This is the tracking sheet for recording your trades, details about those trades, and your P&L.

You can download this as an Excel file, or as a PDF.

This is the tracking sheet for recording your trades, details about those trades, and your P&L.

You can download this as an Excel file, or as a PDF.

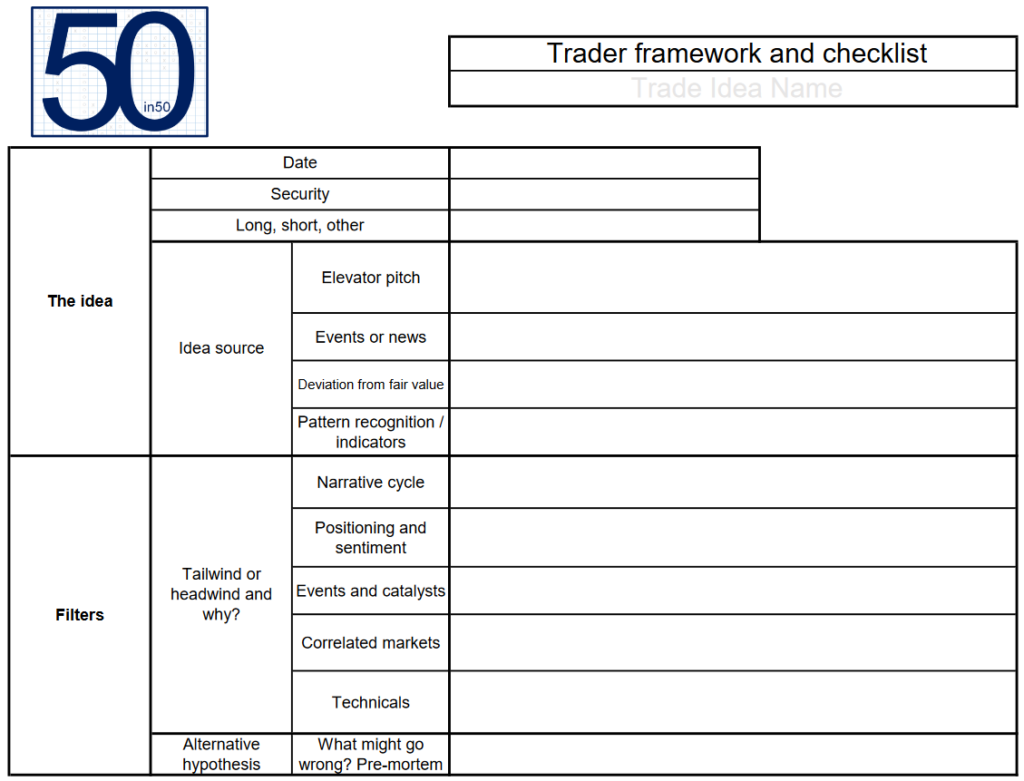

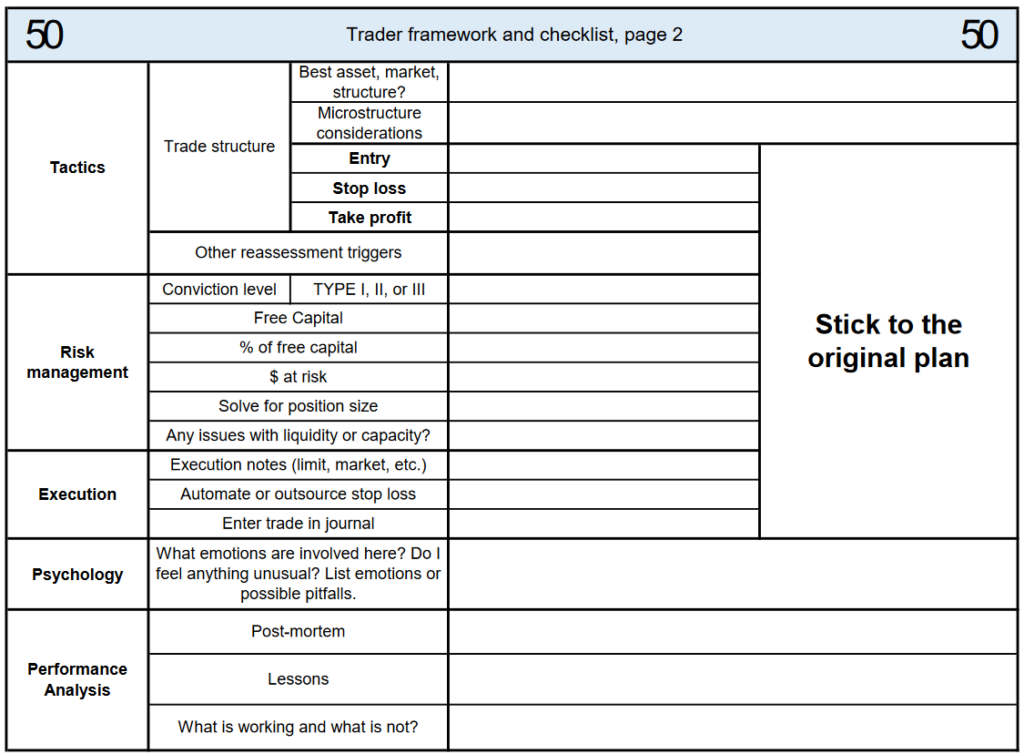

This is the checklist you can use to quickly assess the quality and confidence of your trade ideas.

You can also download this as an Excel file, or as a PDF.

Tap into the wisdom of the most respected names in global markets. Connect theory to practice and advance your career.