It’s fun to reflexively buy every dip but I don’t think that’s going to work here

Ok.

It’s fun to reflexively buy every dip but I don’t think that’s going to work here

Ok.

Short AUDNZD @ 1.1494

Stop loss 1.1611 Take profit 1.1311

Sell EURUSD at 1.1569

Limit order. Stop loss 1.1711.

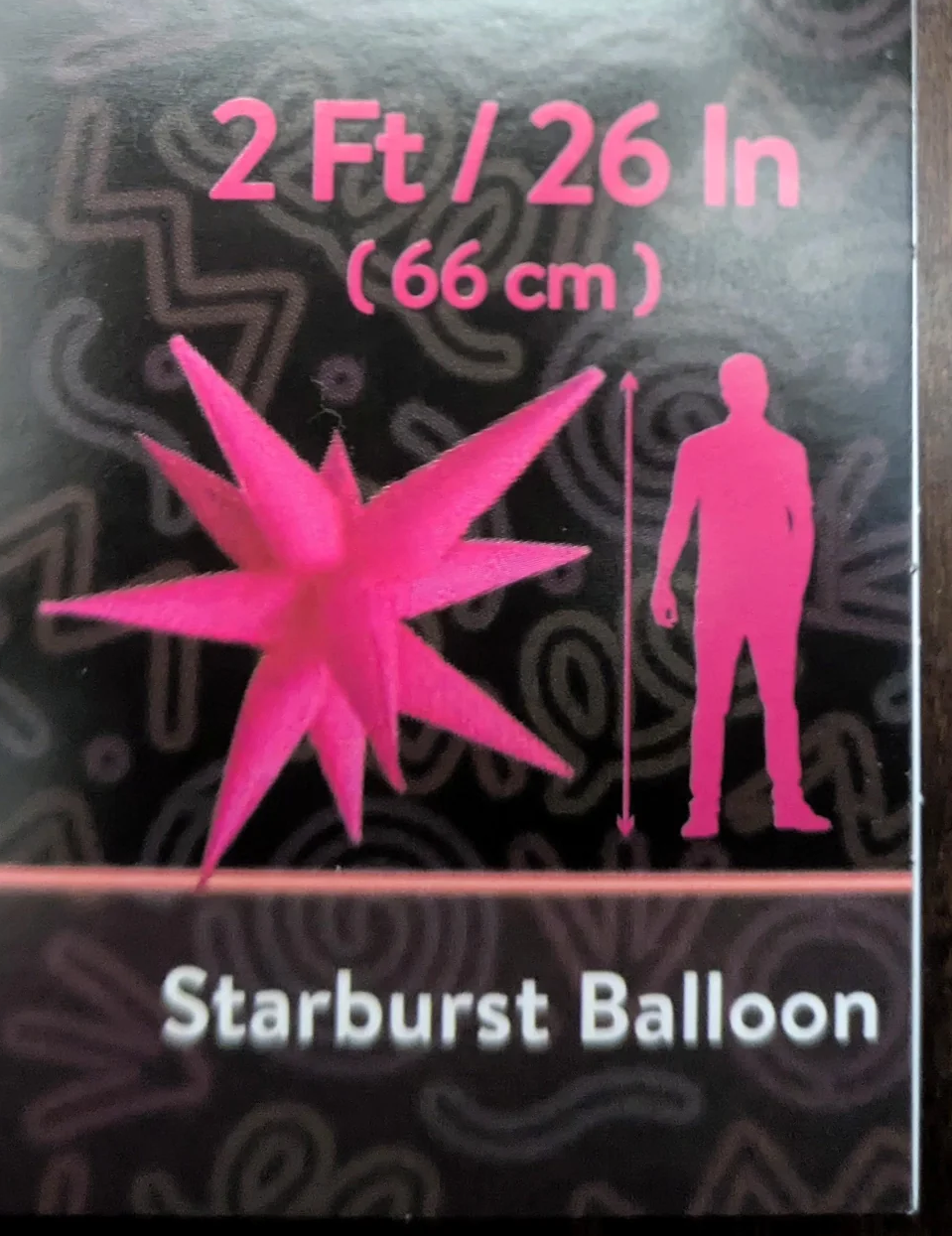

I have reduced a chunk of my bearish equity risk as we’ve got a bit of a blowoff on our hands with 25,255 touched overnight in NQ (my first target was 25,200) and target reached on CRWV (115) and nearly reached on ORCL and NVDA (242 and 191). There is also some possible bullish headline risk lurking from SCOTUS vibes today and/or the end of a government shutdown.

Note in that Polymarket chart that money is coming out of the “November 16+” bucket and going into the “November 8-11” and “November 12-15” buckets. While it’s tough to say what is driving the tightness in funding markets, there is presumably some negative impact on liquidity as the shutdown drags on. Money that should be going to federal workers, contractors, and benefit recipients is instead sitting in the Treasury’s account at the Fed and draining out of bank reserves.

The Supreme Court thing is hard to handicap and my view is that it’s unlikely to have a lasting impact on markets , if any, because:

While the SCOTUS stuff is fun to watch and interesting from the perspective of political history, I don’t think it’s tradable.

My take on this tech correction overall is that it’s a combination of endogenous and exogenous factors.

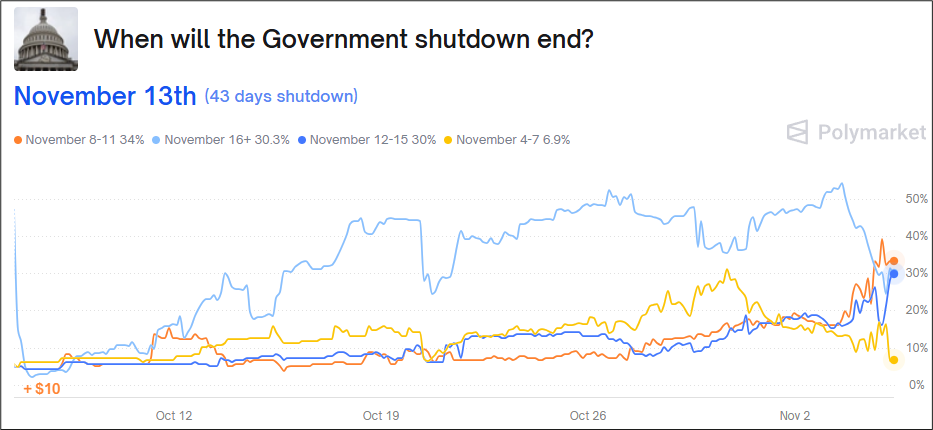

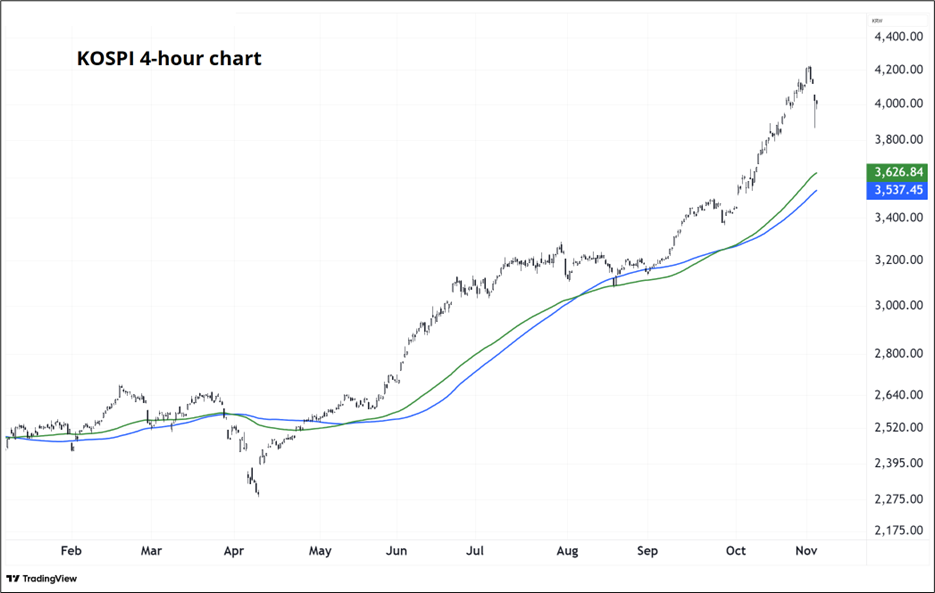

You can see in the bottom panel of that chart that we got 27% above the 100-day MA. That is wild, and exceeds the 26% reading in early 2021. Note that these two are not super comparable because the rally in 2021 was off a massive oversold condition while this most recent KOSPI leg comes off almost overbought conditions in July 2025. It is common for something to go from massively oversold to massively overbought, especially after a crisis, but it’s rare for something to go from overbought to substantially more overbought like this.

Now that the momentum has broken, I expect a long consolidation and correction phase and no new highs for a long time. To get a sense of where we might pull back to, we can zoom in to the 4-hour bar chart.

3540/3630 is the near-term target.

Overall, I think the momentum breaks in everything from silver to crypto to KOSPI, the negative reactions to earnings releases, and the growing skepticism around OpenAI’s ability to find 1.15 trillion dollars lying around between now and 2030 add up to a new mode here where the market will sell rallies more than it will buy dips. The market is used to reflexively buying every one-day dip, but I think this correction has legs. Current levels offer less good risk/reward for shorts in ORCL, CRWV, and NQ, but I do think PLTR can easily do another leg lower, for example, to $172. Targeted shorts and selling rallies remains my framework in tech.

The dollar is benefiting from the selloff in the NASDAQ, which is perhaps a bit counterintuitive. The overall patterns and narrative over the past year has been that US Exceptionalism drives equities and the USD and you can see that’s mostly how it’s played out.

This chart tells a fairly coherent story: The USD and US equities rallied after the election, then sold off after Liberation Day. Then, US equities recovered, but higher hedge ratios meant that the USD didn’t benefit as much from the rebound in equities as one might have expected.

In that context, yesterday’s USD rally, especially vs. JPY and CHF, doesn’t make a ton of sense. What it reveals is that there were still USD shorts out there, especially in AUD, and the last of them is finally capitulating. The big bank strategists are losing their religion on the USD short trade, too, in another sign of capitulation.

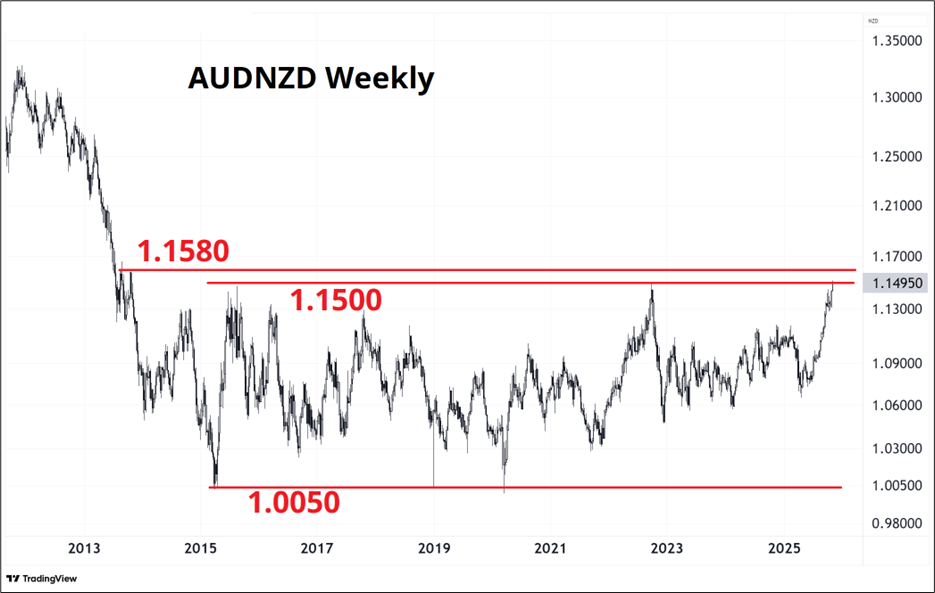

The setup in AUDNZD is interesting. First of all, we are right at the top of the 12-year range. It briefly poked its head above last night and is right at 1.1500 as I type this.

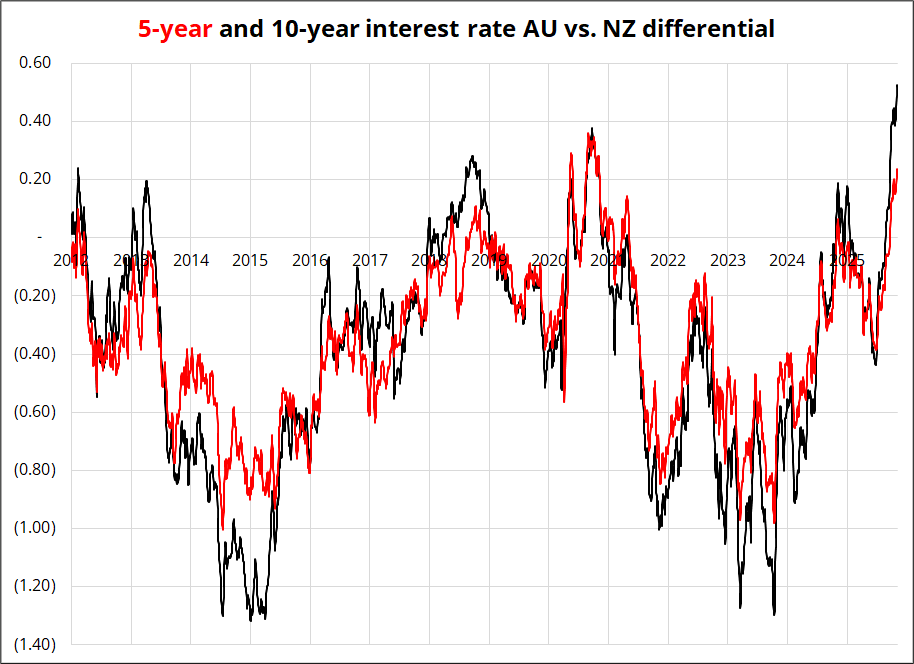

Interest rate differentials follow a similar path and are at the extreme as well.

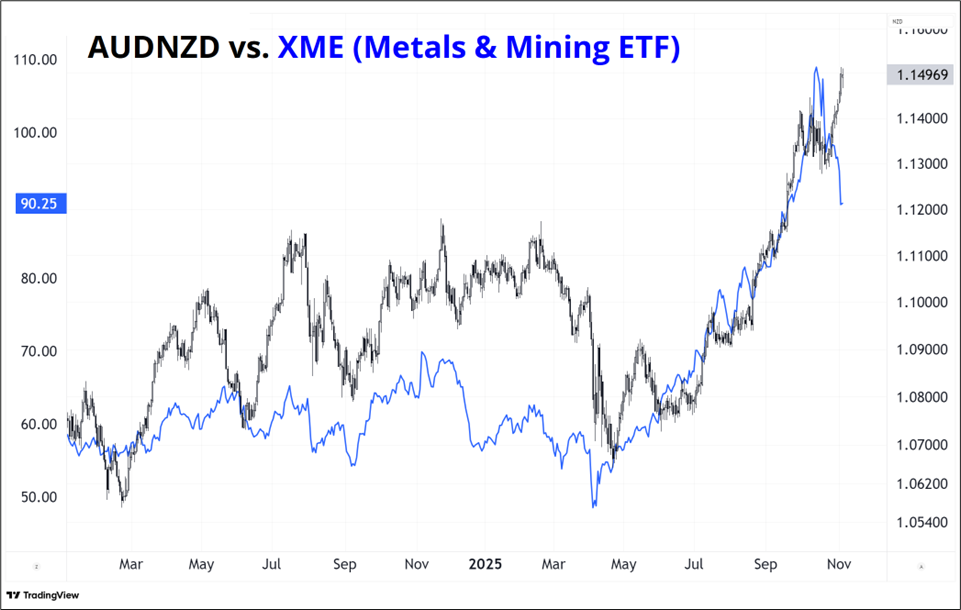

Meanwhile, the boom in mining has cooled as you can see.

AUDNZD has been an incredibly high-Sharpe trade all the way up, predicated mostly on monetary policy divergence. With every high-Sharpe momentum trade in the world breaking down one by one and metals experiencing a huge reversal, and the chart suggesting a range mentality at 1.1500… I like short AUDNZD with a stop at 1.1611, targeting 1.1311. A stop at 1.1611 puts you above the top of the 12-year range. Thanks CC for the AUDNZD inputs!

ISM LOL.

Have a day where 24 = 26.

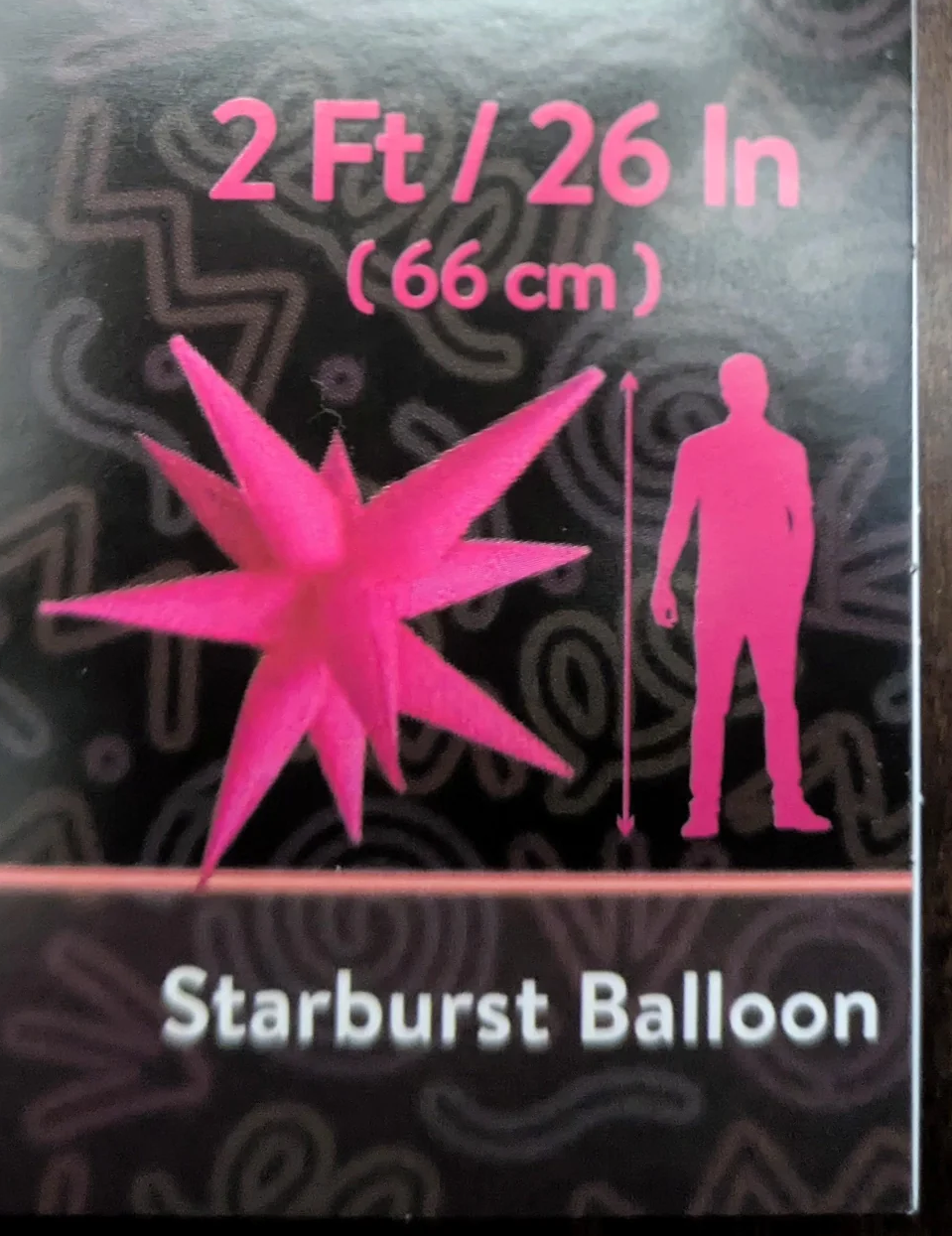

The man is standing 20 feet behind the balloon, maybe?