Comments relevant to backtesters and confusion over an early UK meme

RSI convexity and more

Current Views

Flat

Thoughts on RSI

A client asked me yesterday about EURSEK and the currently low RSI reading. I took a look and found that when the RSI goes below 30, it tends to precede more losses for EURSEK, not a rebound. There are 15 instances (eliminating all overlapping signals) since 2010. Here is how EURSEK trades after the signals. The current signal triggered on September 1 with the close at 11.00.

This is consistent with what I have seen in other products: RSI is often more of a trend indicator than a reversal indicator. Interestingly, if you look at the times when RSI went above 70, it DID work as a reversal indicator. The reason this makes sense is that EURSEK is convex. It grinds lower and spikes higher and so a low RSI means it’s in grinding, trending mode, while a high RSI means it’s ripping into a blowoff. Just some food for thought when you’re looking at RSIs.

Low and high RSIs mean more in a product that tends to blowoff in that particular direction. Another example of this is that USDJPY RSI below 25 is super bullish, while USDJPY RSI above 75 is modestly bullish. If you are watching RSI, the convexity of the product you trade matters. A lot. USDJPY grinds up slow and sells off then recovers fast.

There is a broader lesson here for when you are backtesting. If you just look at everything in linear terms, you will miss some important aspects. Another example is that AUDJPY will be super correlated to stocks if you look only at days where SPX moves more than 1.5 SD, but you will barely see a relationship if you backtest using all the data. Again, the convexity matters for correlations, too. Keep this in mind when you’re backtesting.

NFP cynicism

I was foolishly peddling a quasi-conspiracy theory that the BLS might skew the data to the strong side Friday, but the new head of the BLS has not yet been confirmed so my theory is dumb. Sorry for the waste of pixels.

New from Ben Hunt

Ben Hunt has been pretty much spot on when it comes to the evolution of the political economy and inflation over the past seven years or so. He also correctly called the institutionalization of bitcoin years before it happened. I like that he is more anti-politics than political and has plenty of distaste for Biden, Trump, and the organizational overreach in government and education. Anyway, his latest piece is great:

https://www.epsilontheory.com/so-what-now-what-2/

There are many favorite parts for me to choose from. Here’s a nice excerpt to whet your appetite.

I am delighted to stipulate to my red-oriented readers that the Democrats ‘started it’ when it comes to lawfare, with the preposterous and obviously politically motivated New York state prosecution of Donald Trump. Ditto the politically motivated 0.5% interest rate cut before the election last year. Ditto the personal and corrupt use of Presidential pardons by Joe Biden. Ditto the politicization of the CDC and the political pressure to fast-track mRNA vaccines and the promotion of Fauci’s ‘noble lies’ and the lockdowns to ‘flatten the curve’ by … oh wait, that was Trump … but sure, I am more than happy to stipulate that Biden did exactly the same thing.

And I’m not asking anyone to give up their righteous anger at whoever and whatever they are righteously angry about, least of all myself. Personally speaking, I will never not be angry at an American President who sends badge-less, warrant-less, armed and masked agents to grab people off the street and detain them indefinitely for the probable cause of having brown skin. Or an American government that has established its very own Gulag Archipelago – not in Siberia but in El Salvador and Uganda and the Everglades and the Chihuahuan Desert – where cruelty is the obvious point and punishment exists for punishment’s sake. To a lesser but still very real extent, I will never not be angry at the venally corrupt, vacant, egomaniacal, figurehead former President and the courtiers inside and outside the White House who propped him up for years, projecting nothing but weakness and achieving nothing but the accelerated collapse of Pax Americana.

But I am asking all of us – myself included – to set aside the anger long enough to look clearly at what IS, not what either our anger would have us project or what our innate desire for a return to normalcy would have us imagine.

UK

Normally you see memes and END OF THE WORLD! headlines and CRISIS IN –INSERT COUNTRY– covers on The Economist after markets crater. Those can be good reverse indicators. This collage from April 2024 is a good example:

- Crisis language and doom and gloomers getting busy ✔️

- Wild, extrapolation-style price targets ✔️

- Memes ✔️

- The Economist enters the fray ✔️

That flurry of behavioral signpost madness took place at 160.00 in USDJPY and was the beginning of the end of the JPY selloff. We traded below 140.00 by September.

I bring this up because today I saw the meme below. But GBP hasn’t even sold off yet! Nothing is even happening. So, I am not sure how to interpret the behavioral finance implications here, but my first instinct is to think that the UK will be fine.

I suppose the path to November 26 will be bumpy, but this feels way too well-telegraphed to be a real market event. The temptation to sell GBP or pay UK rates will be strong but I am going to do my best to resist.

Or maybe memes before the crash are predictive? Stay tuned to find out!

Final Thoughts

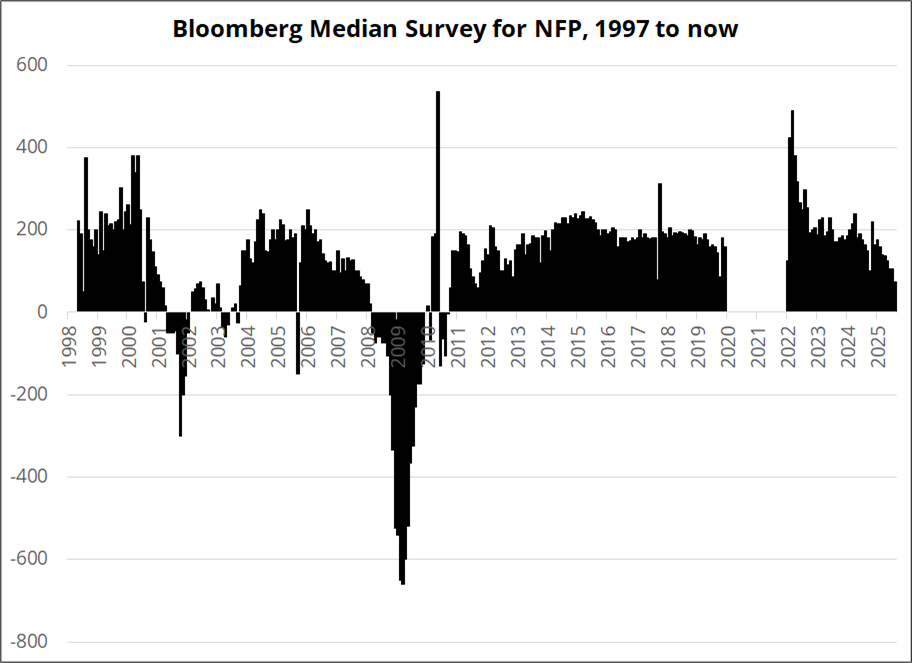

1. This is the lowest median economist expectation for NFP since 2011! Thanks to Mehul for this observation.

2. Short read for baseball fans only via STB.

3. I’m out of the bullish gold trade for now. The highly-leveraged part of the move looks to be over s/t. I still think the market reaction asymmetry is to strong NFP and I will ride my TLT puts to the end.

4. Cool paper on using AI agents to predict human behavior in unfamiliar/untested situations.

5. FYI. The inimitable Bruce Mehlman hosts a chat with Dan Wang about China as a country run by engineers vs. USA as a country run by lawyers. I am not affiliated with Bruce, I just thought this sounds good. You should definitely sign up for his Substack if you care about political economics.

“America is run by lawyers, China by engineers. What does that mean for their rivalry & futures? We’ll discuss!”

You can sign up right here (for free) to listen to Bruce with Dan Wang.

Have a day rife with pattern recognition.

A man whistling. Via Twitter: Things that look like other things

Pareidolia is apophenia for faces