I lean towards weak Retail Sales, but I am not quite sure what to do about it.

The Russian equivalent of…

“There’s no such thing as a free lunch” is:

“The only free cheese is in the mousetrap”

I lean towards weak Retail Sales, but I am not quite sure what to do about it.

The Russian equivalent of…

“There’s no such thing as a free lunch” is:

“The only free cheese is in the mousetrap”

Long 18JUL 1.3410 GBP put

for ~25bps off 1.3470 spot

1/3 hedged into Retail Sales at 1.3400.

Cover the balance at 1.3335/40

The GBPUSD puts are a bit annoying as the trade went instantly in the money and GBPUSD has not traded a pip above the entry point and yet here I am not even able to make back the premium so far. Then again, US CPI was soft at first glance, UK CPI was strong, and the UK jobs data didn’t cooperate, so maybe instead of whining I should be grateful. And post Aussie jobs, the one touch I recommended selling at 62% is now trading 35% so that’s good, I guess. The trip to Brazil gave me a good view into the universality of the USD short position and hopefully (maybe?) that helped you reduce your USD shorts.

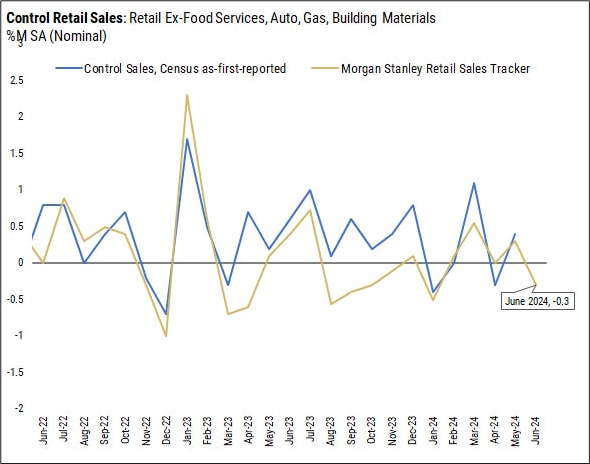

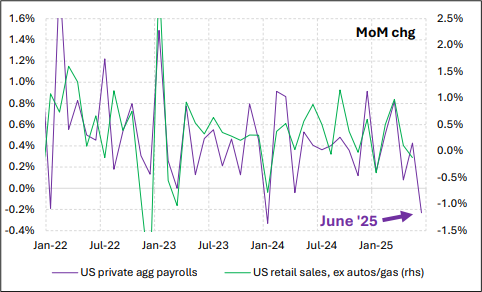

Anyhoo, today we get Retail Sales and two good nuggets point to a lower number. The first is from Morgan Stanley and the second one is from Vanda:

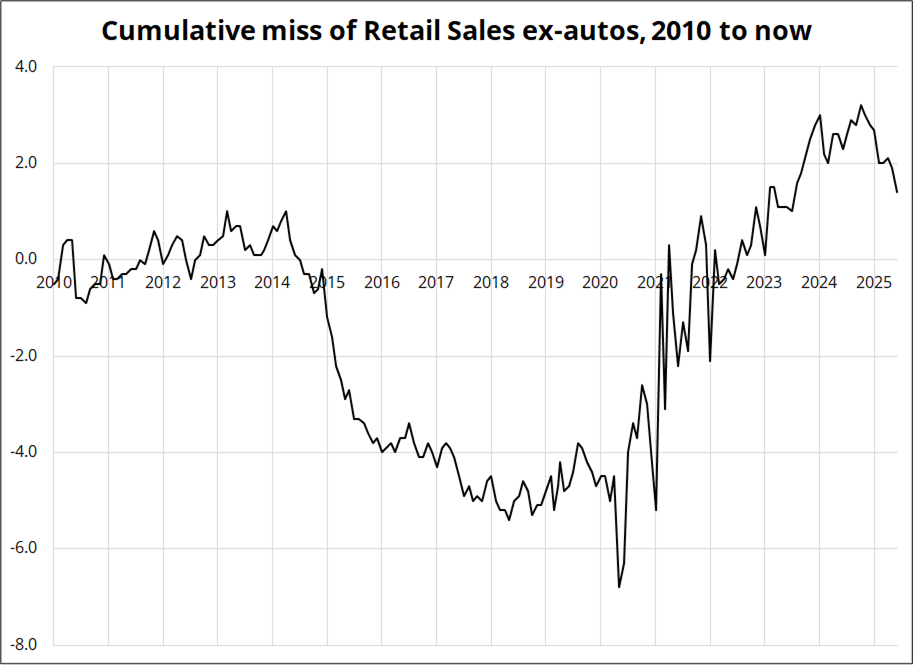

My guess is that the bullwhippy impact of tariff front loading is also probably hard to capture in economist models. Finally, there has been strong autocorrelation of misses in Retail Sales over the past 10 years as the black boxes couldn’t pick up secular stagnation 2015 to 2020 or the stimulus payment jamboree 2021 to 2024.

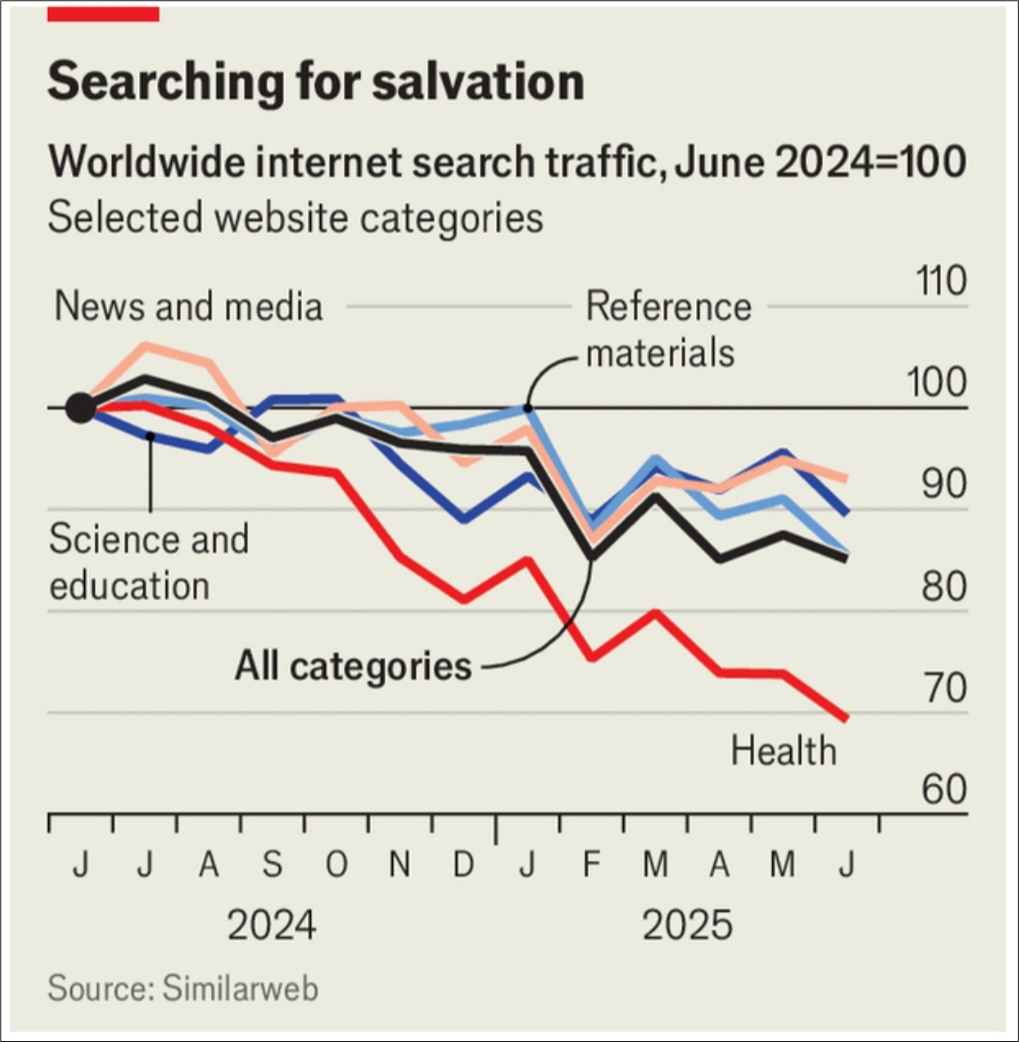

Now, we have rolled back over as you can see here. The chart simply adds the beat or miss each month so you can see how economist errors accumulate over time.

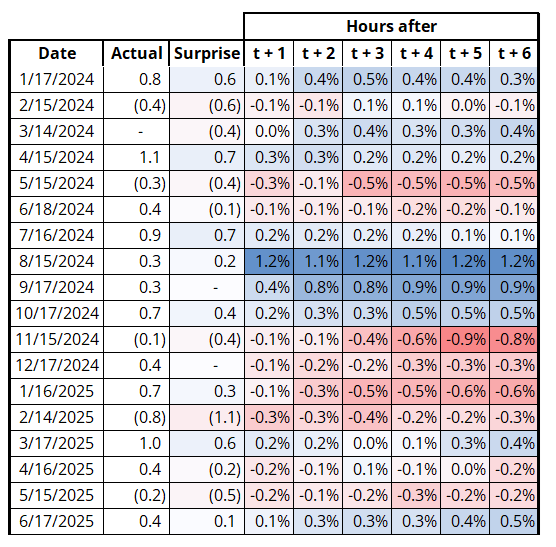

The natural instrument to trade for Retail Sales would be either USDJPY or bonds, but both are currently buffeted by nerves ahead of the Japanese elections this weekend, so I am not sure you will get a clean trade there. Here is how USDJPY did in the six hours following the Retail Sales releases since January 2024. I am using Control Group here because that’s the one that feeds into GBP, and I think it matters more than headline or ex-autos. I think the market thinks that too, because last month ex-autos was a miss, and Control Group beat, and USDJPY went up.

USDJPY reactions to US Retail Sales (Control Group)

The three-hour change is mostly in the 20-40bps zone, which normally would be hard to capture but could be impossible today given models buy USD in NY time zone every day and nobody is going to want to run short USDJPY for very long with Japan CPI tonight and Japanese elections on the weekend.

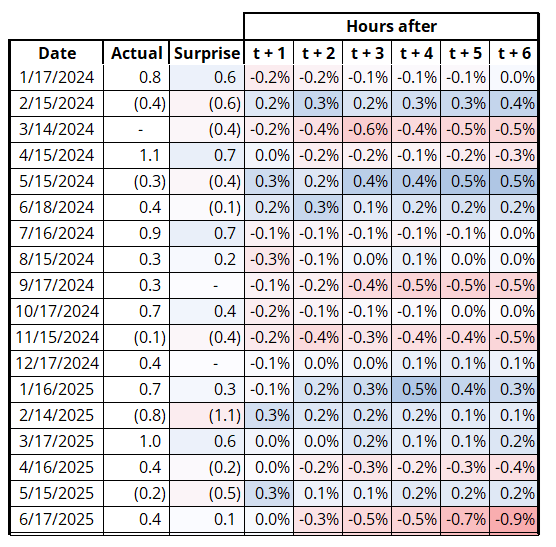

Since I have the short GBPUSD via options, I looked at the GBPUSD reactions to Retail Sales, too.

GBPUSD reactions to US Retail Sales (Control Group)

It is barely worth hedging the GBPUSD put, but given I am running out of time here (it expires tomorrow), I’ll hedge 1/3 here at 1.3400 into Retail Sales and look to sell them on a pop, if there is one. If the number is strong, I will be looking to cover the rest at 1.3335/40. I try my best to always have the trade details in the sidebar.

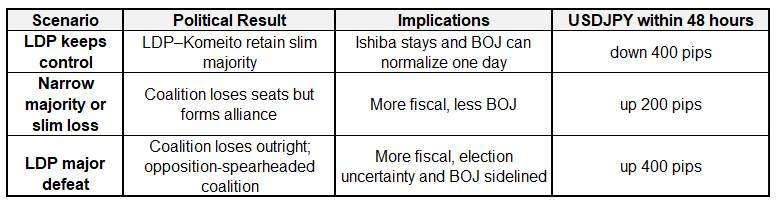

The USDJPY story is super mixed because:

Note the election will probably impact the long end of the US bond market too, at the margin. If the LDP get smoked, expect global 10-to-30-year bonds to open weak Sunday night. Here is my attempt to construct a simple election outcomes grid.

Have a cheesy day.

The Russian equivalent expression for…

“There’s no such thing as a free lunch” is:

“The only free cheese is in the mousetrap.”