The USD needs a steady stream of good news to rally and it’s not getting that.

St. Valentine holding a Valentine

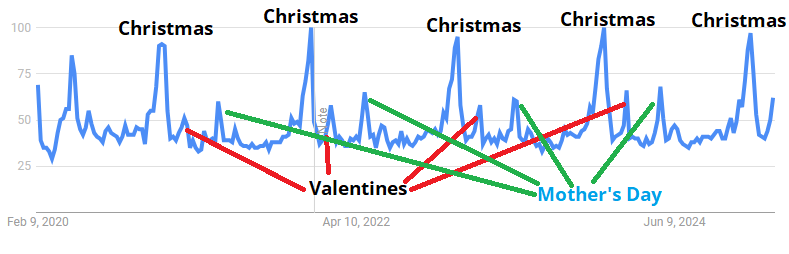

Greeting card searches on Google peak at Christmas. Mother’s Day is second and Valentine’s is third.

See ugly chart at bottom of page.

The USD needs a steady stream of good news to rally and it’s not getting that.

St. Valentine holding a Valentine

Greeting card searches on Google peak at Christmas. Mother’s Day is second and Valentine’s is third.

See ugly chart at bottom of page.

Flat

Much as bear markets need bad news as fuel, the USD needs good news as fuel, or it bleeds lower. Positioning and narrative have been on the side of the dollar for so long that the second the good newsflow stops for the dollar, it leaks. Yesterday’s announcement of reciprocal tariffs including VAT have hung up another sword above Damocles to go with the 25% on Canada and Mexico, and the overarching April 1 deadline. While the new reciprocal tariff announcement suggests a reciprocal tariff start date “could take effect as early as April 2”, the original day-one executive order commanded agencies to report on the causes of persistent annual trade deficits by April 1.

That puts us in purgatory as we await a flurry of negotiations (see India last night, for example) and the wildly-onerous process of attempting to determine what tariffs currently exist. There are 186 countries in the World Customs Organization and there are around ~5,400 Harmonized System Codes for export and import classification. That is 1,004,400 tiny decisions to be made. Obviously, that is an exaggeration, but it helps roughly outline the complexity of a reciprocal tariff plan.

Presumably the administration can start with the big and easy ones like autos and pharmaceuticals, and the countries with the largest deficits and tariffs (China, EU, Vietnam, Japan, etc.) and launch those in early April, and then go down the list and tariff other countries and categories over time.

Countries could try to avert the reciprocal tariff but it’s complicated because of Most Favored Nation principles which often force you to offer the best deal to everyone, not just one country. Also, since the reciprocal tariffs are meant to include non-tariff barriers and VAT, it’s basically impossible for countries to really address the US concerns. Friends of Trump (Australia, Japan, Russia?, and India) can more easily win while the EU and China probably can’t. Canada and Mexico are a whole other story.

This is getting so complicated that it’s going to be extremely difficult to know who is on the right or wrong side of these tariffs by April. Further complicating things are the Mexico on/off in 2019, Colombia on/off in 2025, Mexico and Canada on/delayed in 2025 and so on. None of the announcements have a probability anywhere close to 1 until they are enacted and enforced.

This does not bode well for FX vol and FX trading over the next couple of weeks, especially as the economic calendar next week is pretty scrawny.

A face-ripping reversal in BABA yesterday as the wicked reversal is now a reversal of a reversal as Xi has announced a symposium for tech leaders on Monday.

One of the big knocks on Chinese stocks, and part of why US investors declared them uninvestable, has been Xi Jinping’s revival of the traditional Chinese / Marxist idea of “Common Prosperity” in 2021. In the second half of 2021, the Communist Party cracked down on the billionaire class.

If you’ve got whiplash from the USD bullish story turning so quickly to dollar bearish or the BABA bearish story turning back to bullish again so quickly, you are not alone. But it’s hard to ignore the symbolism of this symposium, so I figured I would discuss it today despite risking narrative whiplash here.

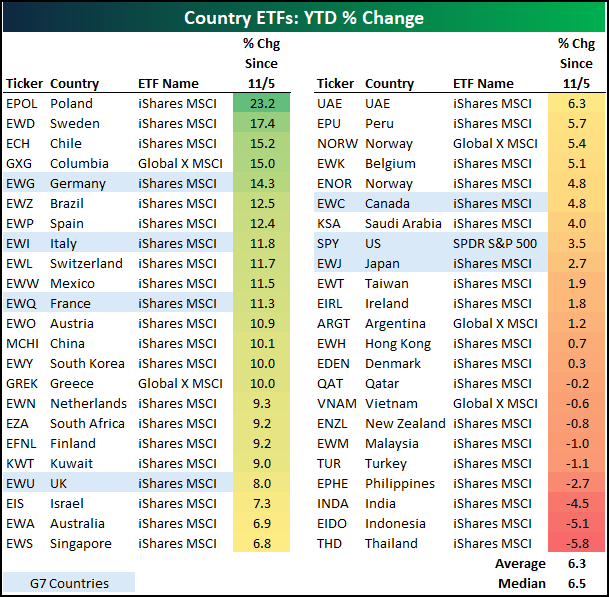

This chart from Bespoke shows how unexceptional US equities have been. The sequencing was supposed to be that tariffs push the USD up and then some kind of grand plan pushes it lower later but as was the case in 2017, the market has front run the tariffs so much that the USD can’t rally.

https://x.com/bespokeinvest/status/1890086585972191607

And on top of the purgatory issue, where it’s almost impossible to stay short euros all the way until April Fool’s news on reciprocal tariffs, the intellectuals are pounding the table on a lower USD again.

Here’s Stephen Roach (bearish USD for at least the past 5 years, FGO, including calling for a dollar crash in 2021. Still, always a smart read if you want to know the USD bearish view in the ivory towers).

And here’s Yanis Varoufakis. I like reading these articles to get a sense of what people are thinking, and while I am sympathetic to these USD-bearish views, they are essentially identical to Stephen Miran’s essay in November, and they are essentially identical to the Shanghai Accord theories 2016-2019 as everyone thought Trump wanted a lower USD in his first term, too. He did! But getting countries to voluntarily appreciate their currencies is different from wishing they would. Anyway, there is a good big picture thesis on why the overvalued USD should go down. But trading valuation and imagined multinational New World Order currency pacts isn’t practical. I am not saying don’t be bearish USD—in fact my guess is that the USD weakens more as the market gives up on the dollar bull thesis for a while—but these big picture reasons are not super tradable.

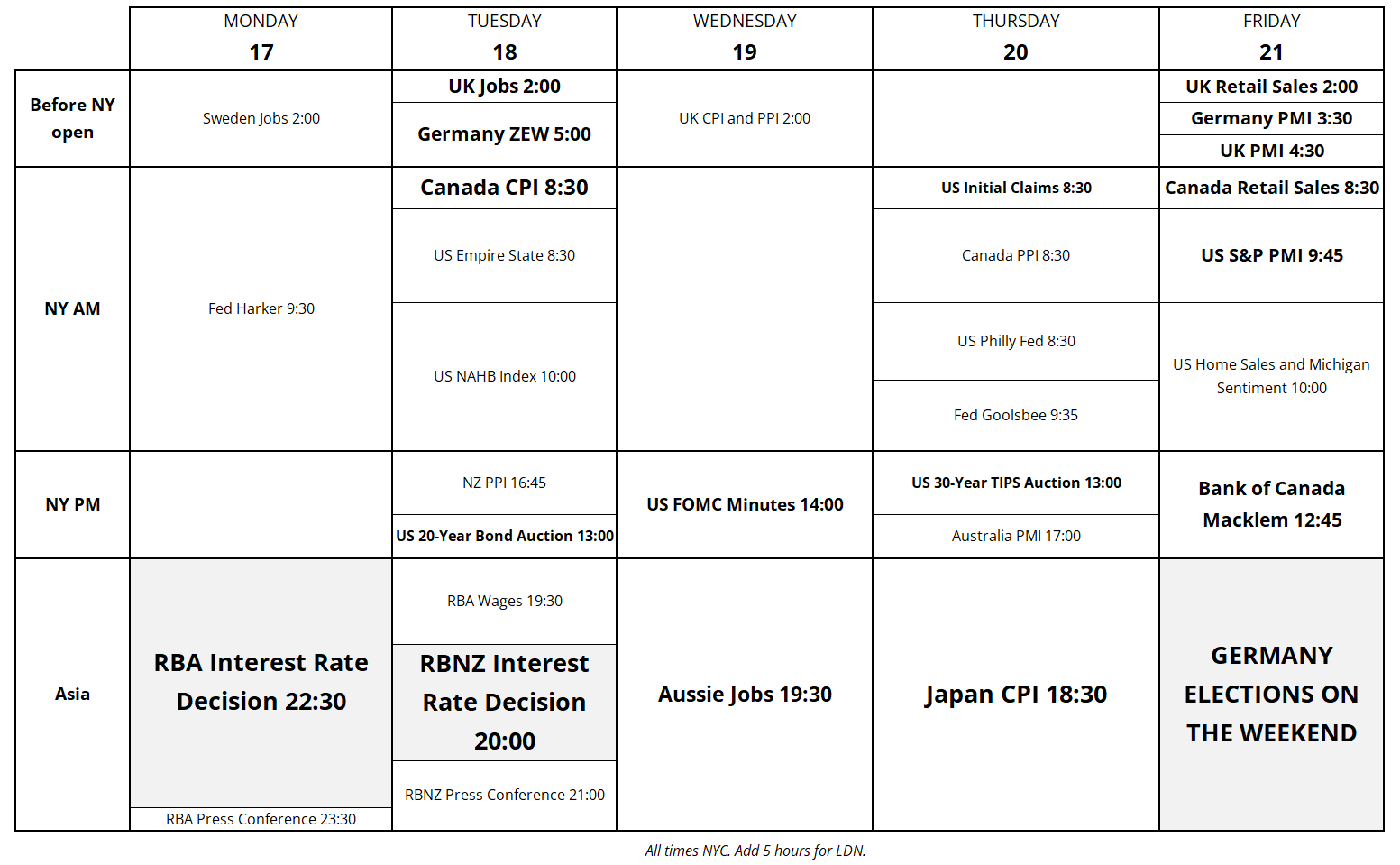

RBA and RBNZ are the highlights at the start of the week. And then prepping for German elections at the end.

The Gulf of America and Mount McKinley: AP style guide.

Have a heart-shaped weekend.

Google Searches for “Greeting Card” 2020 to now

Rejected top image (AI prompt: Ralph Wiggum holding a Valentine)