It’s that time of year, and there is no shortage of catalysts

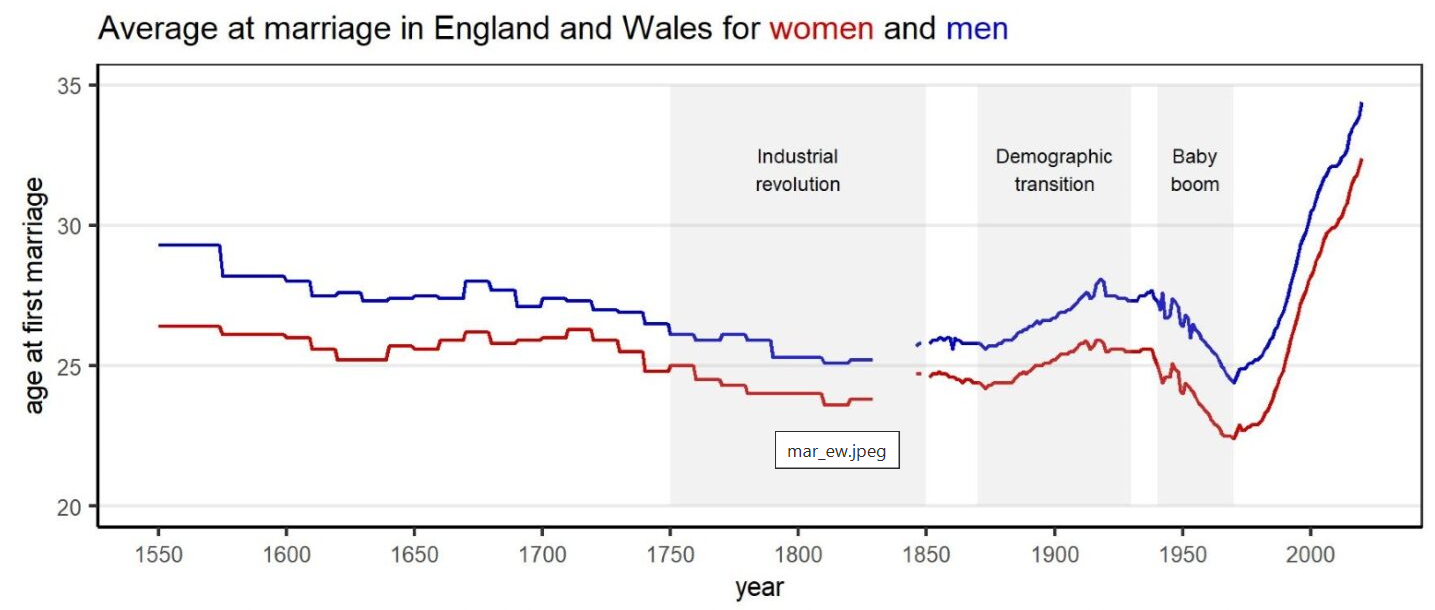

Average age that people get married in England

Larger version at bottom of page

It’s that time of year, and there is no shortage of catalysts

Average age that people get married in England

Larger version at bottom of page

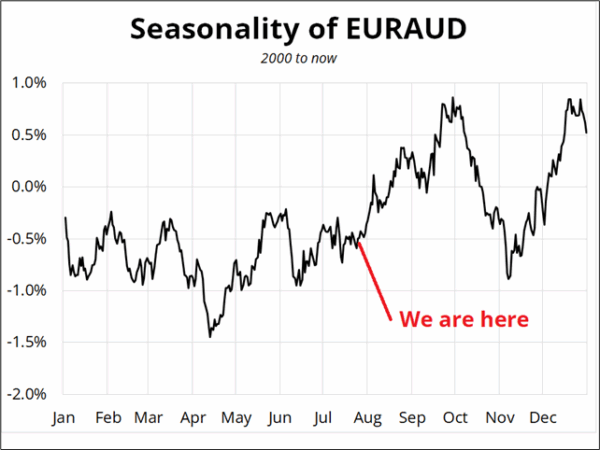

Long 1-month 1.8050 EURAUD call

Cost ~36bps expires 26AUG

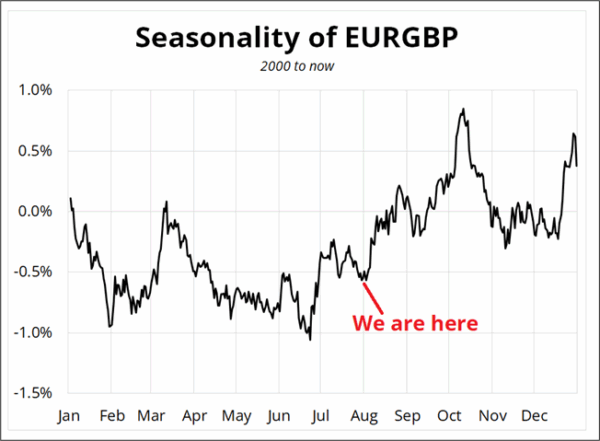

Long 1-month 0.8760 EURGBP call

Cost ~33bps expires 26AUG

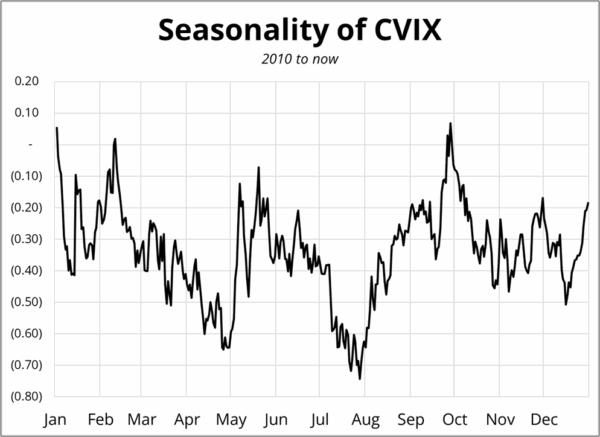

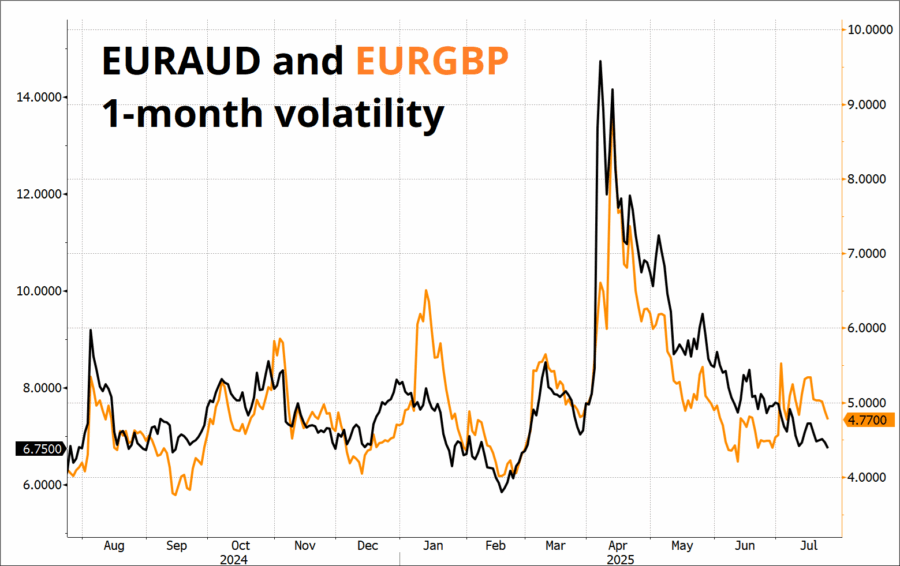

I think it’s a good time to buy 1-month vol. Realized volatility in FX has been unbearably low of late as beta to trade headlines has collapsed and risky assets grind to new all-time highs across the board. But with the vol base so low and a massive flurry of data coming just as we enter a seasonally suspect stretch for risky assets, I think it’s a good time to get involved. Now that ECB is out of the way, I like buying:

1-month EURAUD 1.8050 call for ~36bps

1-month EURGBP 0.8760 call for ~33bps

These are roughly 30 delta options. Here is my logic:

Buying vol because it’s cheap is a losing strategy in isolation because volatility clusters. Low volatility persists until something breaks it out of its slumber. There are plenty of seasonal and macro possibilities coming.

The direction and the vol are correlated here. If volatility picks up, it’s usually because we are transitioning away from extreme greed towards something more moderate (or towards fear). That is, spot/vol correlation is positive, especially in EURAUD. So, buying the vol has some decent convexity if spot blows higher early in August.

If you prefer to do trades via spot, long EURAUD at 1.7765 with a stop at 1.7540 should give you enough room. The EURAUD trade obviously pushes against the recent bubbliness in hard commodities but as I have written about quite a few times: Terms of Trade does not seem to drive AUD much anymore.

This will make you feel super happy. RIP Ozzy.

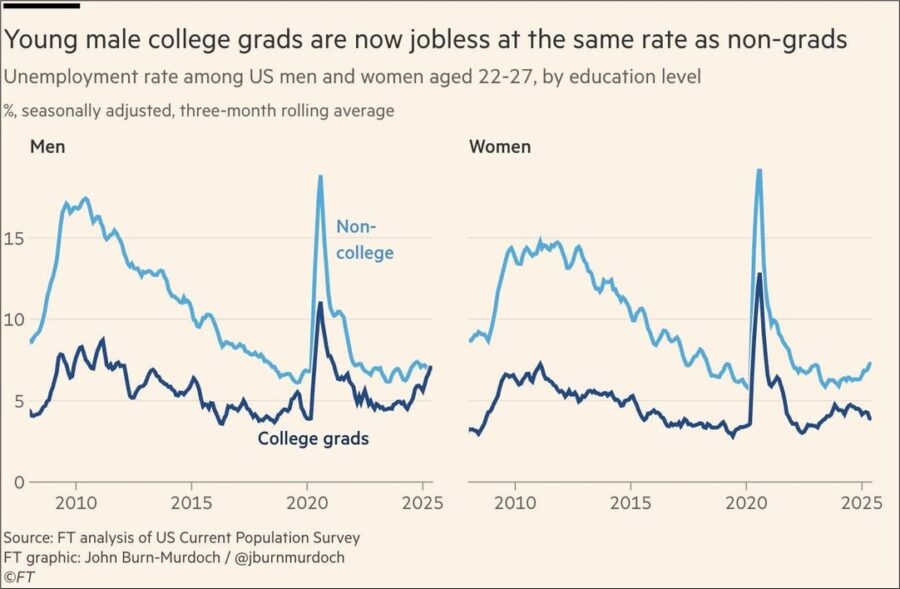

Crazy chart from the FT via DG:

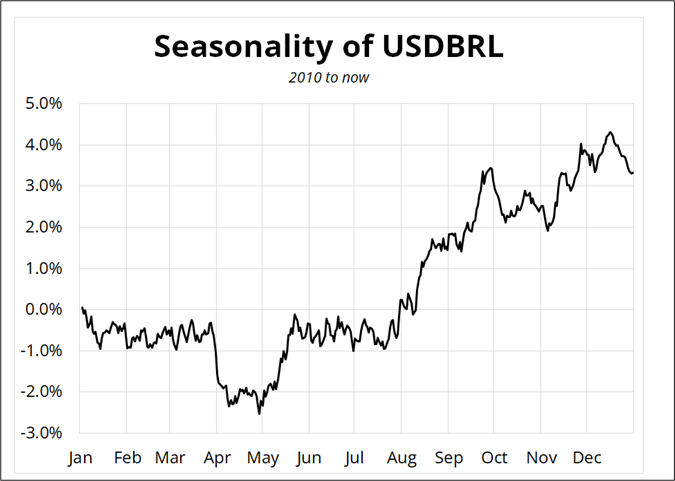

One more seasonality chart. Brazil has traded incredibly well of late, but some caution is warranted into August.

Have a lovely day.

Yesterday’s answer:

Mama Said Knock You Out

LL Cool J