Buy some mittens

Hi. Welcome to MTC#8. It’s been a while because:

1. I am bearish crypto and crypto has been going down slowly so there hasn’t been much for me to add.

2. Overall crypto vol has declined.

3. Christmas and COVID.

A summary of why I have been bearish crypto since November:

1. We are in the bearish part of the BTC halving cycle.

2. We are in the bearish part of the macro and Fed cycle.

3. A sentiment extreme was reached in mid-November when the Staples Center got renamed Crypto.com.

4. Meme stocks and ARKK rolled over massively. Overlap of themes and investors across meme stocks, ARKK and crypto.

5. Crypto can’t rally first week of the month (DEC2021 and JAN2022) which is super bearish as money still coming into crypto funds and these allocations tend to make week1 of each month very strong.

6. Massive ETH and Web3 pumping in NOV/DEC.

7. 69k high in BTC OMG. Ugly chart patterns there too with two failed breaks of the old 65k ATH.

8. Massive hiring binge and migration out of TradFi into crypto in late 2021 is reminiscent of when Wall Street overbuilds EM desks after a multi-year EM rally or of how Silicon Valley massively overinvested and overbuilt capacity in 1999/2000.

These points are outlined in detail in MacroTactical Crypto #4, #5, and #6. In MTC#4 I explained why I liked short ETH the best. I also hate AXS. ETH took forever to crack, which is typical of leaders at market turns. The most popular and most-hyped assets always hold on the longest before cracking because there are always late to the party FOMO longs on the bid on the first few corrections My target in ETH is 3010, but if you’re long, it’s worth thinking about a $1,000 ETHUSD worst case.

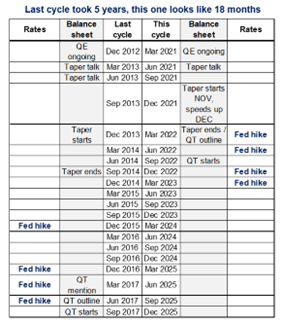

In today’s AM/FX, I explained how the current macro regime is essentially a turbo version of 2018. The box at right shows the timelines of the last fed cycle and this one. It’s important to note that quantitative tightening (QT, the reduction of the Fed’s balance sheet) was barely on the radar a week ago and now it’s the number one topic in macro. This accelerated yesterday with the FOMC Minutes as some members argued for more rapid sequencing from rate hikes to QT as inflation runs a tad out of control in the United States.

Markets tend to view QT as the most risk-negative brand of tightening policy from the Fed because it’s the inverse of the aggressive monetary easing that triggers a Pavlovian “BUY EVERYTHING” reaction each time the Fed eases. Also, 2018 was a very bad year for all asset classes and that is the sample of one QT observation we have to work with.

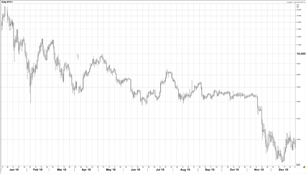

One thing I have observed over many cycles is that bulls in a particular asset class, whether it’s oil, dotcom stocks, crypto, or whatever, tend to overestimate the bull story in their personal asset class and underestimate the importance of the macro. While 2018 is an exaggerated analog for BTC because late 2017 was a full-on bubble, here’s what BTC did in 2018 as the Fed started QT.

Bitcoin dropped from $17,000 to $3,000 in 2018

It was a high-beta risky asset, not a safe haven

I think most people have wrapped their heads around this but just to be clear: Crypto is a risky asset, not a safe haven. That includes bitcoin. This has become even more true as Wall Street adoption has been an important theme. When the Fed tightens, all risky assets are less fun to own. When hedge funds and asset managers are getting killed on their tech stocks, they sell their crypto. The correlation is not close to perfect, but it’s strong enough that we can safely say crypto is a risky asset for now.

When bubbles burst, they have a curious tendency to sell off exactly 80% to 85% before stabilizing. This was true with the 2017 BTC bubble, the dotcom bubble, the Nikkei bubble, the housing bubble, and others. I do not think BTC is a bubble this time, but you could definitely argue that ETH, Web3, SAND, AXS and others are bubbles. The amount of hype on this stuff in the last 6 months and the size of the rallies is close to fitting the definition of a bubble, I think.

The conclusion here is:

· Stay bearish crypto as Fed’s QT plan accelerates. The macro story has got even worse for crypto since I started talking about the crypto bear case in November.

· Stay away from the most-hyped assets, especially GameFi where the dreams are way, way, wayyyy ahead of the reality. Blowback from the Ubisoft attempt and the proliferation of “tokenhype-first, make a fun game second” projects means the user experience is not fun enough to match the hype right now. The hype cycle is probably two years ahead of reality, at least. I play a lot of video games and I’m bullish GameFi super long term, but the hype cycle is so nuts vs. the reality that my guess is we get 80% drawdowns across the board before the next bull cycle begins.

· Imagine gigantic sell offs in ETH, SAND, and AXS. 80% from the highs in those tokens would mean we could go to: ETH 975, SAND 1.68, AXS 33. If you have FTX and live outside the US, you can short SAND, but the risk management is tough obv. I have been reading on Twitter that there may be a SAND unlock January 13 (bearish) but I can’t find it anywhere in the white paper. If anyone knows about it, please email me.

· The goal if you’re a crypto bull is to survive the winter. Winter will end when there is enough breakage in financial markets that the real economy weakens and inflation comes off. Then, the Fed will step on the gas again and the bull cycle will begin anew. Could be a while though. Buy some mittens.

bd

Current trade (From MTC#4):

Short ETH at 4210. Take profit 3010. Stop loss 4902.

I am moving the stop loss down to break even today (4210).

I will track the trade ideas and report on performance once per quarter.

Read my full bear thesis in MTC4, MTC5 and MTC6.