US and China both uninvestable?

3D Beach Art By NZ Artists Jamie Harkins, Constanza Nightingale and David Rendu

Larger version at bottom of page

US and China both uninvestable?

3D Beach Art By NZ Artists Jamie Harkins, Constanza Nightingale and David Rendu

Larger version at bottom of page

Long 11MAY 168/163 put spread in CHFJPY

~35bps

Long 05JUN USDCNH 7.40/7.60 call spread

29bps off 7.2955 spot

Long GCM5 @ 3036

Took profit 3194

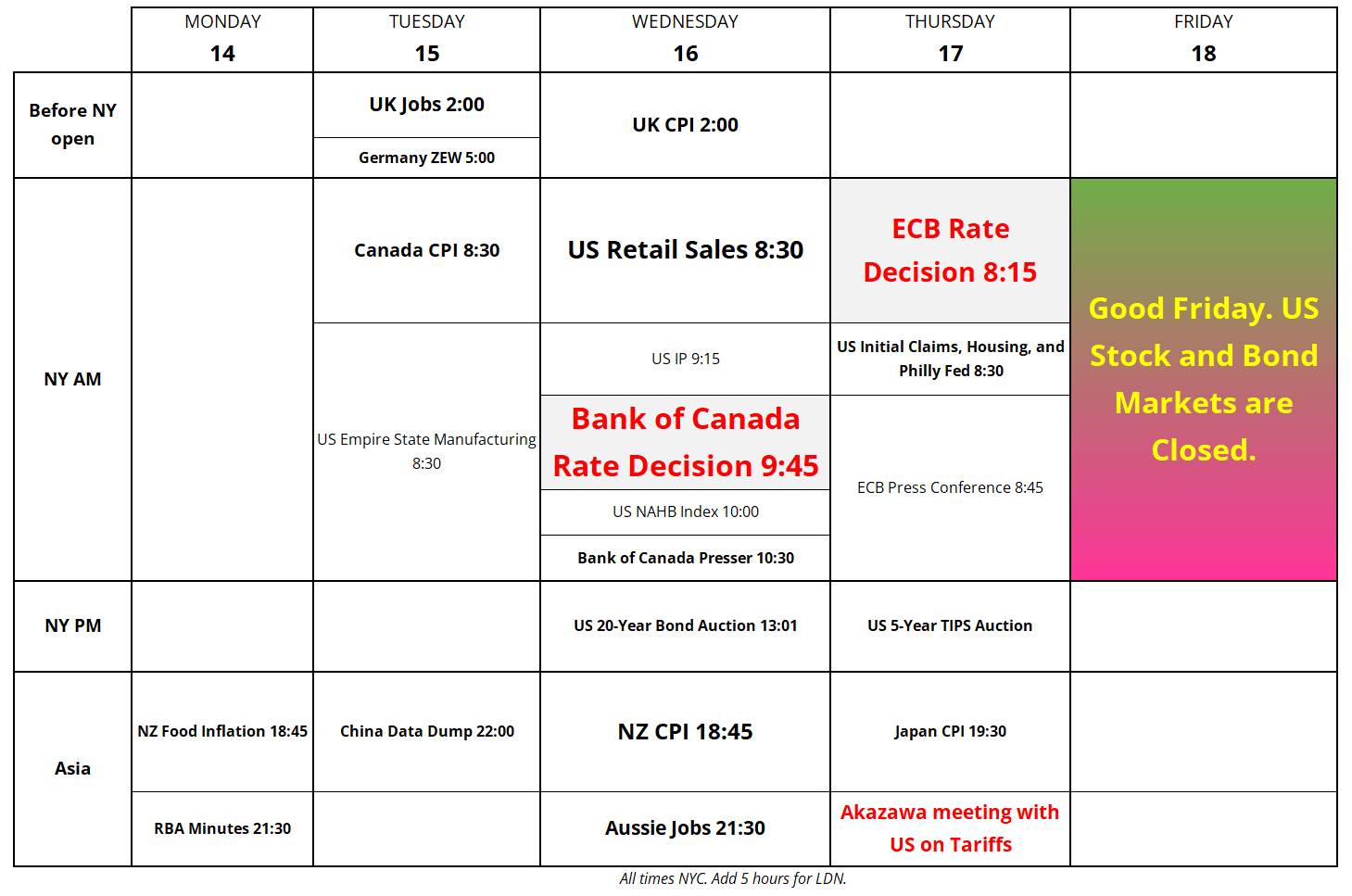

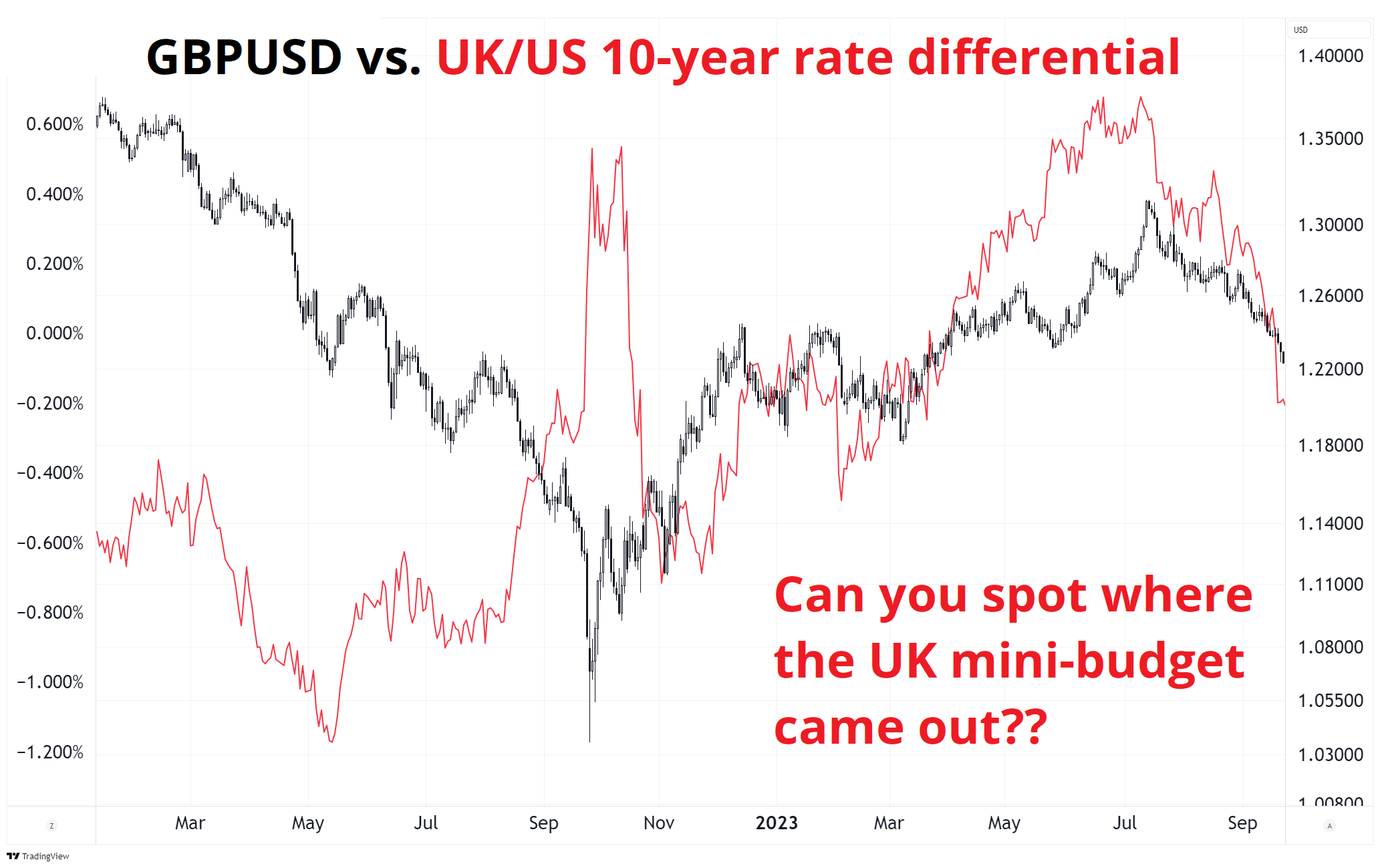

The end of US hegemony trade is in full force as the Trussification of the dollar continues. Those who are old enough to remember Liz Truss remember that her policy mix was poorly received by the markets and so GBP went down as UK yields went up. See chart.

Now, the embargo on Chinese trade, RNG tariffs that change daily, long time allies stabbed in the back all at once, and a concomitant collapse in business, investor, and consumer confidence have triggered a flight out of US assets. In soccer, this is called an “own goal.”

The problem is that if someone threatens to burn down my house, and then in the interest of self-preservation, I make a deal with them not to burn it down, I’m not going to trust that my family is safe. Before I step outside, in future, I will peek through the blinds to make sure he’s not standing on my lawn, holding an axe. Especially if he has a well-known history of reneging on past deals.

In other words, the global investors, wealth funds, and pension money selling US assets are not coming back. When these Canadian or European pension funds are done selling their US overweights, they are never buying them back again, at least until 2028 or later. This creates hysteresis, or scarring, where the damage done cannot be fully undone, whether or not the random number generator used to choose tariff rates lands on something lower.

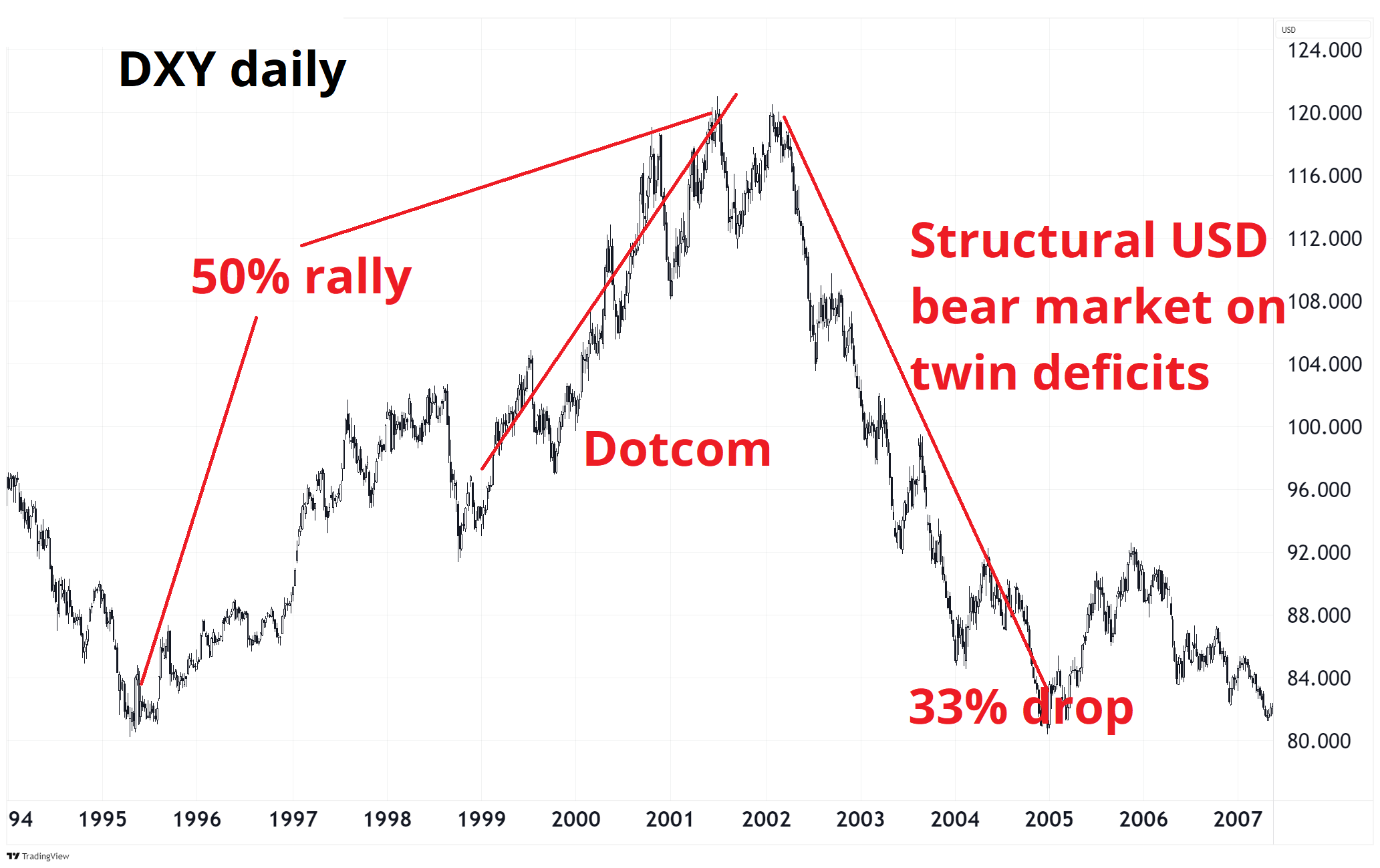

This has the makings of another great USD down move like the one from 2002 to 2008. That move saw the dotcom bubble trigger 8 years of US inflows and a 50% rally before the entire rally unwound in three years. Up 50% and down 33% = unchanged.

Now, we have what is a pretty similar setup with 8 years of inflows into the MAG7 / TINA boom and a new president and a peak in the AI bubble. Another full round trip would make sense.

This has been one way traffic since the German defense spending announcement at 1.0545, and so tactically it’s not easy. Most specs are holding stuff like 1.11 digis that have zero optionality left on them, or they have been waiting for better levels for the last 800 points because it’s hard to buy at 1.10 when it was just 1.06 a few weeks ago. Regime changes are not a time to be overly worried about positioning or entry points. But now we’ve had a huge move and we’re at the bottom of the DXY range and the SNB is probably getting involved in USDCHF soon and it’s all a bit less clear what to do in the short run.

Japan’s Akazawa will meet U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer for U.S. tariff talks on April 17, public broadcaster NHK reported on Friday and that should lead to a healthy runup trade in the JPY as the market needs to position for the possibility of a mini Plaza Accord where Japan makes some kind of deal.

EURCHF is likely to be supported by the SNB down here (0.9210/40) because inflation and interest rates in Switzerland are both at zero and they have no other policy tools left, really. They meet on June 19 and could go back to negative rates, but in the meantime they need to keep the CHF from going vertical. This makes CHFJPY downside structures attractive. People hate to do trades that have seemed good in the past and never worked and they are often referred to as widowmakers. The original widowmaker was short JGBs, and that’s been one of the best macro trades of the past few years. Just because something didn’t work before, that doesn’t mean it won’t work in the future. If that were true, extrapolation would be an excellent forecasting method in financial markets.

Short CHFJPY is tricky to structure because it’s at 175 and the correct stop is near 181, which means you don’t get much leverage. And options are expensive. But I think you can buy 1-month 168/163 for ~35bps and make money on that. I will put that in the sidebar as a trade idea. Price is ballpark off 175 spot. If you want to do spot, the tight stop is 178.30 (more dangerous) or the wider one is 180.66 (less leverage).

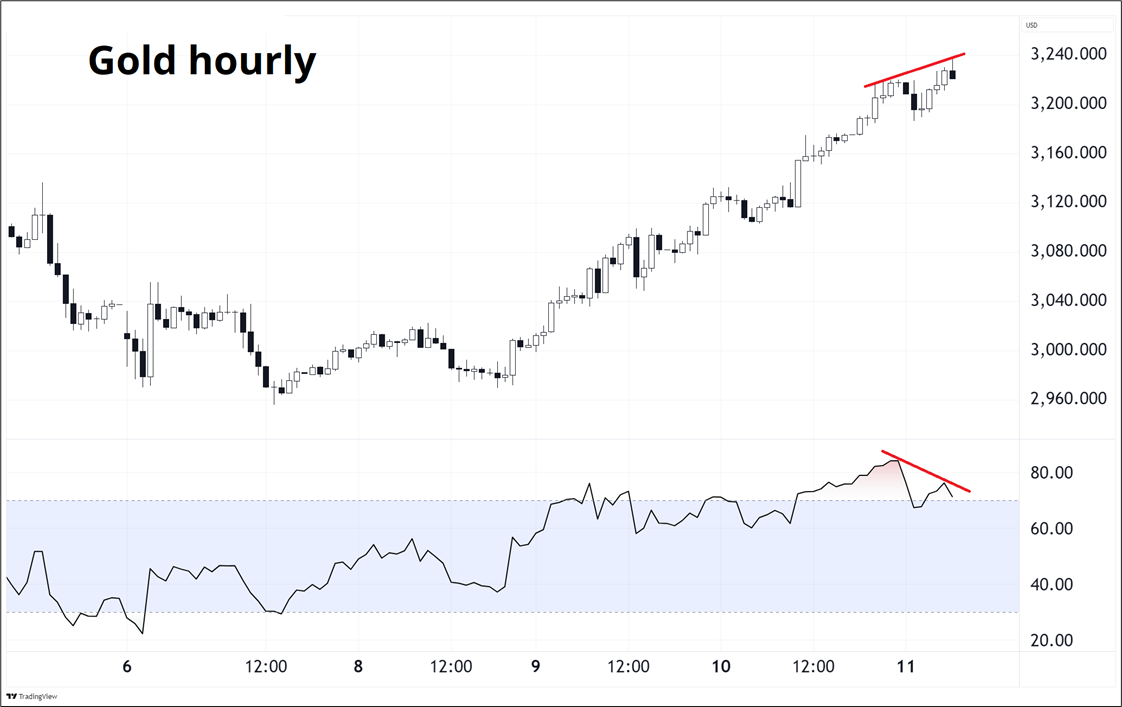

My long gold trade hit the take profit. It was a good idea with a bit of luck as the stop got super close, twice. Note that silver is not participating in this last leg of the USD collapse / gold rally. See red lines, which show silver in the charts.

Also, note that gold is making a negative RSI divergence as the first move up took the RSI to 84 and last night’s move topped with price higher, but the RSI below 80. I am happy to be out of the gold trade for now as the price action could be much less impulsive and much less bullish in the short term. If you were dying to go short silver, this isn’t a bad place to take a shot given its glaring inability to rally despite a perfect cross-market setup.

Good article via TPow.

https://www.foreignaffairs.com/united-states/trade-wars-are-easy-lose

Key excerpt:

In short, the Trump administration believes it has what game theorists call escalation dominance over China and any other economy with which it has a bilateral trade deficit. Escalation dominance, in the words of a report by the RAND Corporation, means that “a combatant has the ability to escalate a conflict in ways that will be disadvantageous or costly to the adversary while the adversary cannot do the same in return.” If the administration’s logic is correct, then China, Canada, and any other country that retaliates against U.S. tariffs is indeed playing a losing hand.

But this logic is wrong: it is China that has escalation dominance in this trade war. The United States gets vital goods from China that cannot be replaced any time soon or made at home at anything less than prohibitive cost. Reducing such dependence on China may be a reason for action, but fighting the current war before doing so is a recipe for almost certain defeat, at enormous cost. Or to put it in Bessent’s terms: Washington, not Beijing, is betting all in on a losing hand.

Money is fungible: if you lose income, you can cut back spending, find sales elsewhere, spread the burden across the country, or draw down savings (say, by doing fiscal stimulus). China, like most countries with overall trade surpluses, saves more than it invests—meaning that it, in a sense, has too much savings. The adjustment would be relatively easy. There would be no critical shortages, and it could replace much of what it normally sold to the United States with sales domestically or to others.

Countries with overall trade deficits, like the United States, spend more than they save. In trade wars, they give up or reduce the supply of things they need (since the tariffs make them cost more), and these are not nearly as fungible or easily substituted for as money. Consequently, the impact is felt in specific industries, locations, or households that face shortages, sometimes of necessary items, some of which are irreplaceable in the short term.

Have a beachy weekend.