What is the alternative hypothesis?

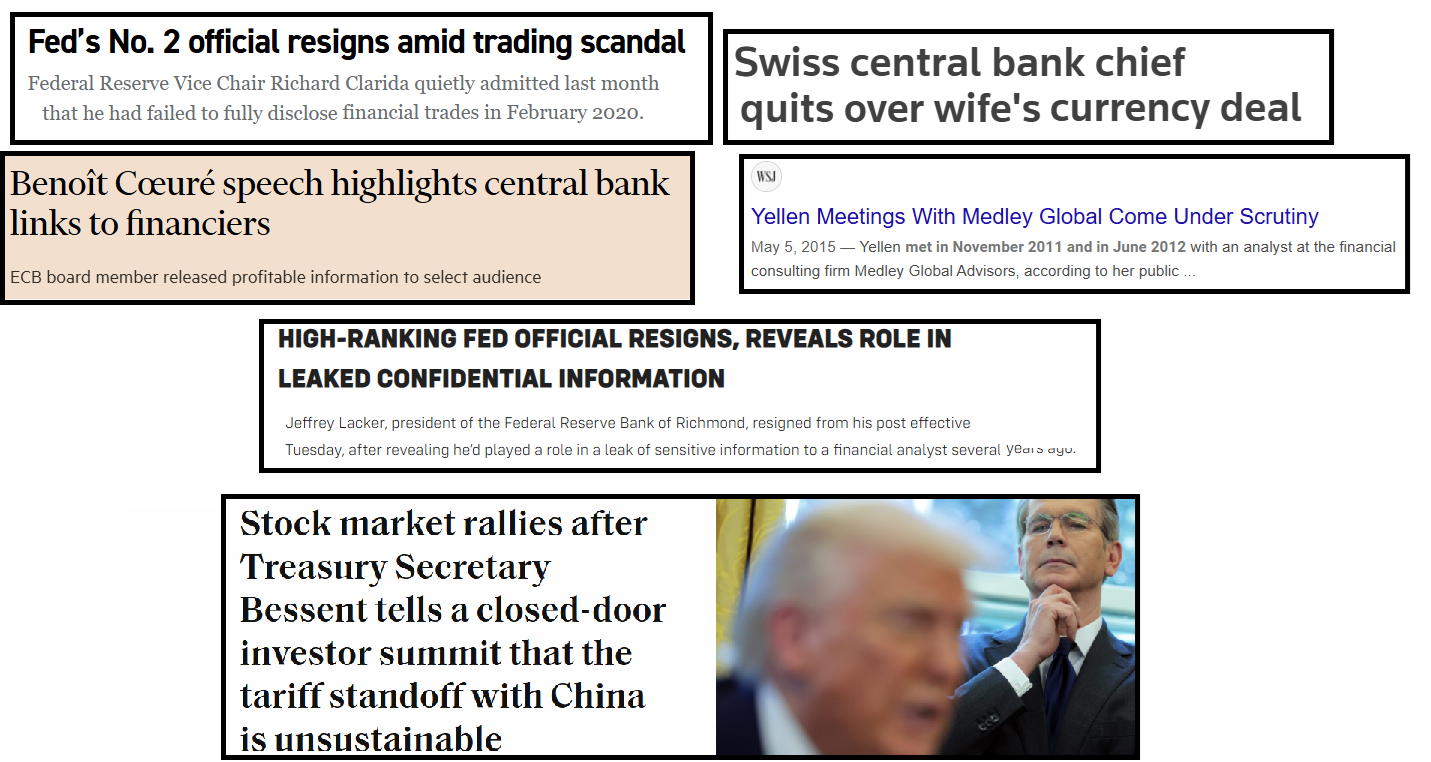

Not really sure what to say about the policy situation here as Trump was studying Powell’s firing a few days and has now decided not to bother, Trump is saying he will reduce tariffs despite zero concessions from China, and Bessent is handing out free material non-public breadcrumbs at closed-door meetings with investors. It’s a mess. Either way, markets are rejoicing in the temperature reduction, and we await either stagflationary recession, a complete unwind of the tariffs, or something in between.

The stagflationary recession story is easy to understand as a trade embargo triggers bankruptcies, a sudden stop in hiring and investment, and inflationary psychology. What’s harder, and potentially more interesting and useful is to try to understand the alternative hypothesis. A world where tariffs are just headwinds, stocks climb the wall of worry, and the US economy skates through unscathed.

I find it hard to imagine, but I want to keep it on my Bingo card because orthodox economist consensus (of which I am often a part) has been wrong so many times. QE wasn’t inflationary, 2021 inflation was not transitory, Silvergate didn’t trigger a banking crisis, etc. Maybe a trade embargo isn’t bearish for the economy? Again, I can’t really figure out how this could possibly be true, but given the state of economic and financial market sentiment, a bullish result would be electric for asset prices over the next 8 months. I suppose the most realistic bull case is that we end up with global tariffs of 10% and all the other chicanery was just mad bluffing. My only point here is that the alternative hypotheses are worth noodling, even if they require Tolkien levels of imagination.

Asia still selling dollars

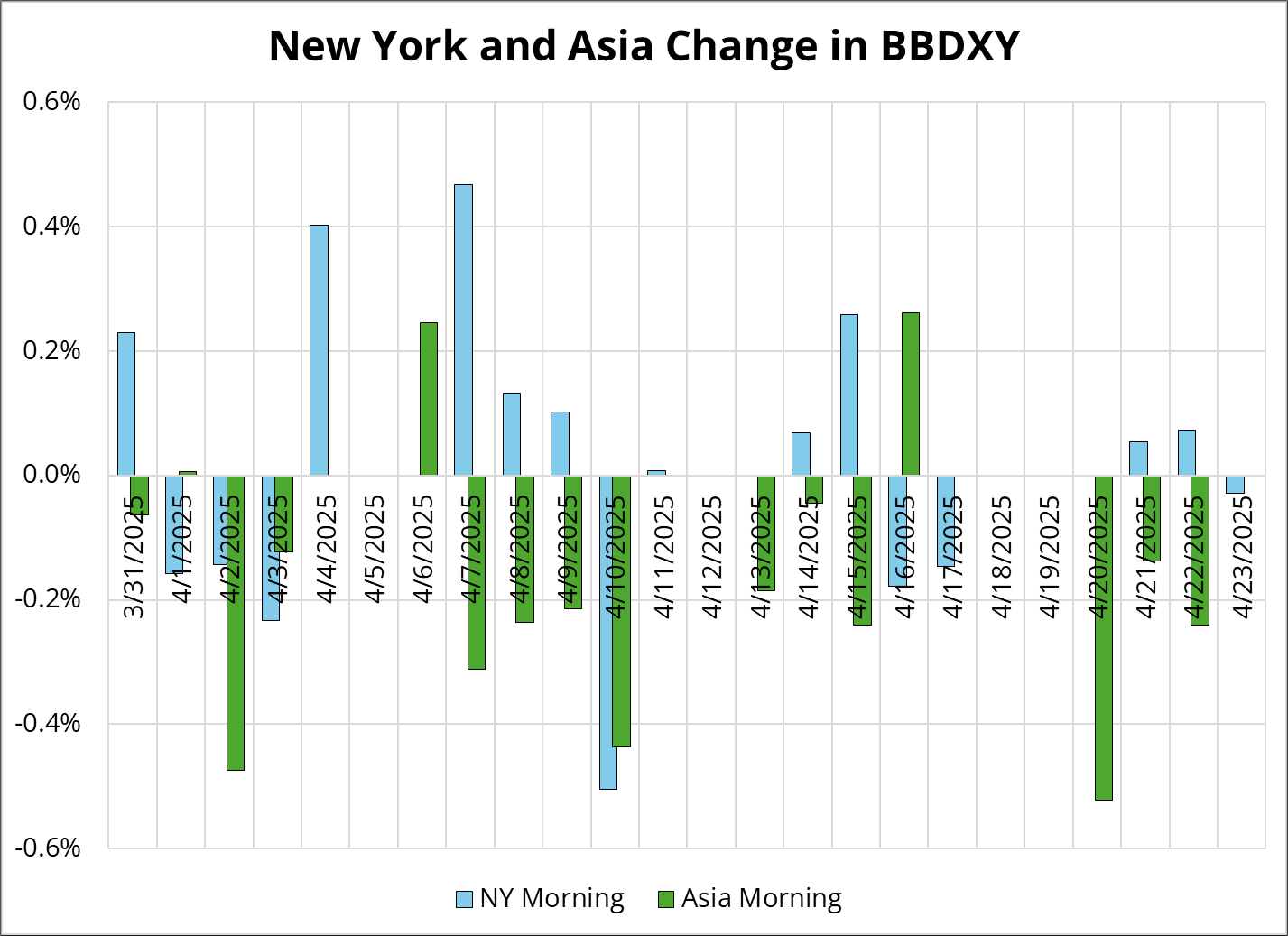

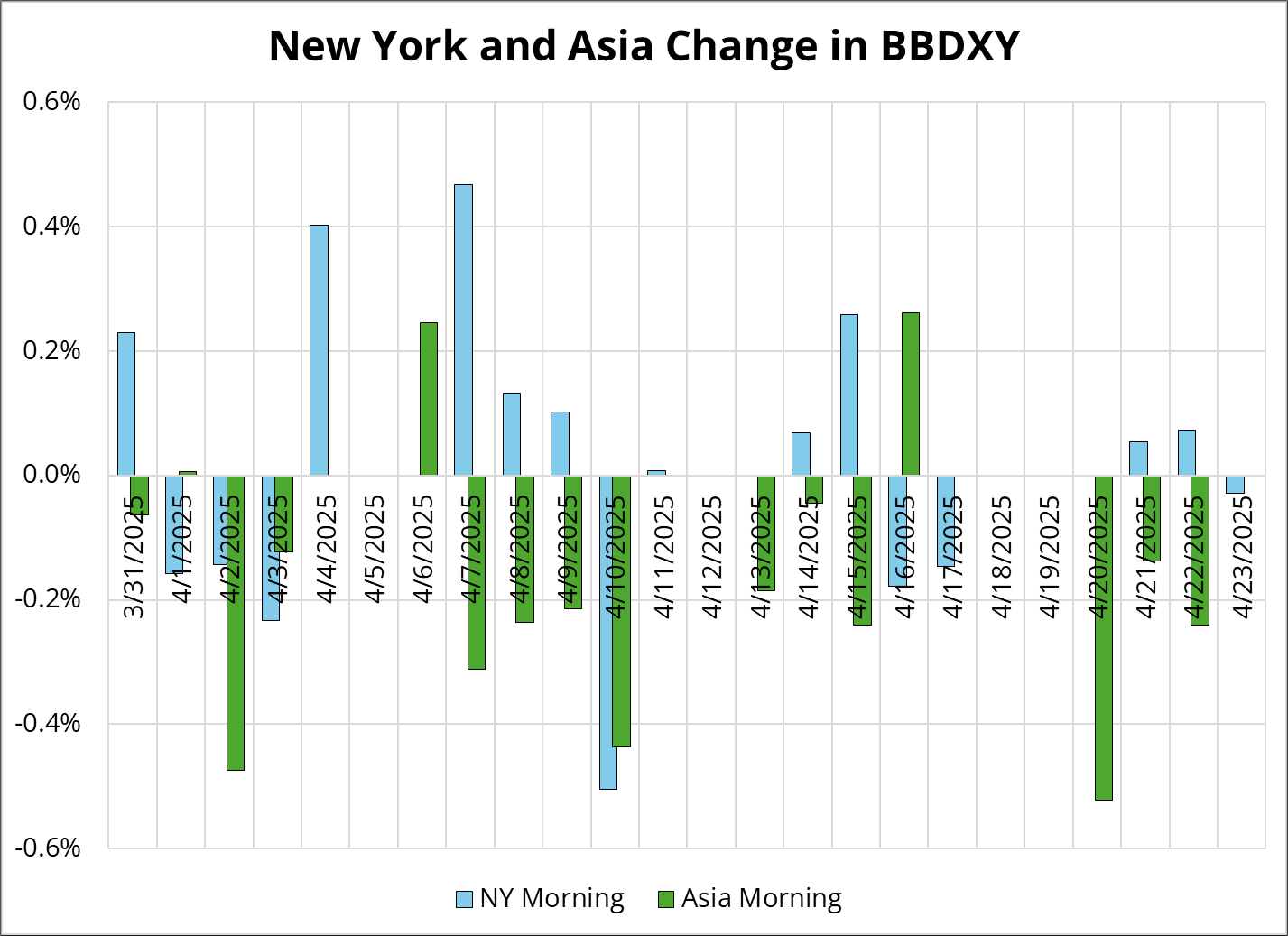

One of the most amazing things about this dollar selloff has been the relentless selling of USD and buying of gold in Asia. Even after last night’s USD-bullish backpedal by Trump right at 5 p.m., Asia came in and ripped gold 2.5% higher.

The buying fizzled and we made new lows, but it shows how the gold buying is completely news and price insensitive. Meanwhile, the USD trades lower in Asia as well, suggesting Asian central banks are probably selling like crazy.

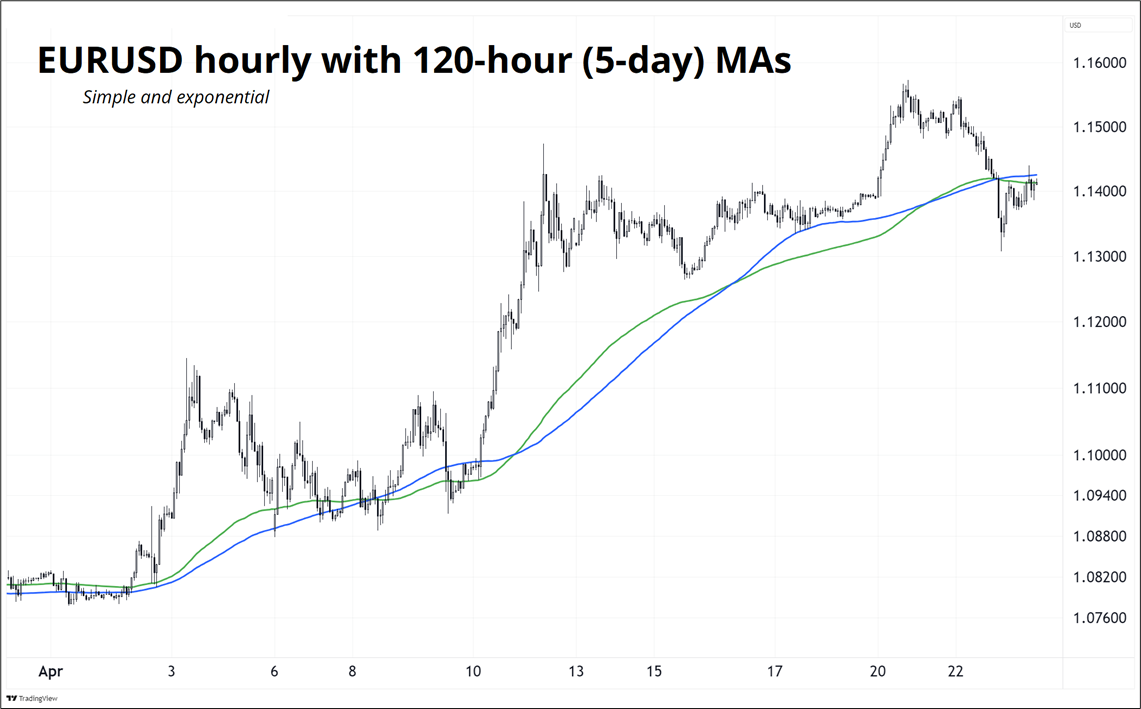

You can see it pretty clearly in this chart.

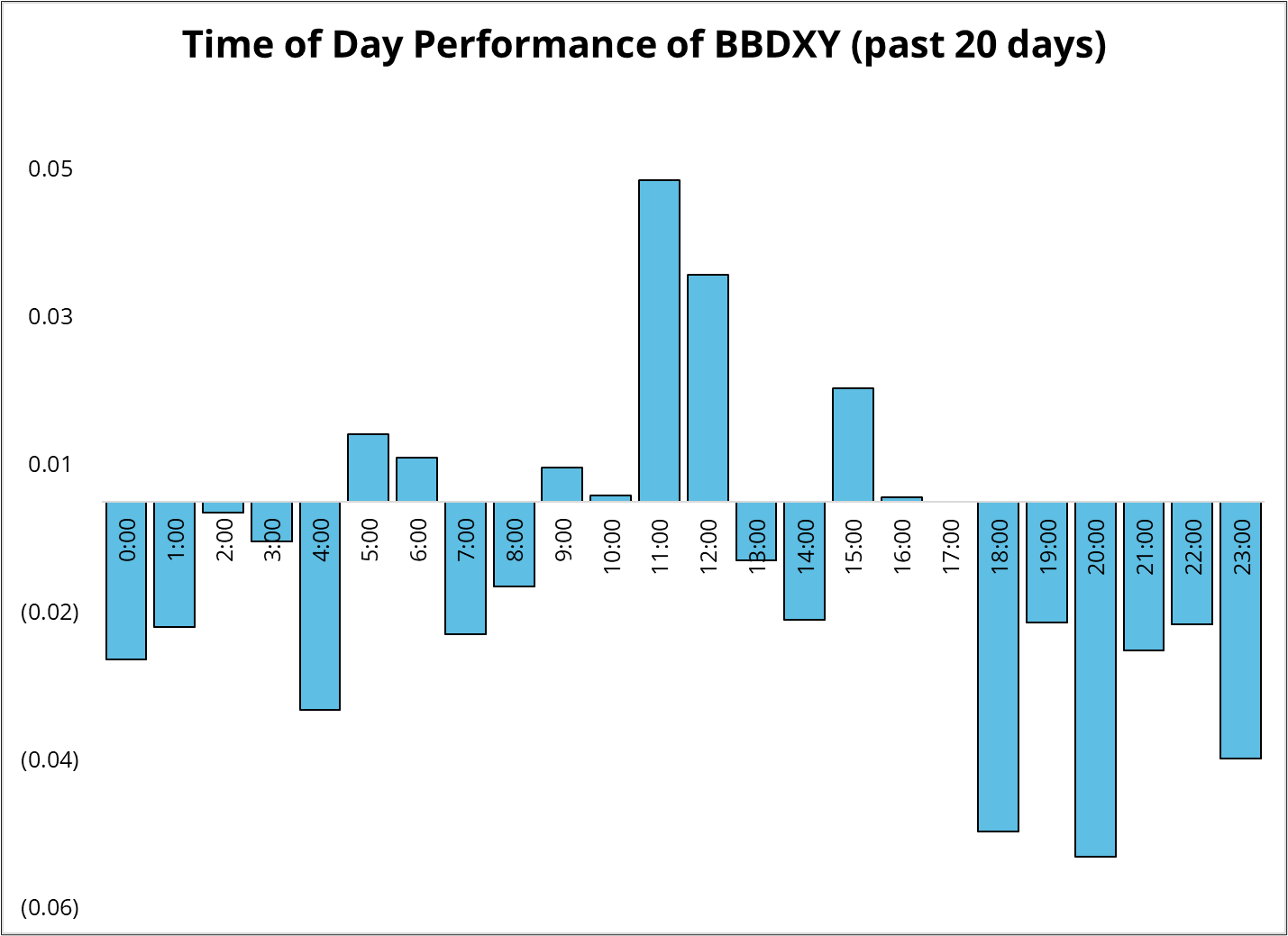

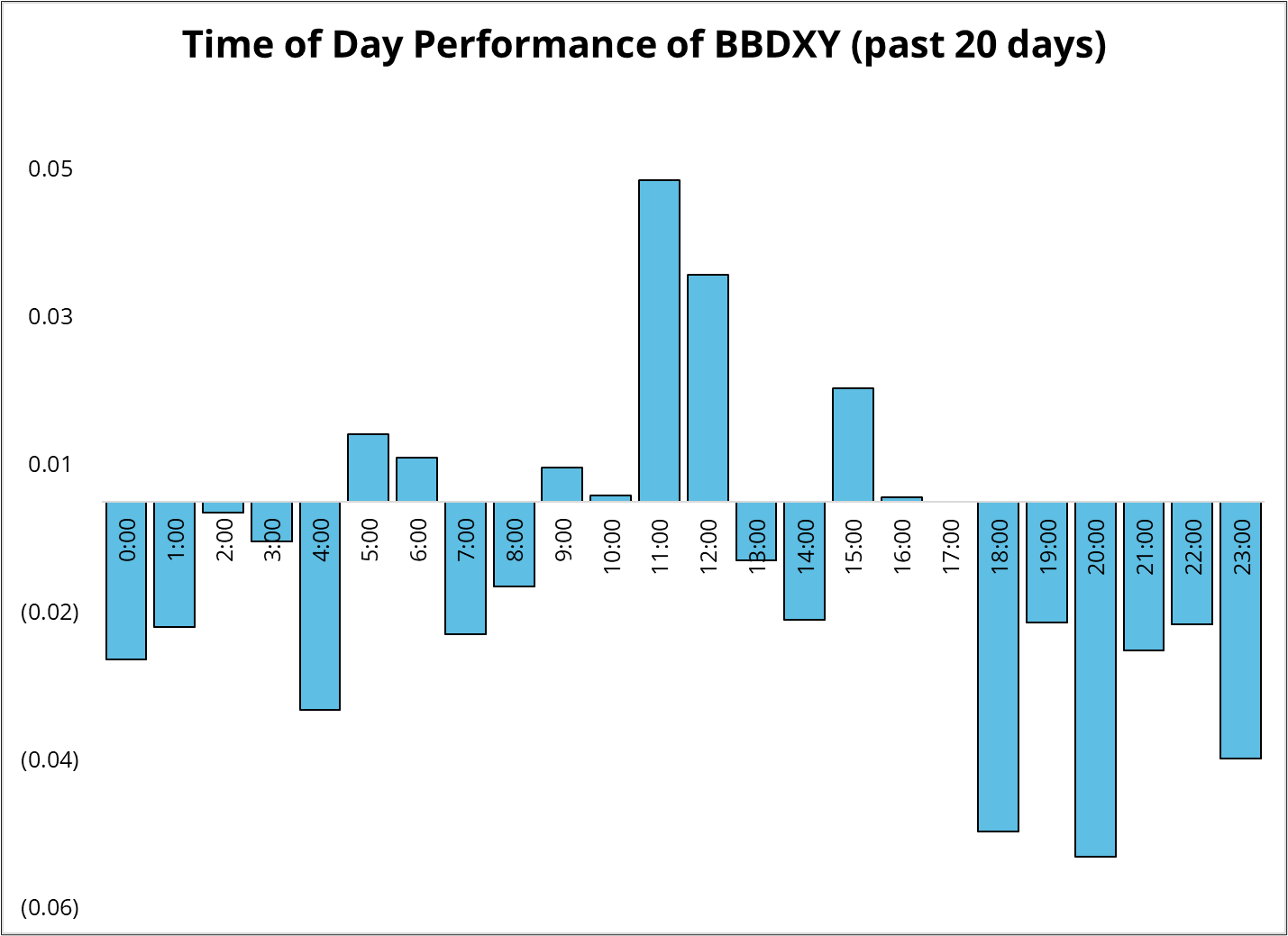

Going a bit more granular, you can see that in US time, the market on average buys USD around the WMR fix and Asia sells from 7 p.m. to midnight NY time.

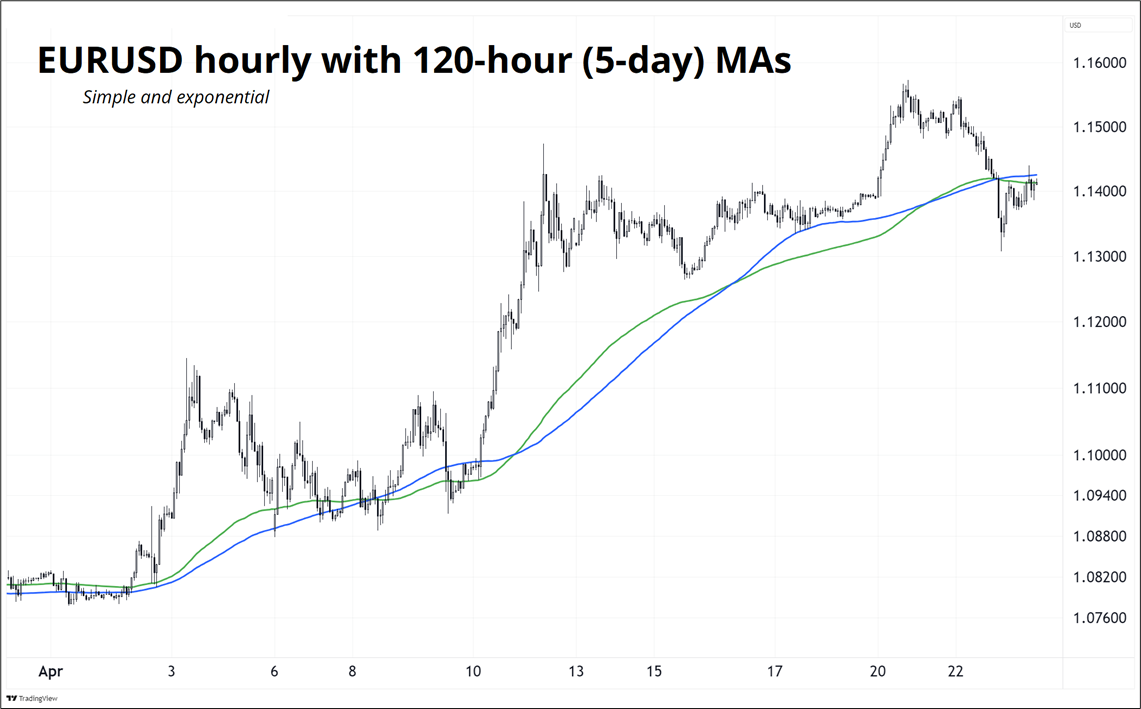

Time of day patterns like this are great when you are looking for tells that might indicate a turn. When Asia stops selling USD, the trend is likely at risk. For now, the moving averages are crossing lower in EURUSD, and it looks to me like we are in for a continued consolidation 1.1250/1.1450, approximately.

Gold

Gold looks like it might have peaked for a bit as the mega overbought signal yesterday combines with all the policy walkbacks and suddenly safe havens aren’t as scarce. If you look at that chart, you can see that there is a strong zone of support 3190/3240 and the last selloff / correction took us 4% below the 120-hour which is 3215. So, if you’re bullish that’s a good zone to think about buying.

Final Thoughts

- Bessent at 10 a.m. today could be interesting, or it could be a generic financial system review. Hard to say. Full info and watching instructions here.

- I don’t think I have ever seen an earnings beat as insane as PEGA last night.

*PEGASYSTEMS 1Q ADJ EPS $1.53, EST. 49C

*PEGASYSTEMS 1Q REV. $475.6M, EST. $356.5M

Wowzers.

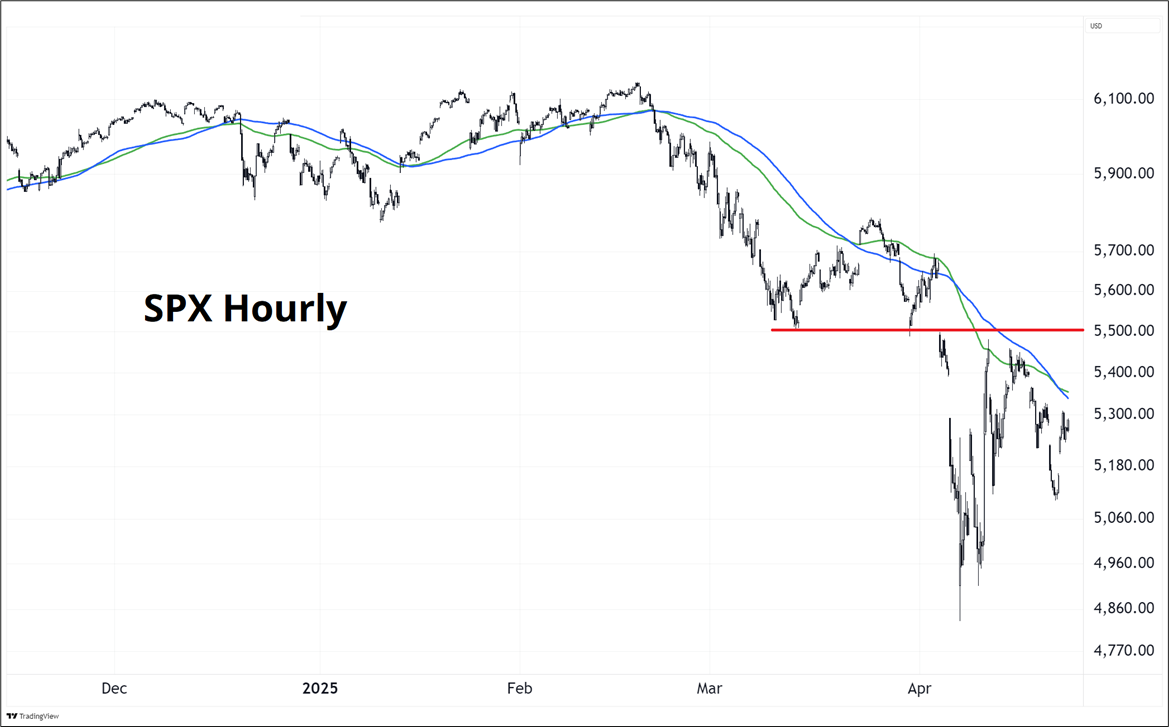

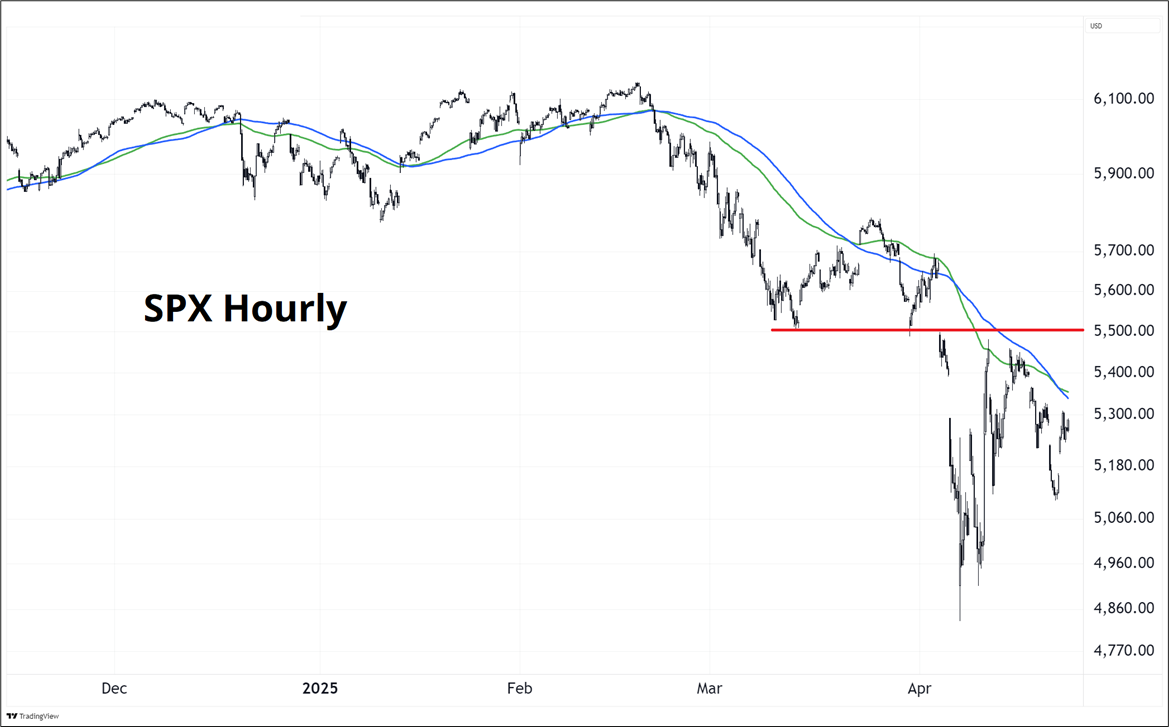

- 5470/5500 in Cash SPX is the absolute line in the sand for bears. If we get above 5500, something has probably changed.

Have a fair and honest day.