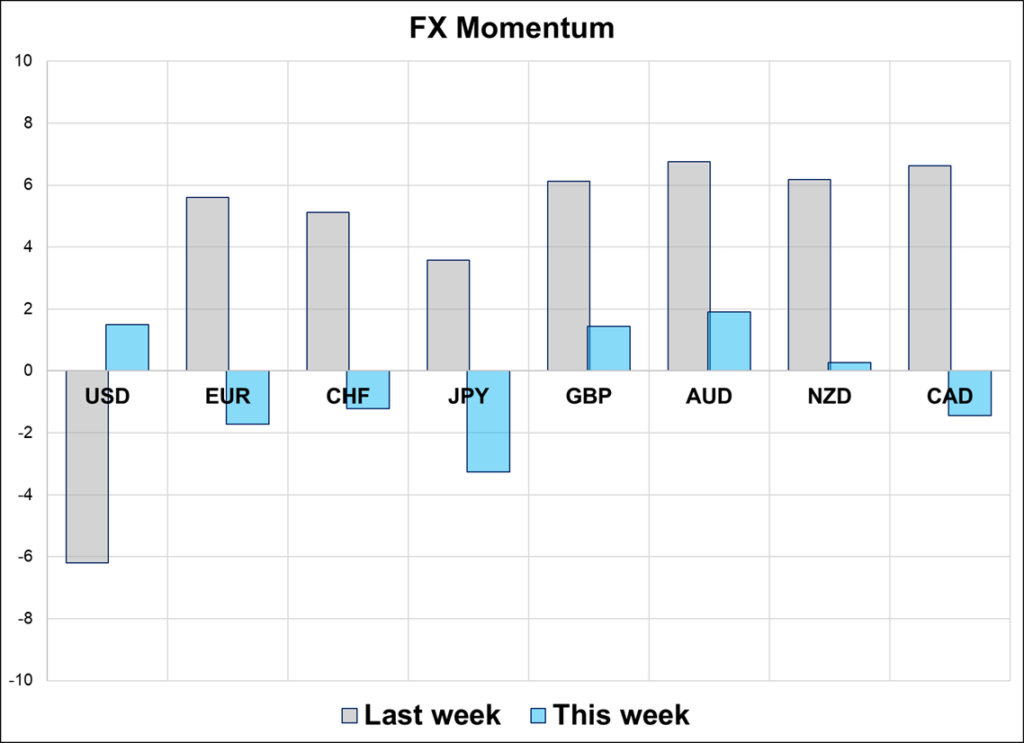

Best to believe there is no theme right now and wait for one to appear.

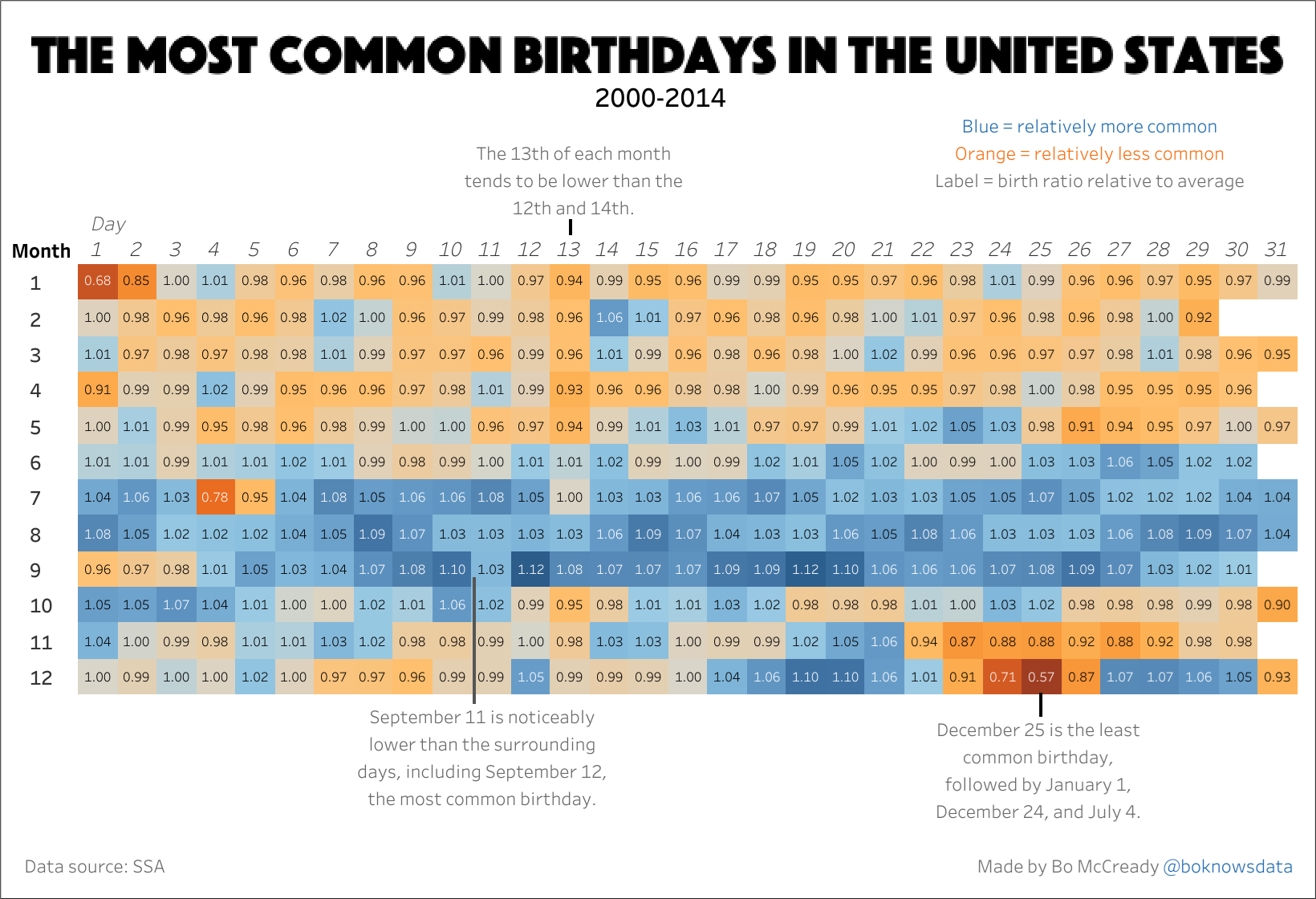

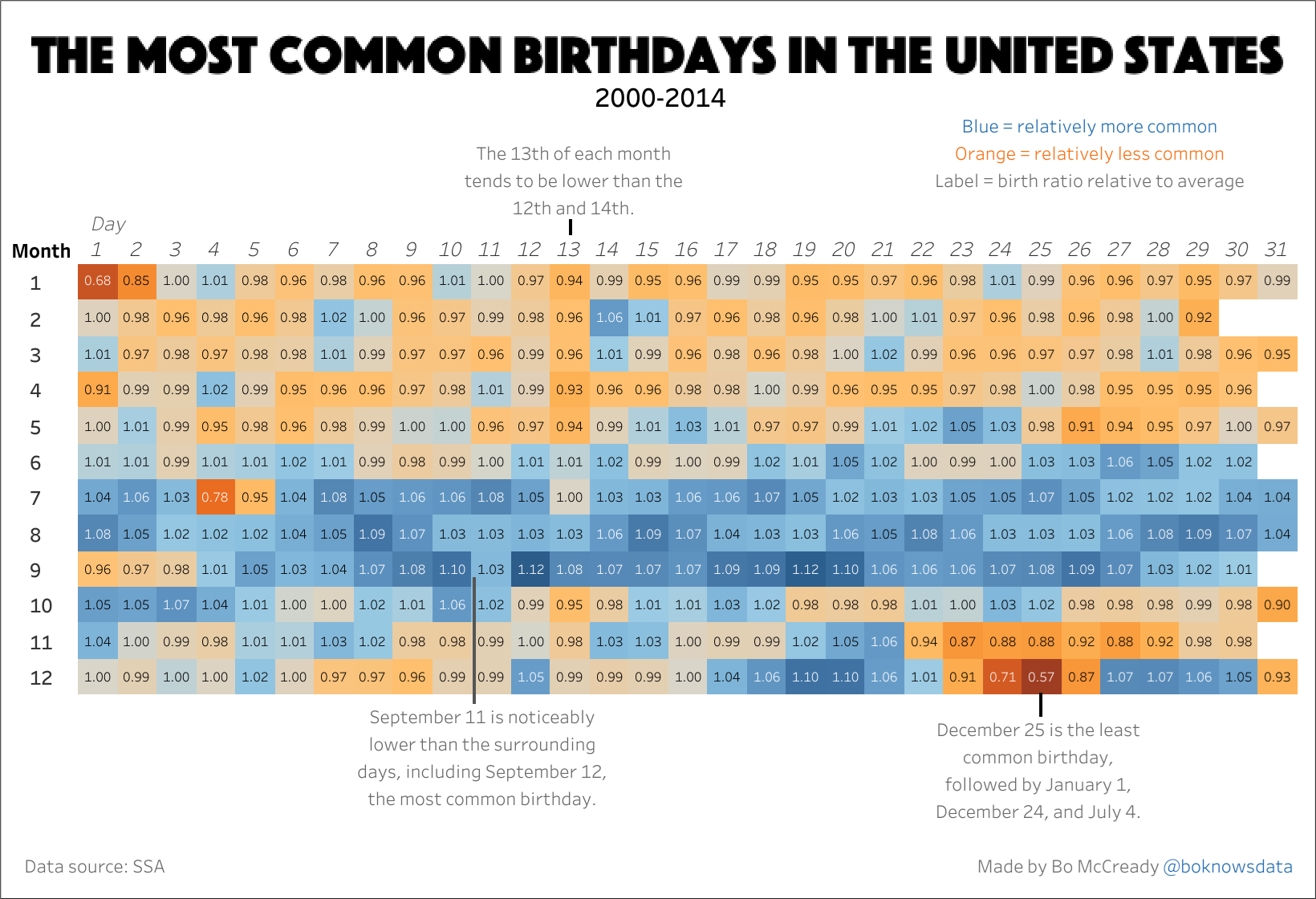

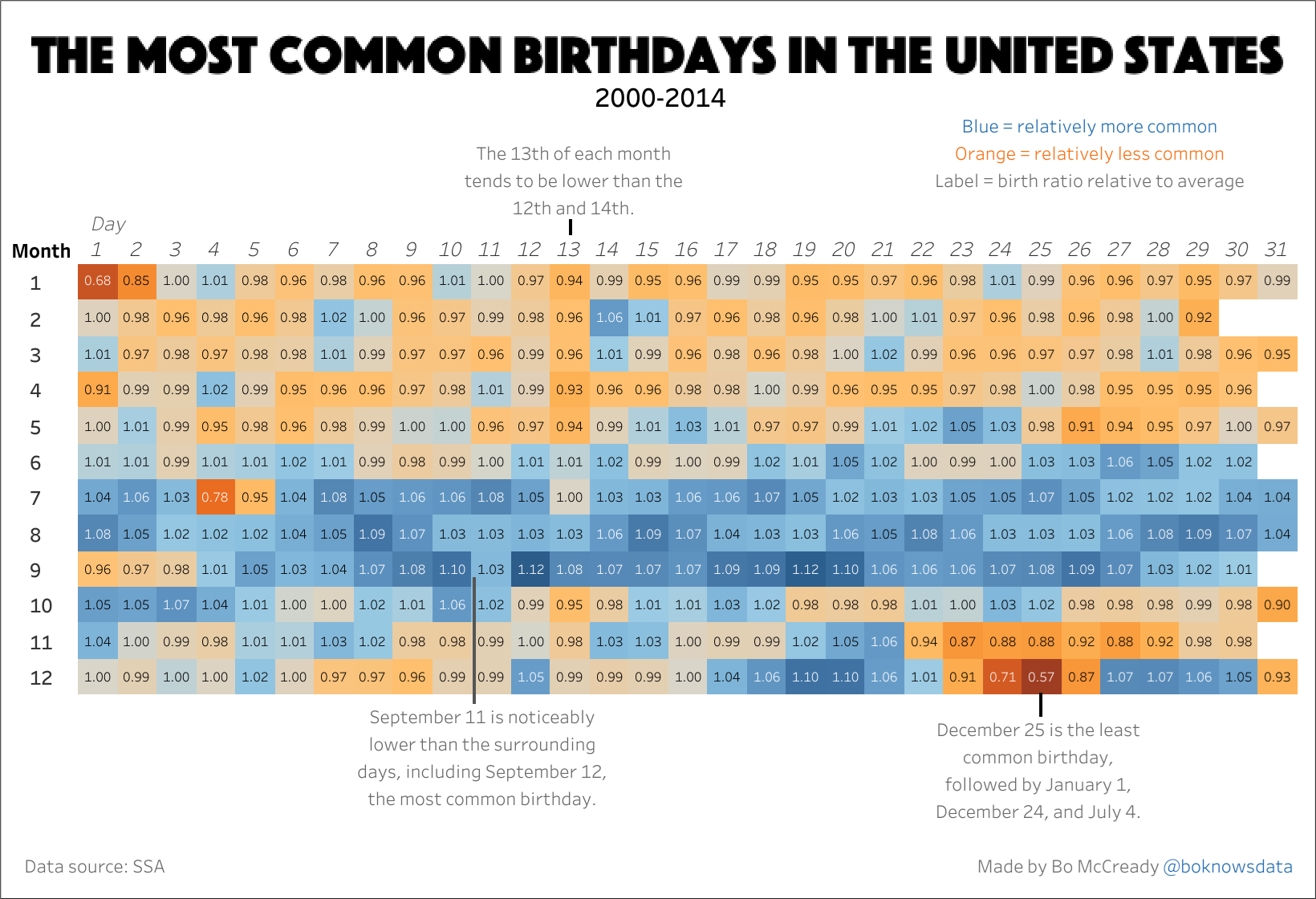

Christmas is the least common birthday in the United States

Larger graphic at bottom of page

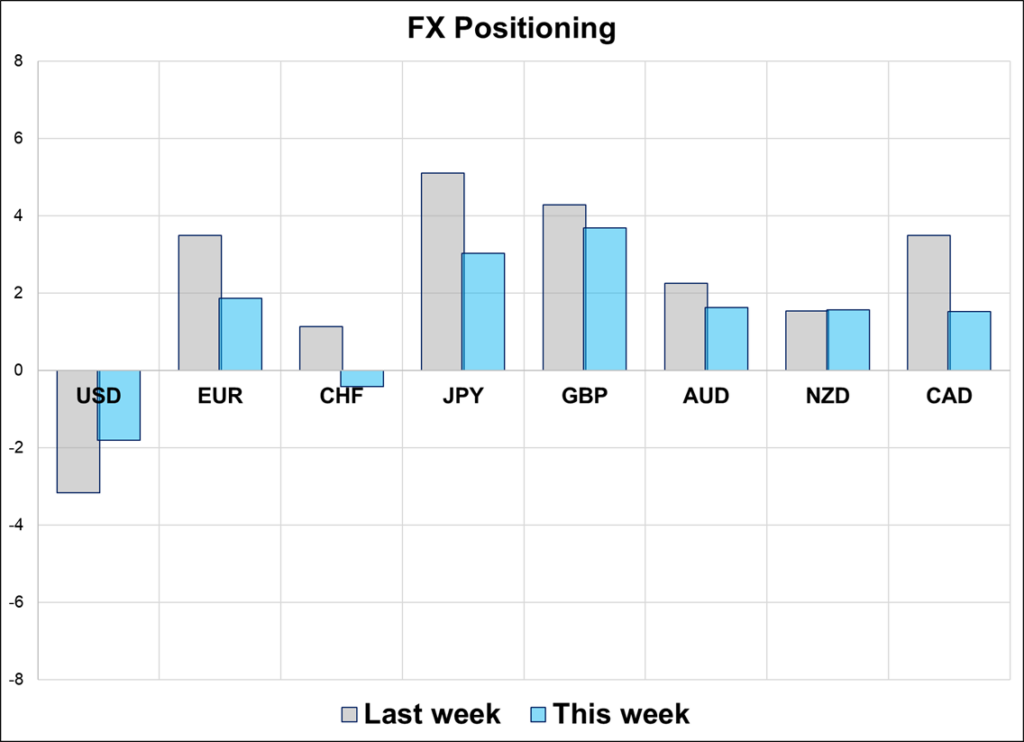

Best to believe there is no theme right now and wait for one to appear.

Christmas is the least common birthday in the United States

Larger graphic at bottom of page

Flat

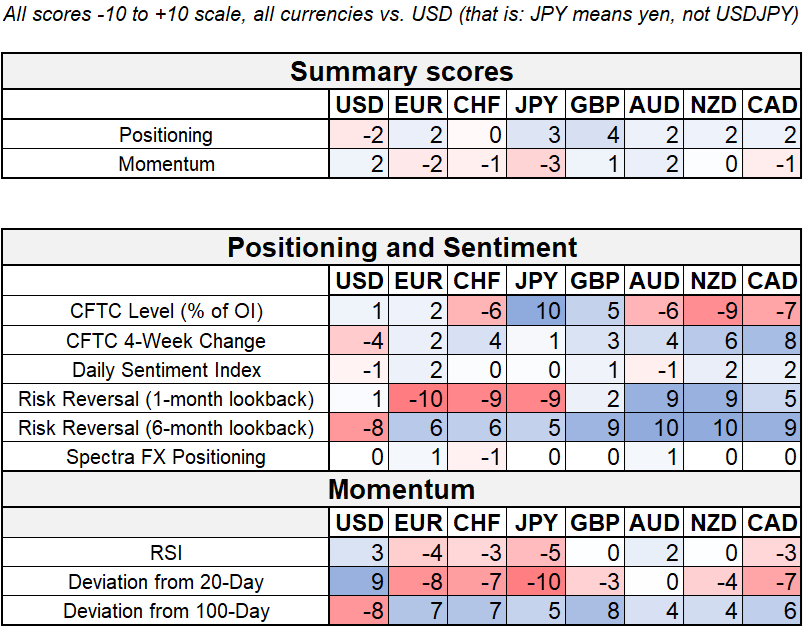

Chalk this one up as a huge victory for retail as the buy the dippers ignored apocalyptic macro vibes and piled into crypto and TSLA and COIN and friends near the lows as institutional investors liquidated. I have abandoned all views for now as the short USD trade is dead for now and anything can happen once again. The anecdotal and sentiment stuff (and crypto) won, and macro lost, as policy is too volatile to trade beyond a 48-hour time horizon.

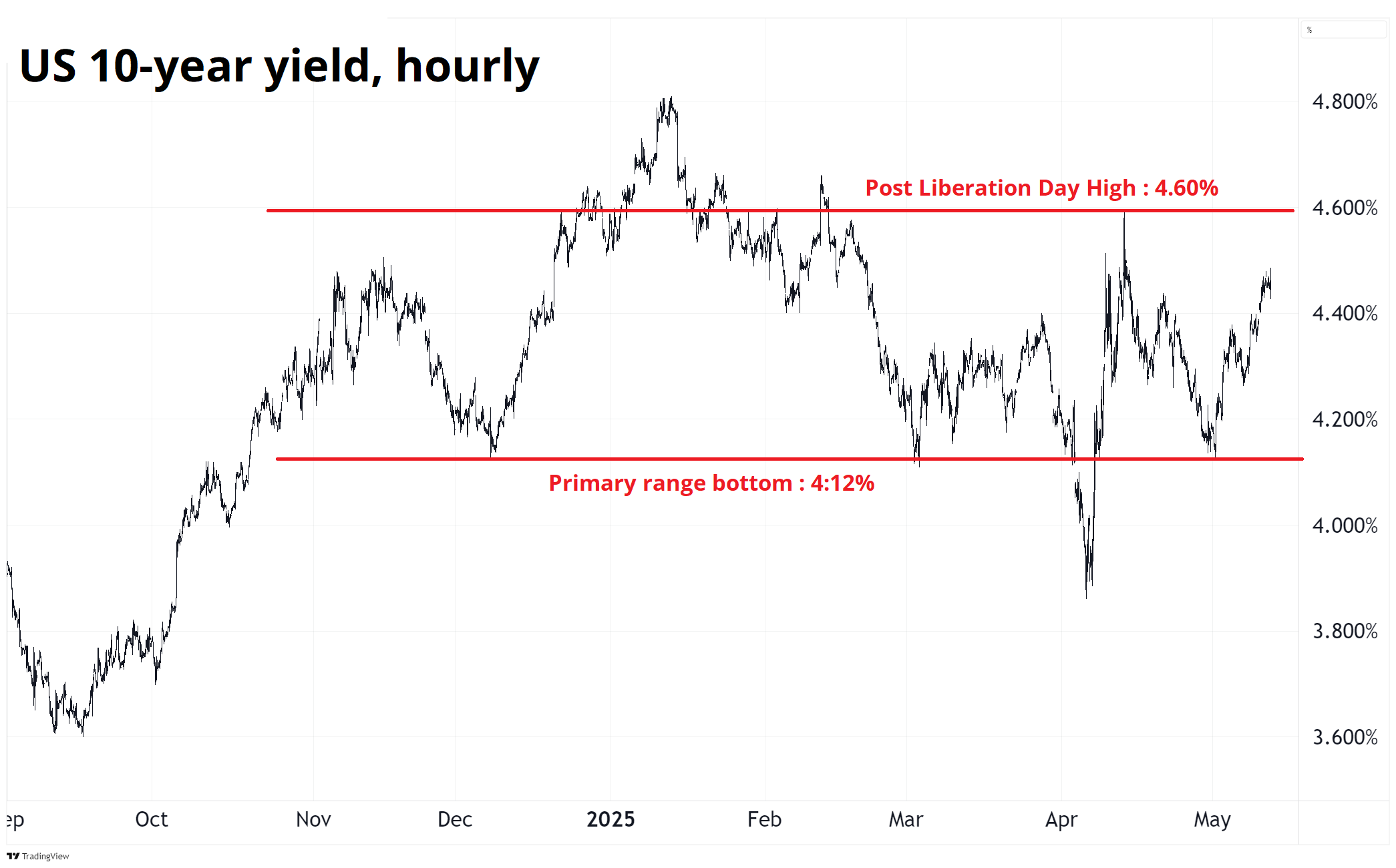

I suppose it’s tempting to fade stocks now that all the good news is out, but I don’t want to get caught in an overly bearish mindset with inflation coming in on the low side today, economic sentiment likely to rebound in response to the circular and reflexive nature of buoyant stock markets, and deficits about to explode in the US. The main limiter from here would be bond yields, but a 4.44% 10-year is not too scary for now.

Speculators are now left in a weird spot where if you believed Trump’s victory was bullish, you lost money, and if you believed Liberation Day was bearish, you lost money. The highly-politicized market environment takes no prisoners. Most Trump-leaning speculators stayed long USD too long, and now most left-leaning speculators stayed short USD and stocks for too long and nobody’s happy.

I will be watching yields to see if we can stay inside the 4.12/4.60 equilibrium zone that has dominated since the November 2024 election.

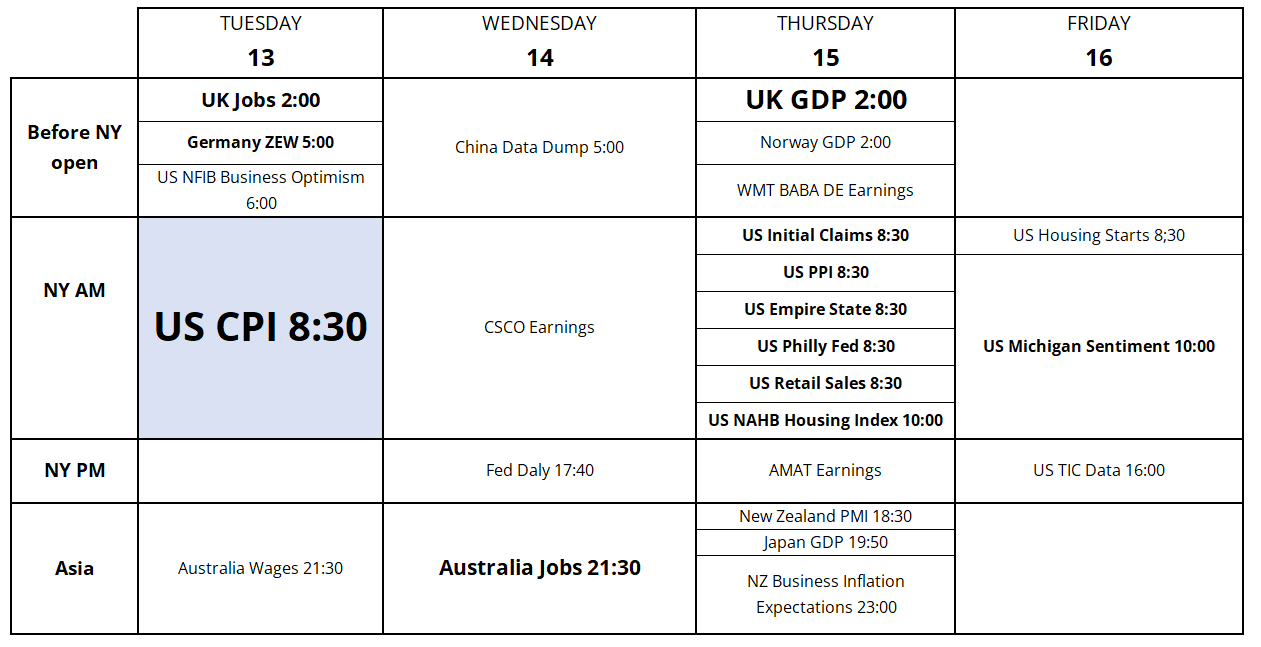

On the macroeconomic side, the fogged-up windshield now gets even foggier. I have been saying that the May and June data, released in June and July, would be the key to assessing the stagflationary risks in the economy going forward, but now we have another policy change taking effect and so clarity is going to take even longer. It’s hard to believe any particular economic number matters all that much now, and while the hard data will probably cool down, the soft (sentiment) data is probably going to reverse higher somewhat because it mostly just follows the stock market.

Sagging tourism, still high tariffs, possible ripple effects from hiring and investment freezes in April, student loan repayments, and still-sticky inflation make for many question marks, but relative to how things looked a month ago, I guess things look pretty rosy?

There has been very little correlation between yields and the dollar of late, but with yields perky, FX volatility falling, VIX under 20, and US policy reverting away from mercantilism (despite still-high tariffs), it’s hard to argue for the structural US deficits theme or the short dollar trade right now. It’s expensive to be short USD, and the newsflow isn’t supporting the trade. I am therefore going to remain open-minded and nimble and see what happens. Maybe this whole thing was just a crazy one-month-long dream and we are going back to the soft landing Biden handed off to Trump? With lower taxes? Color me confused.

Have a celebratory day.

This week’s calendar

Reset

Hi. Welcome to this week’s report. The market has pared its positioning significantly as the China/US truce was the final nail in the coffin for the SELL AMERICA trade. Now, all that’s left are stale CFTC positions and a graveyard of 1.15/1.17 strikes in EURUSD expiring in June and July. It is now time for the market to find a new theme.

https://www.reddit.com/r/dataisbeautiful/comments/i7x16l/its_my_birthday_what_are_the_most_common/

Induced labor and c-sections allow for some targeting / avoiding of particular dates like Independence Day, Christmas, and New Year