It’s fine.

An excellent and mildly (but not too) disturbing short story from 1892.

Links to print and audio versions at bottom of page.

It’s fine.

An excellent and mildly (but not too) disturbing short story from 1892.

Links to print and audio versions at bottom of page.

Long 12SEP 1.3850 USDCAD call

~12.8bps off 1.3807 spot

Sell 30% of notional 1.3860/90 before 8:29 a.m., if possible

I am sad to say that CPI has not really changed the zzz narrative much as the Fed looks happy to pretend 3% is the same thing as 2%. There was a day in recent history where >3% inflation would matter for the Federal Reserve and for markets, but nobody cares anymore. Hedonic adjustment has won over among policymakers and the populace and nobody bats an eye at 53 straight months of inflation above 2%. Much as you get used to a ticking clock in the background after a while, we are now used to 3% inflation. Tick tock.

Meanwhile, Initial Claims spiked and there is some debate over whether it’s real, or simply a weird seasonal adjustment issue in Texas that will fall out next week. There has been plenty of bad news on Texas jobs in recent weeks with Conoco Phillips, Tricolor, and other organizations cutting back or going bankrupt. Today’s Claims data raises the stakes for next week’s release because if we get another 260+, that’s a big deal. Initial Claims is the most timely and accurate measure of the US jobs market. It’s better than NFP, but you need to do a bit of smoothing because any single week can be wonky.

My USDCAD trade is working a bit, and while it’s been a slow grind so far, it’s worth noting that intelligence from various banks suggests that huge USD selling took place around 1.3855/60 from various cohorts, including exporters, other corporates and gamma peeps. We chopped through some serious wood there and that 1.3850/60 area should be support now. I sold 30% of the notional at 1.3875 and it expires tomorrow so I will be selling the rest from here to 1.39.

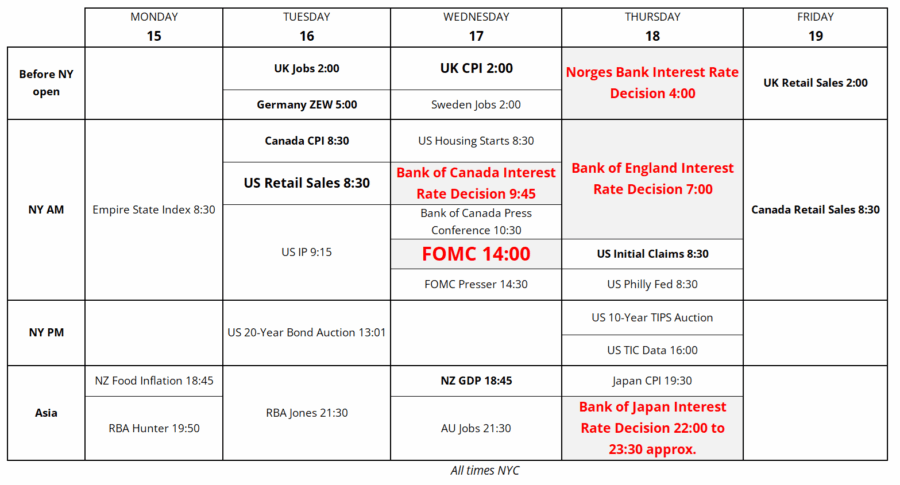

The calendar for next week is absolutely jam packed, as you can see before today’s non sequitur. We have five central bank meetings, a flurry of UK data, US Retail Sales and much more.

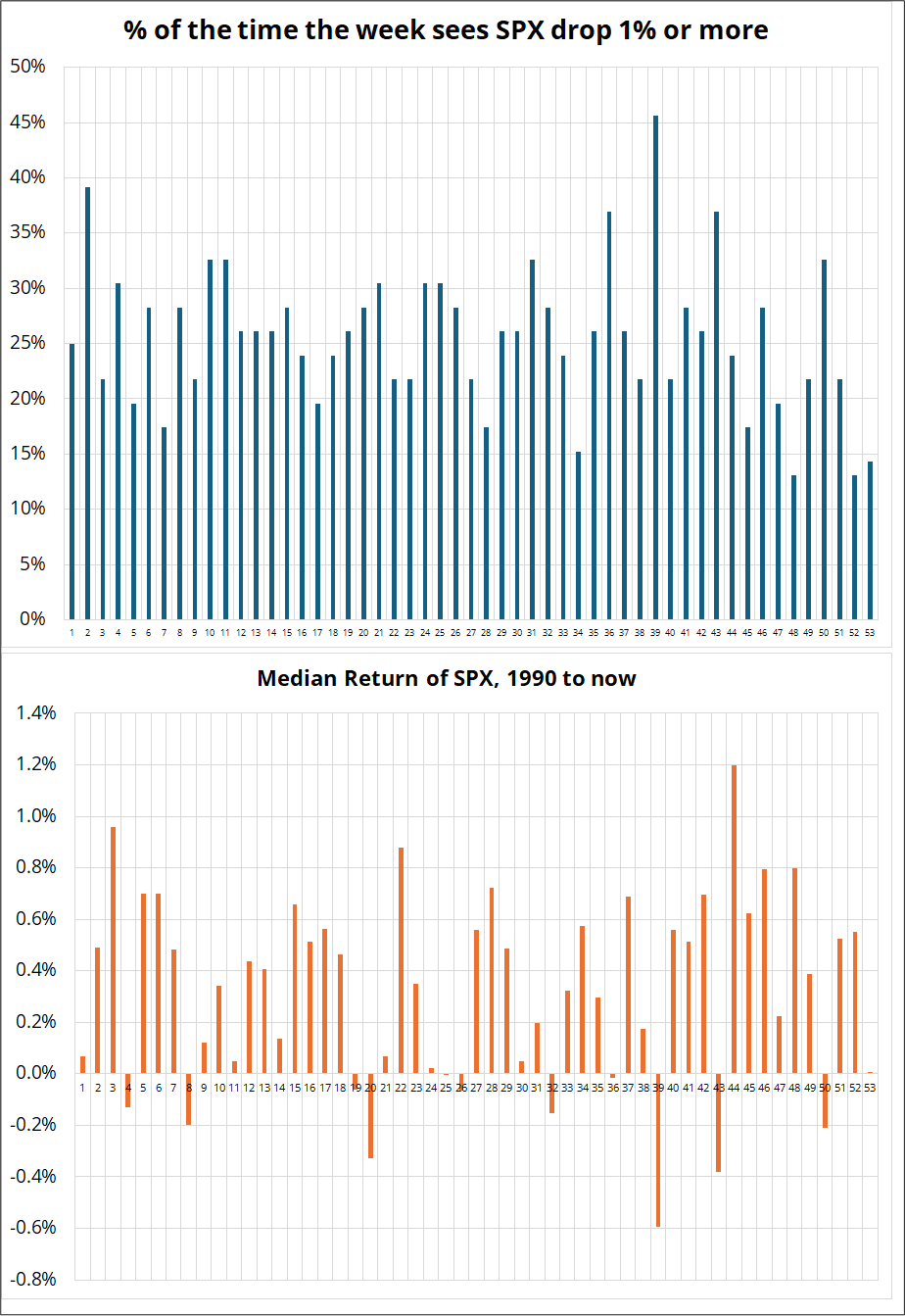

Meanwhile, the week after next is the one where stocks are most likely to have a moment. There is something special about the week after September expiry and this has been true for basically ever. Could be a bit of the old fooled by randomness, but anyway. Data below.

Something to consider. Note the bars for Week 39 on the graphic that follows.

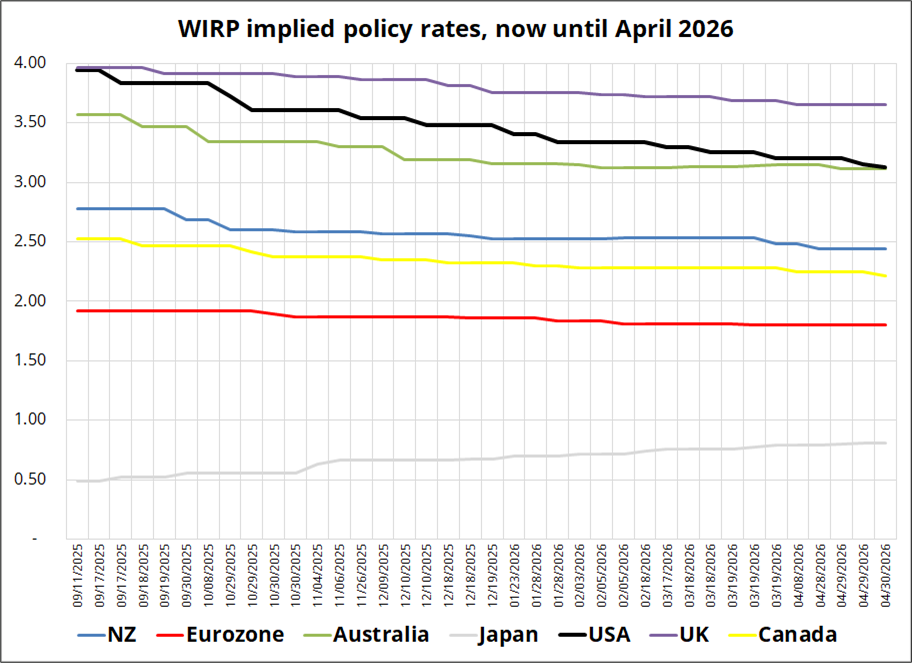

Here is what is priced in for the big central banks over the next six months. USA is the standout.

The standout nature of the USA is more evident if you plot changes (please see below).

Given the super high correlation between global yields and global monetary policy, this suggests that perhaps a fair bit of FOMC dovishness is priced in relative to peers considering where inflation is right now.

Gold looks tired to me, and I would guess we retest 3510/20 at some point. That is the new buy zone as it’s the mega breakout level.

NVDA 185 is the line in the sand.

I am off tomorrow and back next week.

Don’t forget to call your mom this weekend! I bet she would love to hear from you.

Trading Calendar for the Week of September 15, 2025

Looking for a slightly mind-melting short story to read over the weekend?

The Yellow Wallpaper, written January 1892

Full story here (30-minute read)