Everyone is still short dollars, but the reasoning feels wobbly

Singapore is 1.5 degrees north of the equator and lies entirely between the 1st and 2nd parallels.

My hotel was 1.28 degrees north of the equator

Everyone is still short dollars, but the reasoning feels wobbly

Singapore is 1.5 degrees north of the equator and lies entirely between the 1st and 2nd parallels.

My hotel was 1.28 degrees north of the equator

Flat

Hi! I am back from a week in Singapore. We met with 20 or so funds, totaling 70 or so portfolio managers. Mostly hedge funds, but also some bank and quasi-real-money-ish. Here are the main takeaways.

The market is still unanimously bearish USD despite what looks to me to be a fizzling two-pronged thesis.

Prong 1: Pension fund hedging will pick up into year end. This idea makes some sense because in most good USD down trends, the end of the year has seen significant USD selling. Some of this seasonality, however, is an artifact of the old “Stocks up / USD down” correlation which came into force as the Santa rally drove stocks up and the dollar lower in many years. Also: Seasonality has not worked at all this year (in contrast to 2023 and 2024, when it worked remarkably well) and while I am not certain seasonal signals are super autocorrelated, one should at least be skeptical of the year-end seasonal in the USD given the 2025 backdrop.

It gets more interesting if you drill down currency by currency. And I would note that I am looking at the FX world more and more as a bunch of individual currencies and less as a broad USD theme that ought to dominate. EM is no longer correlated with G10, EM Asia is a different beast than LATAM, and commodities no longer have any power or relevance to FX. Gold can go to the moon as the USD goes to the moon against JPY, for example, or EURUSD can go down while USDCAD holds steady or goes up.

I believe that the EURUSD year-end seasonal could still work because there is room for European pension funds to do another round of hedging and central banks are much more likely to buy euros into year end, not sell.

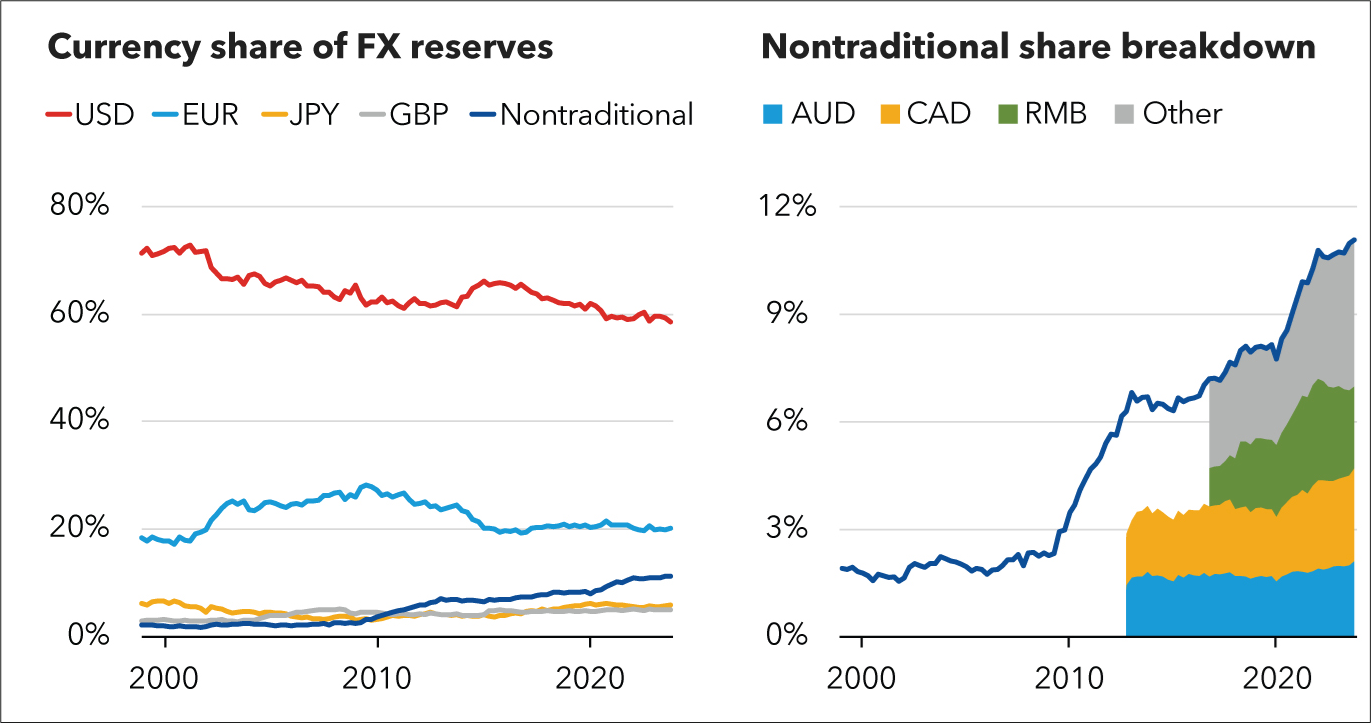

Note that while the world was worried about dedollarization over the past few years, the reality for central bank reserves has been modest dedollarization AND de-euro-ization. Many investors reduced their euro weighting during the Eurozone crisis and you can see in that chart that as the EUR fell on ECB QE in 2015, central banks did not rebalance. There is room for central banks to buy euros into year end if they so choose. Lagarde endorsing such a move after a 20% rally in the euro is another reason this is reasonable. So, year-end buying of EURUSD makes sense to me.

The currency that generated the most excitement in the discussions was the AUD. There is a large cohort of specs and investors looking for the traditional year-end rally in AUD as the Australian Superfunds rebalance hedges to mimic the one-off adjustments made by European and Canadian funds in April and May. Note, however, that much or at least some of the USD hedging by Europe and Canada was motivated by politics and emotion, not economics: Europe was getting the short end of the stick back then and the 51st State nonsense was still in the conversation. Australia was less exposed emotionally and politically and did not hedge as much.

The argument in favor of an increase in AUD superfund hedging is that they are waiting for committee and political approval and will pull the trigger by year end. And the numbers are huge. A speech by Andrew Hauser on September 16th caught people’s attention, but the speech is not exactly a clarion call for more hedging. It’s more like “here’s something to think about.” My takeaway from the speech was more that nominal hedges will inevitably increase due to inflows, not that hedge ratios necessarily need to increase. The paper stresses that as long as AUD is positively correlated to equities and AUDUSD volatility is low, hedging is less attractive. Both are currently true. From the speech:

Investors in some other countries do appear to have increased their hedging ratios in response to Liberation Day, with market attention focused on institutional investors in Europe and parts of Asia. Those additional hedging flows may have played some role in amplifying the US dollar’s decline for a period earlier in the year. In Australia, the super fund sector also increased its equity hedges in the June quarter (Graph 2) – but the pick-up was only small, and market participants report little current expectation of a more material increase in the near term.

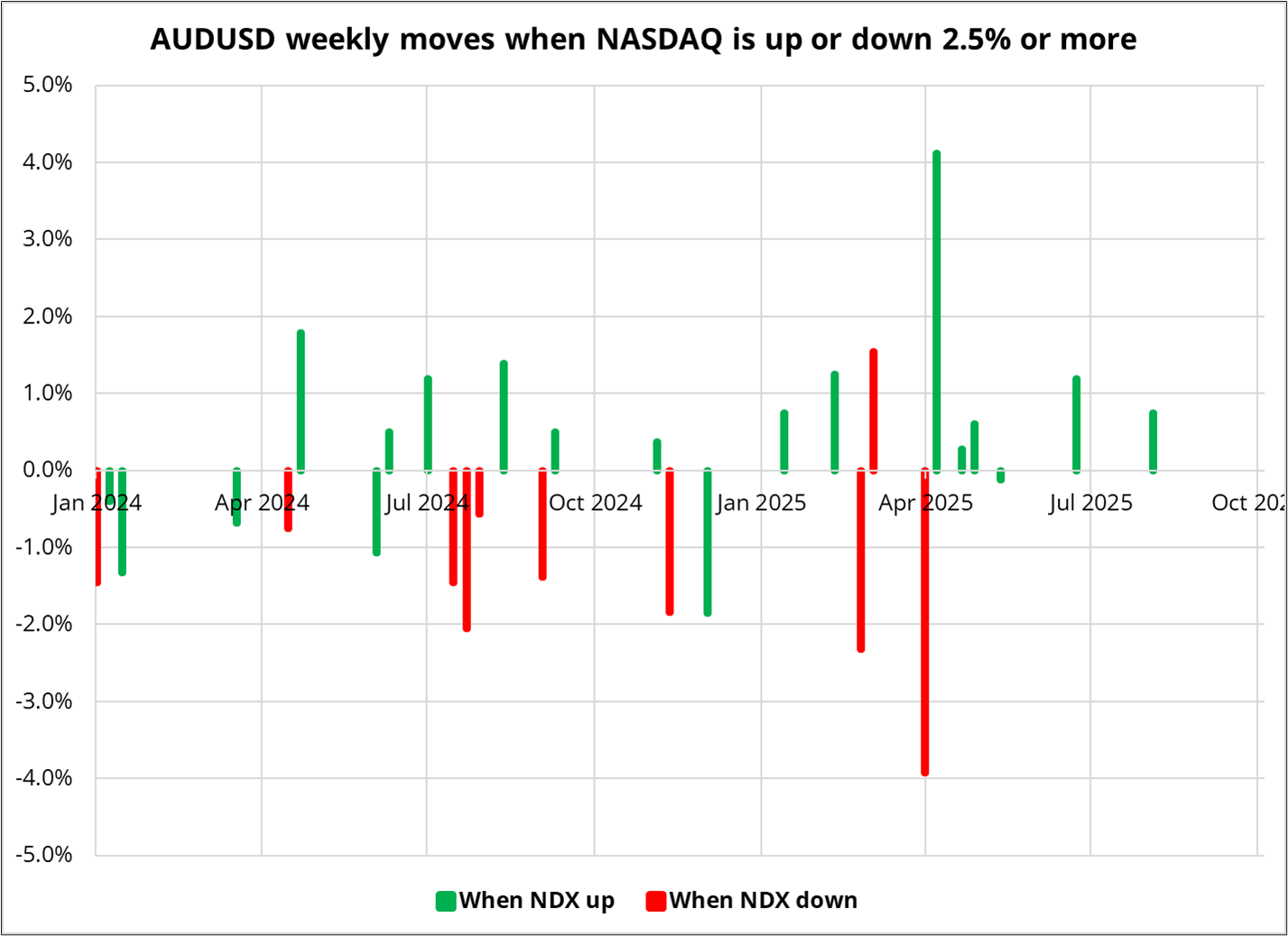

I suggest you read the speech, it’s quite detailed and useful. On my trip to Singapore, the arguments against AUD hedging were stronger in my view, and the closer people were to having direct knowledge and contact with the Aussie Superfunds, the more skeptical they were of the AUD hedging narrative. The dominant arguments against hedging are that the correlation of AUD to equities remains strongly positive, hedging isn’t free, and FX vol is low. The collapse in AUD in April as US equities tanked showed that an increase in hedge ratios could potentially lead to spectacularly bad outcomes. Buying AUD is not a hedge against US equity weakness so far. We will remain on guard for a correlation flip, but there hasn’t been one yet.

Furthermore, Aussie supers are famously conservative and any deviation from peers or benchmark is a lot riskier than sitting still. There is no evidence that AUDUSD goes higher on weak US equities and therefore the Aussie supers are unlikely to increase hedges. Note that Aussie pension funds did increase their hedges somewhat in Q2, going from 17.9% to 21.5%. They are not static, but I don’t believe a tsunami of AUD positive hedging is coming at year end.

On CAD, I am wondering if the pension funds might have overhedged as the emotional impact of the Trump attacks on Canada played a role. At the end of September, with the NASDAQ up 4%, one might have expected to see month-end hedging flows and yet USDCAD only managed to sell off from 1.3925 to 1.3900 before rebounding to 1.3925 again on September 30. That makes it look like maybe they are adequately or even overhedged.

Overall, the year-end pension rebalance story looks weak to me.

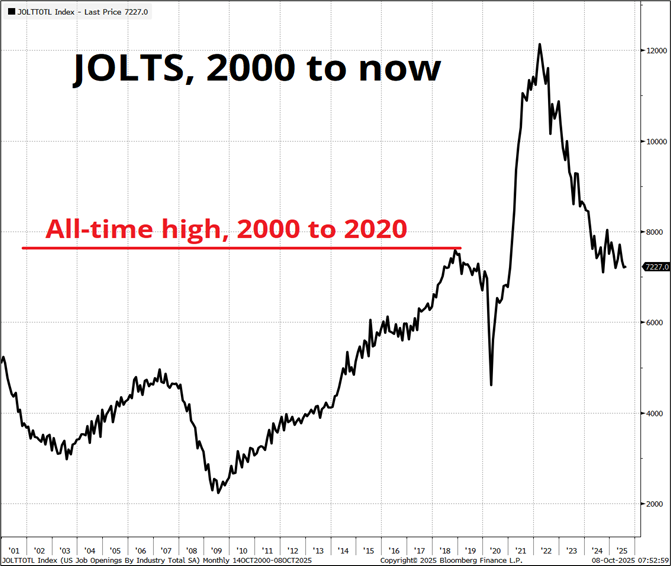

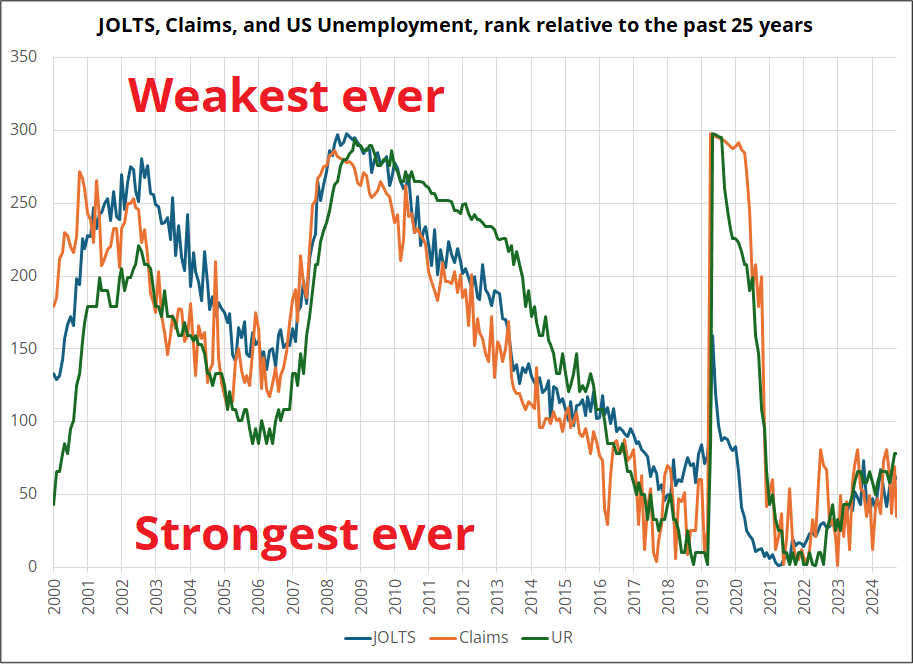

Prong 2: The second reason people are short dollars is the cyclical story, and again I don’t buy it. The US labor market has weakened but remains strong relative to history despite negative changes. JOLTS offers a good example, but you can apply the following logic to Initial Claims and the Unemployment Rate, too. Yes, JOLTS has collapsed from the overheated levels of the strongest jobs market in my lifetime. But it’s still around the best level it ever saw from 2000 to 2018. Same with UR and Claims. The focus on changes has obscured the strength of the levels.

With regard to NFP, imagine a massive policy shock happens in the month of April. When would you expect to see it in the data? Maybe August/September as April/May hiring freezes lead to weak labor demand figures by the start of the fall? Then, imagine that policy shock is effectively shrugged off by June. When would you expect the data to rebound? Probably a few months after it dips; maybe October/November? I think the drop in NFP is the result of a policy shock and the immigration crackdown, and a shortage of labor is as much of the story as any fall in demand. Meanwhile, financial conditions are loose, stocks and credit are on the moon, and gold is on Mars.

The US is pursuing a run it hot strategy and Japan looks ready to join the party. As such, I don’t buy the cyclical bearish USD story, either. There seems to be this pervasive feeling that “we have to be short USD” across macro as US institutional capture and structural stories are forever lurking. But maybe the structurally bearish USD story can be overpowered, or is simply stale.

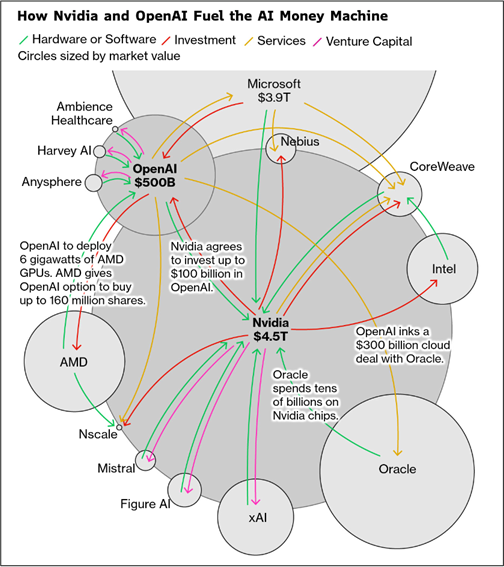

A huge topic of conversation was the explosion higher in debasement trades and the Ouroboros Bubble in US tech. NVDA receives money from MAG7, they give it to AMD and INTC and OpenAI and those guys come back and work with or buy from NVDA. This triggers more buying of tech stocks, which increases the US weighting in MSCI World, which forces global investors to buy more US tech, which increases the wealth of the richest Americans, and they spend like crazy. This graphic from a nice piece on Bloomberg captures the circularity quite well.

Meanwhile, on Twitter and in discussions in Singapore, everyone knows that everyone knows that it’s a bubble but the common knowledge (boosted by Paul Tudor Jones) is that you want to be long the bubble, ‘cuz nothing stops this train. I suppose that everyone knows that they can get out before everyone else, too.

What stops the train? Inflation or peak capex. The policy mix around the world is inflationary and that is part of why everything is ripping. Fiat is debasing. It’s not as much a USD debasement story as a fiat debasement story. A story captured by the fact that everyone we talk to can find currencies they love to short, but it’s very hard to find a currency you want to be long. At some point, I think bonds will get the memo and we will have a repeat of 2022. The big difference this time vs. 2022, though is that the rate hikes side of the Fed policy distribution has been completely chopped off and so the flavor of the moves could be quite different.

I am looking forward to a headline in late 2026:

*TRUMP SAYS FED CHIEF WALLER IS CRAZY HAVING RATES SO LOW INFLATION IS OUT OF CONTROL >> HIKE NOW HIKE NOW >> THANK YOU FOR YOUR ATTENTION TO THIS MATTER

Inflation was political kryptonite for every global leader in 2021/2022 and could re-emerge as a factor in 2026.

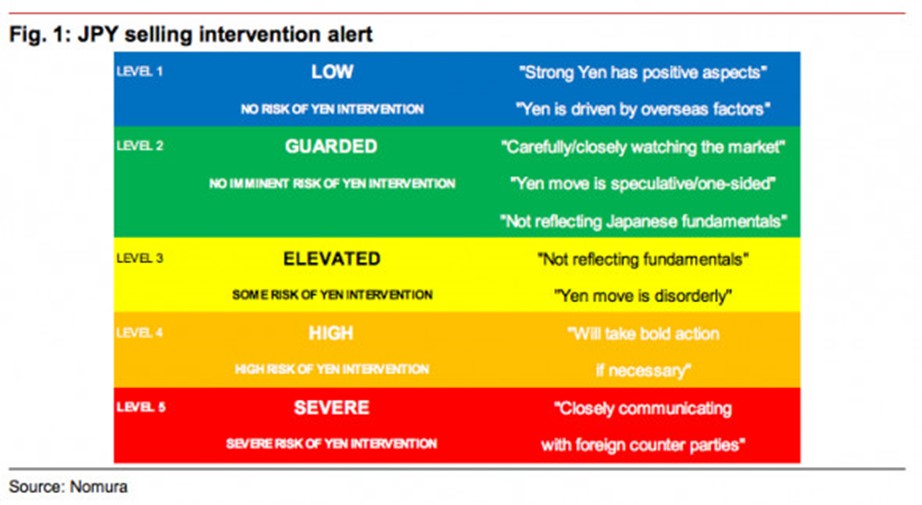

Takaichi is getting a quick lesson in the trilemma as she wants stimulatory fiscal policy while telling the BOJ to back off and simultaneously saying (via her representatives) that USDJPY at 150 is “a bit too much”. You can’t have all three. It feels early for any kind of BOJ/MOF action in USDJPY as it’s worth remembering that USDJPY was above 150 a ton of times in recent years and was here as far back as 2022. USDJPY at 152 is not going to impact inflation much. Past interventions have been related to speed (10 yen or more in one month and 6% in one month have been past benchmarks) and level (above 160).

10 yen from the 30SEP close would be 157.90 while 6% would be 156.77. So one could reasonably guess that 157/160 is a likely intervention zone. In terms of how to monitor the rhetoric, this chart from back when I worked at Nomura in the early 2010s is an oldie but a goodie.

Consensus is that USDCNH is effectively pegged and that’s not going to change anytime soon. The net outflows story has turned to a net inflows story as China becomes investable again and corporates are hoarding USD. A significantly stronger CNH is possible into year end, while CNH weakening appears to be mostly off the table. Xi’s visit to the PBOC in October 2023 appears to have been the approximate start of the CNH quasi-pegging regime.

To say it’s pegged is obviously an exaggeration, but the range of motion of USDCNH has been contracting steadily (see chart).

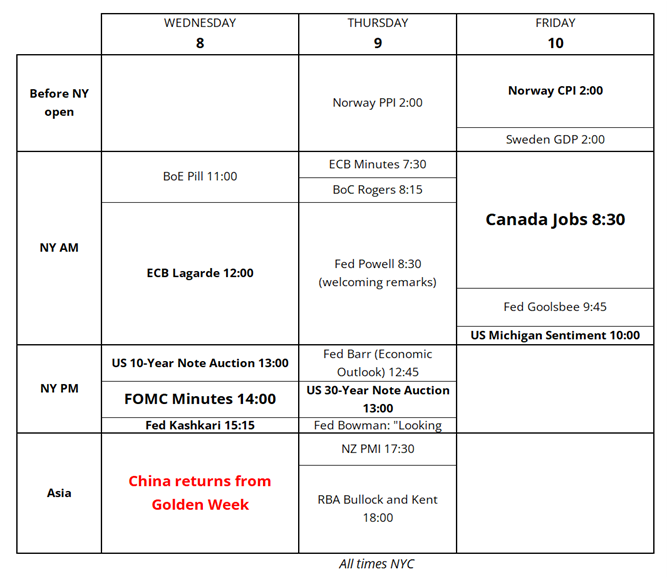

A weird-looking calendar this week because I was off Monday and Tuesday. While there are many Fed speakers this week, most of them are simply offering opening remarks or talking about community banking. FOMC Minutes could be interesting today, and we get Canada Jobs on Friday.

Have a great rest of the week.

Singapore is 1.5 degrees north of the equator and lies entirely between the 1st and 2nd parallels.

My hotel was 1.28 degrees north of the equator.