The soft landing that started in 2023 continues into 2026.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

The soft landing that started in 2023 continues into 2026.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Another year and the US soft landing continues. We got some jobs data today that further confirms the US labor market is producing jobs right around the breakeven level and the Unemployment Rate continues to hover in the mid-4s. The US trade deficit is getting smaller as global exporters re-route the same amount of goods and services to different countries. That is, China continues to set records for global exports, but they are going to different destinations.

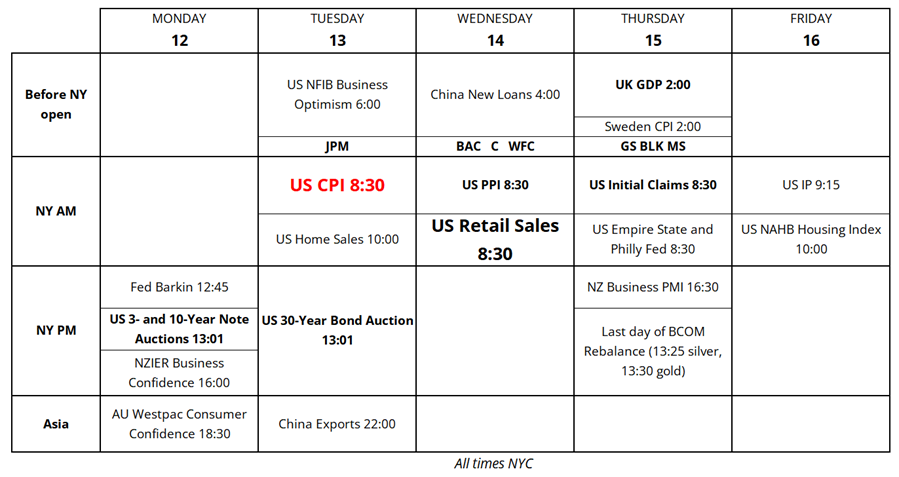

Next week, we get CPI and Retail Sales as the market looks for slowing inflation and still-strong spending as the k-shaped economy keeps on chugging.

Private inflation data (State Street PriceStats and Truflation) point to significant disinflation as the mild inflationary impact of tariffs dissipates and real-time measures of housing prices lose steam. Inflation in Australia and Germany both came in on the low side this week, too, further encouraging those with a disinflationary view. I had been concerned that commodity price and electricity inflation would transmit into consumer prices and keep things sticky, but I have jettisoned that view as the disinflationary forces appear to have the upper hand.

There has been no shortage of geopolitical news this week as Venezuela, Iran, Cuba?, Greenland?, and other countries stare down the risk of incursion by U.S. military and/or soft power. None of this matters much for short-term markets as Venny oil isn’t easy to extract and aggressive talk about Greenland is nothing new. Danish forces have been preparing just in case:

Stocks are banging around at the highs as geopolitical noise has no impact on corporate earnings and is not particularly scary for markets right now. Regime change in Iran would be a massive story for the history books but it’s unlikely to impact how much META spends on capex in 2026 or on WMT’s global earnings. So it’s not something to include when estimating equity or VIX direction.

Equity sentiment is pretty much universally bullish right now, but again, that’s not a reason to be bearish. The path of least resistance is up, even if there’s convexity to some unforeseen event or shock. Bank earnings next week begin earnings season and there doesn’t seem to be any strong reason to expect anything other than a continuation of the bull market in earnings, margins, and stocks. There are some elements of dispersion under the hood (GOOG ripping, AAPL heavy, retail favorites flat) but nothing to write home about.

With less universal excitement about AI right now, the NASDAQ has failed to make a new all-time high still and that bears watching. We’ve got ourselves a narrowing triangle bounded by 25500/26000 in NQ, so whether you’re bullish or bearish, you will probably know if you’re right or wrong quite soon.

Here is this week’s 14-word stock market summary:

Coiling technology stocks, low vol, an economy in equilibrium. Bull market until further notice.

https://www.spectramarkets.com/subscribe/

After Liberation Day, US 10-year yields shot up to 4.50%/4.60% and then traded a 4.20%/4.60% range. In early September, 4.20% broke, and that has been the top of a new 3.90%/4.20% range ever since. With inflation coming in soft in Europe and Australia this week, could we be making another clear top and setting up for a move back down in yields?

There is not much priced in for the Fed in 2026 as the market views the current economic setup the way I do: Equilibrium. The policy shock of April 2025 has subsided, DOGE did nothing on deficits or spending, the government shutdown has come and gone, and US yields and monetary policy have found their happy place.

Elsewhere around the world, monetary policy looks similarly appropriate in most countries with Canada, Europe, the UK, Australia, Japan, and New Zealand all pretty much on hold. There is less than 50bps of change priced into the policy rate for every single one of those countries.

Europe is not a country yea yeah you’re smart.

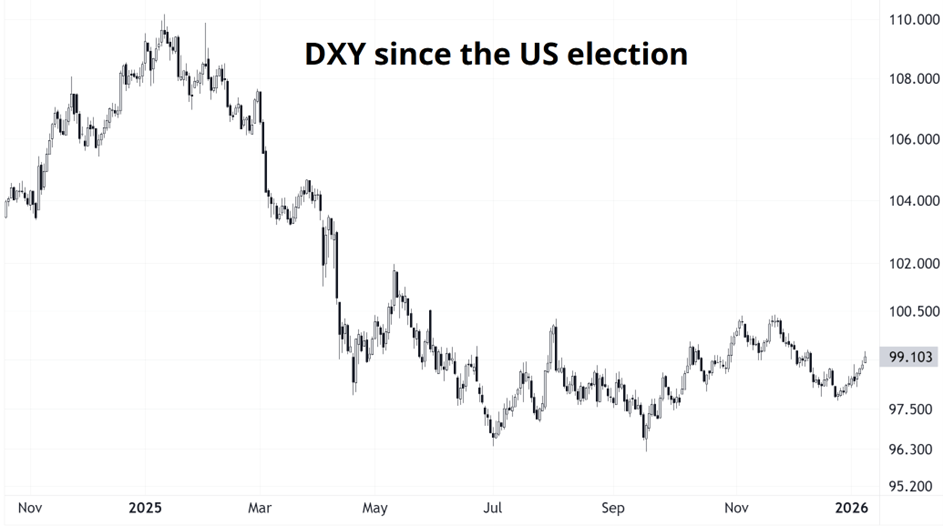

AUDUSD 2023 to 2025 is the most disappointing three-year run for a currency pair I can remember. AUDUSD, like bonds, has been in a moribund range. The market has come into 2026 guns blazing long AUD, but it’s not working very well so far. The USD has rallied a bit in the face of speculators who generally came into the year short dollars.

The move higher in the dollar so far is more about position unwinds than anything else, but there are some arguing that Trump’s latest resource capture move is another reason to believe that the US is exceptional and will benefit in the new world order.

To me, there is no coherent USD narrative right now. The market came in short USD at bad levels, they are squaring up some of that now, and there is no strong USD bullish or USD bearish narrative. As an expert in FX, I used to feel like I always had to have a USD view, but I have learned over the years that there is not always an opportunity one way or the other. Part of your edge can be patiently waiting for a real, tradable narrative.

Like bonds and AUDUSD, the DXY has been in a range for ages.

The sh*tcoins had a bit of a moment to open the year as live-at-home crypto traders took the cash they got from Mom and Dad for Christmas and put it into the most beat up “assets” like DOGE.

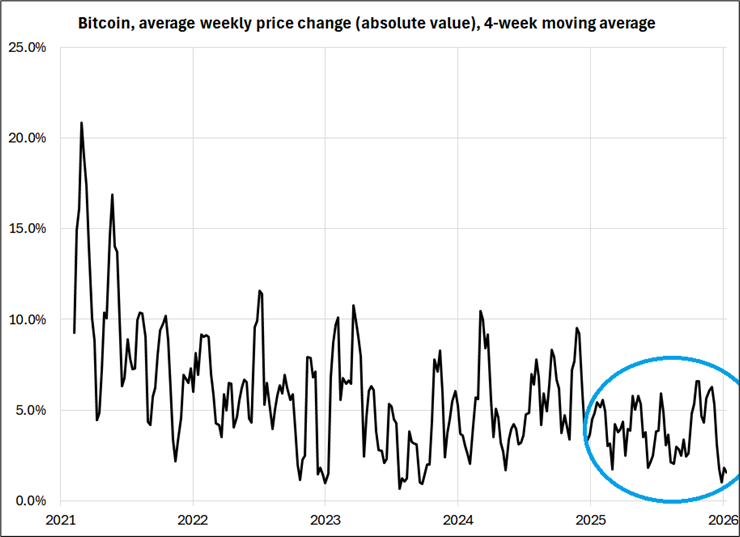

It’s not uncommon for beaten down assets to sell off into year end on tax loss selling and then mean revert as the selling fizzles and dumpster divers emerge. The biggest issue facing crypto right now is simply a lack of volatility. As bitcoin’s market cap grew, and trading becomes centralized on Wall Street, there is no lottery ticket aspect to it anymore. This means a significant cohort have moved on to silver, or OKLO, or other things that move.

Bitcoin HODLers will deem this to be irrelevant, but volatility was the engine of Saylor’s free money glitch and the DAT buying and with all that dead, it’s just made bitcoin less interesting. 2025 was supposed to the Year of Crypto as it officially transitioned from decentralized dollar alternative to the government-backed risky asset layer of the US financial system, but instead it decoupled from debasement and risky assets as those all went to the moon and bitcoin finished flat with volatility making new lows. Hmm.

Sentiment on crypto is extremely bearish, but without a catalyst to break the malaise, I suppose continued low-vol range trading is the best forecast. 75000/95000 on the wide. Back up through 100k would awaken some animal spirits and awaken dreams of a new ATH.

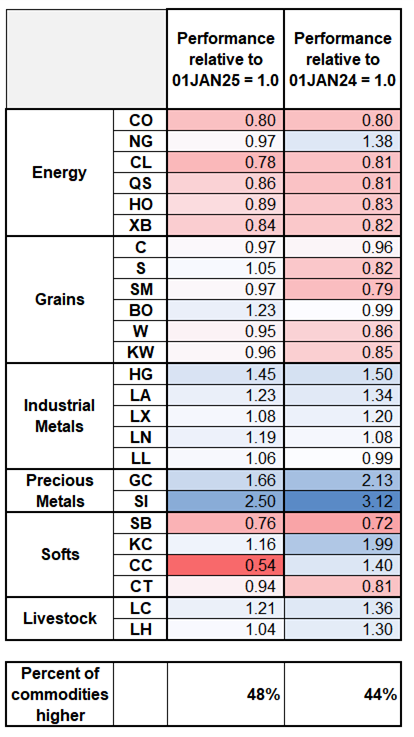

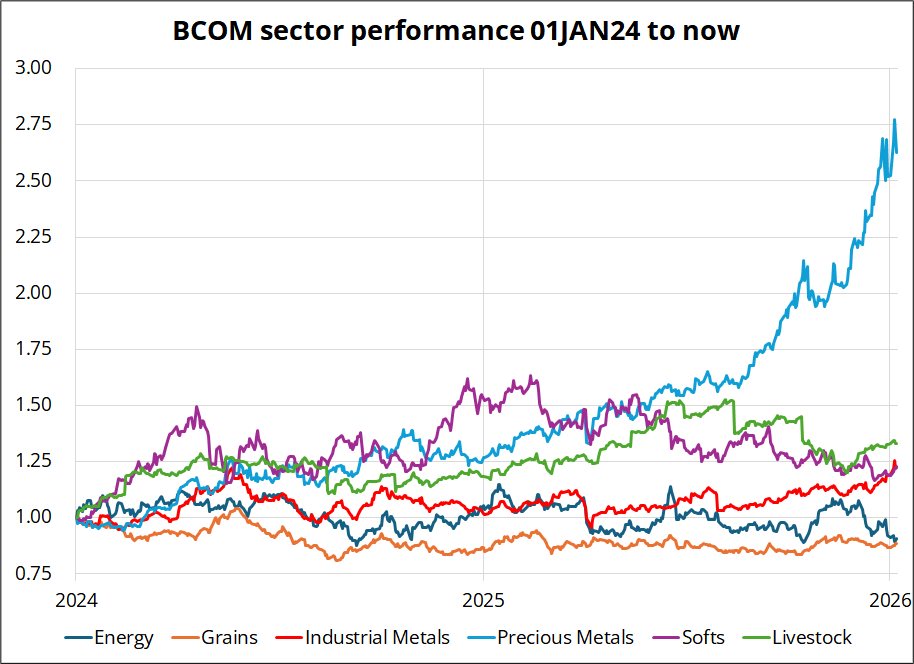

I used the term “commodity boom” in am/FX Wednesday and others have pointed to rises in the BCOM and other indexes to suggest some sort of reflationary impulse or bull market or supercycle in commodities. This has also been described as a “fiat debasement” trade, though I have been less comfortable with that terminology because when I look around, I don’t really see the hallmarks of debasement. Zero revenue stocks aren’t performing that well, crypto trades like it’s never going to rally again, and many commodities are doing nothing, or going down = Not debasement.

This is more than just semantics, because it’s hard to forecast what is going to happen in markets if you don’t have a reasonable explanation for what’s going on right now. A friend of mine who trades commodities emailed me yesterday and said that it’s not accurate to call the current thing a commodity bull market. He said: “I would describe the commodities environment as ‘bearish’ with metals as a bullish outlier”.

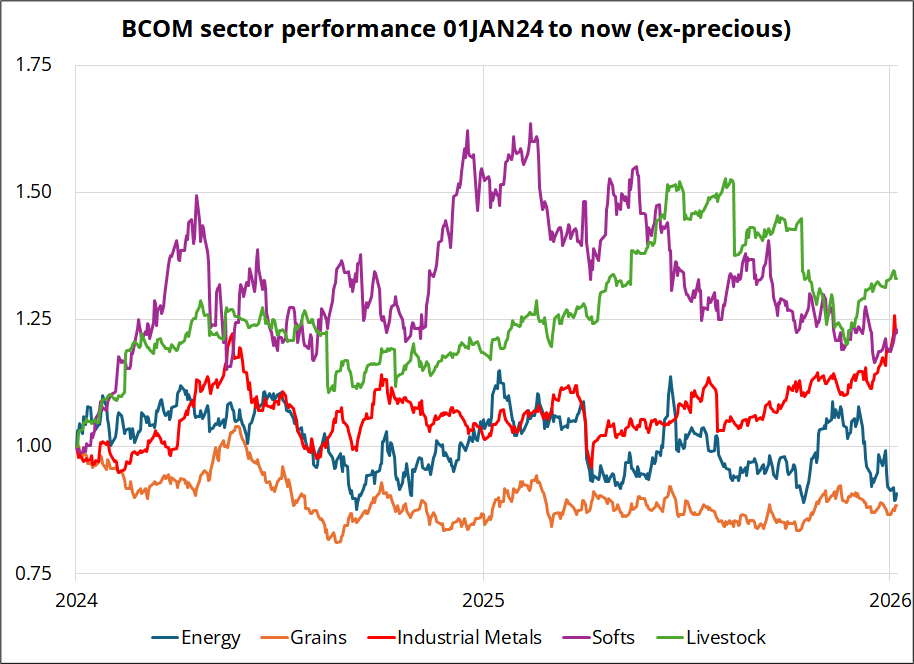

This is a significant reframing compared to what I had been thinking and compared to what you read in the financial media. Below I show the performance of the main commodities, indexed to 01JAN24 and 01JAN25.

I accept my friend’s assertion! Since January 2024, it’s metals and livestock. Since January 2025, it’s just metals.

So we can hardly call this a debasement trade, or a commodity bull market. Metals are rallying on the global energy transition and a geopolitical change (metals are now strategic) and retail and financial speculators are pouring gasoline on the fire. There is no reflation trade here. That’s why bonds aren’t selling off, inflation is unlikely to soar, and bitcoin and whatever else aren’t rallying. And there is probably no catchup trade unless you can make the case for substitution of crude oil for metals. Which you can’t.

Changing how you view the commodity story might also make you less bullish AUD if you believe a narrow commodity bull market has less bullish implications for the Oz than a commodity supercycle. AUDUSD is the most crowded FX pair out there right now and once again, it’s not being very nice.

Here are the sector baskets within BCOM, if you’re curious. All rebased to 01JAN24 = 1.0.

That’s it for this week.

Get rich or have fun trying.

*************

These are so good! Take the time to read all 26. You can find the six minutes.

https://www.gurwinder.blog/p/26-useful-concepts-for-2026

*************

A forgotten classic with big 1990s energy.

River of Deceit by Mad Season (Layne Staley)

*************

How to survive as a finance professional in the Age of Slop

By Brent Donnelly

*************

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.