The State of Play

It has been a nightmare for the consensus trade as micro wins over macro. Technical, sentiment, and anecdotal indicators pointed to overbought gold, oversold stocks, and an overcooked SELL AMERICA theme respectively and those indicators have won, for now. While the dollar and bonds haven’t rallied much, NASDAQ shorts and gold longs have been punished for adding at the extremes.

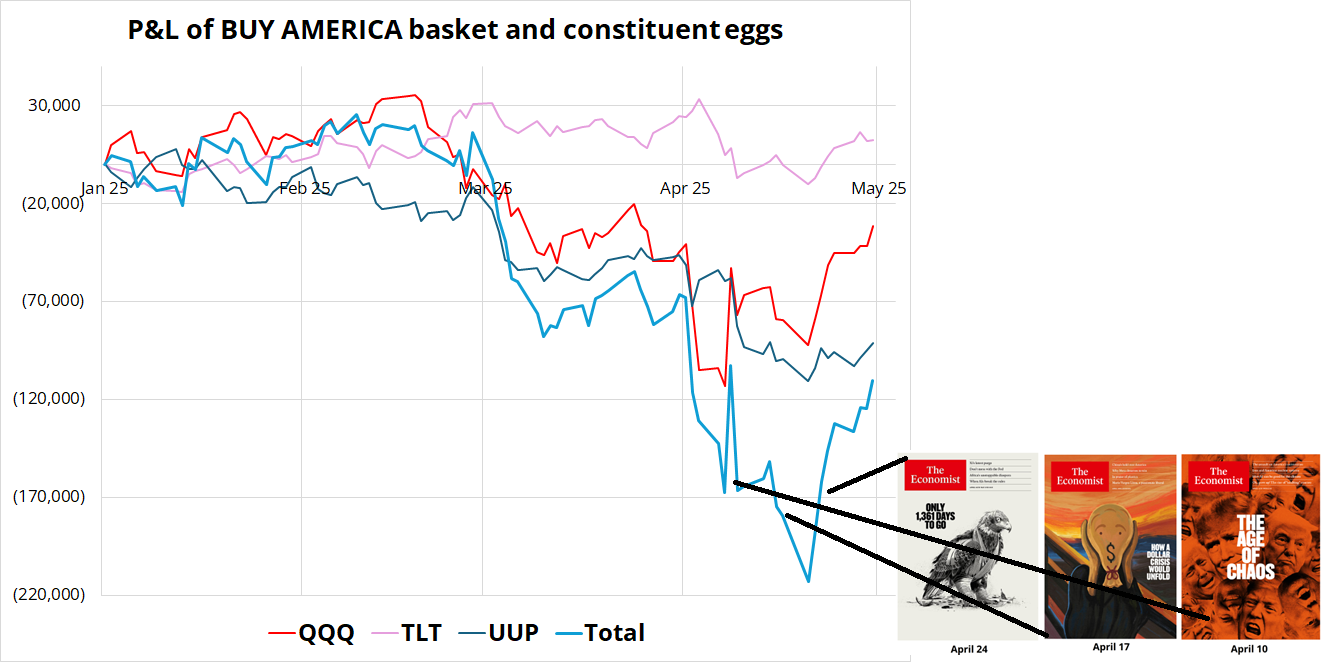

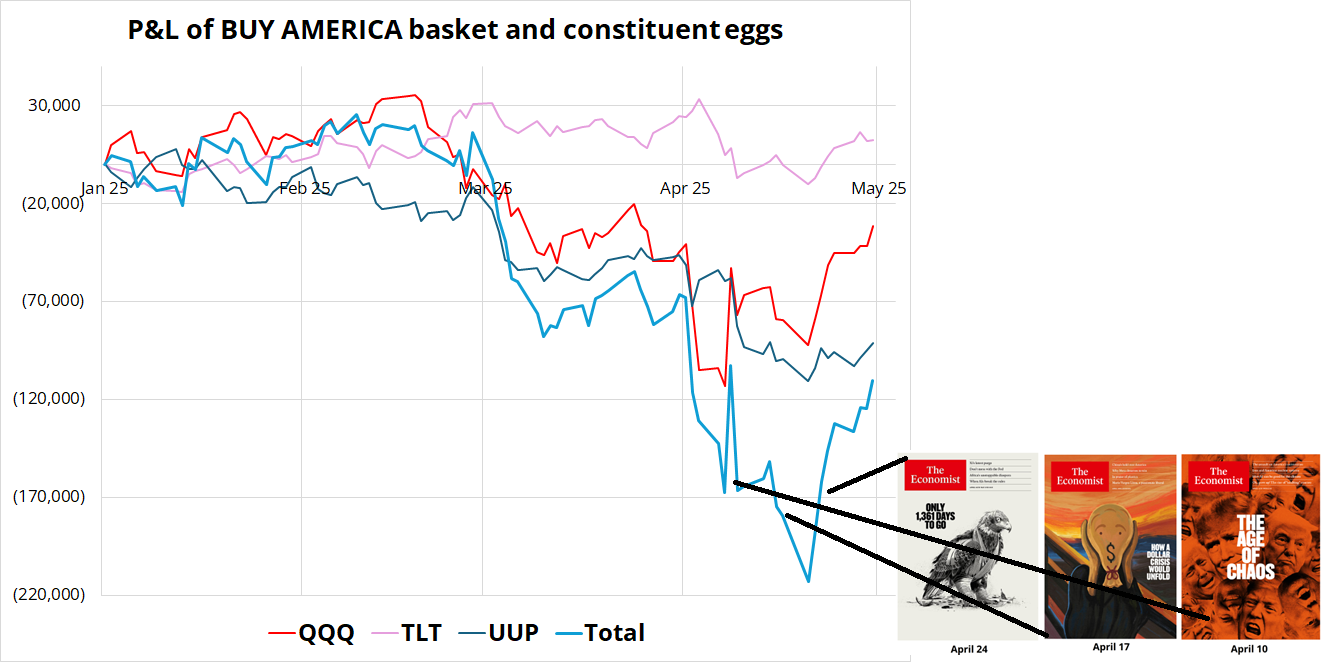

The unprecedented magazine cover trifecta market peak SELL AMERICA sentiment as every commentator in the world (including me) counted up the trillions of dollars of US overweights around the world. Here’s the vol-weighted BUY AMERICA basket updated.

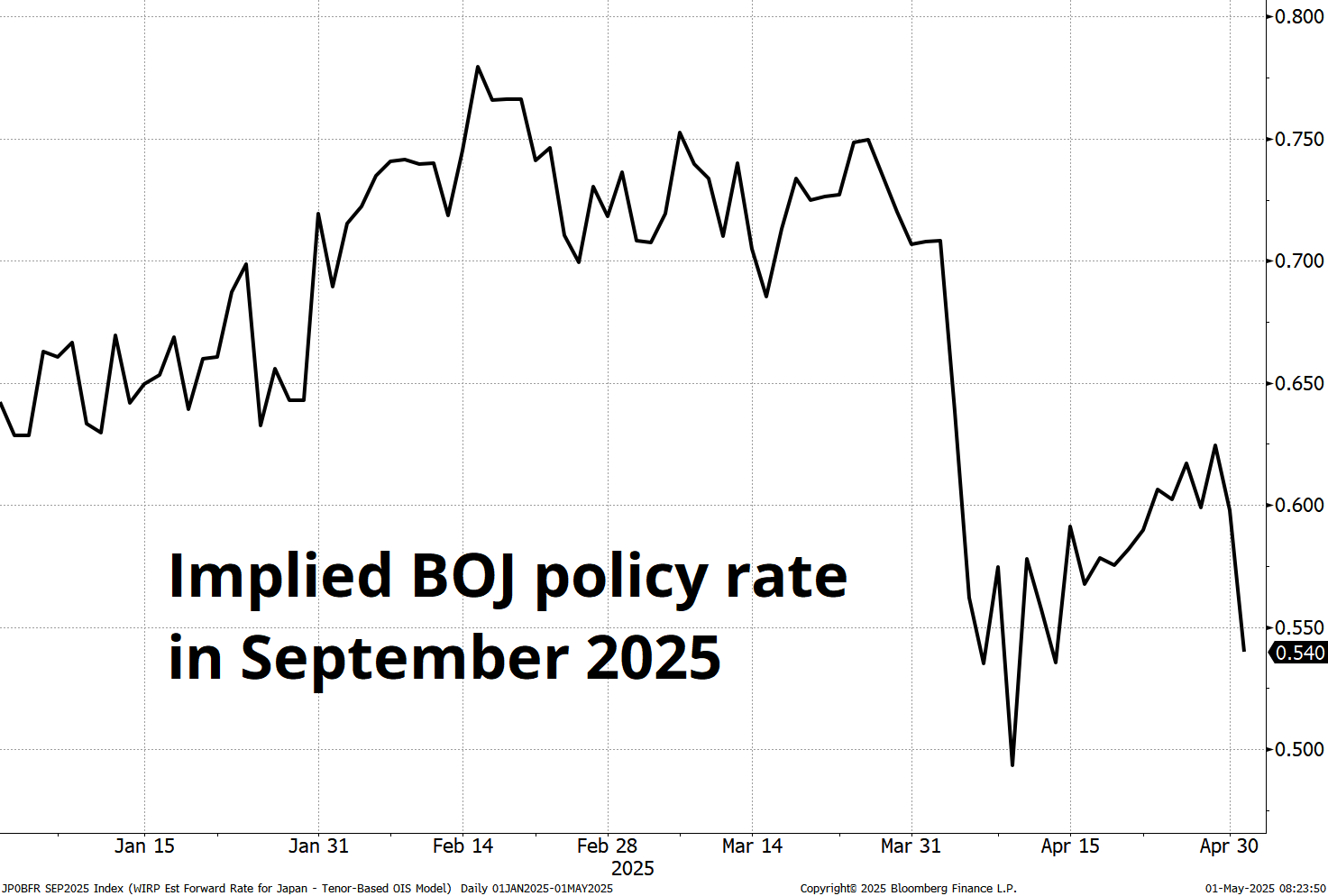

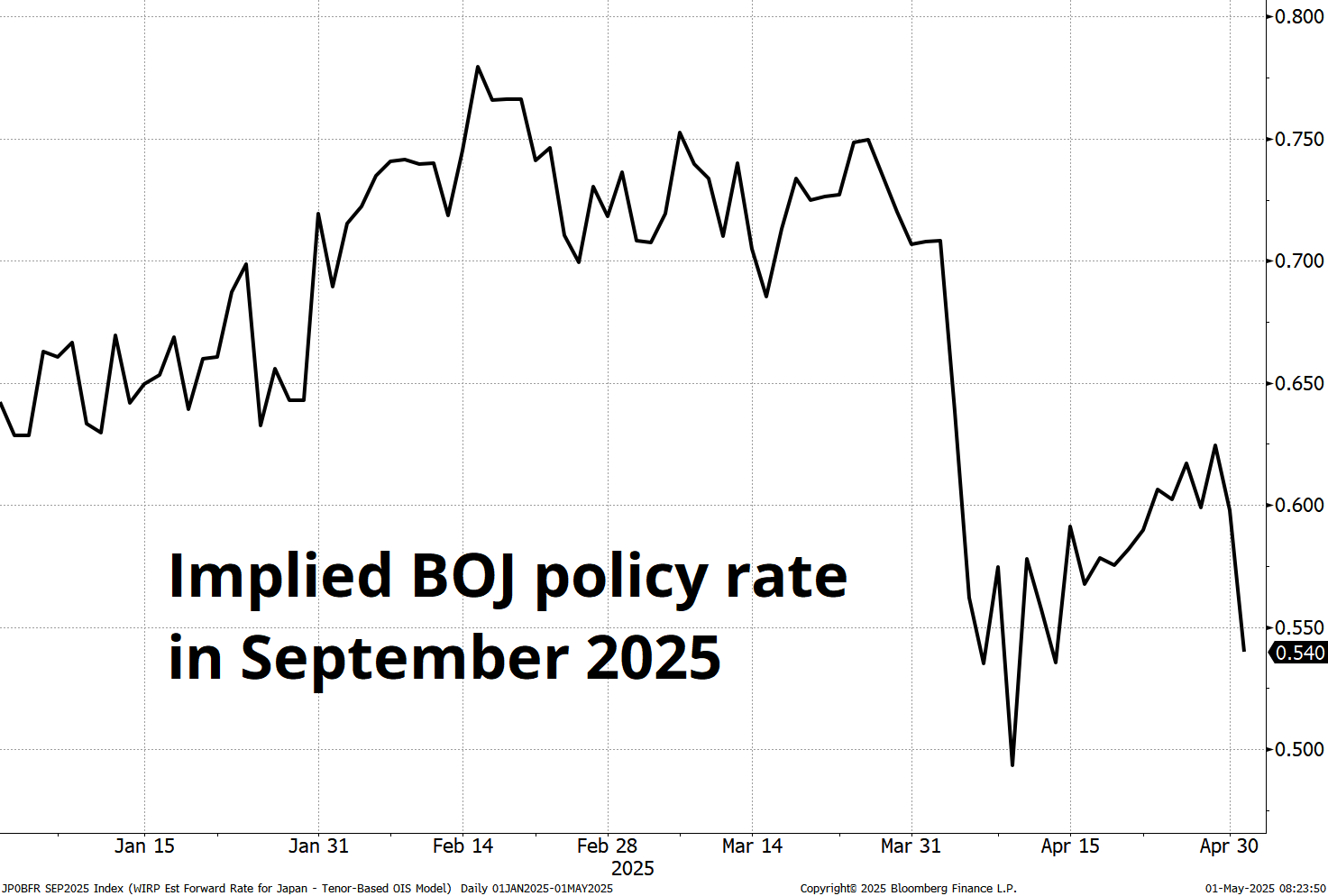

Now we wait to see if this magazine trifecta marks a major low for the theme, or simply the beginning of a consolidation. EURUSD still trades quite well, as do GBP, CAD, and AUD, but the JPY has finally cracked as the BOJ might be done with their hiking cycle. Governor Ueda’s commentary was not great news for JPY bulls, e.g.:

- Ueda says likelihood that BOJ outlook will be realized has fallen due to tariff uncertainty.

- BOJ cuts 2026 CPI forecast from 2.0% to 1.7% and projects 2027 core inflation at 1.9%.

- BOJ cuts 2026 GDP forecast from 1.0% to 0.5%.

Future hikes are not ruled out but look increasingly uncertain. Here is how the market pricing has evolved…

Meanwhile, there has been a dramatic reversal in the END OF AI CAPEX theme. That theme peaked the weekend of the DeepSeek Freak, as the market caught on to the fact that the December 2024 release of DeepSeek was a potentially existential moment for AI capex. Here’s how it has played out so far.

Man, that Microsoft comment is not good for CRWV shorts!

Foreign selling of US equities has burned itself out, AI Capex might not be dead yet, the BOJ is not hiking any time soon, China stopped buying gold last week, the oil collapse is capping inflation worries, and equity shorts are finding the interregnum between Liberation Day and economic deep impact too lengthy to bear. An absolute nightmare for all the trades that were working perfectly two weeks ago.

Now, we await the economic data as recession odds are quite low as we are currently living right in the midst of a potentially-generational economic shock. It’s like the wave is way out there offshore, and everyone is still sipping beers and smoking cigarettes on the beach.

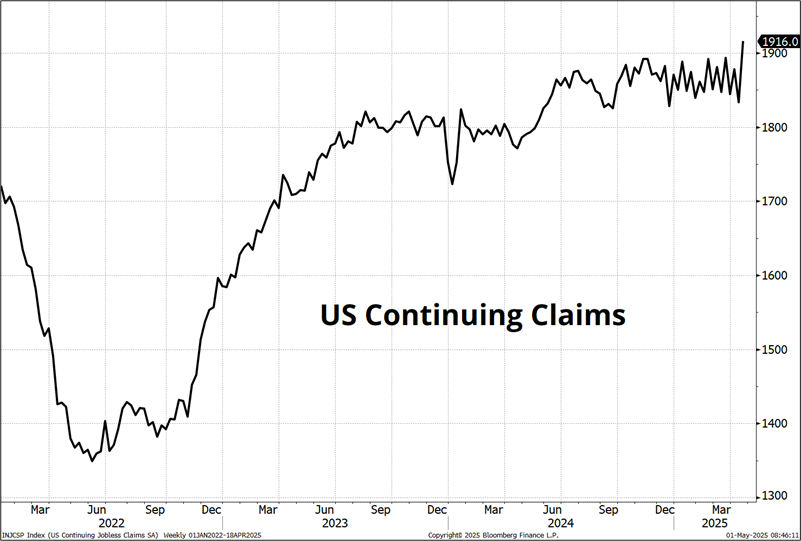

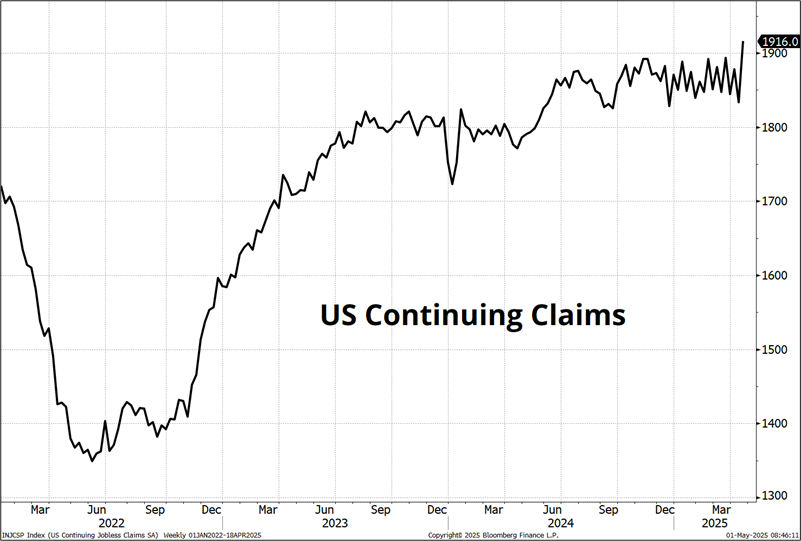

While misses in ADP do not correlate with misses in NFP, today we did get an interesting Initial Claims release. The main series flicked higher to 241k, which is within the range over the past year or two, but Continuing Claims broke out to a new 4-year high. It’s a sawtooth graph, so I don’t want to attach much signal to the move, but another piece of the puzzle, perhaps.

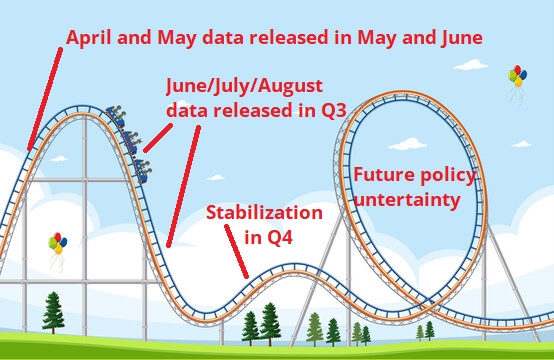

The jobs market is almost surely weakening, but as we have been discussing here for a while, it’s the hard data for May and June (released in June and July) that really matters. Right now, we are navigating the roller coaster effect of front-loading and current overall weirdness in the data. See graphic.

Meanwhile, we navigate a world where some prices are collapsing (oil), while others are set to explode higher. E.g., this email TW received this morning:

Dear KOHLER Valued Customer:

Thank you for your continued support and partnership as we navigate through the adjustments in the global trade policies. As a result of the policy changes that were announced on April 2nd and amendments from April 9th, KOHLER will be implementing a weighted average price adjustment of 15-18%. Kallista and Robern products will increase by 12%. These changes are effective May 10, 2025.

And then, on top of all that, you have ever-present bond vigilante risk due to out of control and still rising US deficits. It is not clear that bonds will be a good hedge if we enter a recession and the deficit explodes further.

You may have noticed that I have not been posting any FX trade ideas recently. The reason is simply that my view is we remain in consolidation mode (EURUSD 1.1250/1.1500, etc.). I wrote a three-pager on long AUDNZD when we were 1.0660 but by the time it was ready to send, we were 1.0710. And while US asset prices have rebounded, the relentless pension fund selling of USD has not stopped. Even if they are not selling stocks, they are still increasing USD hedges. But in the meantime, Asia stopped selling USD and so there doesn’t seem to be any juice in the short dollar trade short term. I still think EURUSD heads toward 1.2000, but I am waiting for better levels. A washout through 1.1250 and subsequent recapture of that level is the dream scenario for me to reengage long EURUSD.

I removed the CHFJPY put spread from the sidebar as it has effectively revalled at zero.

Final Thoughts

- The Tiësto White Lotus theme remix is not new, but it’s sooooo good.

- Oil sentiment and price momentum are at such an extreme that I cannot resist thinking about longs. Stop loss below 09APR lows.

- *KOHL’S BOARD TERMINATES CEO ASHLEY BUCHANAN FOR CAUSE. Yikes. He was their last great hope, according to most.

Have a spooky yet beautiful day.