Sloshing

The USD continues to slosh around on the back of various headlines, including direct comments from Bessent and Trump that seem to signal a minimum bar of a scaled 2.5% tariff increasing monthly up to as high as 20%. Trump, meanwhile, promised tariffs on steel, computer chips, semiconductors, and pharmaceuticals, on top of universal tariffs which he wants to be “much bigger” than 2.5%.

It’s easy to become lazy and jaded by all these articles, but it’s possible that Trump (who promised Day One tariffs, then failed to deliver) was simply waiting for Bessent to be confirmed. Bessent was confirmed yesterday.

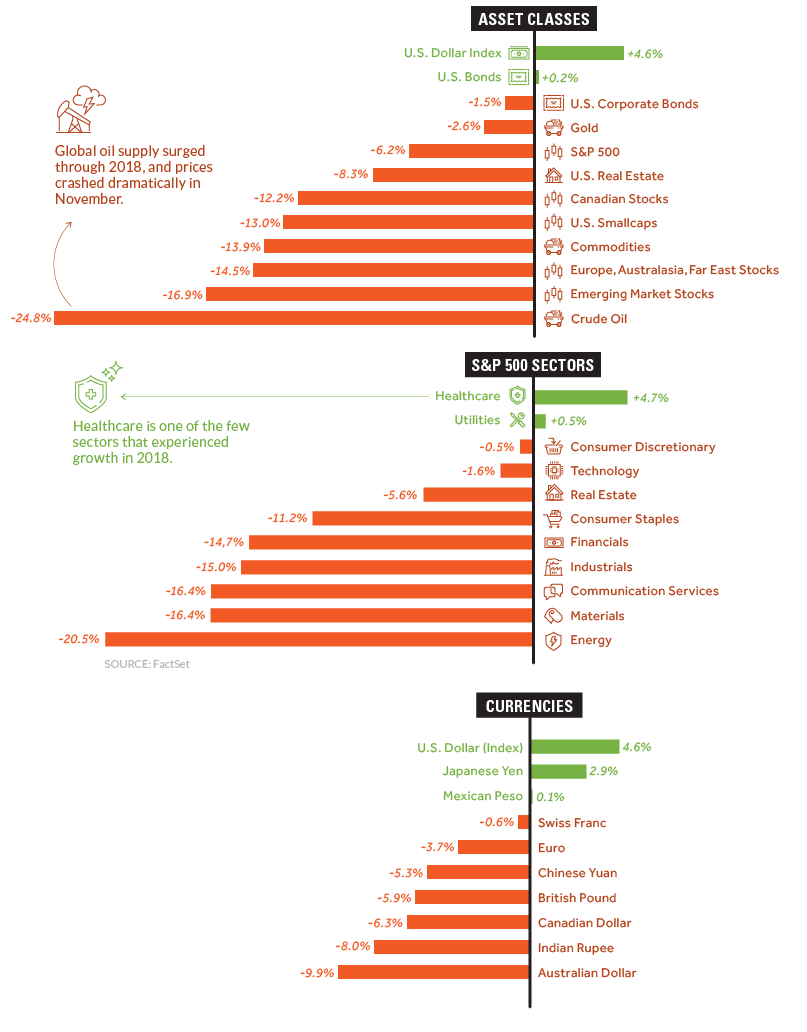

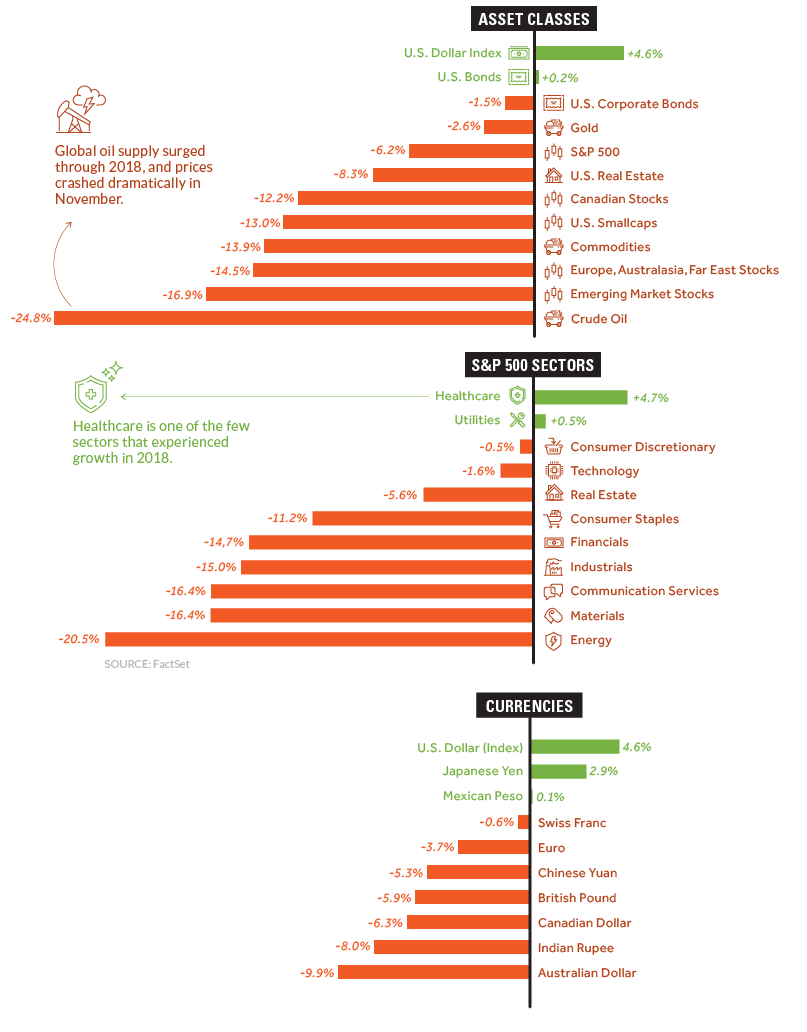

While we have been beaten into submission by nearly two full months of headlines, this is not the time to fall asleep as trade wars are no joke and are not priced in. 2018 was a turbulent and somewhat awful year for risky assets as a tight Fed, high valuations, sticky inflation, and a series of trade war actions crushed stocks in February 2018. The market then traded sideways, grinding to a marginal new high before a renewed 20% collapse into Christmas Eve.

It’s fun to read summaries of the February 2018 dump as there are many echoes to the current situation. See this article, for example, which offers these reasons:

- Tariffs driving uncertainty

- The Federal Reserve sent dovish signals, but the market ignored them

- Big tech under scrutiny due to high valuations. Case Shiller P/E was 33.3 in January 2018 and is currently 35.4 and the long-term average is 16.6

Here’s an excerpt from “February was an insane month for the market” from CNN.

In early February, the runaway train stock market ran smack into spiking bond rates that were pricing in the threat of inflation. Investors suddenly became worried the economy, boosted by huge tax cuts, could overheated and force the Federal Reserve to raise interest rates.

It certainly didn’t help that the post-election surge had left stocks relatively expensive — and vulnerable to a sharp pullback.

“February will be remembered as the month where fear of unbridled inflation met with valuations well beyond historical norms,” said Peter Kenny, senior market strategist at the Global Markets Advisory Group.

Something to think about as the market feels soooooooooo complacent on tariffs. I get it. I’m bored of what feels like a Groundhog Day situation. Headlines could heat up as early as this weekend if we are to take the February 1 date seriously. I know I joked about the “In two weeks” thing, but tariffs could happen! Are you ready?

Out of interest, here’s what stuff did in 2018:

Oh, and bitcoin was down 73.5% in 2018.

Speaking of crypto, it’s interesting and eye-opening how World Liberty Financial is buying so much ETH. This is Nancy Pelosi levels of signal, one would think, though I don’t know what it is signaling, really. If you are a crypto person and have an idea of what the meaning of this $388 million stockpile of ETH might be, please let me know.

The Dollar

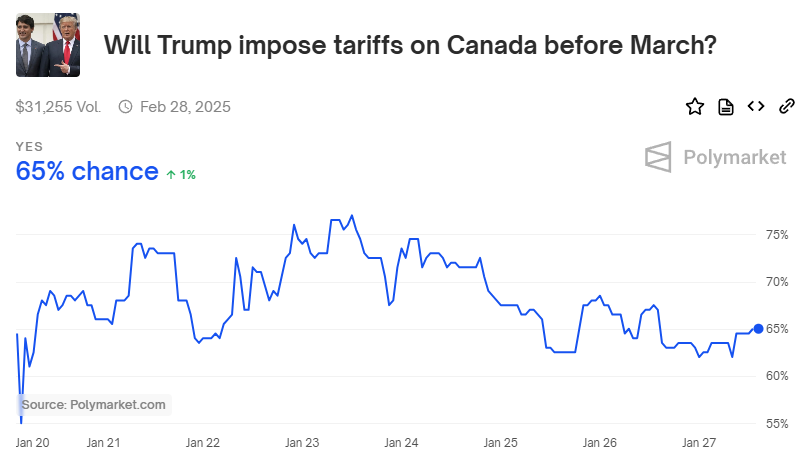

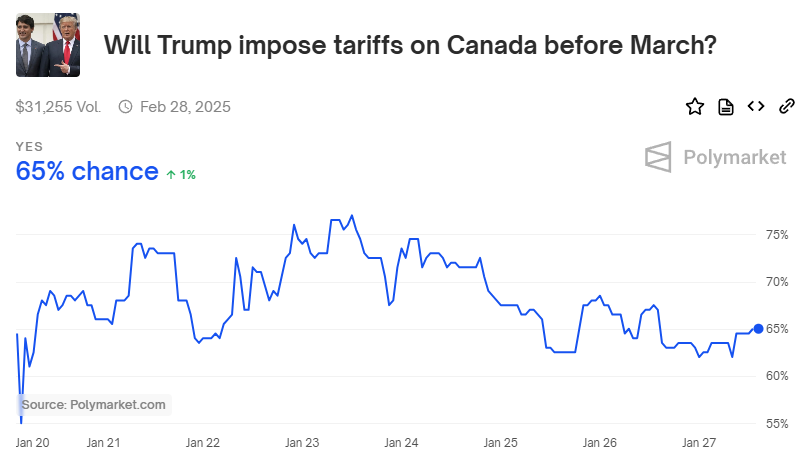

It’s challenging to figure out what is priced into the USD for tariffs because there is some circularity between rate differentials and tariffs. So you can’t just say “the USD is in line with rate diffs, so not much is priced for tariffs.” Canadian yields are presumably impacted by tariff probabilities as a 25% tariff on Canadian exports would be worse than 2008 for The True North. Looking on Polymarket, there is only one useful contract, and it’s thin, trading $1000/side or so.

If we take the Bessent thing and make some assumptions, we can get to 2.5%/month times four months = 10% and then maybe they stop for a bit. That would be 4%-5% in USDCAD, depending on what multiple you apply, which gets you from 1.44 to 1.50/1.52. But if tariffs are, say, 30% priced in (which feels about right to me, vs. the 65% on Polymarket), you get 4%-5% times 0.7 which gets you to 1.48/1.49. Throw in a stock market selloff, some retaliatory tariffs, and a bit of panic and overshoot and something around 1.50 sounds right.

Is the market positioned for that? I don’t think so. The interesting dynamic about a slowly ratcheting tariff is that it will create a weird dynamic where USDCAD reprices higher, but then you know the worst-case scenario and you still have to price the removal of the tariffs on some kind of settlement. It’s fiendishly complicated.

Anyway, if you want to buy USD calls, one week probably covers it for now because if nothing happens in the first couple of days of February, we are back to waiting for Godot.

Chips

After reading reams of stuff on the DeepSeek situation, it seems like the threat to NVDA is real as we move from training to inference, but the threat overall is not existential for companies like AMD. Those companies could actually benefit. And Jevon’s Paradox means the end users of AI like META probably benefit, even if they paid the highs for a zillion H100s.

That said, the DeepSeek news is a friendly reminder that Capex is always cyclical and comparing NVDA to CSCO or Glencore or any other past capex beneficiary will probably be the correct viewpoint one day. Picking the top in the capex cycle is different from just saying “capex is cyclical” of course, but if ever there was a bell rung, this one is a clanger.

This article is good, and not too long. https://stratechery.com/2025/deepseek-faq/

Final Thoughts

Please note: The calendar I published yesterday omitted Thursday’s GDP release.

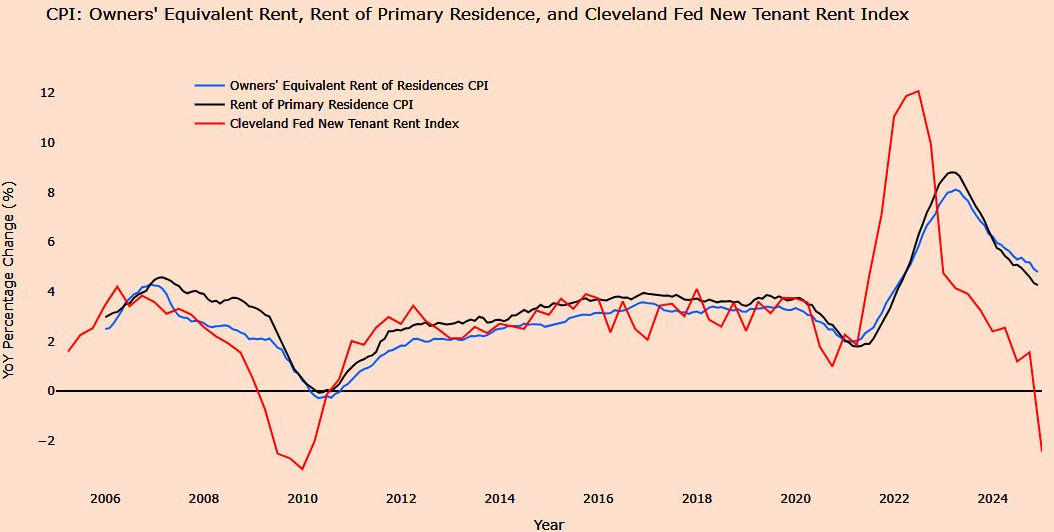

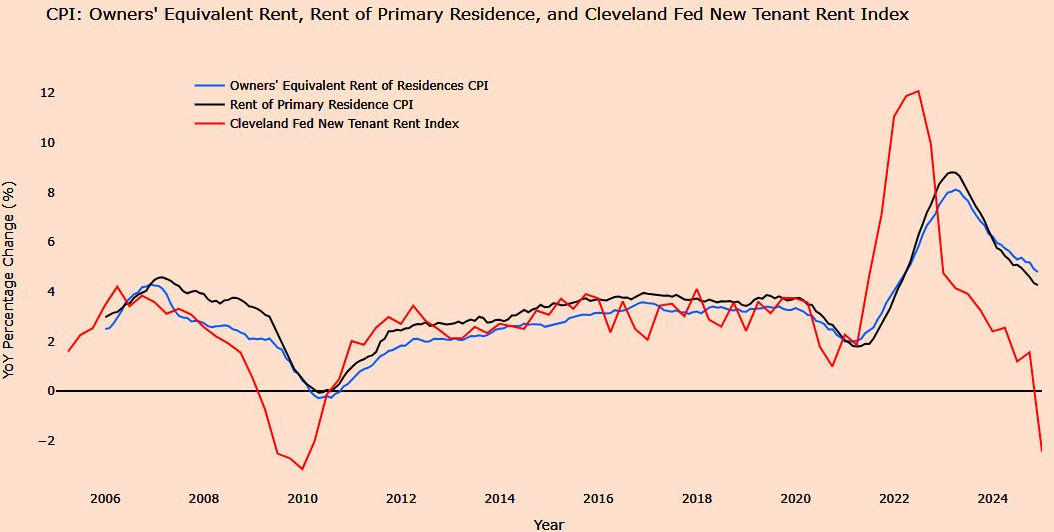

FOMC tomorrow is tough to handicap but I can’t really see it being all that important given the tariff stuff is the dominant narrative and there is way too much uncertainty on that front for us to care much about Fed prognostications. Fed commentary has been strangely whipsawish as many on the Fed have put both feet in the on hold square while Waller and others still champion multiple cuts. I would think they don’t know and we don’t know. If stocks do a repeat of February 2018, I can tell you that Waller will be right! If they don’t, he might not be. There is a major Choose Your Own Adventure aspect to the data right now as market-measured rents tumble while non-shelter services inflation hums along above 4%.

https://x.com/APM_Research/status/1883186185016676482

I hope you enjoy today’s 24-hour round of the Global Humans Simulation Game.