CPI as expected = vol crusher

The AI imagines a realistic photograph of the loudly crying face emoji

CPI as expected = vol crusher

The AI imagines a realistic photograph of the loudly crying face emoji

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

I suppose we got just about the most boring possible outcome here for CPI as the data continues to show inflation significantly above target, but nobody, not even the Fed, cares. The tariff impact looked minimal as inflation in apparel, furniture, and audio/video products slowed. Here’s the overall picture. Old resistance in CPI is now support and we are bouncing higher, but not in a way that is overly concerning as the Fed seems to be more than comfortable with 3% inflation.

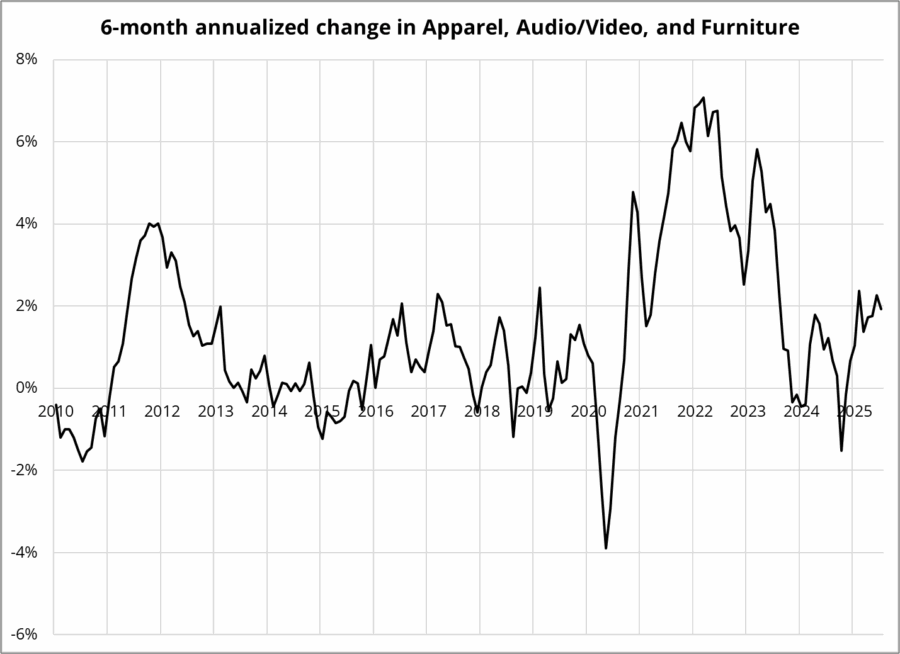

I looked at the 6-month annualized combined change in three tariff-sensitive sectors, and you can’t really see much of anything scary going on.

Good thing Ethereum is not included in CPI!

The data does not scream “action required!” as it’s pretty much right in line with expectations. Stocks popped on relief around the components, but oddly enough it’s Supercore and services driving the stickiness in inflation, not goods prices. Not exactly an all clear for the Fed, but nothing to dramatically change pricing either.

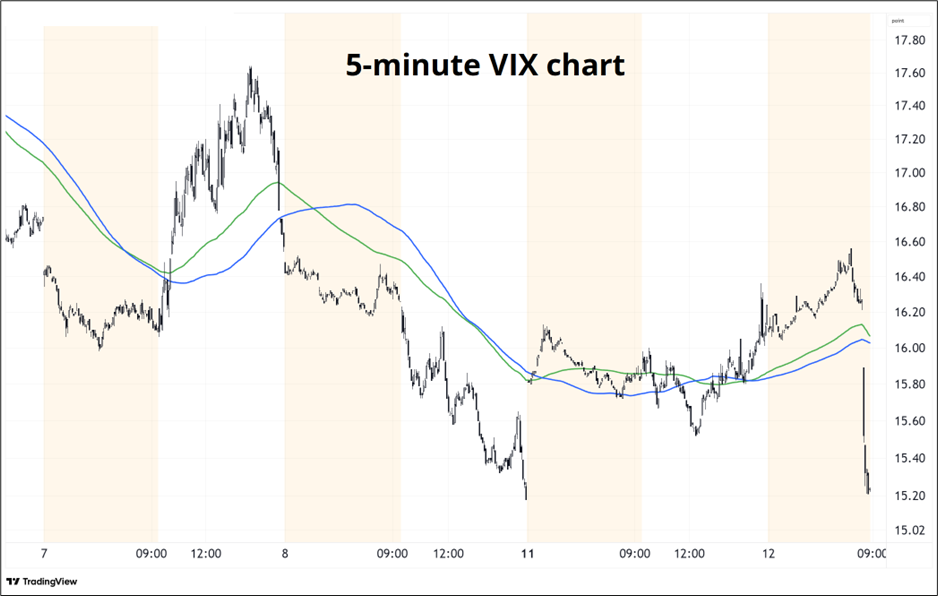

I suppose the main impact here might be vol compression as the market is prepared for an uptick in financial market volatility due to seasonality, but not getting anything to chew on. The VIX cratered on the release.

Implied vol is super low and realized is also super low. So it’s probably a good time to exercise as much patience as humanly possible.

Gold and silver are struggling to make upside headway, even as risky assets moon, crypto rips, yields fall, Fed pricing turns more dovish, an unorthodox dove and USD bear is nominated to the Fed, and the government continues to introduce a new form of economic nationalism with an export tax on chips and in-person presidential vetting of the CEO of a private company, Intel.

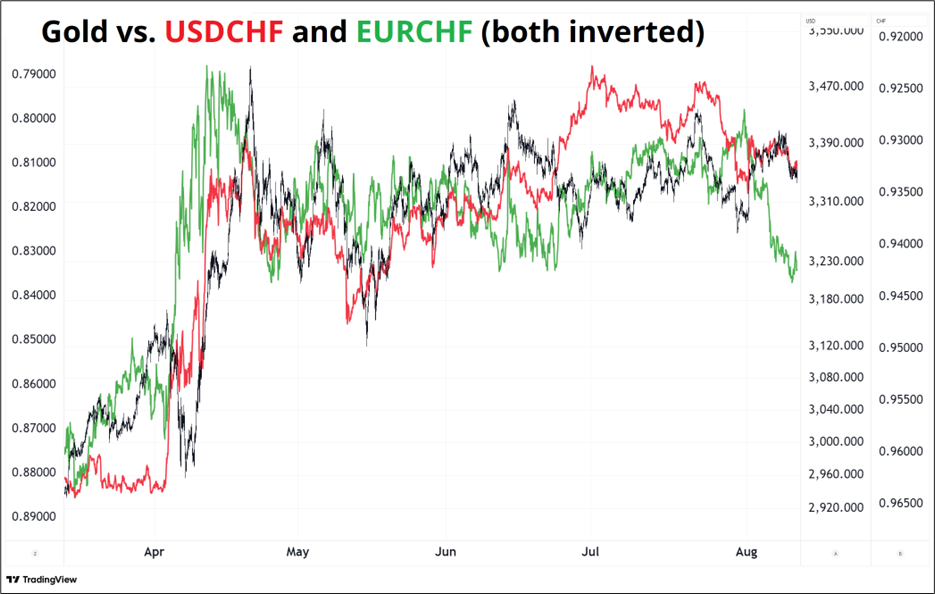

The tariff scare also barely moved gold, and so it looks like the price has reached a level where the demand curve bends lower. Perhaps the drop in economic uncertainty as tariff angst subsides is reducing upward pressure on gold. Probably not coincidentally, the CHF is showing weakness for the first time in ages.

Less global uncertainty, another flurry of hope on Russia, and equity exuberance have all taken the shine off gold and CHF.

The chart of gold itself (next chart) shows a bunch of triangles forming, with 3300 as the bottom and 3400 at the top, with the vertex approaching as the price continues the sideways action that started in April. A break through 3300 would take out the triangles and through 3245 would take out the May and June lows.

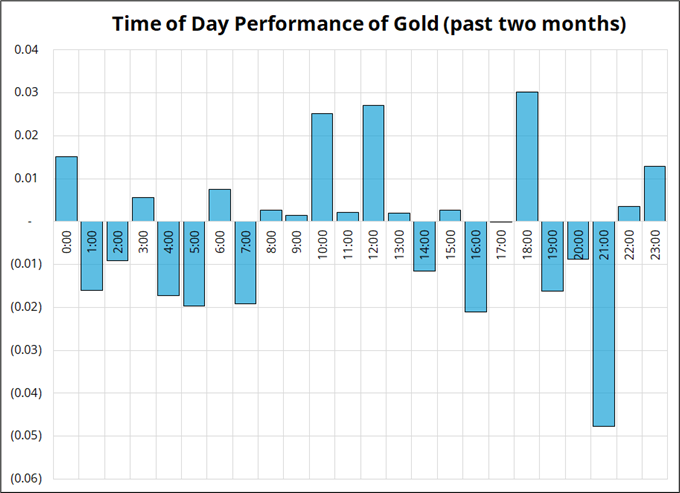

The ravenous Asian time zone demand has dissipated as you can see here:

Overall, the price action in gold is weak. But all is not lost for the bulls as long as we hold 3250/3300.

Does it ever seem like modern political discourse is dominated by crazy idiots? Well, that’s because it is. In a new paper entitled “Dark personalities in the digital arena: how psychopathy and narcissism shape online political participation”, Ahmed and Masood find that your intuition isn’t wrong:

This cross-national study investigates how psychopathy, narcissism, and fear of missing out (FoMO) influence online political participation, and how cognitive ability moderates these associations. Drawing on data from the United States and seven Asian countries, the findings reveal that individuals high in psychopathy and FoMO are consistently more likely to engage in online political activity….Conversely, higher cognitive ability is uniformly associated with lower levels of online political participation. Notably, the relationship between psychopathy and participation is stronger among individuals with lower cognitive ability in five countries, suggesting that those with both high psychopathy and low cognitive ability are the most actively involved in online political engagement.

Almost everyone blames recent political trends on their chosen enemy group, but the real culprit is social media, which has elevated the worst people in our society to positions of influence from which they were previously shut out.

I am off to see family for a few days. am/FX returns Monday, August 18.

Have a laughing / crying day.

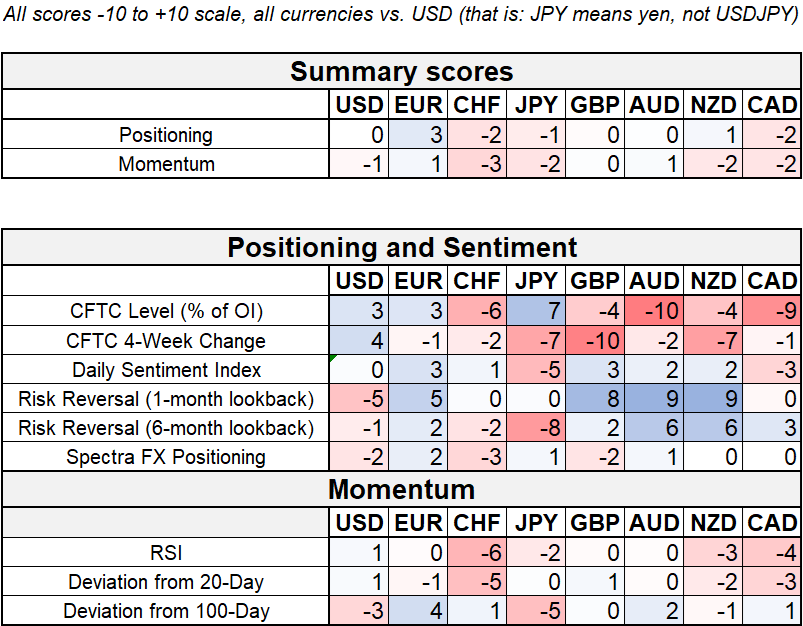

Positioning thoughts, most profound

Hi. Welcome to this week’s report. Positioning remains tightly wound around the zero bound as few narratives are found and we remain rangebound and specs get clowned up and down. Dollar shorts have long since unwound post the July 1 turnaround and while the euro was newly crowned as the reserve currency most sound, even that story appears to have run aground. AUD isn’t cooked, but it’s been nicely browned. In the background, the CFTC is still short the pound, and the UK-negative narrative remains sound.

If the yen drops, and no one is there to short it, does it still make a sound?

There are some huge 1.1500s coming off over the next two days, with a total of four yards of EURUSD XX at that level Tuesday and Wednesday. There are also some juicy ones at 1.1700. USDJPY options activity has been muted of late as 1-week USDJPY is now on a 7 handle and nobody cares. Get ‘em while they’re cheap and unpopular.

The AI imagines a realistic photograph of the loudly crying face emoji.

Weird.