It’s hard to find positive NIIP currencies with good carry

I am so sick of these biased editorials.

Big pharma and Big tech are bad enough. How can we trust Big Dinosaur???

It’s hard to find positive NIIP currencies with good carry

I am so sick of these biased editorials.

Big pharma and Big tech are bad enough. How can we trust Big Dinosaur???

Flat

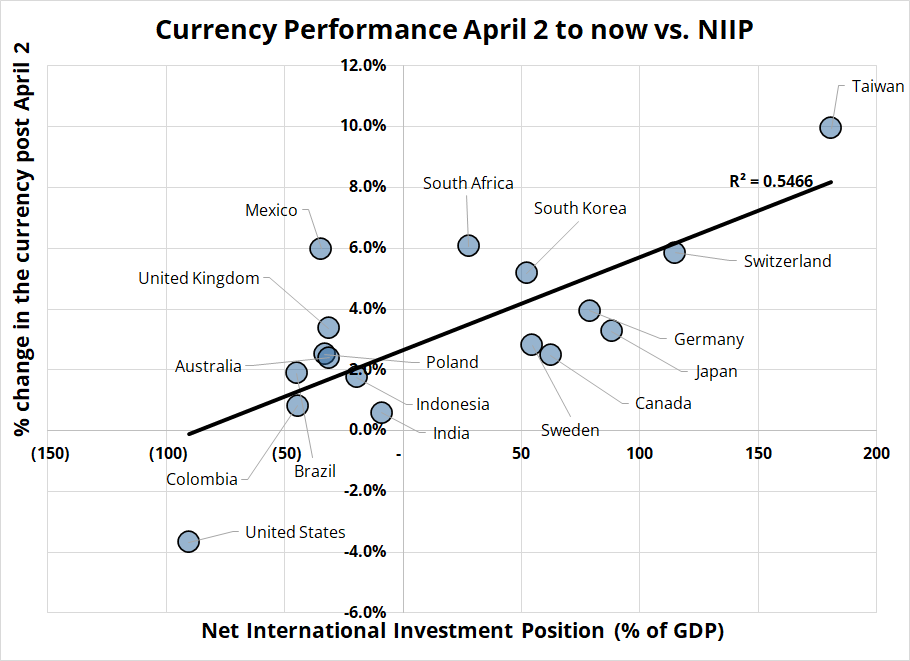

Last week I published a chart of currency performance vs. NIIP post Liberation Day. First, let me update it as of today (below).

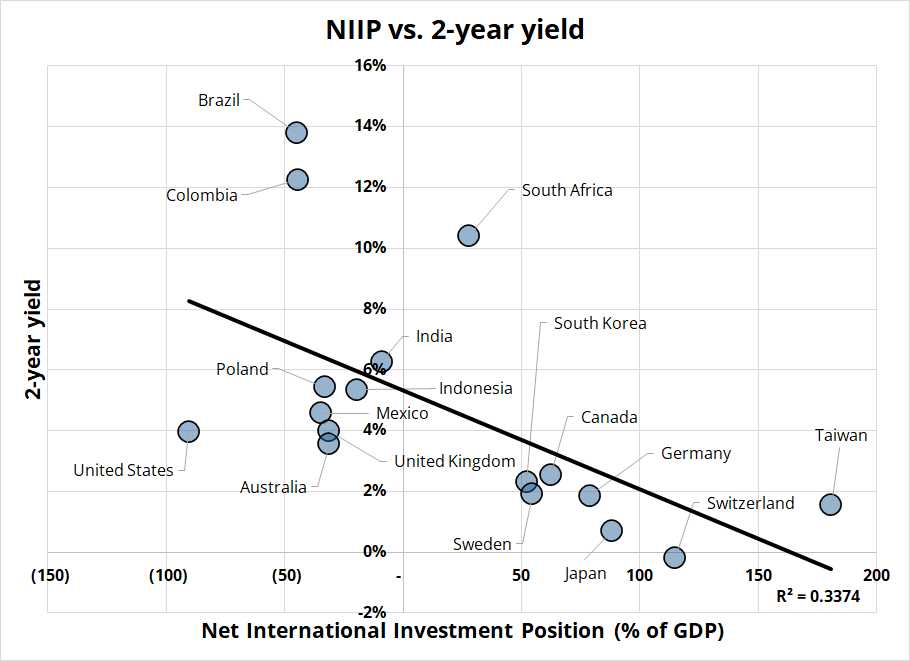

A client asked me: “Given positive NIIP and long carry are the two themes right now, are there any currencies that screen well for both?” Short answer is: Not really.

The second chart here shows that most good NIIP countries offer poor carry. The only currency in the top right quadrant (positive NIIP, good carry) is ZAR. The rand always has many warts, but with Ramaphosa meeting DJT today and South Africa doing the necessary greasing in advance (*SOUTH AFRICA TO OFFER MUSK STARLINK DEAL BEFORE TRUMP MEETING), USDZAR is testing a major low.

No view here, I am just answering the question and thought you might also find the data interesting.

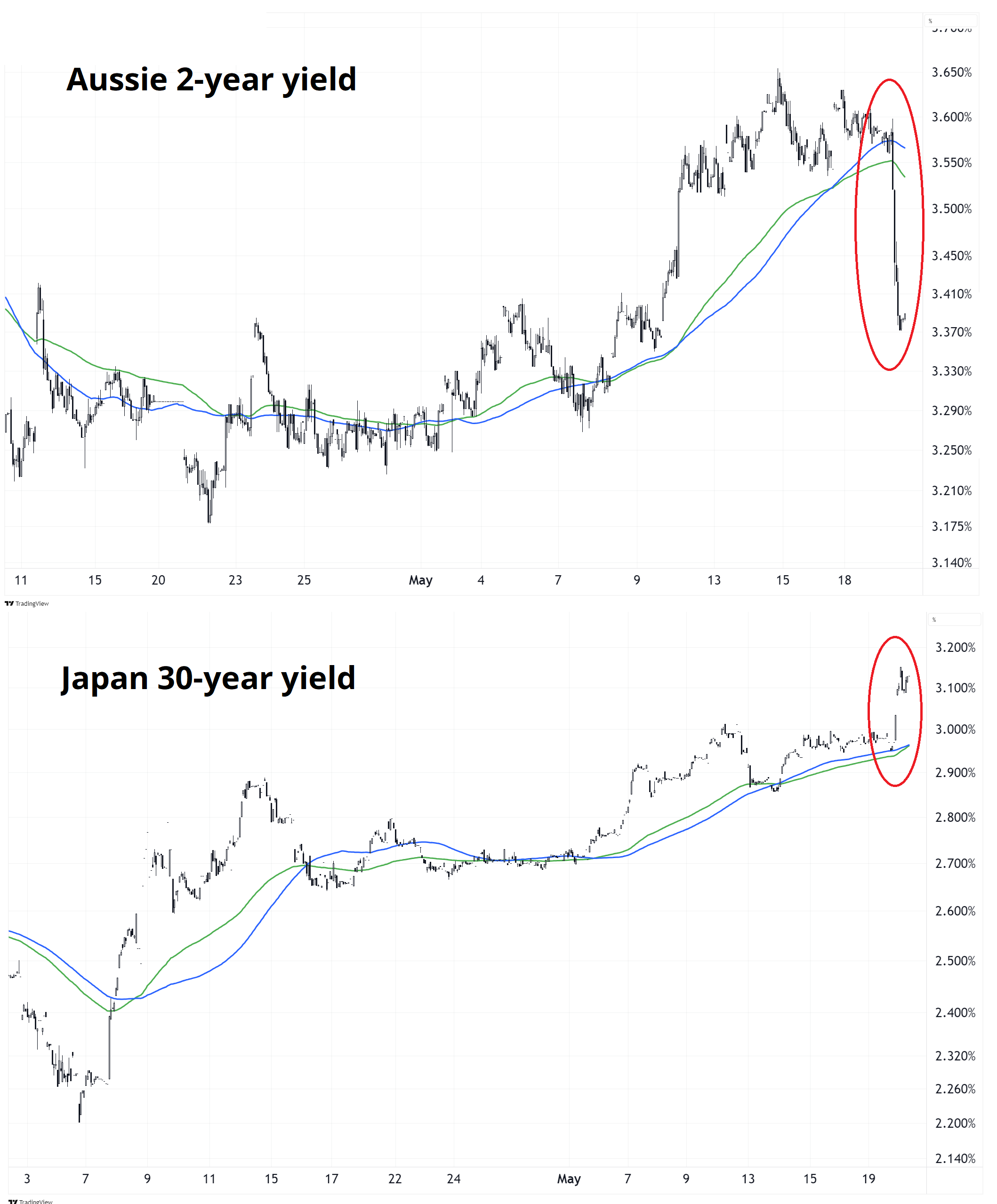

Some rather spicy moves in fixed income last night as the RBA failed to ratify universally hawkish expectations, while JGBs dumped on a poor auction.

As the Big Beautiful Bill moves towards a house vote (the plan is to advance it to the House Rules Committee either Tuesday or Wednesday and if the bill clears, House Speaker Mike Johnson is targeting a vote on the House floor by Thursday before sending the chamber home for a weeklong recess), I would think US bond markets will get nervous. As long as US 10-year yields are below 4.60%, the chart looks pretty unscary, but a rapid move through there should reignite bond vigilante concerns. The market is rightly going to lean short bonds and long JPY over the next few days as the Big Bill looms and G7 Finance Ministers meet.

Their communiqué used to be a market mover in the glory days of FX and there is perhaps a 1% chance they tweak the language in a nod to the US wanting a weaker USD. One percent is low but it’s not zero. Also low but higher odds (10 delta?) that Kato and Bessent say something interesting about the yen.

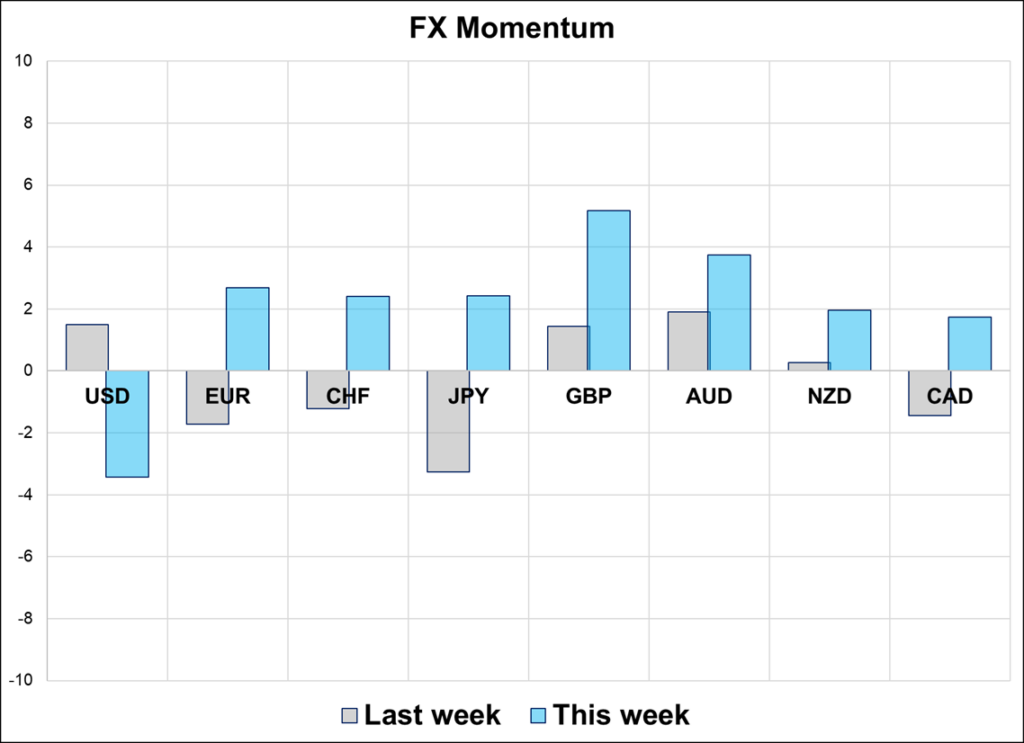

The main problem with the popular SELL AMERICA theme (other than the fact that it’s not working) is that all three legs are short carry. Short bonds, short USDJPY and short stocks are all trades where you have to pay to wait. The next three days are therefore important for the USD and bond legs because if we don’t get some downside momentum by week’s end, the market will cover. To me it looks right to be short bonds and short USDJPY right now and cover with everyone else if nothing interesting has happened by Friday.

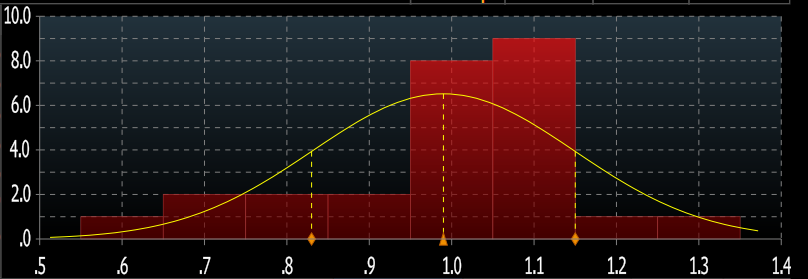

Inflation data out of the UK tomorrow will be a weird one as all sorts of seasonal and one-off factors come into play. Sewerage, vehicle excise duties, and Easter timing all point to higher prices and the dispersion among forecasters is wider than usual.

Almost anything is possible when a figure is this distorted, so be ready for 1.5% or 0.6% or anything in between. The market is long GBPUSD, so a sub 0.8% print would be the biggest market mover as the market has removed more than a full cut from the predicted path. The perception is that the BoE is less dovish and the market loves GBP. A super weak figure would be much more surprising than a super strong one.

If you are looking for a short-term trading vehicle to be short bonds, I find TMF is good leverage and amazing liquidity. I’m short that thing at 36.90 with a stop at 38.51. Not an official sidebar trade, but just FYI if you are looking for a good way to be short bonds PA. It trades 2 cents wide 1000 shares/side give or take. If 10’s take out 4.60%, I will look to add.

Have a feathery day.

Jiggly

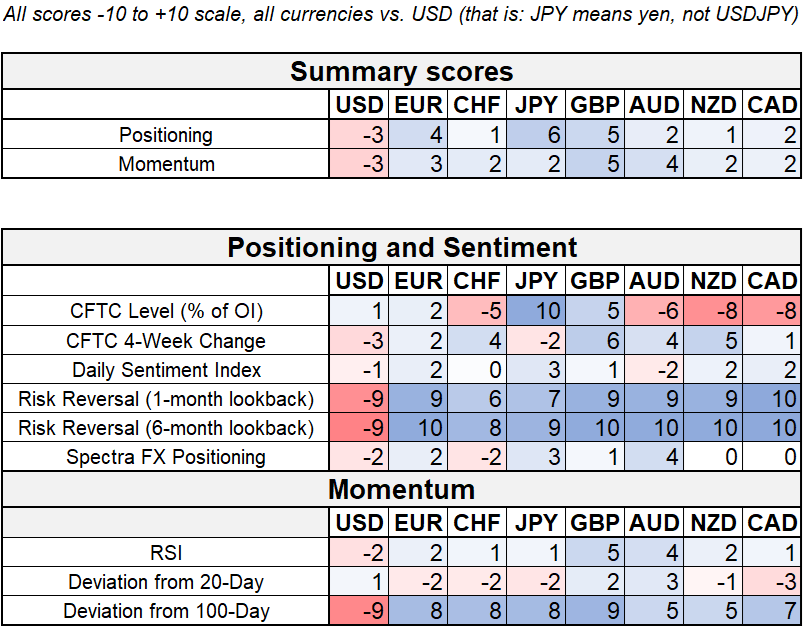

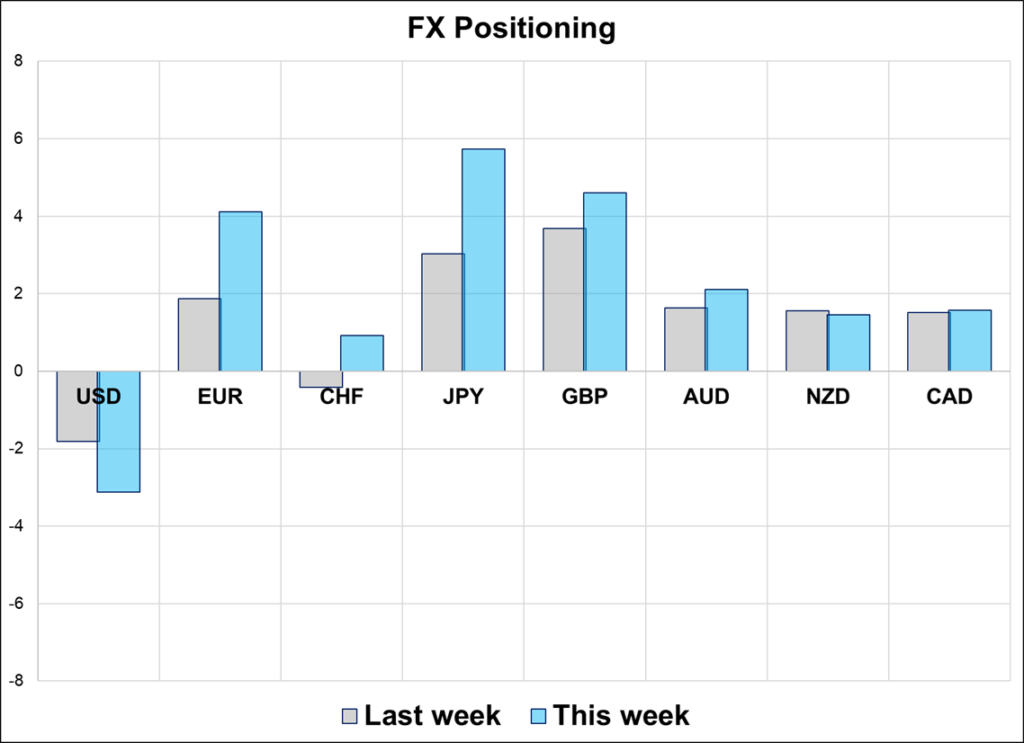

Hi. Welcome to this week’s report. The market remains fixated on a single direction (USD lower) and while it’s not working, it’s not really not working, either. Even as US equities recapture the pre-Liberation Day level, the dollar has few supporters. Momentum has waned and large topside options are burning off day by day, but the narrative and the Asian time zone sell USD flows continue. The USD down story needs a new catalyst, but the USD up story remains off the table for now.

I am so sick of these biased editorials.

Big pharma and Big tech are bad enough. How can we trust Big Dinosaur?

HT Barack Obama’s Basketball playmate