Do you constantly recalibrate, or stick to the plan?

One should be able to see that things are hopeless and yet be determined to make them otherwise.

F. Scott Fitzgerald

Do you constantly recalibrate, or stick to the plan?

One should be able to see that things are hopeless and yet be determined to make them otherwise.

F. Scott Fitzgerald

Long USDCAD @ 1.3815

Stop loss was 1.3693, now 1.3864

Take profit 1.3998

Long USDJPY @ 148.15

Stop loss was 146.93, now 147.93

Take profit was 149.98, now TBD

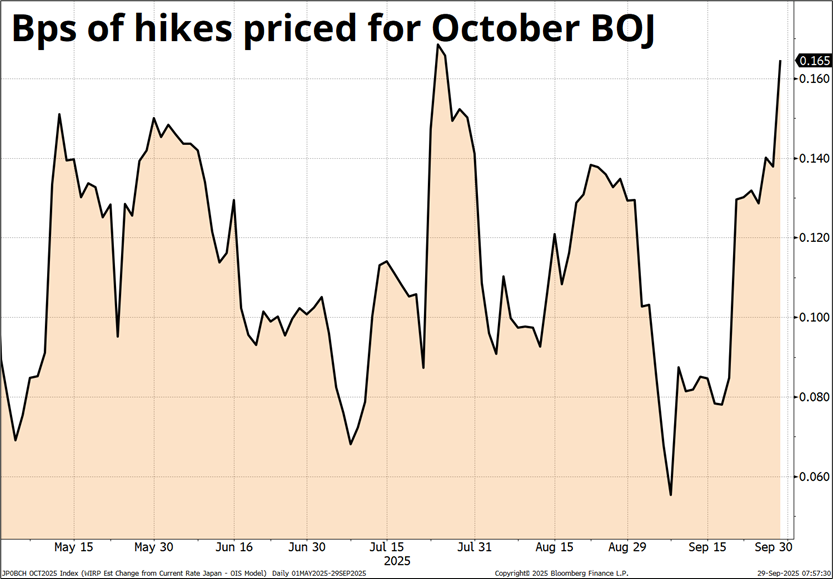

The most dovish of the BOJ doves, Noguchi, spoke last night and sounded… Hawkish. Pressure is building on the BOJ to hike at the October 30th meeting as inflation remains high, Bessent wants them to hike, wage growth remains solid, the JPY is weak, real rates are über-negative, and 2 voters dissented at the last meeting.

Years of experience has shown us that BOJ hikes are irrelevant to USDJPY, other than on the day of, or maybe the day after. Same deal with BOJ rate cuts (USDJPY collapsed after the BOJ cut rates below zero in 2016, for example). Still, we need to pay some attention to the BOJ because global fixed income trades off their actions and preferences, and there are micro-term moves in USDJPY in reaction to BOJ.

Two voters dissented last time, so a rate hike at the October 30 meeting seems like a very likely outcome to me. But it’s not a reason to be short USDJPY. US jobs data is many times more important than any tweak of the BOJ policy rate, and the LDP leadership outcome is also more important. Koizumi is the heavy favorite, and mostly priced, while Takaichi would be a huge dovish surprise (+200 points USDJPY).

I suppose you could say that the BOJ Summary of Opinions (tonight), the Tankan (tomorrow night) and two more speeches (Uchida and Ueda on Thursday) could seal the deal on the BOJ, but again, I feel like the BOJ has been and will continue to be a red herring. Full calendar follows lower on the page.

Current LDP odds on Polymarket:

While I was in Toronto celebrating the Blue Jays, USDJPY rallied to within a few pips of my 149.98 take profit but never traded there. I was off the desk, but I watched the market and saw USDJPY 149.91/94 on several occasions. This raises the perennially interesting question of whether you should stick to your take profit or hit a bid in that situation. In hindsight, the answer is obvious, I should have hit a bid. But in real life, the question is less obvious because if you do that on all your trades, you are paying a 7-pip tax and your risk/reward on entry is always modestly worse than you thought it was.

Imagine a world where you do fifty trades per year, and you sell out 7 pips early most of the time (let’s say 70% of the time) because the risk/reward is bad once you’re so close to the TP. You are going to lose 35 X 7 pips (245 pips). But in a few cases, like this one, you will save yourself 120 pips or so. Then the real question is: When USDJPY is 149.91, how many times will it trade all the way back down without trading 149.98? The answer is obviously: Not very many.

When I worked at Lehman, we had a policy of “3 pips discretion on all take profits” for a while and eventually realized that it was stupid. If you leave an order at 149.98 and the trader always does you at 149.95, you are paying an extra 3 pip transaction cost on every single order. If you’re an active bank trader, that ends up being hundreds of thousands of dollars of P&L you are giving away. So, we changed the policy to “all TPs done at the rate”. There was the occasional bummer when it went 96 paid and that was the high ahead of your 98 offer, but in the long run we all agreed that the initial plan was the best plan and there was no need to exit every trade early despite the obviously bad optics of trying to extract the last three pips from a 200-pip trade.

Honestly, I don’t think there is a correct answer—both answers lead to the same outcome in the long run. You minimize regret by using discretion to get out early, but you pay an ongoing tax on your trading. And it all comes out in the wash. Also, maybe I am trying to make myself feel better here, because I whiffed.

Still, another benefit of sticking to your original plan is that it uses less mental capital. If you consider every trade to be an infinite series of real-time decisions where you mark to market every second because you have to consider each moment a new setup with new parameters, you expend crazy amounts of mental capital. I prefer to have a plan at inception and mostly stick to that plan barring incoming new information.

The unfortunate thing here is that I knew the corporate USD buying was going to end Friday and was a bit worried about the USDJPY down into government shutdown pattern (and had been writing about that), but I convinced myself that with US 10-year yields closing at 4.18%, a breach of 4.20% was imminent and that would take USDJPY to the promised land above 150.00. Oops.

Maybe all this is just me justifying a bad decision. But I am pretty sure either strategy (fixed plan or constant reevaluation of trades as they evolve) has equal merit. I just prefer the reduced mental load of sticking with a fixed plan. Going forward from here, I think USDJPY is now more likely to retest 150.00, but I will move my stop loss up from 146.93 to 147.93 so that the maximum loss on the trade is close to zero. I will also remove the take profit (changing it to: TBD), in case Takaichi wins. 10 pips/week of positive carry is nice too, so there’s that.

The USDCAD long trade is well in the money, and I will move my stop loss up on that trade, too. In this case, I think 1.3864 is the correct stop because we have formed a nice base 1.3880/00 and have not been below 1.3900 since we gapped up through there on Thursday’s data. If that stop is hit, it’s still 50 pips of profit, approx.

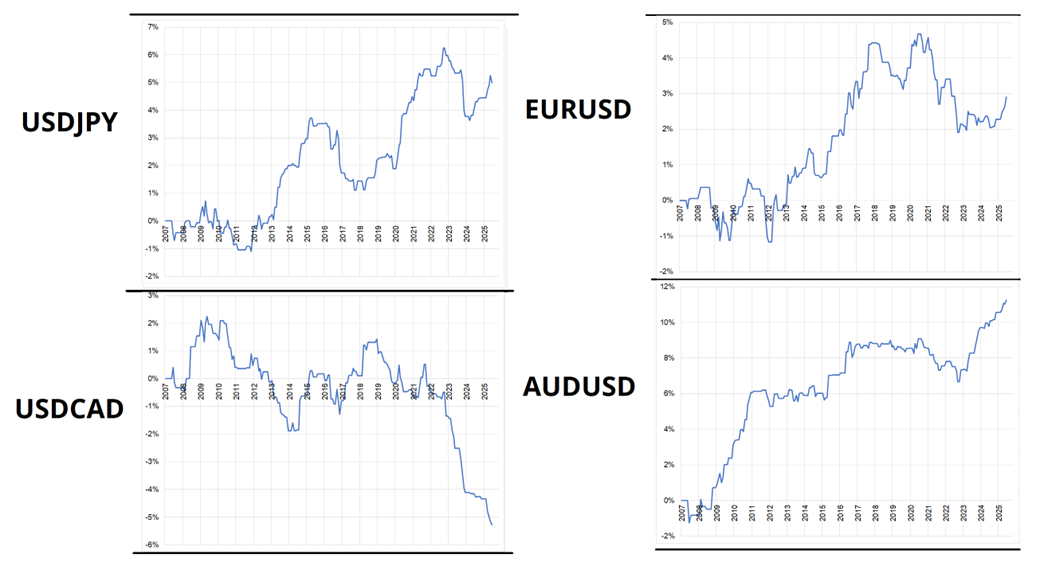

Now, with the corporate USD buying out of the way, it’s time to think about what real money might do tomorrow. The USDCAD is particularly at risk into month end tomorrow because Canadians are hedging very actively and the S&P 500 is up 2.8% and the NASDAQ is up 3.8% this month. This next grid shows you the cumulative P&L of long four currency pairs from 7 a.m. to 11 a.m. (the main month-end window) when SPX and NASDAQ are up at least 2% in total (they are +6.6% total this month as of right now).

Cumulative P&L of long four currency pairs on last day of month when: ((SPX + NASDAQ) > +2%)

You can see I am going against the flow by staying long USDCAD, but I think the pair has enough momentum to survive the selling tomorrow. You can also see that AUDUSD and USDCAD have been somewhat relentless at month end in recent years, while USDJPY tends to go up in months where stocks rallied (i.e., AUDJPY and CADJPY up even more). EURUSD month-end has been quite random since COVID.

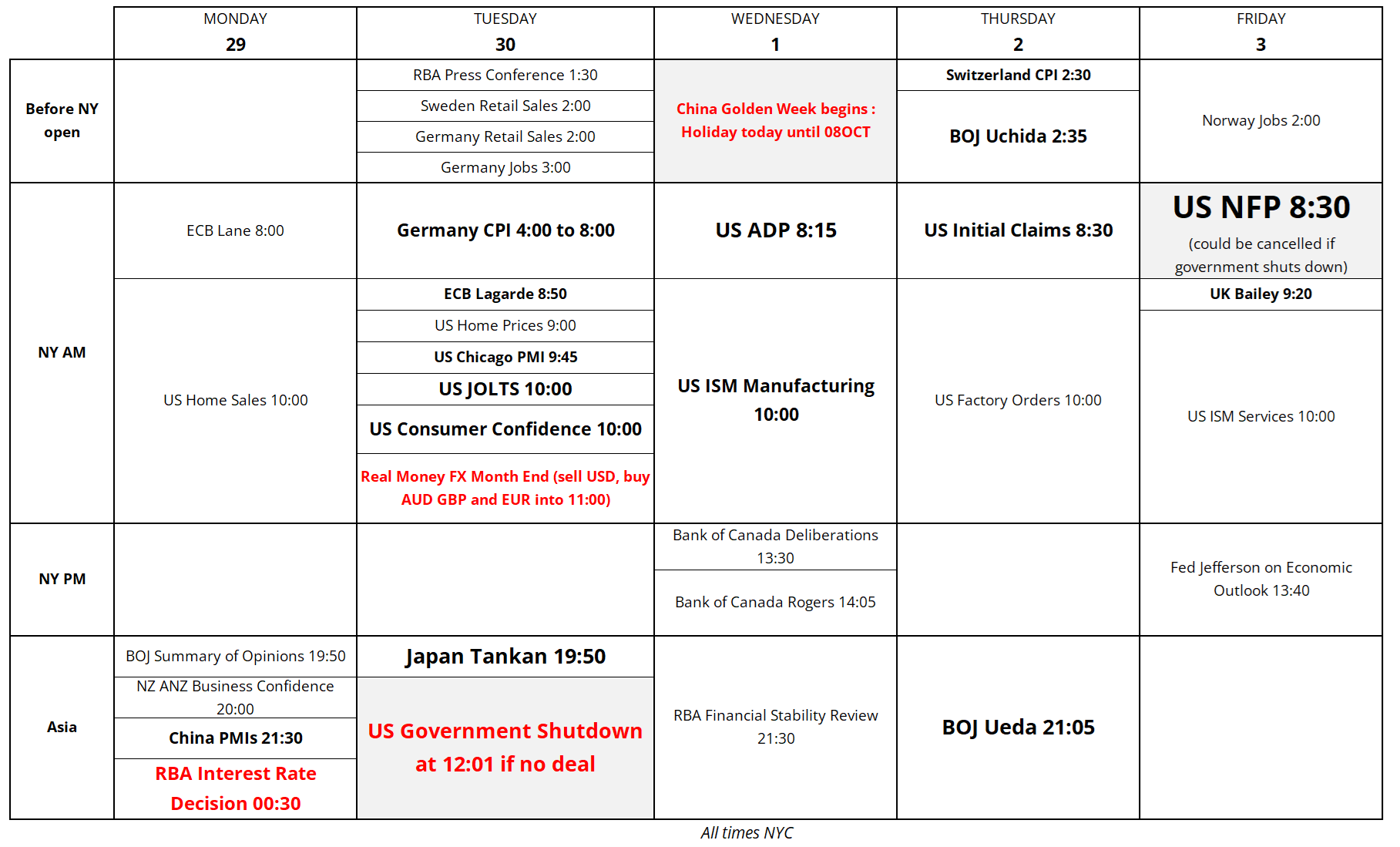

This week’s calendar is as full as the last bus. The big events will be the RBA (not much priced—one full cut by late February 2026), the US jobs data, German CPI, US ISM, US Jobless Claims, and maybe US NFP. If the US government shuts down at midnight on Tuesday, NFP will be delayed.

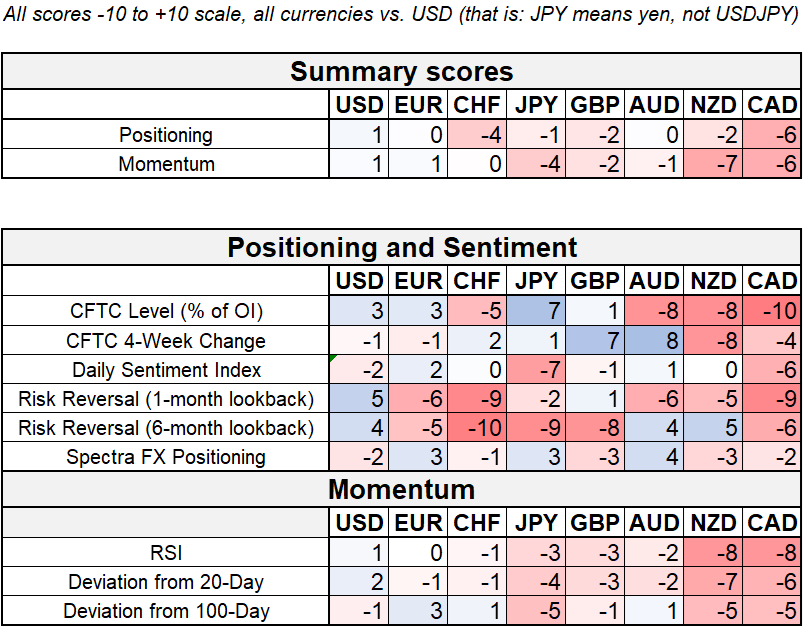

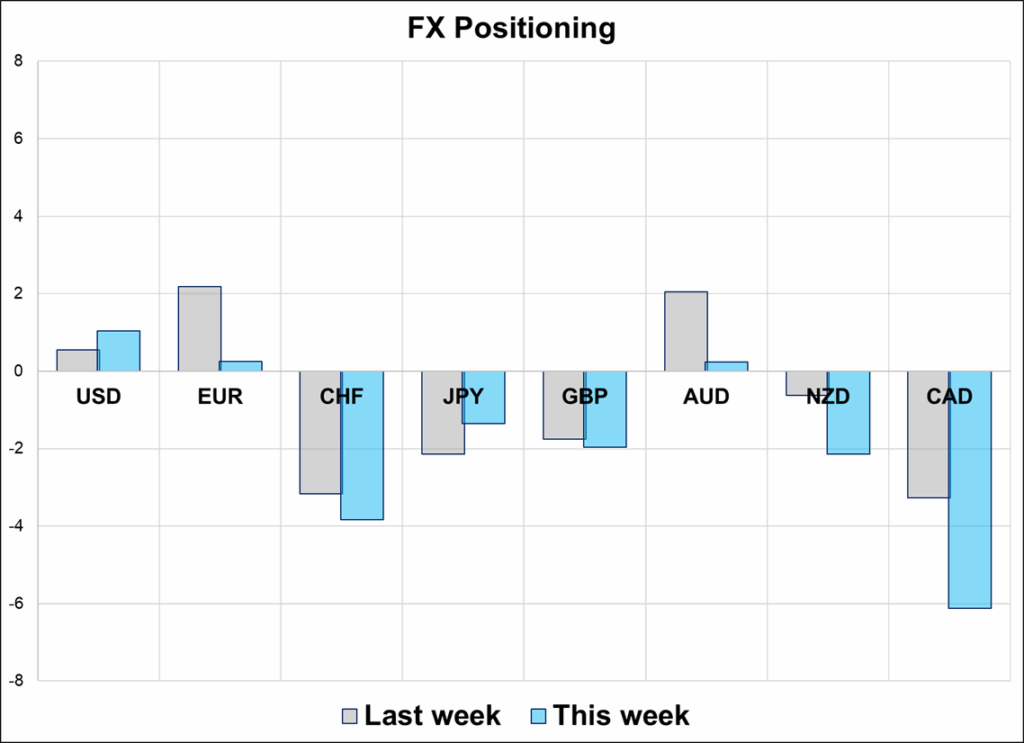

Positioning remains mixed as options markets chase USD calls, but specs more broadly are all over the map.

You can see that the short CAD score is getting pretty large there, and that is something of a yellow flag for my long USDCAD, while CHF shorts are biggish and the market is running a small short in NZD and GBP. There is more of a focus on EM than G10 right now, especially Brazil, as the Lula / Trump fight cools and vol remains low enough to make carry an attractive proposition. 5.27/5.28 remains key in USDBRL.

Momentum has pushed aggressively lower in NZD and CAD as the economic stories in both places reflect too much housing and consumer leverage in a nation of falling home prices.

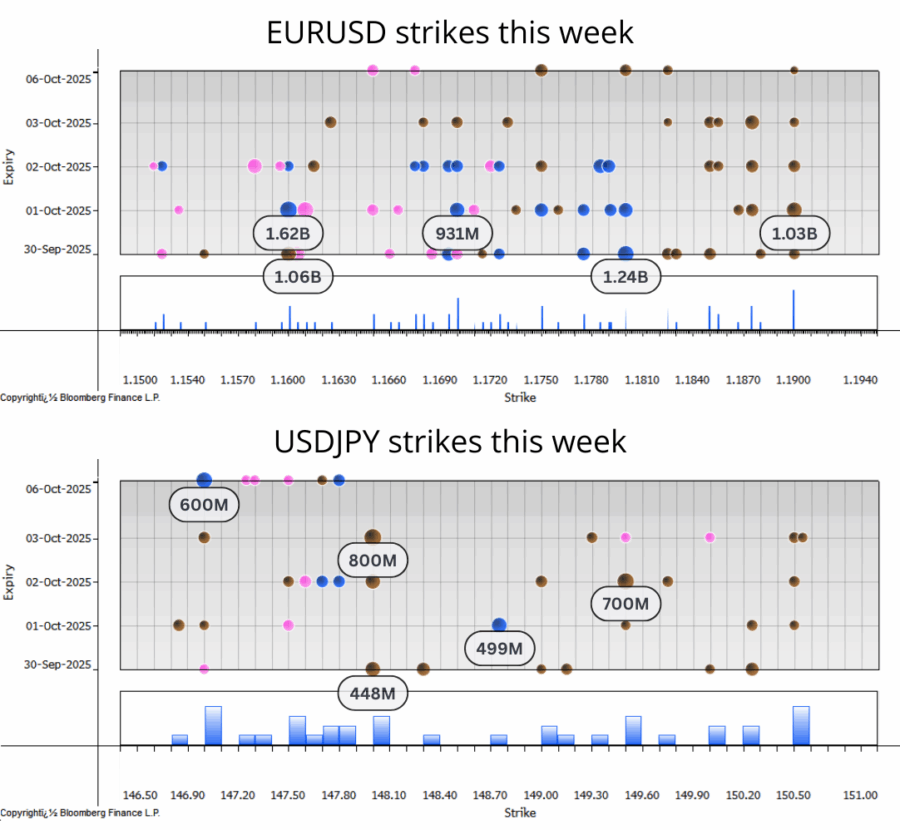

And below are the notable strikes in EURUSD and USDJPY this week. Nothing eye-popping, but EURUSD clusters 1.17 + 1.18.

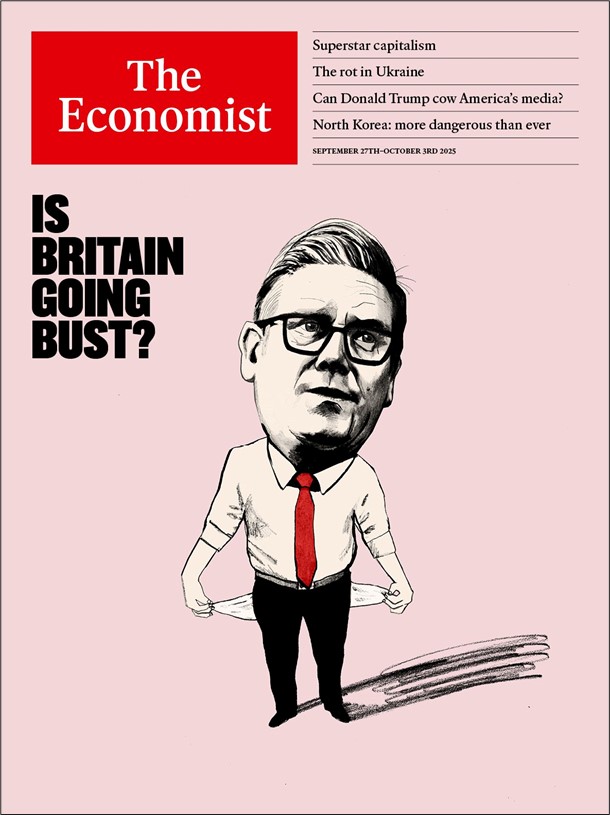

1. Can the UK experience a budget crisis, when everyone expects a budget crisis? That’s not usually how it works, but it’s possible!

Here is last week’s EU cover of The Economist, with a headline that screams “Betteridge’s Law”. This is not a Magazine Cover Capital trade because it’s the UK cover, not the US one.

2. Programming note! I’m travelling on business for a week, so there will be no am/FX until October 8th. Don’t freak out!

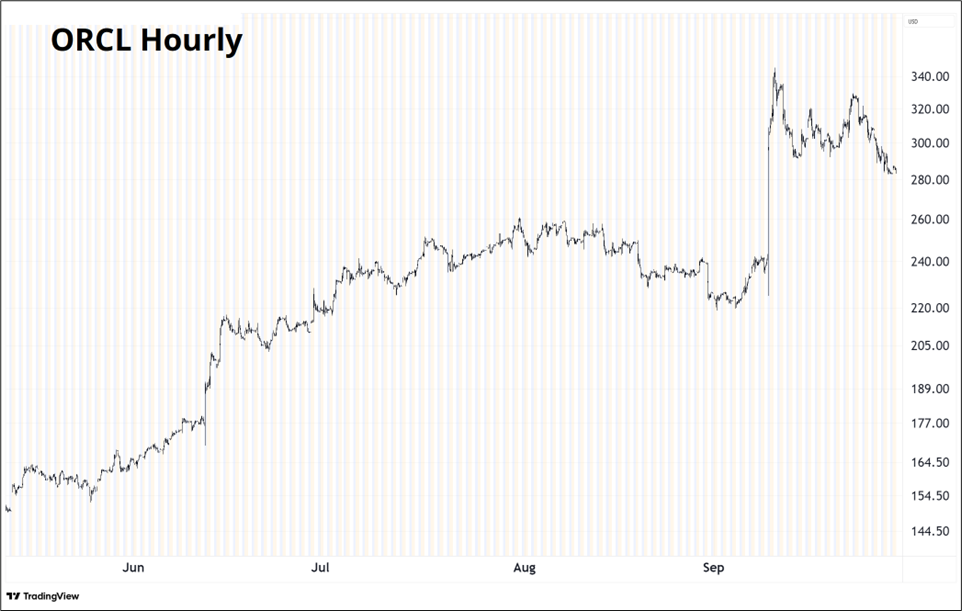

3. It looks like the market is slowly calling BS on Oracle’s $300B deal with OpenAI. It would take a move all the way down to $245 to unwind the euphoria, though. Stocks have recovered most of the losses after the most recent “AI has gone too far” scare, with the 25k ATH in NASDAQ and NVDA 185 the levels to watch. That $184/$185 zone has been MEGA resistance in NVDA on multiple waves of good news, so it’s a good one to watch if you’re monitoring overall AI sentiment ebullience.

4. https://www.thefp.com/p/nobody-has-a-personality-anymore-culture-internet-society

5. Go Jays.

Have a hopeful week.

F. Scott Fitzgerland (not Joaquin Phoenix)

“One should be able to see that things are hopeless

and yet be determined to make them otherwise.”

HT CnD