Thank you for trading macro. Your view is important to us.

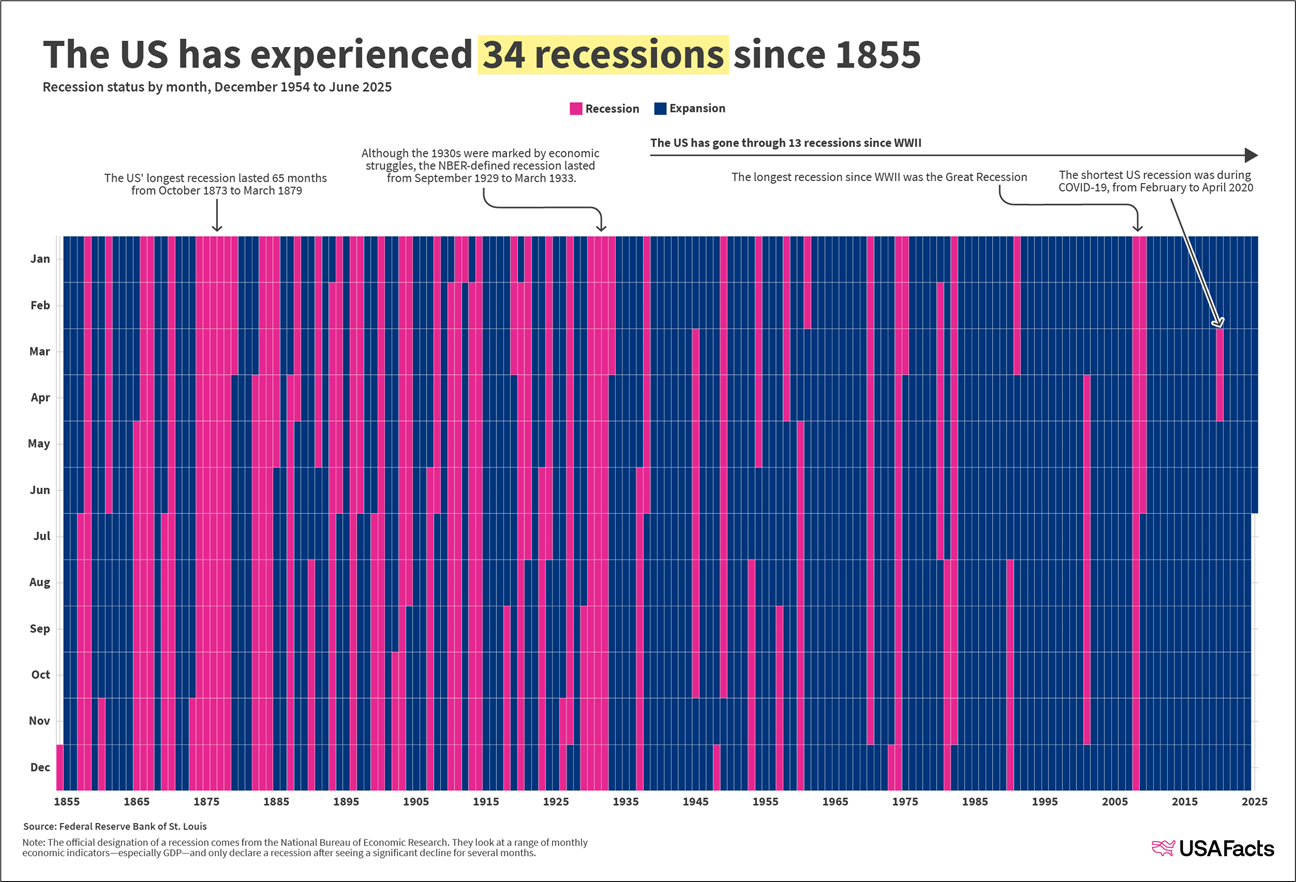

Recessions in pink

Expansions in blue

Thank you for trading macro. Your view is important to us.

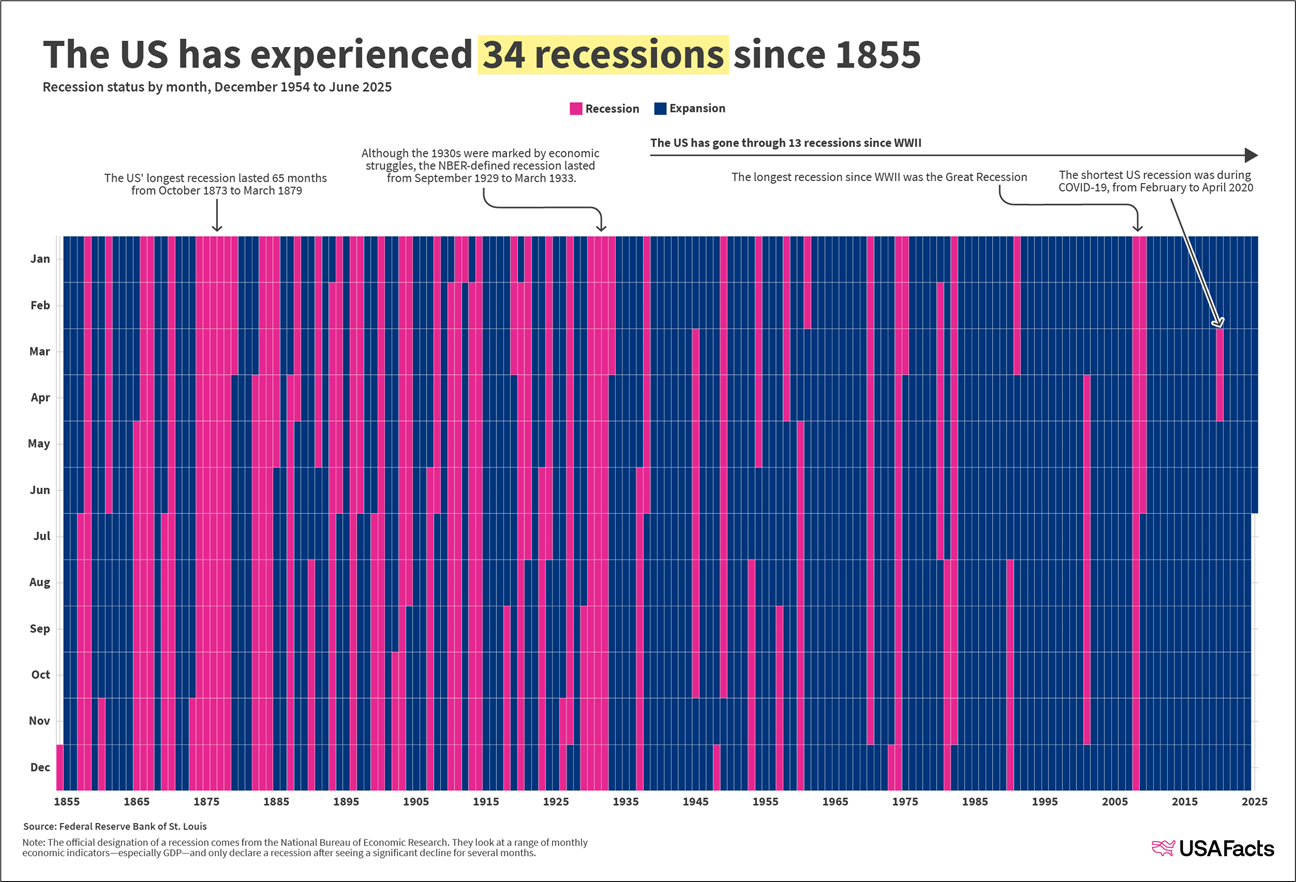

Recessions in pink

Expansions in blue

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

This is a short writeup today as macro appears to be on vacation as the market is more focused the micro implications of corporate earnings. My preference is to mix it up, firing off the odd 8-pager and also the occasional 2-pager like today. It all depends on what’s going on.

There has been a notable lack of downside follow-through in the USD as the market keeps trying to pound USDJPY in the 147 area, but the pair refuses to break. Gold, silver, and crypto are not participating in USD debasement either, despite what was universally seen as a soft jobs report on Friday. This is particularly surprising following the firing of the head of the BLS, the exit of Kugler, and dovish comments from Daly.

This is consistent with the lack of follow-through in fixed income.

I suppose it’s too early to say that the jobs report is a watershed moment as the rest of the data remains more mixed than soggy. Core PCE hottish, CPI ticking up, Initial Claims near the lows, ISM Manufacturing weak, NFP soggy, and ADP as expected does not exactly paint a coherent picture. In fact, it paints the same picture as the past few years: Pockets of fragility in an otherwise solid structure.

This week lacks luster as the data flow is minimal, and the market is more focused on the micro, not macro or FX. My lean is for a stronger ISM as we have seen a decent rebound in Chicago PMI, consumer sentiment readings, and Philly Fed. Something like 53.4 sounds about right for ISM Services today (expected 51.5). I would think that takes USDJPY to resistance at 148.00.

There is still a fair amount of uncertainty around tariffs as the EU deal lacks detail and the Indian and Chinese buying of Russian oil remains a reason for Trumpian vitriol. The August 12th deadline with China isn’t getting much press because everyone is bored of tariffs, but yuge new tariffs on China would be a major step backwards and might actually matter a bit for risky assets. Meanwhile, we are getting more of the usual 2017-style nonsense this morning:

*TRUMP: XI CALLED FOR A MEETING

*TRUMP: WE’RE CLOSE TO A CHINA DEAL

Warsh and Hassett remain the favorites for Fed Chair as Bessent has bowed out.

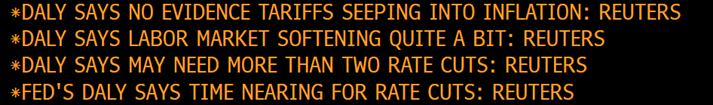

Daly has joined Waller and Bowman and the September cut crew have now reached critical mass (it’s 92% priced in). IMO, Daly is using a laughably short time series to make her determination that tariffs are not inflationary, but hey. After three months of CPI and PCE data, she’s confident enough to sound the all clear. Interesting.

This is all setting up for a zippy, negative stagflationary surprise in Q4.

Have a day filled with growth and production.

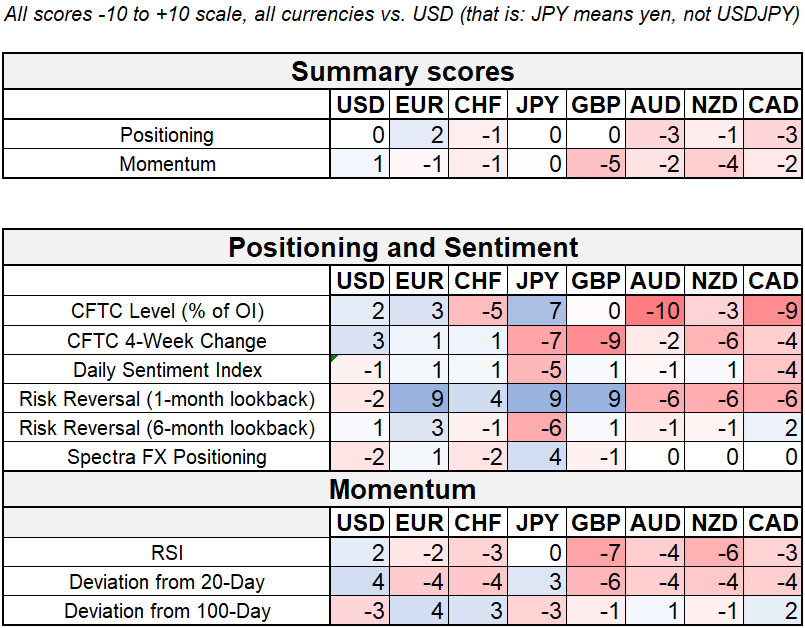

This week’s positioning report reflects a bit of malaise as the USD shorts are all gone, and the USD longs initiated on strong US data and a hawkish FOMC were obliterated by the weakness in NFP. The CFTC reduced its forever-long in JPY a bit (finally) when we were trading 150.00ish, but the urge for them to reduce further is probably gone as they generally follow price. Short CAD vibes picked up as last week USDCAD staged its first impulsive move in ages.

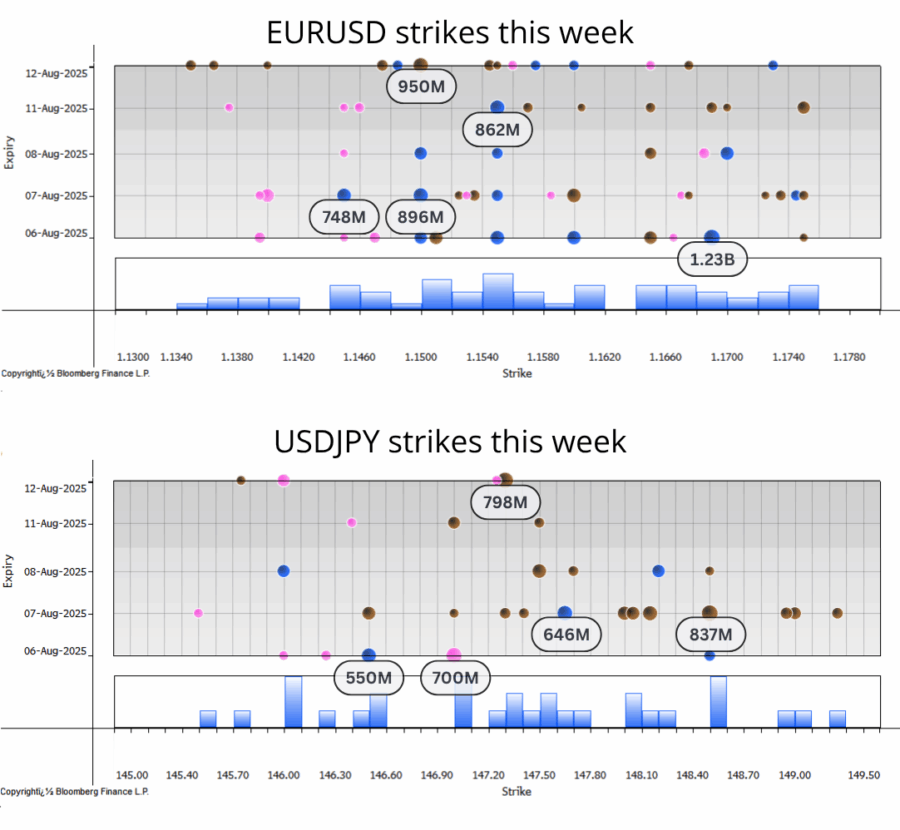

A decent collection of strikes at both 1.1500 and 1.1550 this week with notable but not gigantic stuff there all week. In USDJPY, the landscape isn’t particularly striking as we have a 147.00 coming off tomorrow in 700 bucks and some stragglers 147.50/80. Overall, the lack of yard-plus strikes indicates less than maximum engagement by the big players. Expect stickiness if we are close to 1.15 near 10 a.m. any day this week.