EU trade deal

Bemusement has turned to anger in Europe as the EU/US trade deal, with all its unrealistic promises, leaves Brussels embarrassed and European politicians livid. Here are some choice words from British journalist Andrew Neil.

Trump has left Ursula von der Leyen’s career hanging by a thread. When news first broke on Sunday that the United States and the European Union had agreed a new trade deal, all we had to go on were the broad assurances of President Trump and Ursula von der Leyen, President of the European Commission, that it was a historic triumph for both sides.

‘The greatest deal ever made,’ claimed Trump, with characteristic understatement.

Then we saw the details. And it was indeed a great deal – for America. For the EU, the self-styled greatest trading bloc in the world, it was more like a humiliation. By lunchtime yesterday that grim truth had also dawned on several European leaders.

French prime minister Francois Bayrou said it was a ‘dark day’ for Europe and accused von der Leyen of indulging in an act of ‘submission’. His trade minister stated defiantly: ‘This matter is not settled.’

Meanwhile, prime minister Viktor Orban of Hungary, never one to moderate his language, accused von der Leyen of being a ‘featherweight’ who had been ‘eaten for breakfast’ by Trump.

One distinguished European commentator even claimed the EU had been forced into making an act of ‘imperial tribute’ to Washington DC. As European anger mounts, it’s not just the agreement that’s in danger of unravelling.

So is von der Leyen’s career. It’s easy to see why her job is now hanging by a thread when you dig into the details.

Of course, there’s a lot of smoke and mirrors in all this. The European Commission has no power to buy military equipment nor instruct EU member states how to do so. Nor does it import energy or dictate to member states what energy they should import. But Brussels has signed up to all this and Trump will be assiduous in checking if it delivers.

The short excerpt below (from a Bloomberg article) captures the lack of realism in the headline figures:

The huge figure for energy imports “is meaningless, as it’s unachievable not only because EU demand cannot grow that much, but also because US exporters cannot supply that much either!” said Davide Oneglia, an economist at TS Lombard.

The lack of detail underlines that the deal finalized by von der Leyen and Trump in Scotland is a pragmatic, political agreement, rather than a legally binding pact.

However you slice and dice the details, this appears to be an embarrassment for Europe and a negative for the continent as the goodwill from all the bravado and big headline defense spending numbers appears to be unwound by this capitulation to US interests. The perception was that Europe might be taking the global leadership baton, but now they look weak and fractured again.

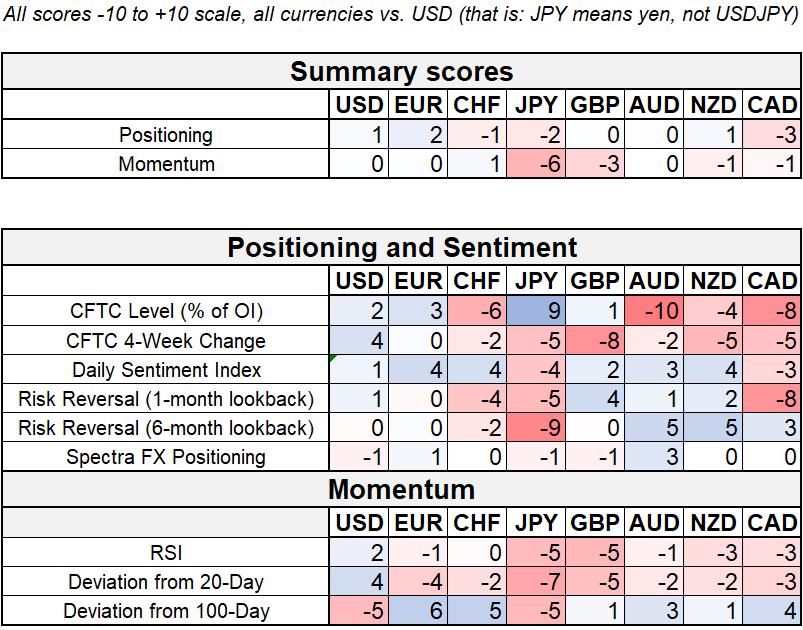

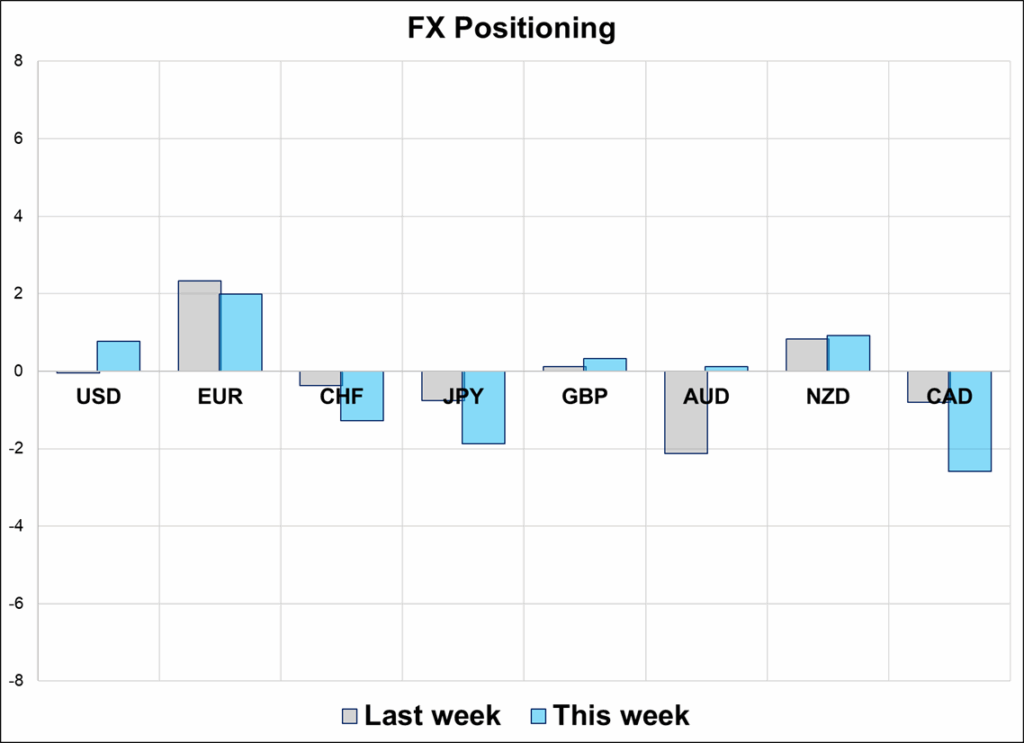

Is this bearish for the currency? I suppose so. It reinforces the old paradigm of US dominance and if there is a risk that even a tiny fraction of these promises to buy US goods are kept, it creates a new source of capital flowing into the USA. This further degrades the US capital flight story, and that story didn’t have legs as TIC data shows capital flight from the USA was an April-only thing. And Section 899 is gonzo. The rapid change in sentiment towards Europe is another body blow as the entire USD-bearish thesis wobbles around the ring, dizzy and confused.

Today we get some second-tier data (Consumer Confidence and JOLTS) along with a 7-Year Auction and then Aussie CPI tonight. Tomorrow is the biggie with ADP, GDP, QRA, and FOMC, followed by China PMIs and the BOJ.

After reading a litany of FOMC previews, there seems to be a bit too much certainty around the double dissent. Is it possible that Bowman might choose to go with the consensus? Waller is already all-in for a dissent, so that should be completely priced in (his 17JUL speech was titled: The Case for Cutting Now). If you read Bowman’s comments, she is kind of like: “I’m open to the idea of cutting in July” not “WE MUST CUT NOW!” like Waller. I suppose it depends on how she interprets the most recent CPI data as her view on a July cut was predicated on the evolution of the inflation data and that release came out after her June 23 comments.

I think given the overwhelmingly dovish commentaries I am reading, the risk is that Bowman does not dissent and the overall tone of the FOMC tomorrow looks more hawkish than the dovish lean in expectations. With September priced around 69%, there is room for a market move either way.

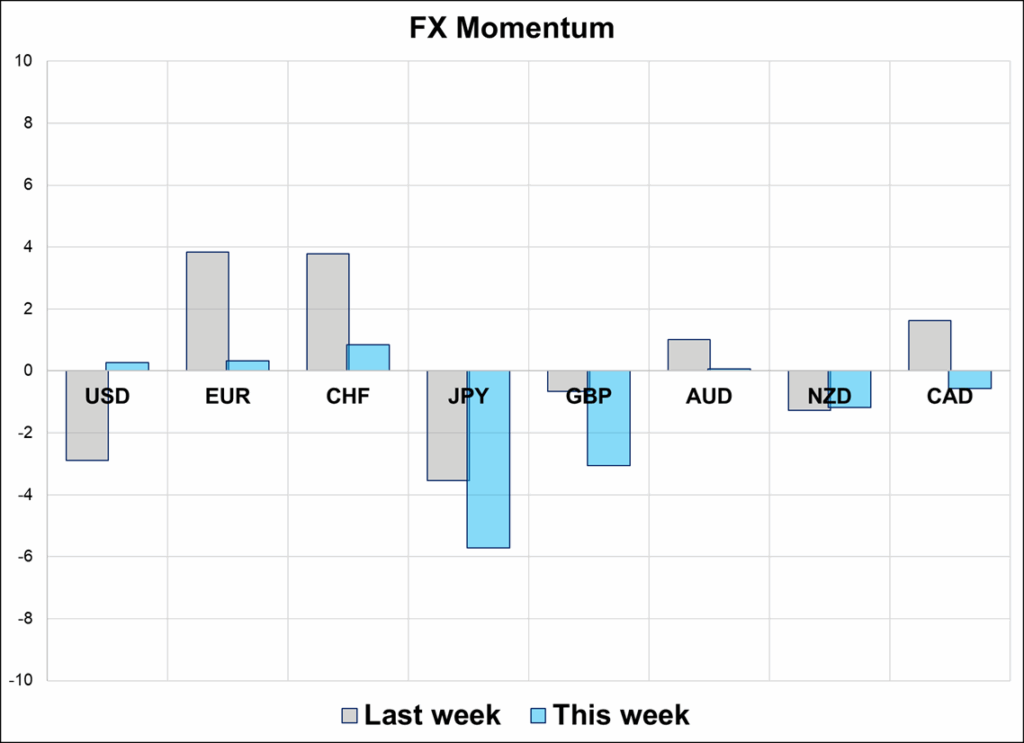

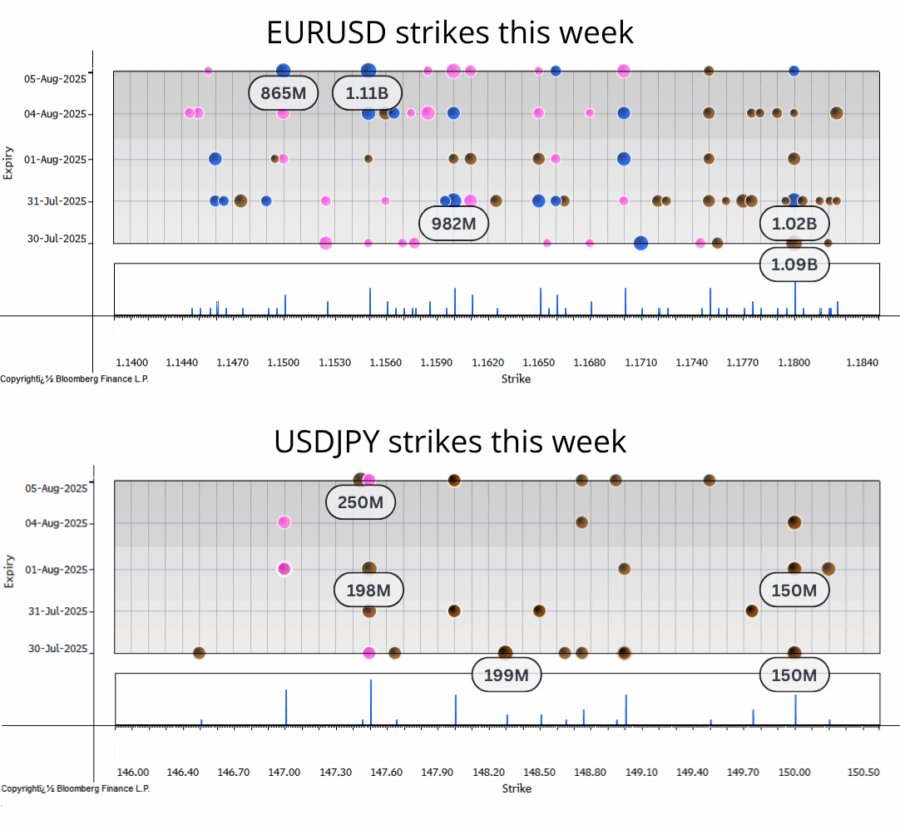

I like buying 1-week 149.50s in USDJPY for ~30bps off 148.75 spot. Vol remains low and the odds of a hawkish Fed are higher than the market thinks. And you get some tradable events like month end and NFP, too.

Infinite supply of crypto proxies

I am surprised that the USD debasement trades like gold, silver, and bitcoin have not corrected at all, especially as the bitcoin treasury nonsense has finally hit the wall. The US dollar has stopped falling and policy uncertainty is lower, even if the trade deals are light on detail and subject to heavy skepticism and questioning.

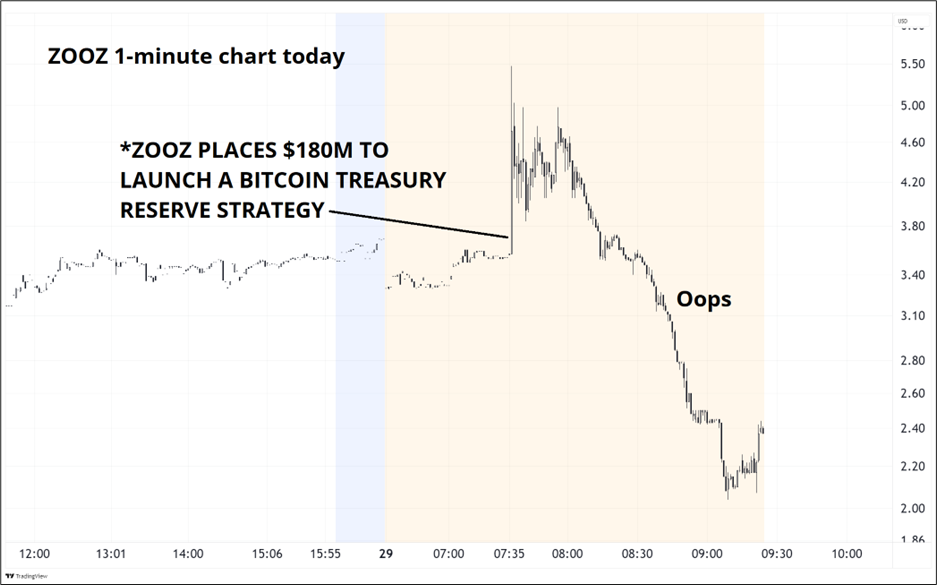

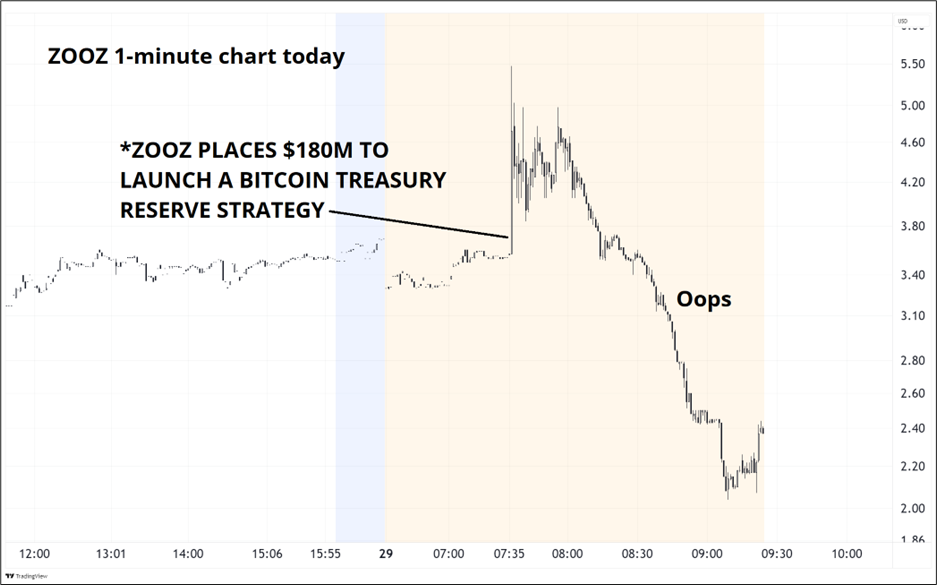

We had another crypto treasury announcement today, and the market firmly rejected it, as the stock (ZOOZ) is trading below the bitcoin treasury announcement level after less than two hours.

If you look at all the Crypto Week plays like CRCL, DFDV, SBET, etc., they have all cratered since crypto week. But the cryptocurrencies themselves are hanging on as treasury and ETF flows continue. This feels to me like the smart money and insiders (Adam Back, etc.) see exit liquidity much like when companies clamor to IPO as the insiders can see that the demand for their wares outstrips any rational valuation. This will create infinite supply of these bitcoin and ETH treasury companies until the market finally gets the joke. And the market is getting the joke. ZOOZ is now trading below where it was when they made their announcement. I would expect companies like RIOT to hurry up and do secondaries, like MARA has already done. As the supply of bitcoin treasury companies will far outstrip demand soon, their NAV premiums should start to crater.

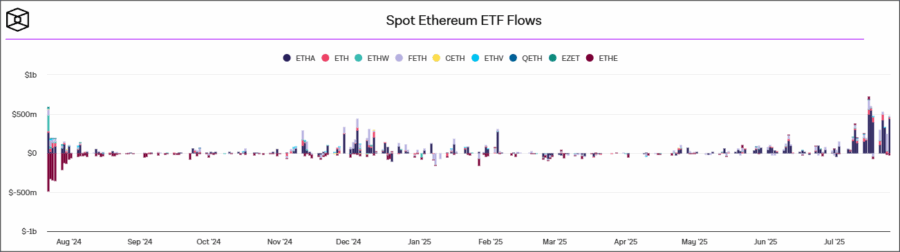

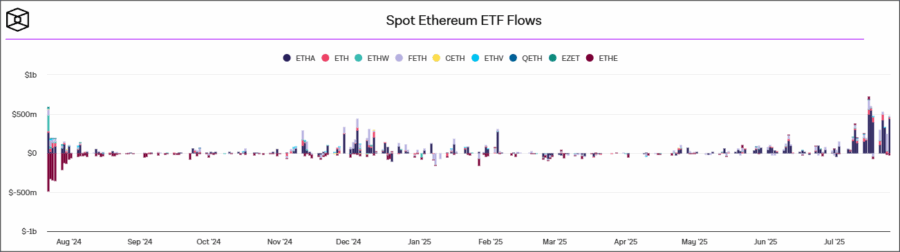

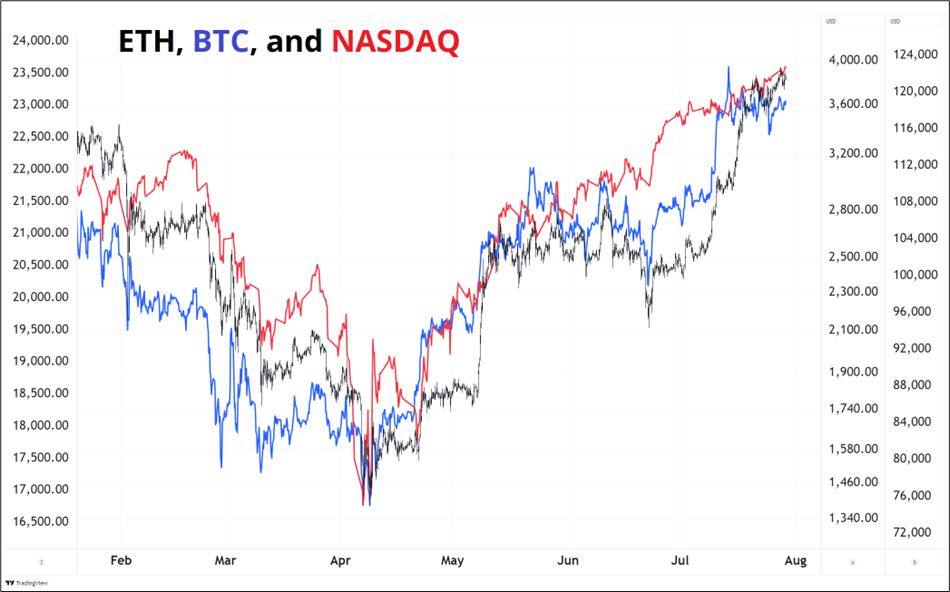

Meanwhile, ETH is getting near the triple top at 4080. This is shy of the all-time highs reached in 2021 (4429) and 2022 (4840) but still poses major resistance as rapacious treasury demand is set to subside.

ETF demand for ETH has been off the charts, too.

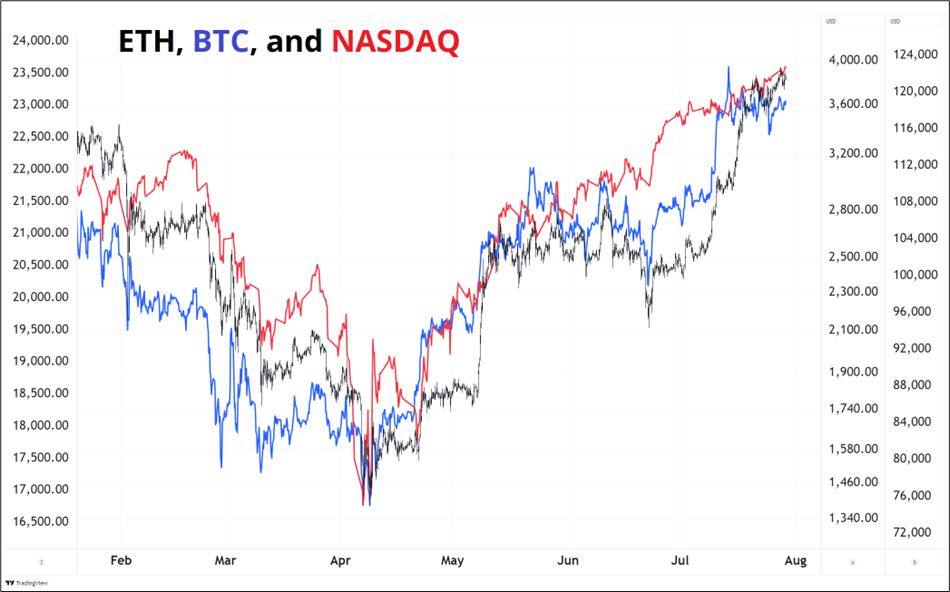

My thesis is that the bitcoin treasury fad rhymes with the ICO fad in 2017 and the SPAC fad in 2021, and the NFT fad in 2022 and we are seeing a major top in all these garbage crypto proxies. Price action in CRCL, DFDV, SBET, MARA, CEPO, ZOOZ, and other crypto-adjacent stocks is likely a tell. That said, it’s hard for crypto to sell off when NASDAQ is at all-time highs given ETH, BTC, and NASDAQ are highly-similar risky assets. This chart shows NASDAQ and BTC tend to lead and ETH follows in 2025.

I am more comfortable short the proxies than the cryptocoins themselves because the massive oversupply of listed crypto proxies makes them more vulnerable than the underlying. Ironically, insiders who are able to sell their overvalued crypto proxy stocks at 2X, 3X, or even 4X NAV might get to buy them back below NAV one day in the not too distant future and retail investors could end up losing twice as they buy from insiders at inflated prices and sell back to them below fair value.

Final Thoughts

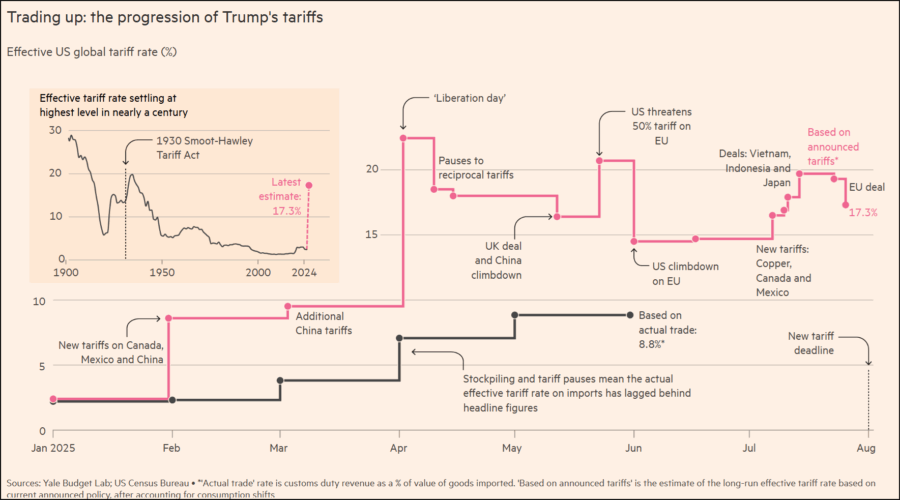

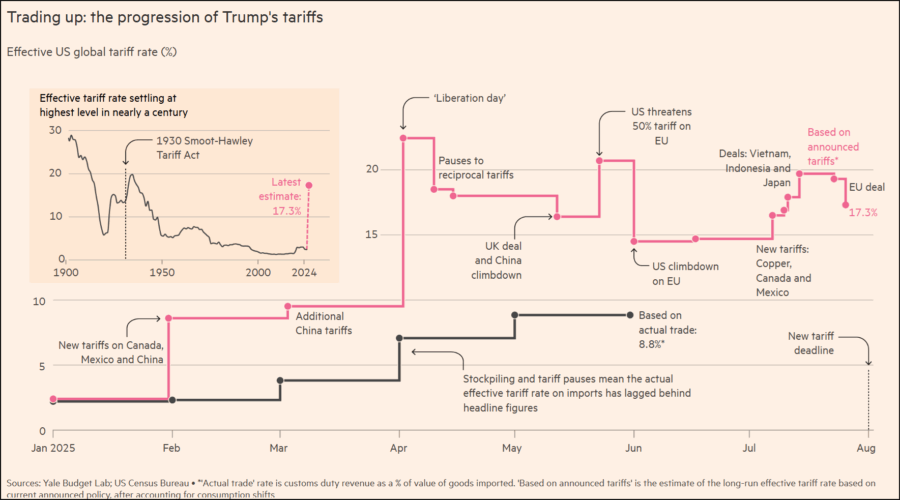

Cool chart from the FT.

Have a multicolored day.