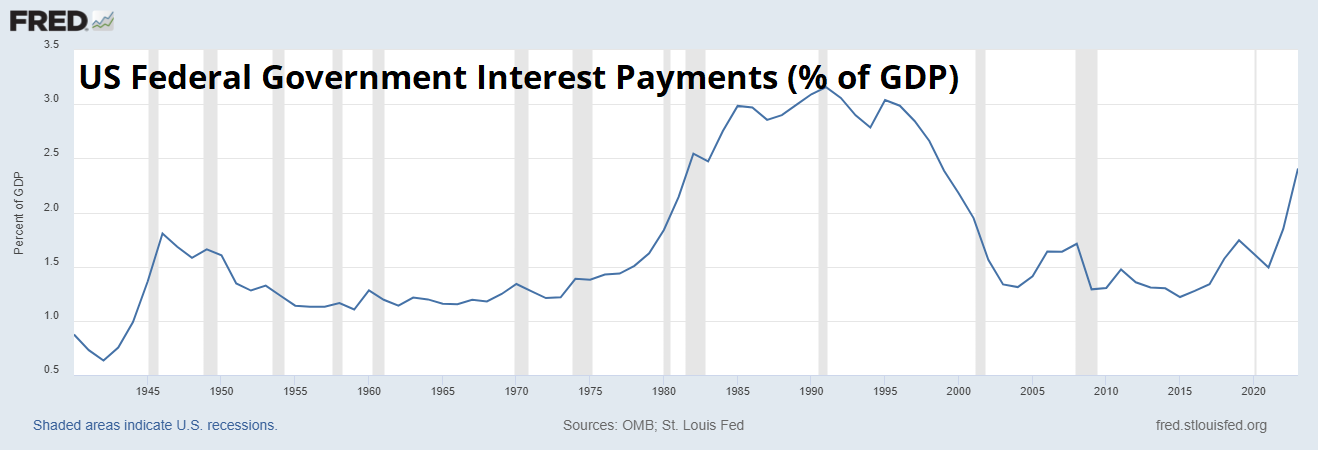

In an MMT world where the Fed has truncated the policy distribution by promising no more rate hikes, inflation rebounds. There is zero possibility of tax hikes to deal with inflation so the primary cure for this inflationary reacceleration, if it gets worse, needs to be rate hikes.

Oops, I Did It Again

Current Views

Flat

Loose

The Fed seems to be in a similar spot to where they were in late 2021 where they have committed to a policy framework, but that framework is wrong. Then, they continued ultraloose policy through a huge speculative bubble and inflationary boom, continuing asset purchases right into 2022.

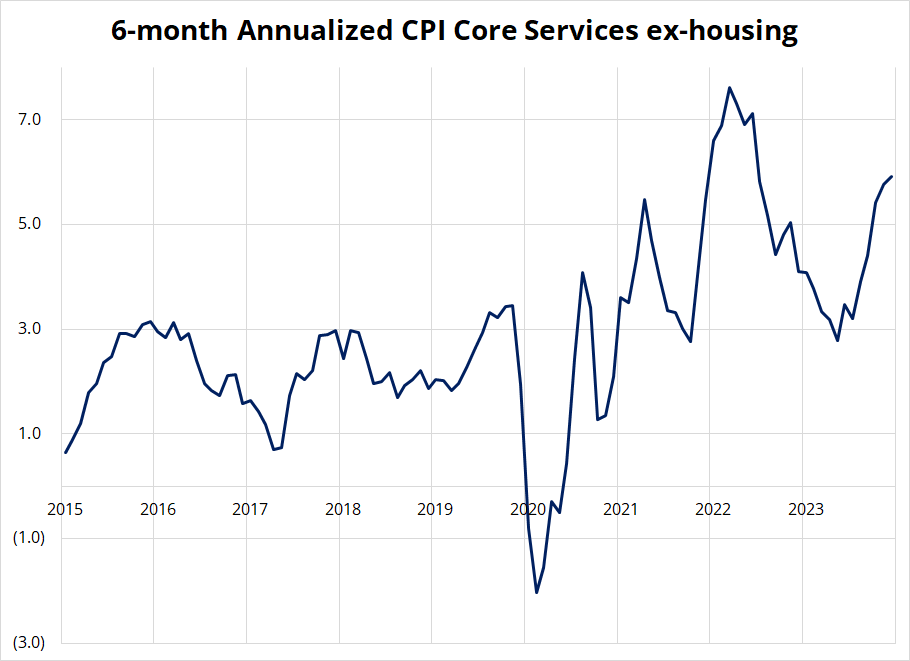

Now, they rolled out the Mission Accomplished banner in November 2023, stoking a reacceleration of inflation pressures reminiscent of the most historic central bank mistakes. Powell’s premature removal of foot from brake has triggered a huge loosening in financial conditions and a flight to non-fiat assets as the market frantically buys insurance to cover the risk that this is a second Fed policy error in two years.

The Fed’s predisposition toward loose policy remains an unshakeable institutional bias. Yes, they hiked like crazy and that’s not loose policy in theory, but the second there is a window to go loose again, they dive through it.

As Arthur Burns explained in his mea culpa around the failure to control inflation in the 1970s:

Viewed in the abstract, the Federal Reserve System had the power to abort the inflation at its incipient stage fifteen years ago or at any later point, and it has the power to end it today. At any time within that period, it could have restricted the money supply and created sufficient strains in financial and industrial markets to terminate inflation with little delay. It did not do so because the Federal Reserve was itself caught up in the philosophic and political currents that were transforming American life and culture.

I’m kind of obsessed with that speech these days as its description of the interplay between societal factors, loose fiscal policy, and a central bank unwilling to turn the screws is eerily familiar to those operating in financial markets from 2021 to now. Obviously, there were much more significant pressures in the 1970s, but the general setup is similar, even though there is no oil crisis or wage/price spiral going on. It’s like 1970s-lite.

When will it end?

There is approximately zero chance of a fiscal awakening over the next 4.75 years as the current and next president are both advocates of various forms of either lower taxes or higher spending or both. Therefore, more Fed rate hikes would be the only countervailing force that can take on rising inflation expectations, rising commodity prices, and 6% inflation in services.

Forgetting about the idea that Fed hikes are stimulative, which is possible but hard to believe ad extremum, the only fix for inflation in an MMT world where tax hikes are off the table would be more hikes.

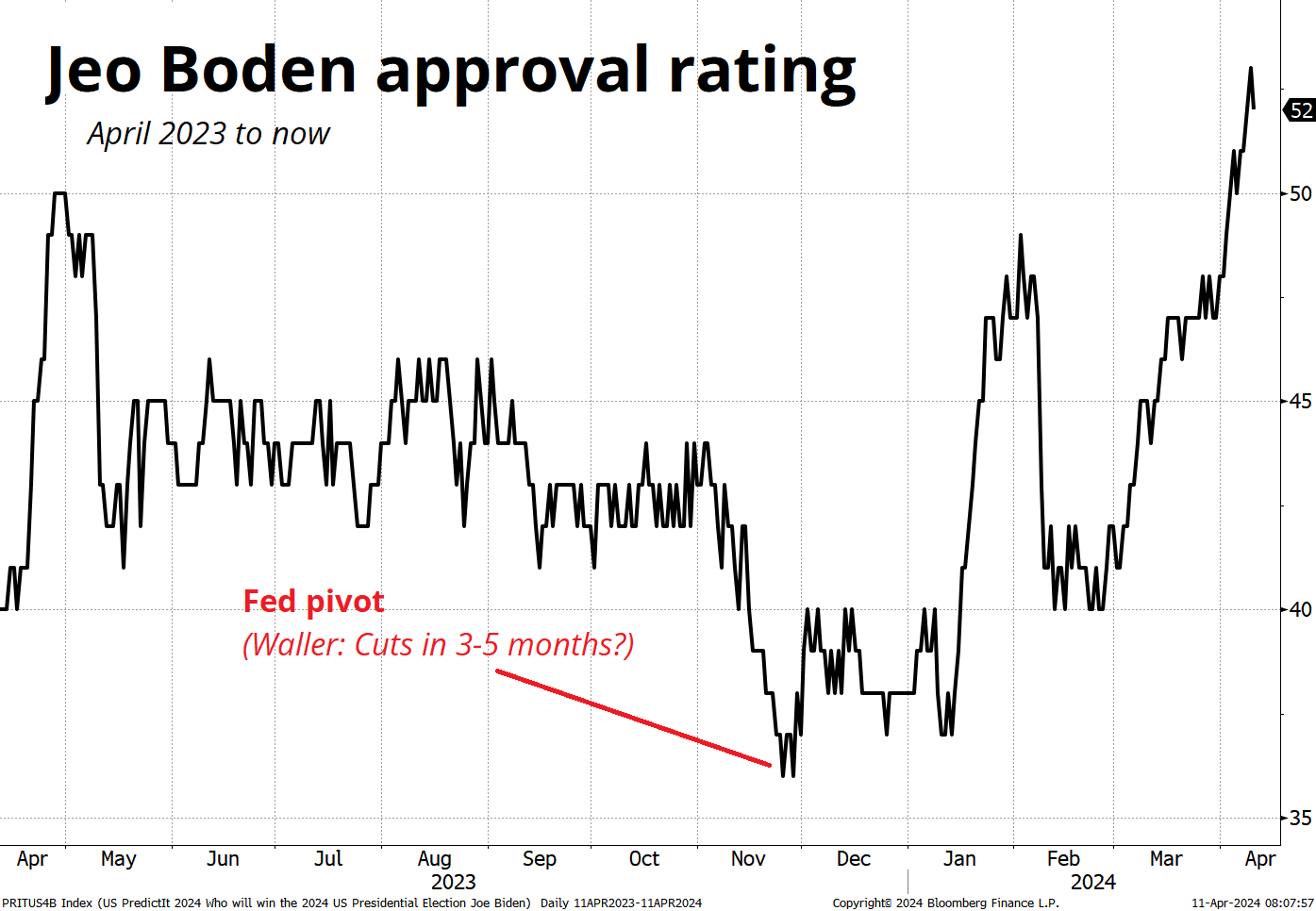

It’s worth considering, of course, that the Fed’s target is not really 2% inflation but this:

By that measure, Fed policy is working! The other non-dual-mandate reasoning for loose policy is this:

Still, regardless of whatever political and financial repression / fiscal dominance motivations you assign to the Fed… At some point they will have to hike rates again if inflation goes up, up, and away. One of the most important signposts to watch for now is the first utterance by a Fed Governor of something to the effect of:

*FED: RATE HIKES NOT OFF THE TABLE

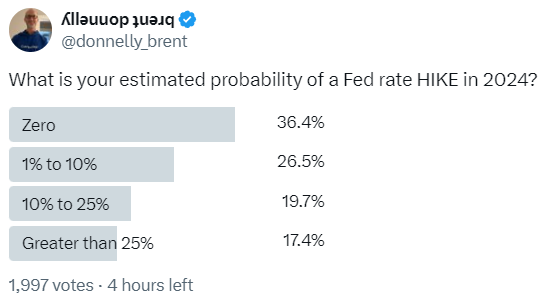

This loosening of financial conditions, rebound in inflation expectations, and boom in commodity prices is predicated not so much on the number of Fed cuts, but on the fact that hikes are not a serious part of the distribution. This could change fairly soon. I sent a poll yesterday on this question and here are the results.

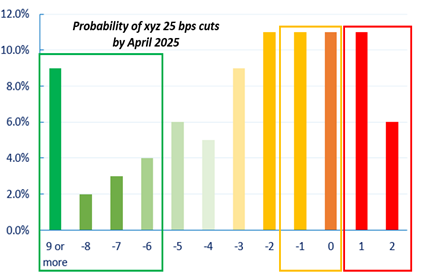

And this colorful graphic shows how Alfonso Peccatiello calculates the odds of various Fed outcomes (using SOFR options market implied probabilities).

Both suggest that expectations for a Fed hike over the next 8 to 12 months is in the 10%/20% zone. That’s a tail for now, but watch Fed communications closely to see if they are ready to blink. Still early for that, probably, but obviously there is a point at which someone in the Fed gets nervous about the persistent drift away from target.

Until the Fed pivots the pivot and moves back to a policy framework that allows for the possibility of hikes, I am not sure the USD can rally all that much.

Yes, the huge move higher in yields drove the USD much higher yesterday but once the dust settles, it’s not obvious to me that loose fiscal + loose monetary + commodity strength + global manufacturing rebound = strong USD.

Finally, it looks to me like the CHF shorts are tired. Depending on where we close today, you’ve got a false break of 0.9090 in USDCHF and a failed triple top and lower high in EURCHF into 0.9825/0.9850. Time to square up the CHF shorts and reload at better levels.

Finally, post CPI and PPI, the good PCE and Core PCE forecasters are leaving their estimates unchanged. That’s interesting, to say the least.

Have an oi oi oi kinda day.

good luck ⇅ be nimble

More from the Spectra Markets Library

The debate over soft data

I think soft data is showing the way, but many disagree.