Could go up / might go down

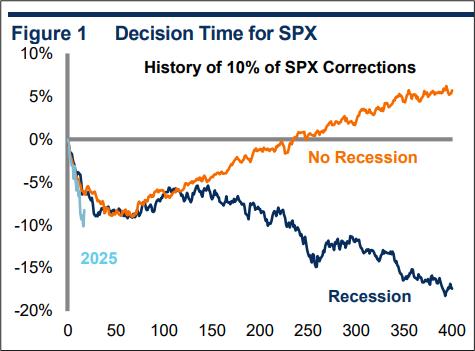

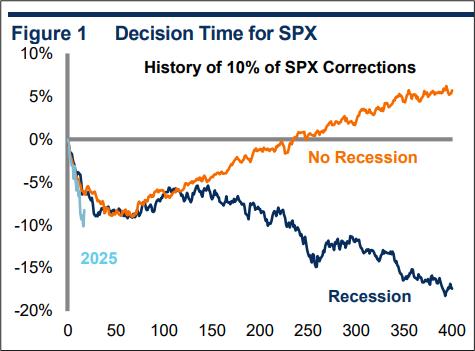

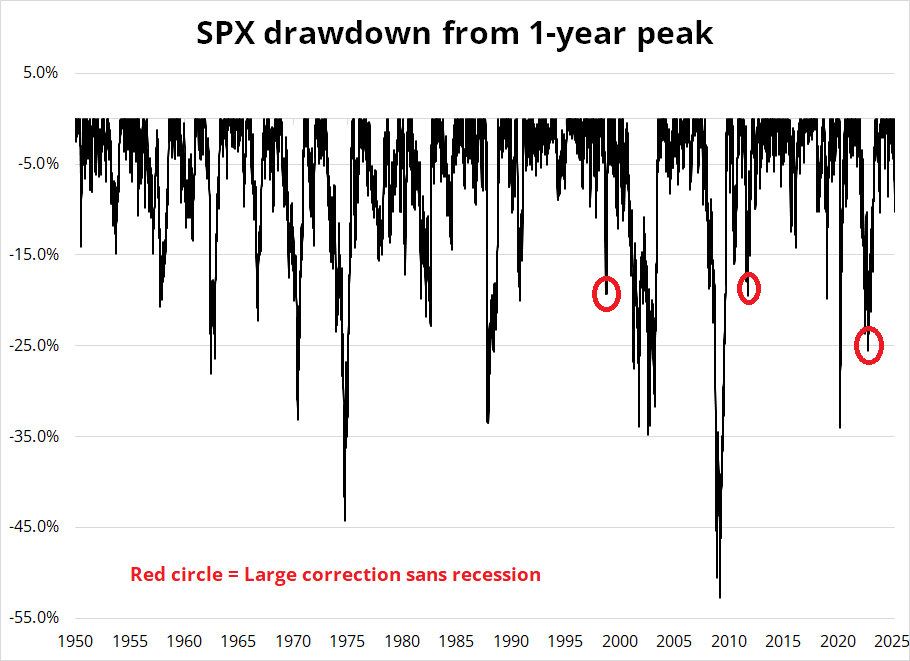

First up, a nice chart from Fred Goodwin of State Street. 10% corrections in stocks are, on average, a raging buy, except when the US goes into recession.

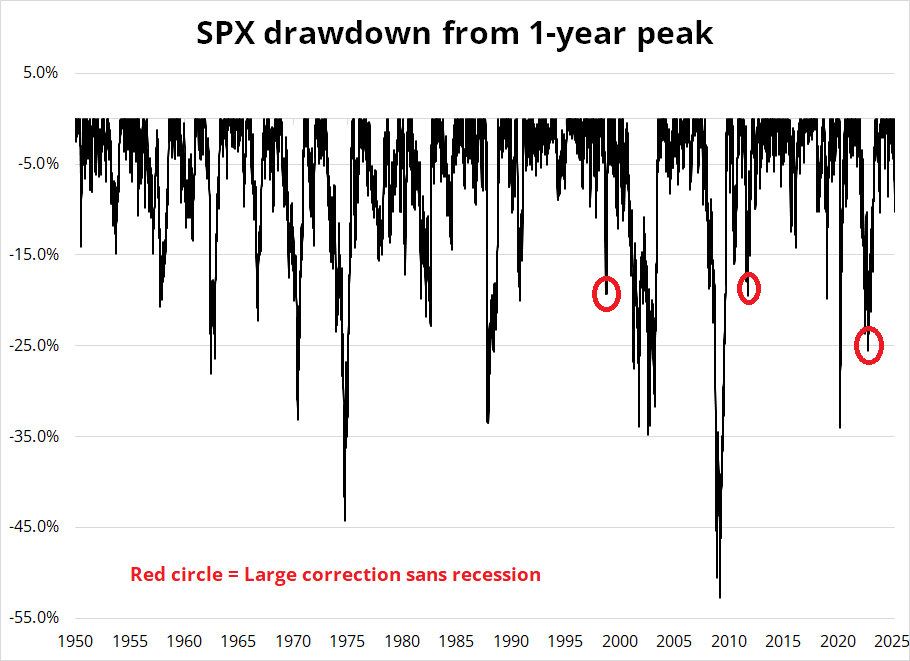

This is a great chart, but I will note that averages obliterate a lot of important detail. In 2022 there was no recession and yet we dropped 25% off the highs. 20% in 1998 and 2011, though those periods were marked by LTCM / Russia and the Eurozone crisis.

While it is tempting to think that there’s a big trade for April 2, there probably is not. Here’s the problem with game planning… When there is a major policy change like this Liberation Day Tariff Announcement, or QE, or a tax cut, etc., there are two stages of market reaction:

- Announcement effect

- Real world economic impact

A perfectly efficient market will compress 100% of the reaction into the announcement effect by reacting with a large and immediate move that effectively frontloads the entire future economic reaction into a short window. As markets got better at understanding QE, for example, you saw large announcement effects while the flow and stock impact of Fed bond buying was extremely limited.

See this study, for example, which states:

Announcements suggesting the start of a new round of QE reduced the mortgage rate tremendously, while the effects of further news diminished. Announcements of an increase in mortgage-backed security purchases decreased the mortgage rate more than the Treasury rate and reduced the credit risk of holding mortgage securities over Treasury securities. The delayed effects of QE announcements on the mortgage rate were less than short-run effects but persistent.

But QE announcements are pretty clearly targeting tighter spreads and higher asset prices while sending a strong bit of forward guidance to interest rate markets. In contrast, the April 2 announcement will be full of weird details, including: What countries are targeted? What are the tariff rates? What industries will be targeted? Will VAT be included in the calculations? What about other non-tariff barriers? Are the tariff rates fixed, or might they rise? How fast will they / might they rise? Are the tariffs credible, or will they be rejigged a few days later like the USMCA exemptions in Canada and Mexico? What is the implementation date? Will the tariffs be cancelled and negotiated away before or after implementation? Do tariff rates go up if enemies retaliate? Is this the start of a coherent and sustained strategy from the White House and a real effort to reshape global trading… Or will Trump soon declare victory in the Great World Trade War and move on to shinier objects? Good luck parsing all that.

To me, the ultimate story here is going to be one of either a) economic recession or b) soft landing resilience, and nobody on Earth will know which way we’re headed on April 1, 2, or 3. So, what we will probably get is a big relief rally in risky assets after April 2 as the market just heaves a sigh of relief that the uncertainty has passed. Then, we get 6-to-8 weeks of quiet and then the economic data decides the fate of the free world.

In other words, I think the announcement effect will be close to nil because the future impact of such a complex (and fully expected / pre-announced) policy announcement on market prices is impossible to trade. That said, removal of uncertainty is bullish risky assets and bearish vol. With month-end approaching, I will look for opportunities to put some trades on, but for now I am flat. One thing I will say is that owning vol could be extremely disappointing over the next few weeks.

The path I am describing where stocks rally into early May would match the standard path of bullish April seasonality, and then we might hit Sell in May and Go Away just as the economic data turns down as there is a sudden stop in economic activity in Canada and a huge slowdown globally as export business stalls, US government cutbacks hit, and confidence swoons. This is all pretty complicated, so I will keep an open mind. My view could change at any moment, but for now, that’s how I view things playing out. Choppy with a bullish bias. If you have seen any grids or game plans for specific tariff expectations and market reactions, please share.

Dude, where’s my VAR?

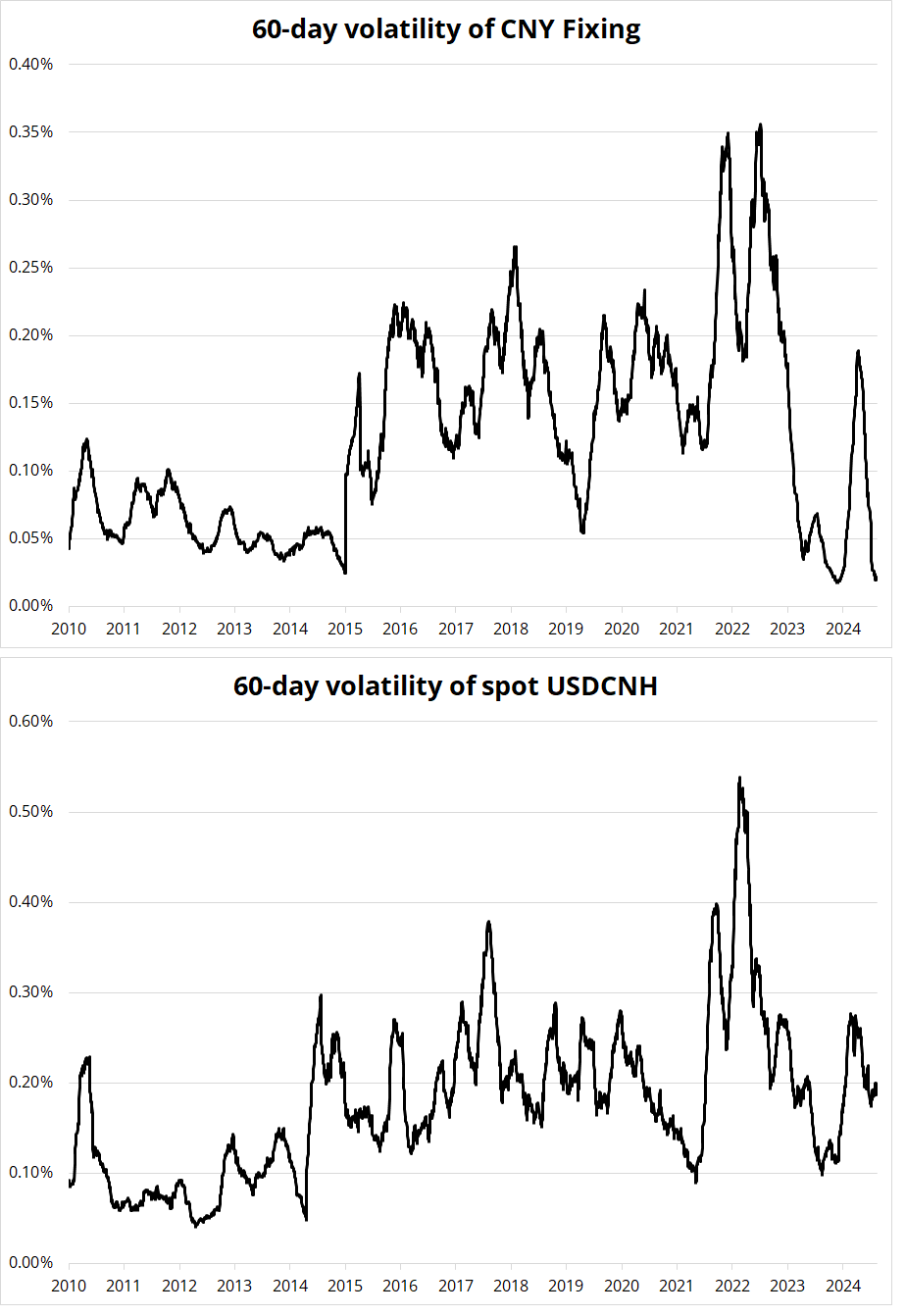

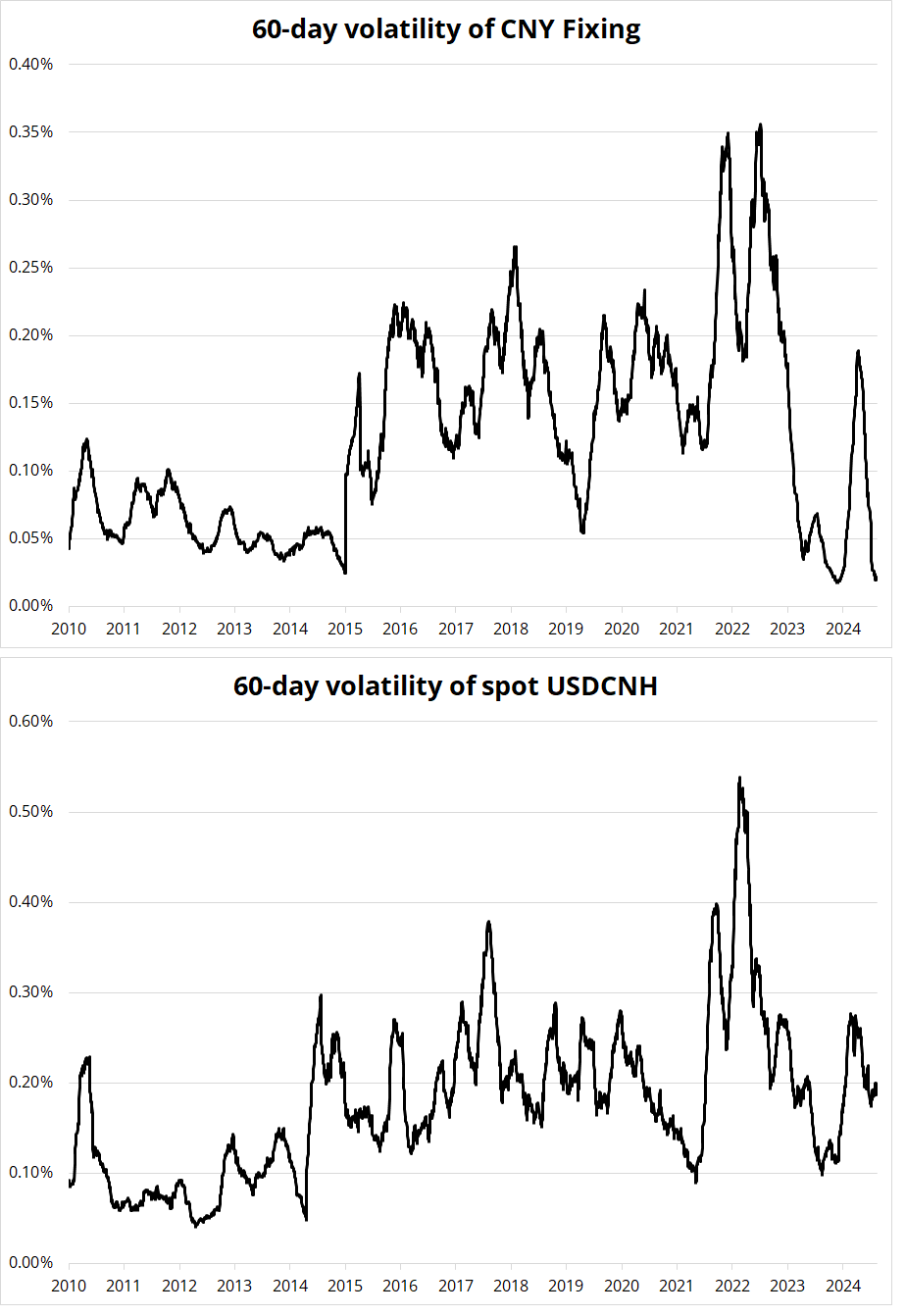

USDCNH is effectively pegged these days, even as the US has ramped up tariffs on China. This is opposite to expectations from six months ago, and it’s a bit confusing tbh. There is no reason to trade USDCNH right now, unless you have a view on the timing of a depeg. You can either be short vol now (expecting no depeg) or long vol now (expecting a depeg) or flat.

For me, the best thing to do is just watch the fix closely every night and when it moves, get excited.

Final Thoughts

This link is to a great essay on how the more efficient and productive we get, the higher the opportunity cost of chilling out. It hits home for me! Thanks, Suv.

https://fakepixels.substack.com/p/jevons-paradox-a-personal-perspective

And here, a cool map of the Artic and various territorial claims. For no reason. It’s just cool.

Have a toasty day.

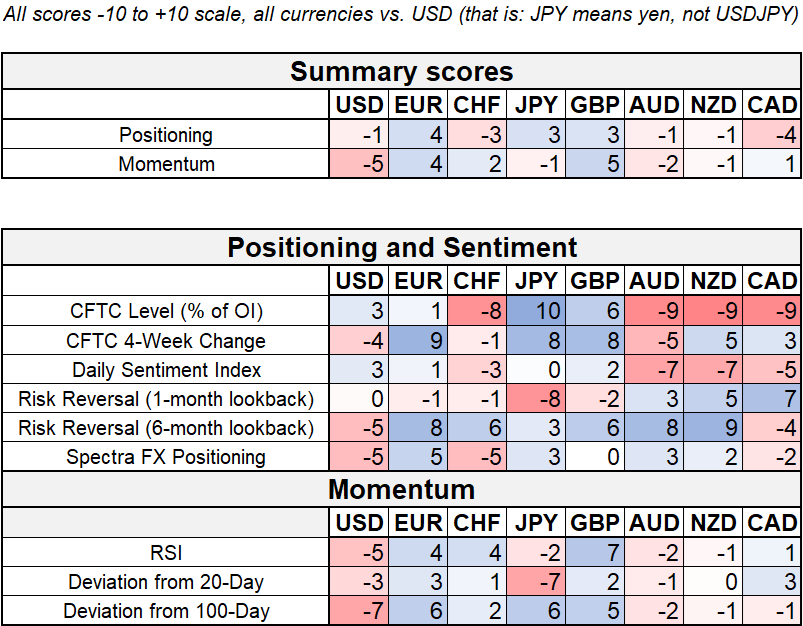

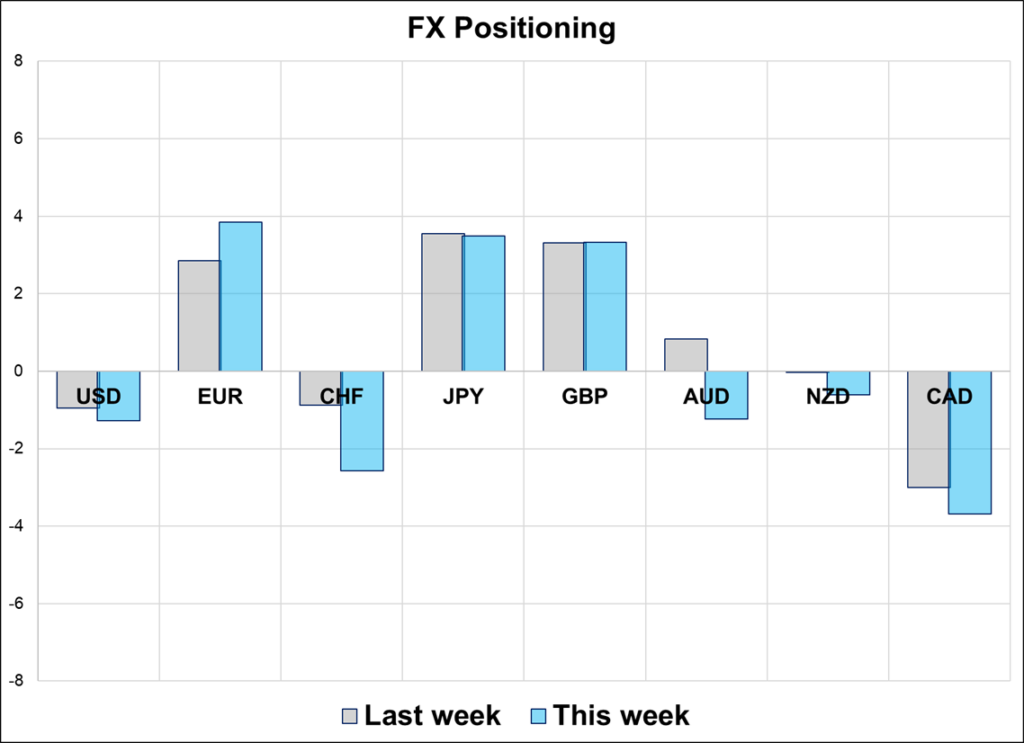

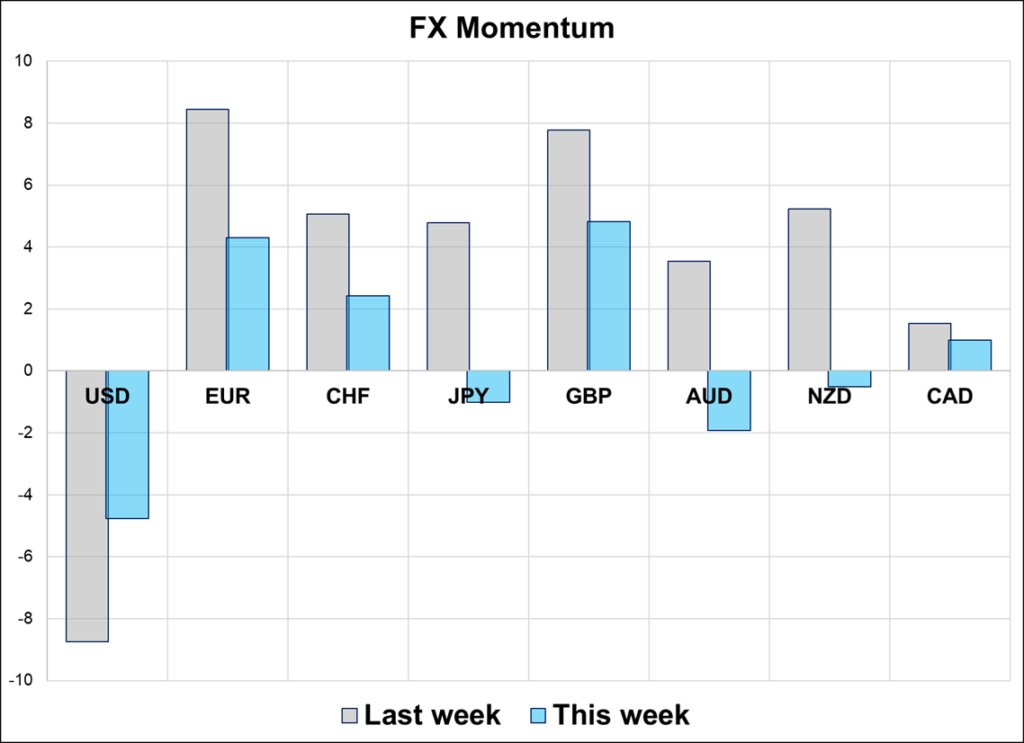

The Spectra FX Positioning and Momentum Report

Nowhere

Hi. Welcome to this week’s report. FX positioning is just about nowhere this week as the market has aggressively piled into EUR topside while remaining short CAD and CHF. Tentative longs in JPY also remain but are low confidence US recession plays mostly targeting a significant fall in US yields. The market is waiting for Liberation Day (April 2) but it’s hard to pin down what exactly would matter for markets on that day as information is likely to drip out beforehand and the news on that day will be complex and hard to parse.

Observations

The CFTC is still all in short CADJPY, but speculators with shorter time horizons are long euros and unsure how to manage risk ahead of tariff announcements scheduled for April 2. EUR topside has stalled along with interest rate differentials and relative equity performance.

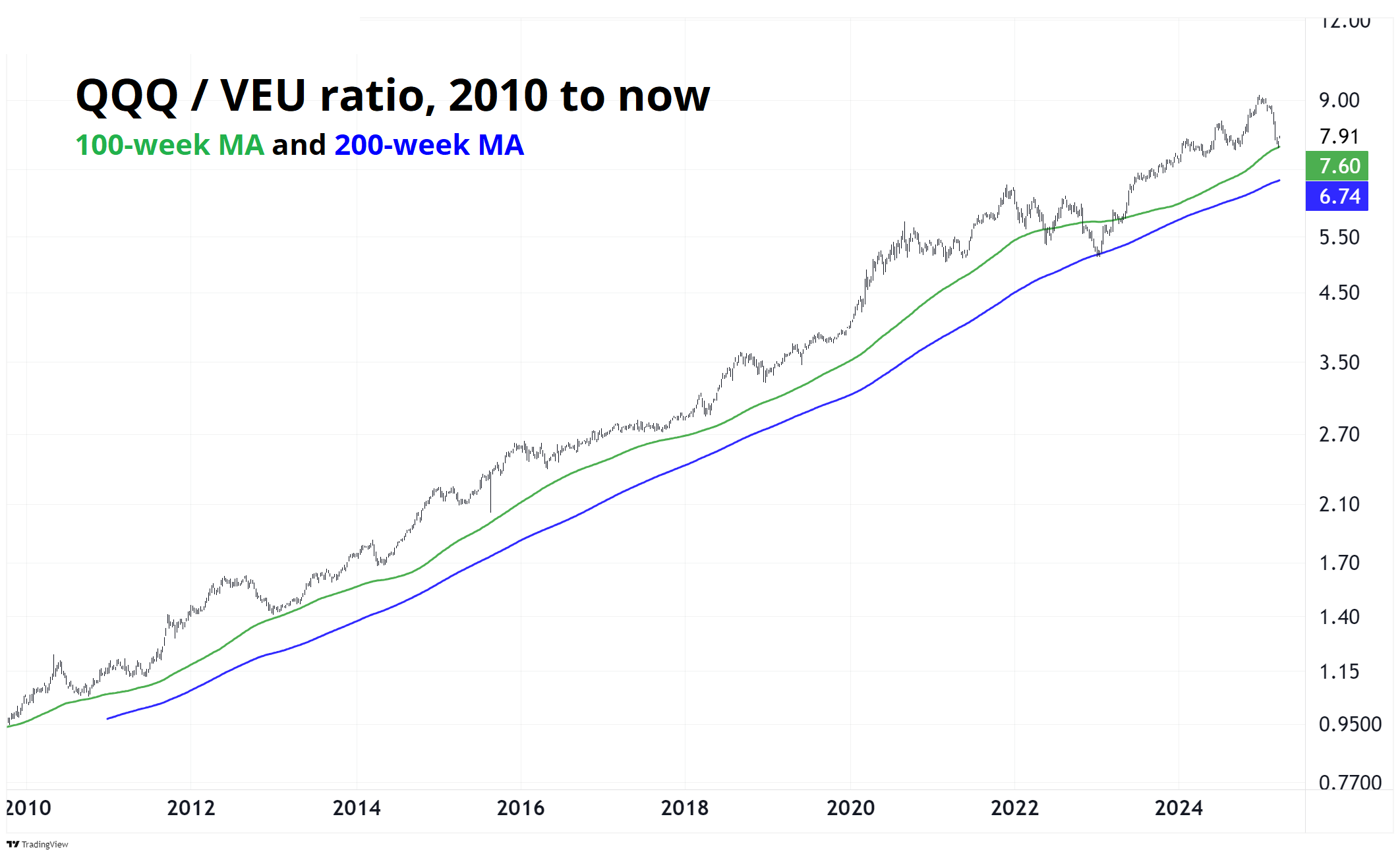

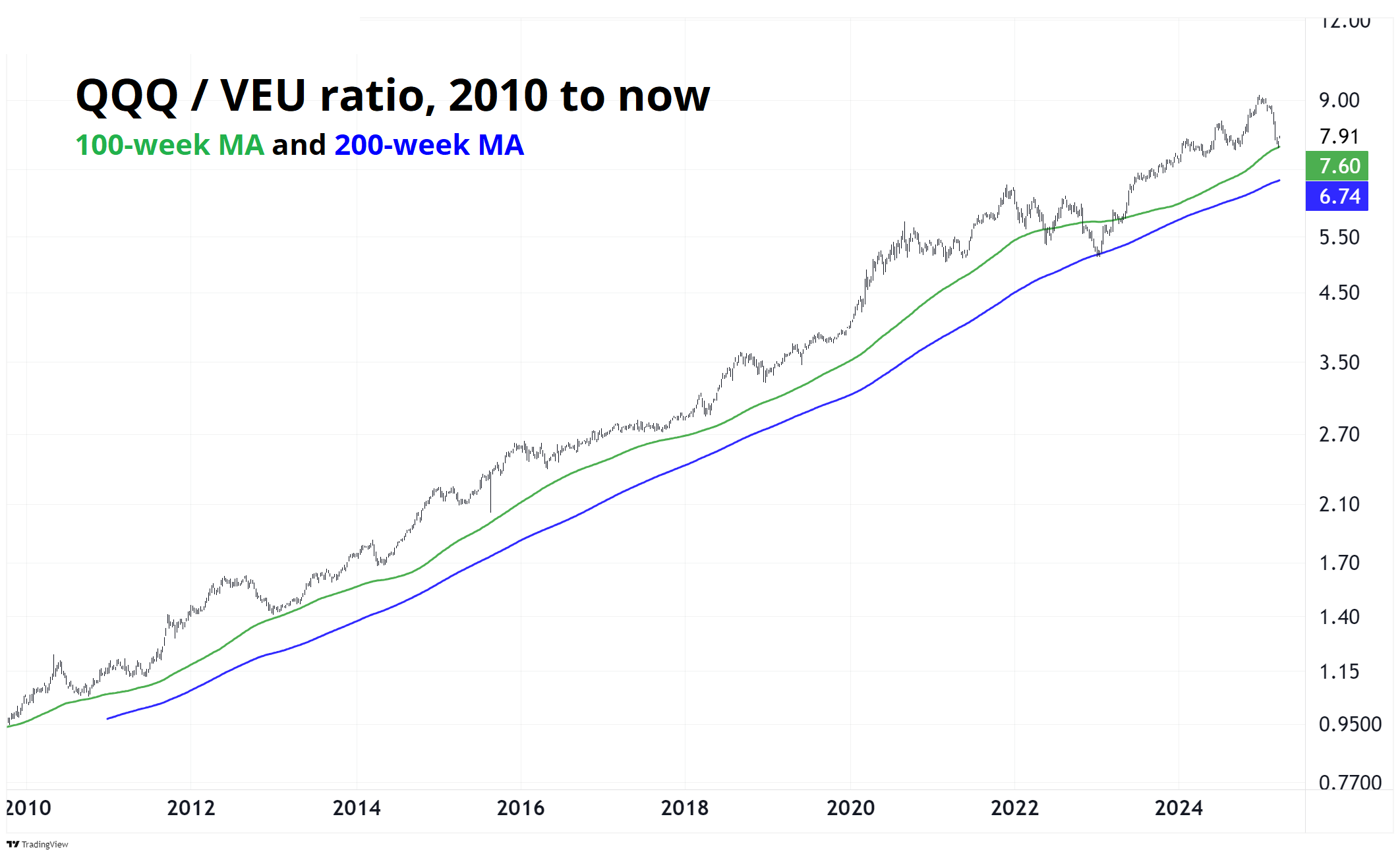

While currency positioning is far from enormous, European equity longs are massive both outright and vs. short MAG7. The end of US exceptionalism might be here but it’s not going to be a straight-line trade, apparently. This chart shows the ratio of QQQ (US tech) to VEU (global equities ex-USA) and you can see that it has held the 200-week MA so far.

In contrast, the German equity rally, which made no sense to most people for ages and ages, suddenly makes sense and the ratio of QQQ to German stocks has busted the 200-week as you can see here. The market is getting more and more confused as to the importance and directional impact of tariffs, and we may need to wait for Q2 economic data before we really know whether TINA is dead or just impersonating Snow White.

Finally, spot traders and option players have been trying topside AUD over the past few weeks, but the CFTC is unrelenting as it adds to AUD shorts on the rally.

Price action in AUD is not inspiring for bulls.