I was going to use “Rolling in the NIIP” as my title but I exercised self-control

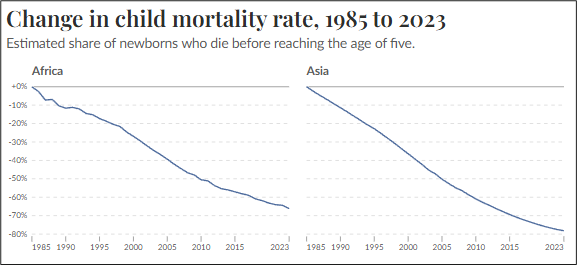

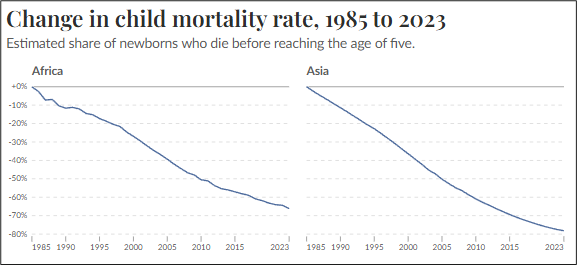

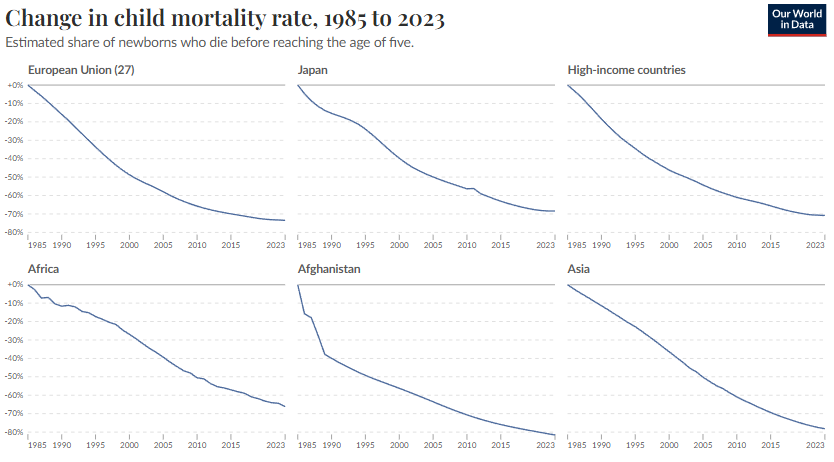

Child mortality has dropped dramatically in developed and developing countries, even since 1985

I was going to use “Rolling in the NIIP” as my title but I exercised self-control

Child mortality has dropped dramatically in developed and developing countries, even since 1985

Flat

I am a little bit obsessed with the 2003-2007 period when the USD was in a structural down trend as the market obsessed over the US Twin Deficits and negative Current Account balance. Then, the structural theme dominated the cyclical stories much of the time and when I asked a senior trader why suddenly everyone was obsessed with current account balances, when they didn’t seem to be an input from 1995 to 2002, he said:

“It matters when it matters.”

For whatever reason, yesterday I got a flurry of research and emails about the US fiscal story and how things could get ugly as the Big Beautiful Bill passes. Why is fiscal stimulus bad for the USD, but German fiscal is bullish euro? Perhaps because the US has a deeply negative Net International Investment Position and very high starting debt and deficits, while Germany does not.

Why then, can Japan print infinite deficits without consequence? Sure, their NIIP is hugely positive, but their starting debt levels are huge. Shouldn’t that be super bearish JPY? No. Japan is a completely weird and isolated situation. Most of their debt is held by the central bank and domestic pension funds. And those domestic pension funds are investing the money abroad and earning positive real rates of return. So, their huge debt is a bit of a mirage. For a great explanation of this, you can read “What About Japan?”, an excellent NBER working paper.

The start of the abstract sums it up nicely:

Over the last decade, the Japanese public sector has primarily borrowed at floating rates while investing in longer-duration risky assets, earning an annual return exceeding 6% of GDP above its funding costs.

So, the USA is in a somewhat uniquely awkward position if foreign buyers decide they don’t love US treasury bonds, stocks, and real estate quite as much as they used to. If growing debt and deficits and shattered trust lead to global diversification away from the dollar and US assets, that could potentially lead to less demand for US assets and the value of the dollar would likely fall in response to this lower demand.

It matters when it matters.

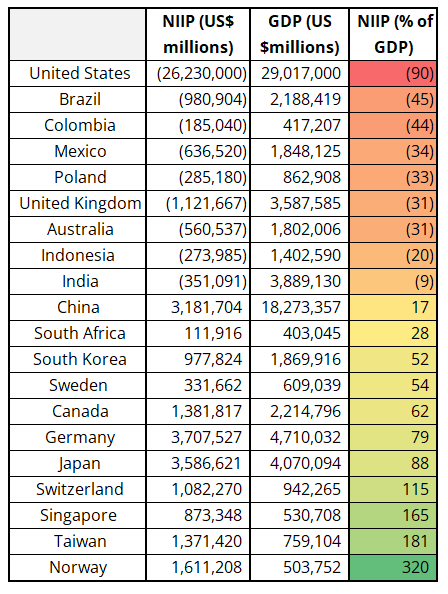

Here are the Net International Investment Positions of some of the major countries whose currencies we trade (minimum $500B GDP):

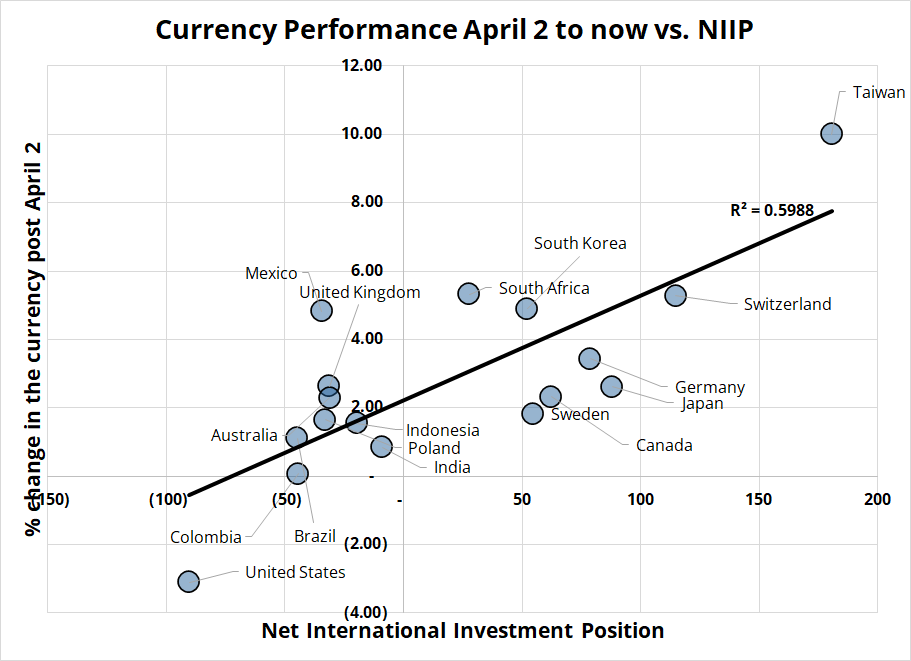

To look at the currency performance of these countries, we need to exclude China and Singapore (because they are quasi-pegged against the USD) and Norway (because they aggressively hedge their investment position and their currency does not trade in connection to their surplus (see here for a full explanation of Why Long NOK is not Long Norway)). Then, if you map currency performance vs. NIIP since Liberation Day, you get a decent fit.

Is this a coincidence? It could be. But more likely it’s showing that with less global trust comes less desire to finance the external position of other countries. I don’t want to overstate this relationship, but it could be a useful framework going forward if Liberation Day was the peak for the USD and global investors become more risk averse as it pertains to investing in countries that require a steady stream of external capital.

Then again, if the AI theme isn’t dead, and the US is still in soft landing mode despite tariffs, all this could unwind, and we could go right back to TINA and US exceptionalism. But I don’t think we will.

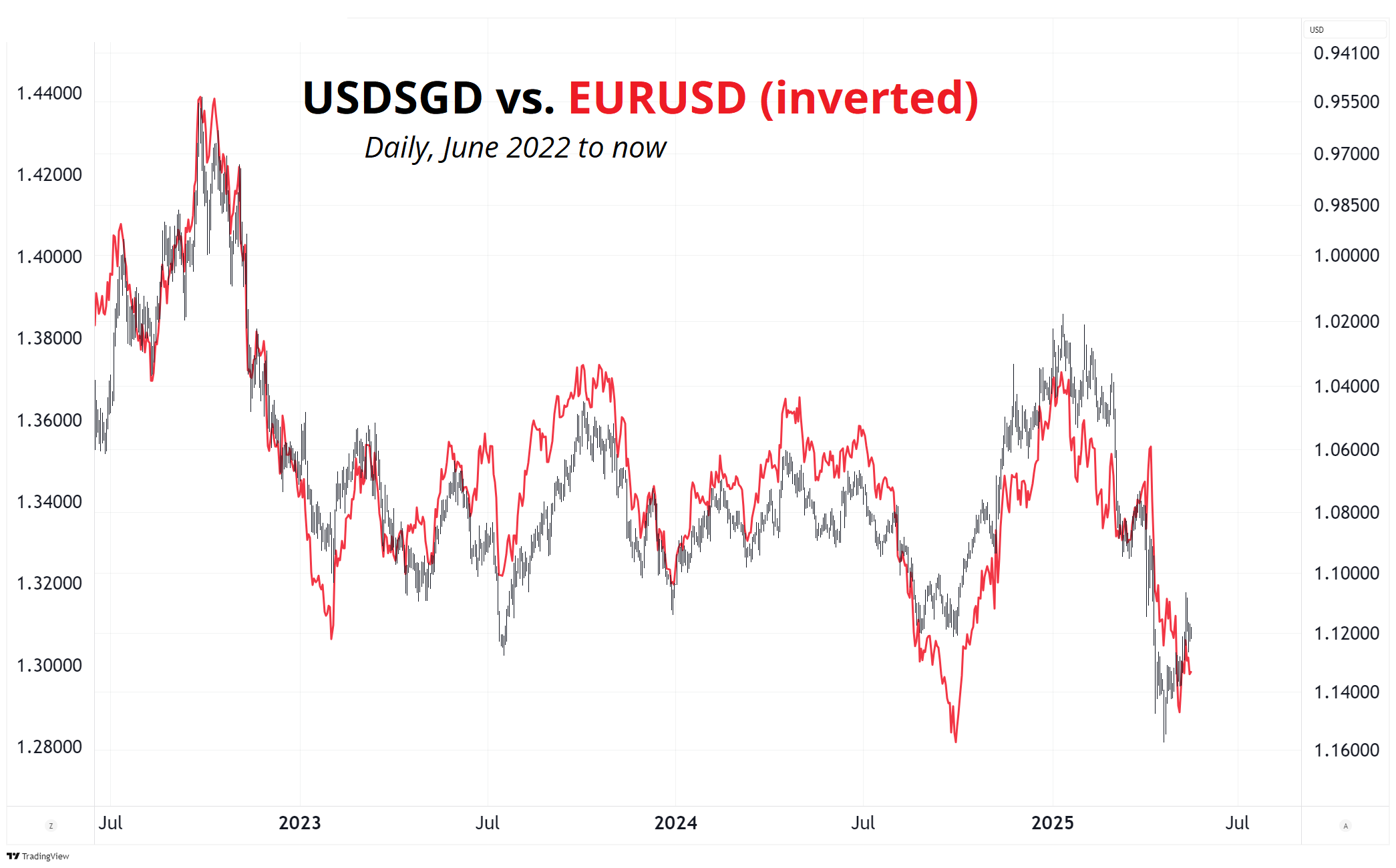

A quick note on SGD. If you’ve been in FX a while you know that SGD is just a EURUSD proxy. But just for those who don’t know: The Monetary Authority of Singapore (MAS) manages USDSGD very tightly to a basket of currencies and only deviates within a range/band. Therefore, for all practical trading purposes, the only time to trade SGD is when you think it’s in the wrong location within the band, or when you think the MAS could change the band by recentering it or changing its slope. Trading USDSGD requires specialized knowledge of MAS policy. Otherwise, trading USDSGD is just trading EURUSD upside down. Much as trading NOK does not expose you to Norwegian macroeconomics, nor does trading SGD often expose you to Singaporean macro.

I walked through Central Park on Monday and it reminded me of Thoth. One of the wildest documentaries ever. Winner of the 2002 Academy Award for Best Short Documentary. Inspiring, mesmerizing, joyous, a bit disturbing, uplifting, and intensely sad. All at once.

“Passersby stop to stare at his flamboyant outfit, but they stay to experience his music: original one-man operas. Thoth sings all parts male and female in an unknown language as he simultaneously dances, plays the violin, and beats out rhythms with bells tied to his ankles.”

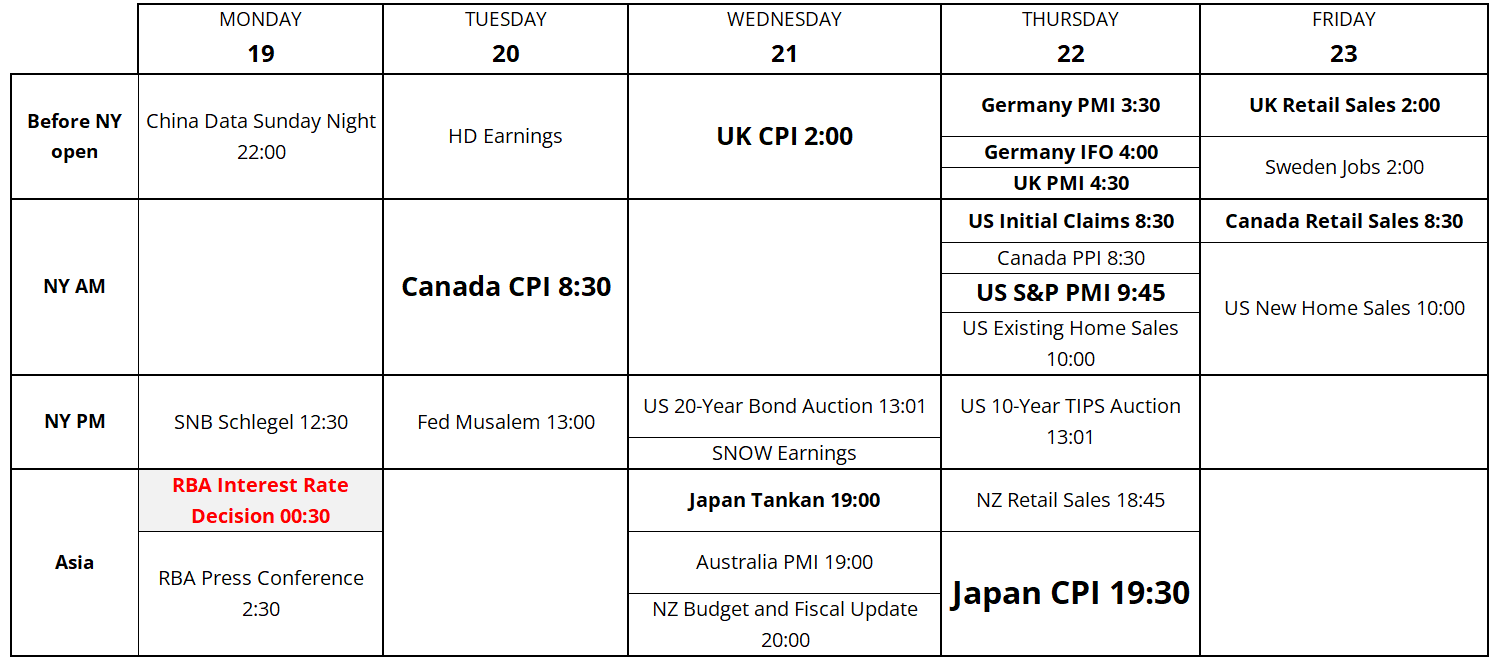

Next week’s calendar is below. Have a rosy, fresh-faced, healthy, bouncing weekend.

Calendar for the week of May 19

It’s not all bad news out there!