become a huge liability.

The Conservatives led every poll conducted from September 2023 to February 24, 2025, but are now behind the Liberals in 14 of 15 polls since March 14. The website 338Canada does math similar to the 538 methodology in the USA and shows the Liberals winning 178 seats vs. the Conservatives at 130. See chart below.

There is no trade here. Just updating you and I suppose the takeaway is that economic data showing the performance of the Canadian economy in April and May will be much, much more important than usual. And this applies globally, too, as exporters frontload like mad ahead of tariffs. Once that boom subsides, we could see a sudden stop in economic activity as the rush to beat the tariff deadline peters out and companies start axing workers.

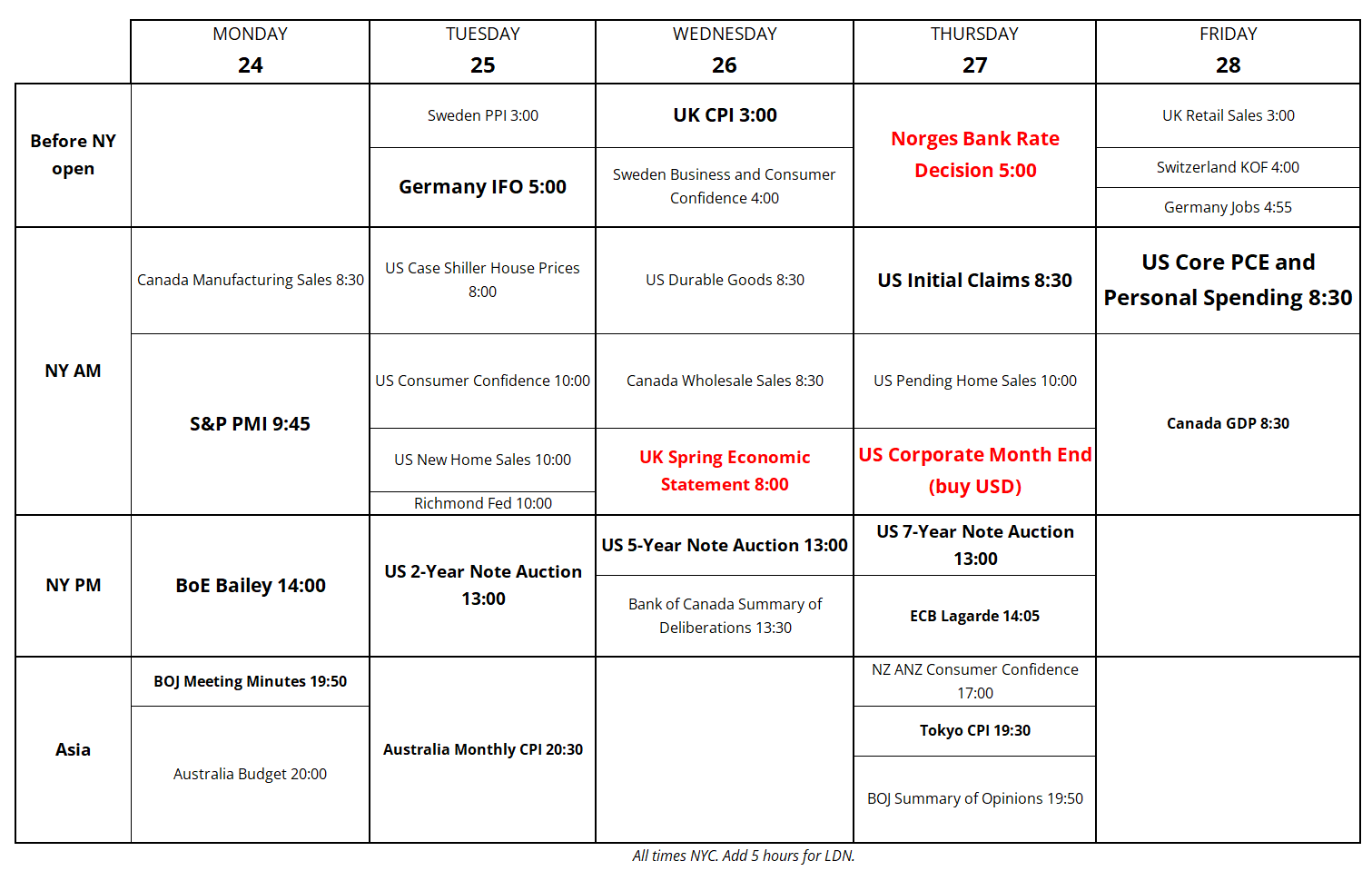

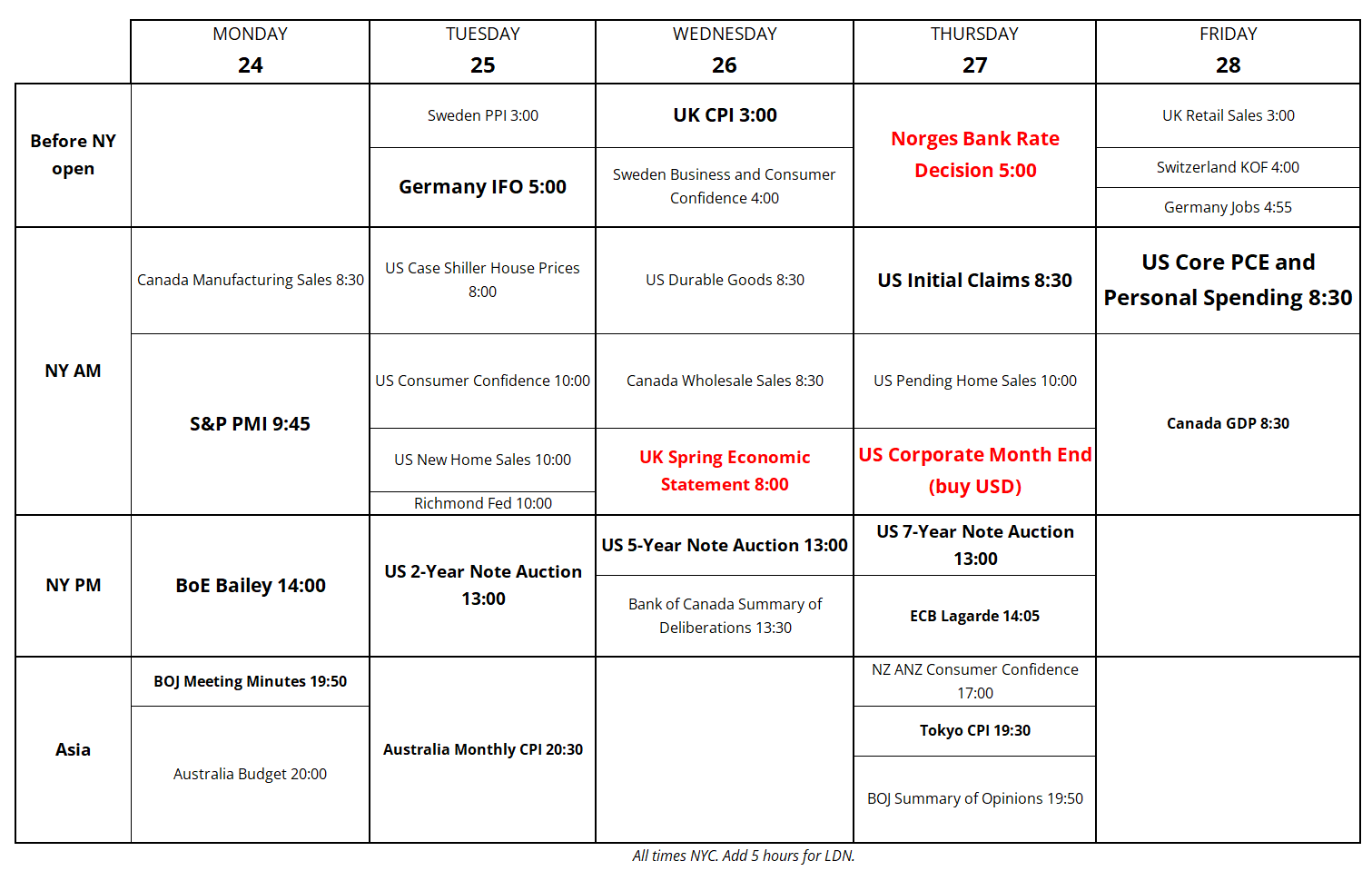

Calendar

The calendar is spotty this week as month-end madness extends through Friday and into Monday. Despite fears of job losses in the US, it’s hard to put the big recession trade on with Claims bobbing around sub 230k.

Final Thoughts

Wild ride in Tesla as the US government has so far had some success in bailing out stockholders. While Lutnick and Trump issue buy recommendations, the CFO and other insiders are selling stock. Interesting times.

And Robin Hood now allows you to “invest” in NCAA games. Yikes.

Have a curveball-free week.