If My Grandmother Had Wheels

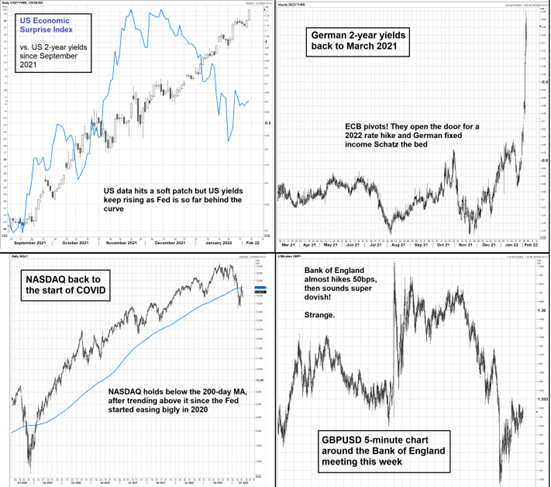

Before we start, here’s the need-to-know macro this week, in four charts:

And… US real rates are the highest they have been since June 2020. There you go. A whole week of global macro in 60 seconds. Boom.

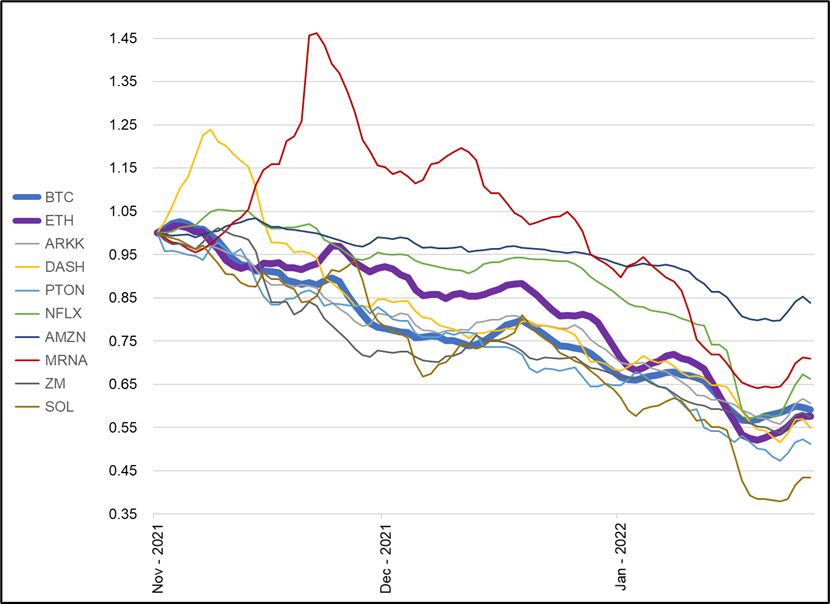

The fall of the COVID darlings

Some risky assets peaked in FEB/JUNE of 2021 (ARKK and doge, for example) but many held strong all summer and fall. But when Powell dropped transitory from the lexicon in November, pretty much everything finally buckled. Here are some of the markets that rallied “thanks to COVID” and how they performed since the end of “transitory” and peak everything in November 2021. BTC and ETH are the fatter lines just so you can see them more easily.

The fall of the COVID darlings

Performance scaled to November 9 = 1.00

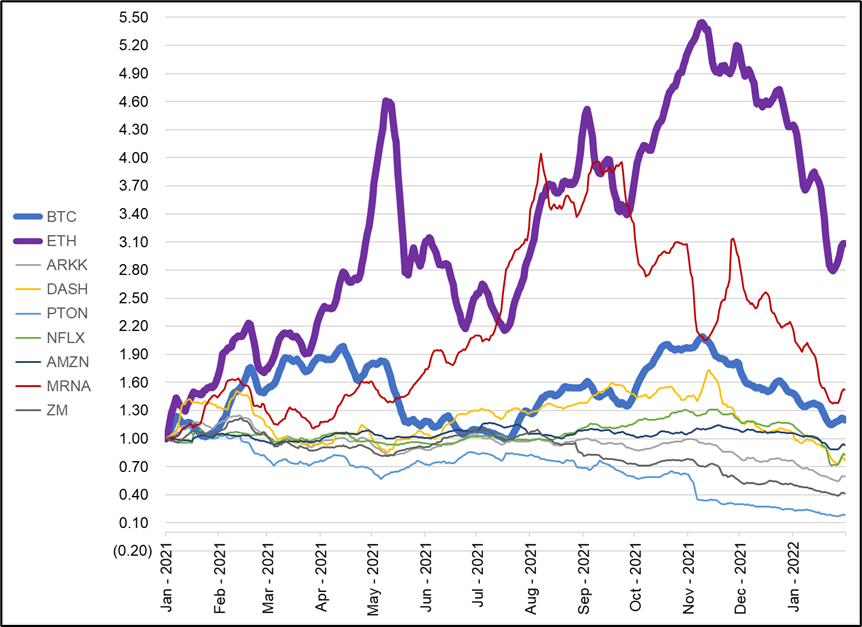

The similar moves and magnitudes of crypto and the other COVID faves might be a a tad discouraging for anyone using crypto as a portfolio diversifier, but on the other hand, here is what those same assets look like for all of 2021:

I had to leave SOL off that chart because it rallied 60X in 2021 so it nukes the y-axis. Overall, you made much, much more on the way up and you lost about the same on the way down so crypto did a great job in 2021. It’s hard to get upset about a 50% drawdown in something if it rallied more than one grillion percent in the prior few years.

BUT! And it’s a very big but… Since most economists agree sunk costs are irrelevant and most physicists agree that time moves only forward, it should not matter to you whether you bought bitcoin at $420 in 2013, or at $69k in November 2021. What matters now is not where we have been, but where we are going. Prior returns offer some insight into future volatility, but they won’t help us predict future performance.

You very often read stuff like this on the interwebs: “If you bought bitcoin in 2012, you’d be a billionaire today… If you bought AMZN in 2000, you’d be a ripped gigachad today…” True facts but also: If my grandmother had wheels, she would be a bicycle.

Sidenote, not everyone believes that time can only move in one direction. The idea that time flows forward is a hypothesis established by astrophysicist Arthur Eddington in 1927 and recent quantum experiments and theories point to the possibility that time could flow in reverse in some mirror universes that run adjacent but backwards to ours. There could be alternate worlds whose future is moving further and further into our distant past. There is an excellent and trippy book by Philip K. Dick about this. It’s called Counter-Clock World.

https://www.livescience.com/truth-behind-nasa-mirror-parallel-universe.html

Looking forward, here’s what I see:

1. Institutional adoption of crypto is bearish for volatility. Retail traders like to buy options, and risk-seeking market makers like to sell options. There will be no shortage of supply in BTC and ETH vol going forward as the firms making markets in crypto are profit-seeking risk takers, not risk averse systemically important financial institutions.

2. The merry-go-round of ETH competitors will continue to spin. I talked about this in MTC #7: These Charts All Look Like Mountains. The one super awesome world computer token to rule them all will have almost infinite theoretical value, and almost every other coin is worth just about exactly zero. This means altcoins trade like super low delta call options with mad skew.

3. The recent bear cycle confirms to me that BTC is the only cryptocurrency with a proven use case. ETH seems like it probably has one, but it also has a crazy long list of competitors. The gas fees are a constant source of consternation. The Merge is coming and maybe that will help. Or maybe it won’t. The idea is that ETH 2.0 should increase transaction speeds and reduce fees but that is not certain yet.

There is more to crypto than just optimizing the trilemma and ETH obviously has a major network advantage and a potential developer edge through its use of solidity. But for now ETH is slow, expensive and not fully decentralized. Honestly, I don’t think anyone really believes crypto is decentralized anymore with most of it happening on the cloud using central servers and running through expensive rent-seeking exchanges and gatekeepers. Then again, I’m not sure many people care about decentralization anymore as crypto has long since jumped that shark despite its genesis as a peer-to-peer electronic cash system running off the bankster grid.

With nearly infinite capital chasing nearly infinite projects, there is a non-zero chance that something other than ETH emerges as a better, faster world computer. Or maybe not. I don’t know. As I’ve written before, my goal in MTC is not to pick individual L1 and L2 and tokenomics winners. My goal is to analyze the narratives driving price and study the impact of global macro on crypto. If I asked readers to send in their theoretical list of potential BTC and ETH killers, the consensus would converge on something like:

ETH killers BTC killers

SOL

DOT (Polkadot)

ADA (Cardano)

LUNA (Terra)

AVAX (Avalanche)

ALGO (Algorand)

FTM (Fantom)

HBAR (Hedera; don’t punch me)

EOS (eos.io)

Please don’t @ me if your favorite is not on there. The table is a gimmick to make a point. Will ETH beat all those competitors and the dozens of new ones that will emerge in 2022? Maybe? Probably? Maybe not? If you are a gambler or a trader, any coin will do, as long as you are willing to take profit before it makes the big K2 mountain formation. For now, as we are in the bearish part of the bitcoin halving cycle and the bearish part of the macro cycle as the Fed and global central banks are extremely hawkish… I think you need to worry more about the downside than the upside. And with so many competitors, ETH has downside and execution risk that BTC does not.

One thing that many people dislike about crypto is the deterministic way both supporters and haters look at it. Financial markets are probabilistic, not deterministic. If someone says: “Bitcoin is definitely going to $100,000 by the end of 2022,” you should conclude one of three things a) they don’t understand how the world works b) they are overconfident and have poor self-awareness, or c) they are attempting to emotionally manipulate you so you will buy their product or pump their bags.

Successful traders and investors think in terms of probability and expected value, not absolute, guaranteed outcomes. They look at tail risks because they know that financial market returns are not normally distributed. In a bull market, everyone is a genius and none of this silly risk management and humility are necessary.

But it’s not a bull market right now.

Here is how I breakdown the expected value of BTC and ETH one year from now. First column is the scenario, second is where the coin ends up in that scenario, and the third is my subjective probability of that scenario.

You can quibble over my scenarios and my numbers, but that’s not the point. The point is that nothing in markets is 100%. Here are the main assumptions I used to build this grid:

1. 2022 is a modest continuation of the crypto bear market as financial conditions tighten.

2. ETH more volatile than BTC.

3. ETH more left tail than BTC due to substantial competition for use case.

4. ETH more downside as air still coming out of Web3 hype bubble.

This yields an EV calculation that makes BTC a positive EV bet for me, and ETH a negative EV bet for me over the next 12 months. You can do something similar for any time frame, but the error bars become crazy wide if you go out too far. It’s hard enough to guess where something might be in a year. In a complex system, the farther out you go, the less likely you are going to be able to make reasonable estimates of direction and volatility.

The good thing about making EV grids is that it rids you of the false notion that something is definitely going to happen. Something could be almost certain to happen or it could be extremely unlikely to happen, but in markets, nothing is certain and it’s best to understand and embrace that. Or just be wildly overconfident and hope for the best.

To wrap up this section, I like BTC better than ETH over the next twelve months because it has less downside tail risk in a bear market and no use case competition. I also believe that in the long run, the flippening (where ETH market cap rises above BTC’s market cap) is less likely than the macroflippening (where BTC market rises above gold’s market cap). I believe this, even though the market cap of ETH is 50% of BTC and the market cap of BTC is 10% of gold.

Do you like free things?

Are you a trader with less than 5 years of experience? I am starting a free trader education Substack to help you level up your tactics, strategy, mindset, and risk management. Walkthroughs + detailed analysis of one real trade idea, once per week. Learn more and sign up here: https://50in50.substack.com/p/what-is-50-in-50

I will try to make it interesting for professionals too… Anyone can sign up. Low risk with upside.

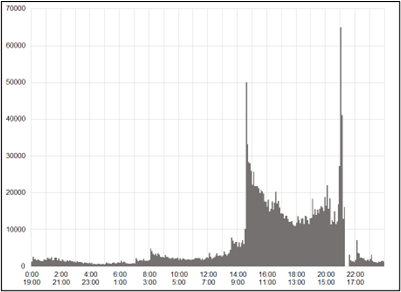

Volume by time of day in BTC

Changing gears now… If you have size to transact, it’s good to know how volumes are distributed by time of day. Even if you are a smaller trader, transaction costs (bid/offer spread) is generally correlated to volumes so if you have a choice of when to execute, it’s preferable to execute during periods of high volume. Transaction costs are tiny in isolation but can be significant in aggregate, over time.

Calculating volume by time of day is easy in most markets because there is a central exchange or two you can use for data. Crypto is global and less centralized, but I did my best. Here is the chart, using GMT, which is London time. Subtract 5 hours to get NY time, etc.

Distribution of BTC trading volume, by time of day (GMT)

Hourly data from Bitbay, Bitfinex, Bitso, Bitstamp, Coinbase, Exmo, Gemini, Korbit, and Kraken

January 1 to now

You can see in the chart that the overlap of London and New York trading and the CME hours offer the best liquidity for trading bitcoin. This is what I would have expected, but I wasn’t sure so I ran the numbers. Astute readers will recognize this distribution because it’s similar to how volume is distributed in currency markets. For example:

Volumes by time of day – EURUSD currency spot

First row of x-axis label is GMT, second row is NYC time

And in case you’re curious, here’s how volume is distributed by time of day in the analog version of bitcoin:

Volume by time of day – Gold futures (GC)

First row of x-axis label is GMT, second row is NYC time

And staying in the risky asset family, bitcoin’s grandpa, the S&P 500:

Volume by time of day – S&P 500 futures (ES)

First row of x-axis label is GMT, second row is NYC time

Did SAND trade worse after the lockup expired?

One thing I try to do in my writing and research is be honest about whatever pops out of my investigations. There is a major replication problem in academic research because what tends to happen is 19 people run an experiment and find nothing interesting, then the 20th person runs the exact same experiment and gets a super interesting result. The 20th person publishes and the first 19 do not because nobody wants to read about the study that discovered nothing particularly interesting (aka, the null hypothesis). This is captured brilliantly in Randall Munroe’s classic comic:

SIGNIFICANT IMAGE HERE

There are many ways to lie with statistics via errors of commission and omission but the most nefarious lying comes from p-hacking and significance issues where there is not always clear evidence of what might have gone before the researcher reached their final conclusion. To avoid this, when I test something, and the result is the null hypothesis (i.e,. my theory was wrong) I still publish it. Sure, it’s a bit boring but it’s transparent and honest and hopefully when I publish something significant, it’s more believable because people know I’m not just p-hacking and snooping and tweaking parameters in pursuit of wow factor.

I was bearish SAND in January, partly because I felt the GameFi hype bubble was overinflated, but also because there was a lockup expiring and it looked like insiders might sell a ton of SAND. To test whether my hypothesis was true, I looked at the price of SAND vs. three other tokens from the GameFi ecosystem around the time of the lockup expiry. If insider selling was relevant, SAND should have underperformed its peers from January 14 or so when the lockup expired.

Here is the chart:

Four Metaverse, GameFi tokens performance 12JAN21 to 03FEB21

In this case, it looks like my hypothesis was wrong. SAND went down, but only due to macro factors that took all of crypto and GameFi lower in the same period. See, I told you the null hypothesis is kinda boring! Boring. But honest.

I am excited about the future of Web3 and blockchain and bitcoin. I just think we are in a bad part of the cycle here as the hype machine is out of control, there are barely any laws (and anyone that tries to follow the laws gets punished!) … and grift is everywhere. When I send out links like the ones below, I get a lot of “OK boomer” replies (I’m talking to you, Jeff!!) but I would like to be clear about one thing:

I belong to GenX—the coolest generation.

Parting shots

ONE

Here Are The Details About Flyfish Club, Gary Vaynerchuk’s NFT Restaurant Opening in 2023

I don’t know who Gary Vaynerchuk is but when I said that out loud here everyone laughed at me. I guess he’s famous? Anyway, he’s opening a restaurant funded by NFTs. Funded by what look to me like securities that trade in the open market (on OpenSea) and reside on the blockchain. I don’t fully understand why this would be legal but I’m not a securities law expert. I watched the promotional trailer and the concept is super cool but it reminds me a lot of Star Atlas. A cool concept where you buy the token and then hope to either a) flip it or b) watch a flawless execution of an extremely difficult business plan in a hypercompetitive industry that is scheduled to come to fruition in 2 years or so. Still, pretty cool!

TWO

I played Gods Unchained (a blockchain game) this weekend. The UX of the game is good. The UX of the blockchain integration is industry standard (i.e, borderline unusable). What I did not realize until I started playing is that the game is a nearly perfect clone of hearthstone, a game which I got bored of two years ago. The “launch a token then clone an already-popular game” business model is popular in GameFi but has limited appeal, I would think. Uninstall.

THREE

https://www.vice.com/en/article/xgdvnd/the-nft-ecosystem-is-a-complete-disaster

FOUR

How’s that smooth love potion doing?

FIVE

Fidelity <3 bitcoin

Thanks for reading

bd

The big driver of crypto these days is global macro.

If you want to know global macro, sign up for my daily,

Global macro is my real job. MTC is just for fun.