Preparing for all scenarios

We waited all this time for a US data release, and I just came to a scary realization: What if CPI data doesn’t matter? If the Fed is on autopilot, and they are not serious about the 2% inflation target anymore[1]… Does the October 2025 CPI print really make any difference? I suppose the real question ought to be: Is there a CPI number that will change December FOMC pricing?

I can imagine a scenario where gold drops $100 on strong CPI and then everyone realizes that strong CPI means we have even lower real rates because the Fed don’t care about CPI right now. And then gold rallies $200. For some asset classes, it’s worth considering that—barring a release that rattles December Fed pricing—today’s action could lean more whipsaw than breakout.

In FX, I think the USD will maintain its strength after a strong release because the corporate flows are coming next week, USDJPY has absorbed the minimal selling out of Japan, and there will be a seller’s strike into EOM, similar to last month. So, a strong CPI will work in the direction of the USD flows, and the dollar could follow through afterwards.

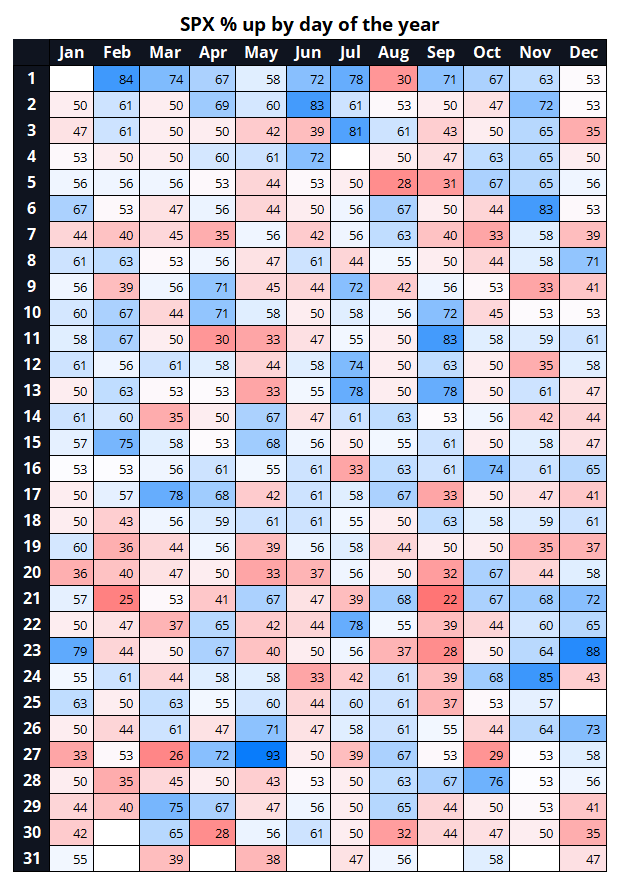

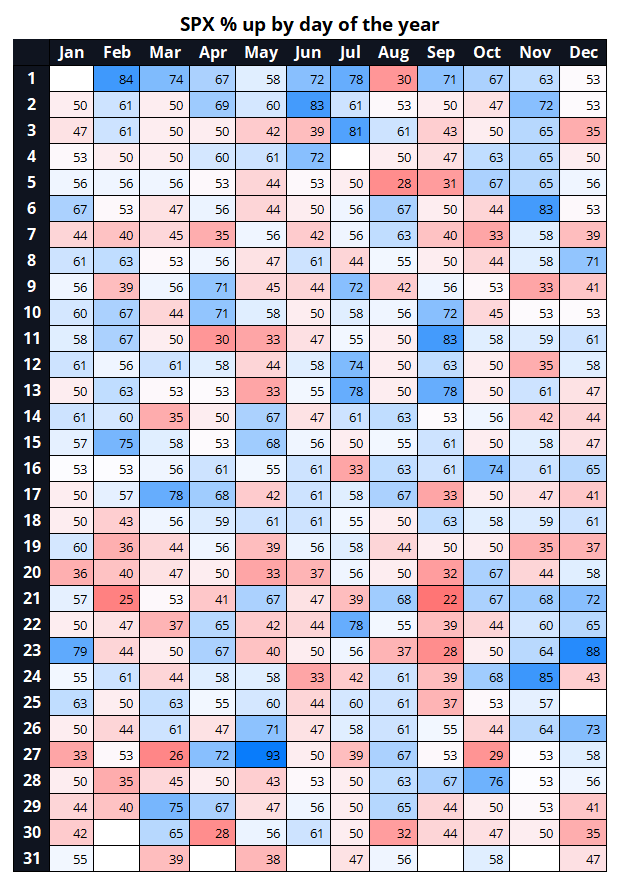

In contrast, equity selling will quickly run into bulls positioning for the seasonal explosion in early November (see first eight days of November in table below).

While one can argue that equity positioning is already somewhat long, my guess is that the NQ mini crash from 25300 to 24100 in one day (October 10) already cleared a lot of the dead wood. And the margin hikes and crapout in gold and silver have done the same. Therefore, I would view a strong CPI as an opportunity to buy stocks and metals on a medium dip.

My guess is buying these dips makes sense: NQZ5 @ 25005, GCZ5 @ 4011, SIZ5 @ 46.27 make sense.

Higher inflation + dovish Fed isn’t bearish stocks or precious metals.

It’s bullish.

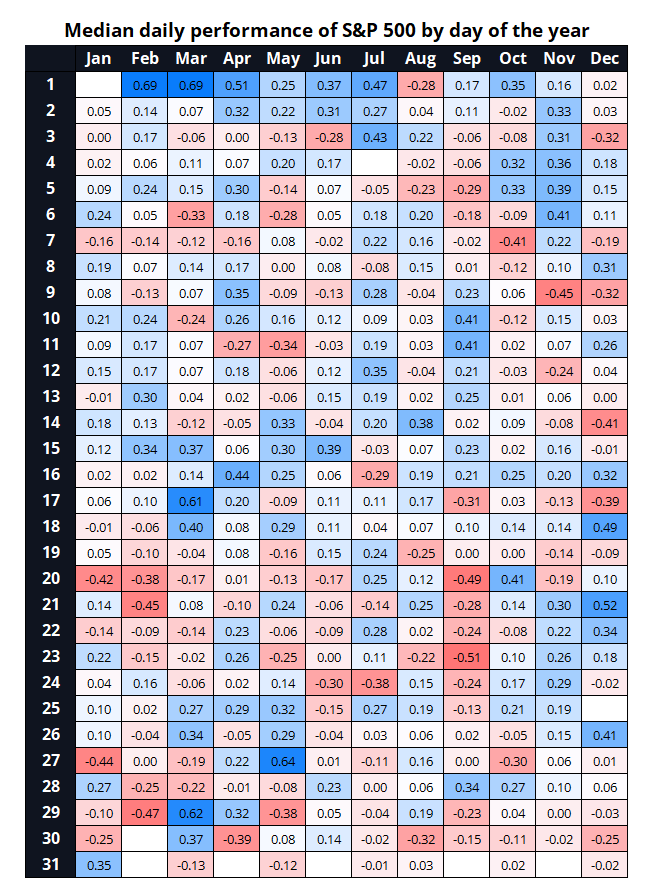

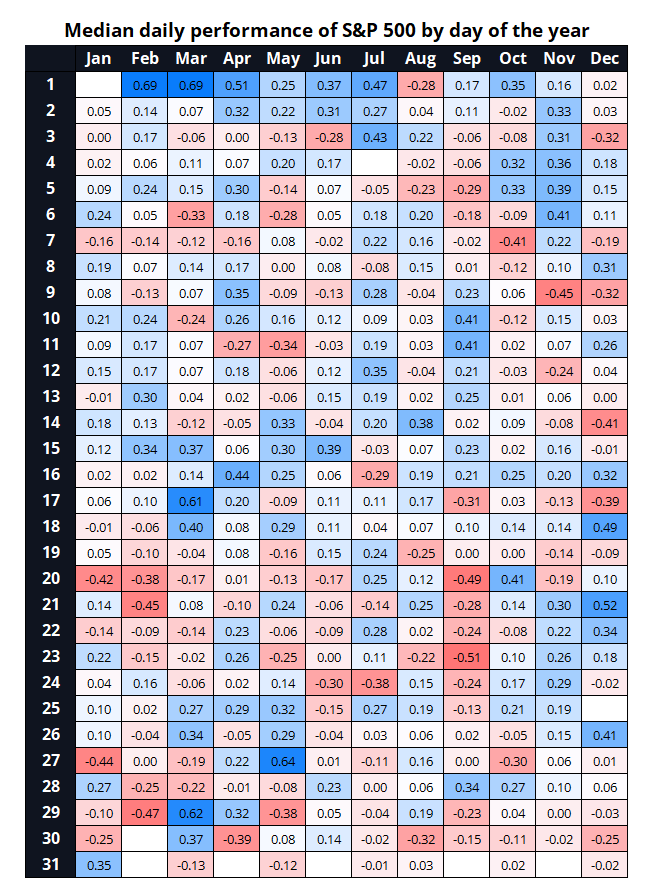

That table above showed win% by day of the year for stocks. Here are median returns. Look at those 401k inflows on the first of the month lol. And note again: the first eight days of November. Corporate blackouts fade at the end of October, and visions of sugar plums dance in our heads as carols and Christmas wrap appear in Walmarts nationwide as the Halloween merch is discounted 80%.

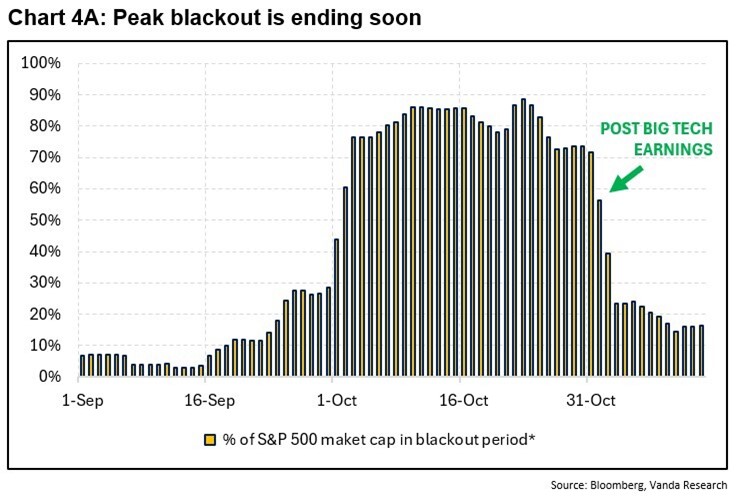

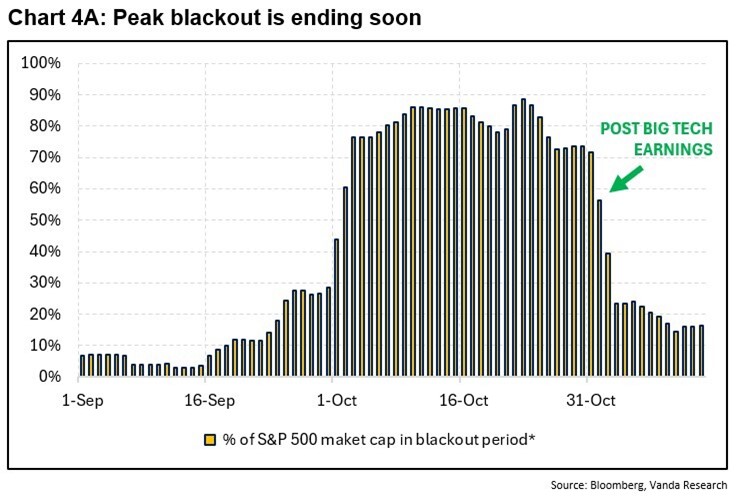

Here’s a nice chart of corporate buyback blackouts by the excellent research peeps at Vanda.

Seasonals have not worked well this year, but the market will still try to get ahead of this one in equities because it’s such a famous and reliable pattern. And it’s called the Santa Claus rally.

What kind of person would be bearish ahead of something called the Santa Claus rally?

A grinch.[2]

Final Thoughts

- My extremely specific prediction for the World Series is:

TOR / TOR / LAD / LAD / TOR / TOR = Blue Jays in 6

- I read a ton — and rarely get super excited when reading. Most of it just gets sucked in and processed without much of a visceral response. This essay got me excited. It’s just so clear and accurate and on point. And unique/original.

https://josephheath.substack.com/p/populism-fast-and-slow

It’s a 10-minute read. Worth printing or saving when you can actually pay attention. Short excerpt:

Working through the consequences of this, it is not difficult to see why the left has been unable to get much traction out of these changes, especially in developed countries. People are not rebelling against economic elites, but rather against cognitive elites. Narrowly construed, it is a rebellion against executive function. More generally, it is a rebellion against modern society, which requires the ceaseless exercise of cognitive inhibition and control, in order to evade exploitation, marginalization, addiction, and stigma.

Elites have basically rigged all of society so that, increasingly, one must deploy the cognitive skills possessed by elites to successfully navigate the social world. (Try opening a bank account, renting an apartment, or obtaining a tax refund, without engaging in analytical processing.) The left, to the extent that it favours progress, is essentially committed to intensifying the features of the modern world that impose the greatest burdens of self-inhibition on individuals.

Seeing things in this way makes it easier to understand why people get so worked up over seemingly minor issues, like language policing. The problem with demanding political correctness in speech, and punishing or ostracizing those who fail, is that it turns every conversation into a Stroop test, allowing elites the opportunity to exhibit conspicuous self-control. It requires the typical person, while speaking, to actively suppress the familiar word that is primed (e.g. “homeless”), and to substitute through explicit cognition the recently-minted word that is now favoured (e.g. “unhoused”).

Elites are not just insensitive, but positively dismissive of the burdens that this imposes on many people. As a result, by performing the cognitive operation with such fluidity, they are not only demonstrating their superiority, they are rubbing other people’s faces in it. (From this perspective, it is not surprising that the demand for “they/them” pronouns upset some people even more, because the introduction of a plural pronoun forces a verb change, which requires an even more demanding cognitive performance.)

- Useful commentary on how the US shutdown will impact future US data, via Nicholas Van Ness @ Credit Agricole.

Employment data for October will be impacted

As of last Saturday, the shutdown has now persisted through the entirety of the reference week for the October jobs report and therefore will cause some temporary impact on that data. For some of the main metrics, we would highlight:

-

- The unemployment rate would temporarily spike, as furloughed workers are considered “unemployed on temporary layoff”, though this would reverse once the shutdown ends. With the CBO estimating that approximately 750k workers have been furloughed, this would equate to a temporary spike of just over 0.4ppt in the unemployment rate.

- Nonfarm payrolls, on the other hand, would be unaffected. This comes down to the fact that furloughed workers would receive backpay once the shutdown ends and therefore would be included in NFP, as anyone who eventually receives pay is included on the payroll count. President Donald Trump has threatened to withhold backpay, but we think this is unlikely as there is legislation on the books requiring backpay.

Data quality concerns could persist even after the shutdown ends

Even after the shutdown ends, we would also reiterate that upcoming data would face some data quality concerns, on top of those that had already emerged due to factors such as declining response rates. This is because government employees have not been able to go out and collect data for most of the month of October at this point, which could leave some gaps for certain October reports. This would be less of an issue for some measures such as nonfarm payrolls, which rely largely on responses from businesses that should have historical records of their employment but could be more of an issue for something like CPI.

In this case, while alternative data sources have become more common, CPI still relies heavily on BLS agents going out into the field to collect price data and conduct surveys, meaning that the October data may have to rely even more heavily on imputation (which has already become more common even prior to the shutdown). This would mean more uncertainty and wider confidence intervals, meaning that some October releases such as CPI may have to be taken with a bit of a grain of salt.

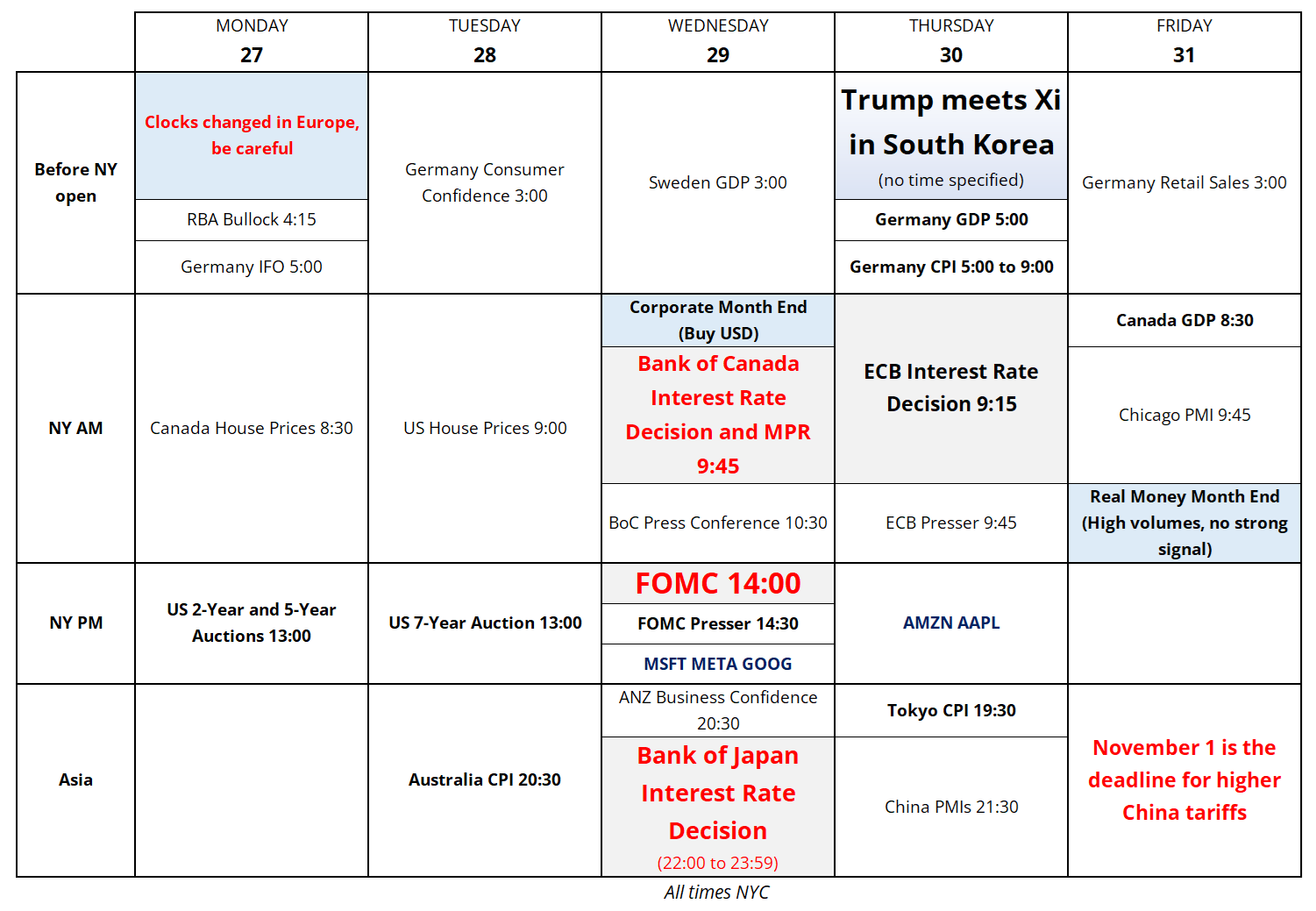

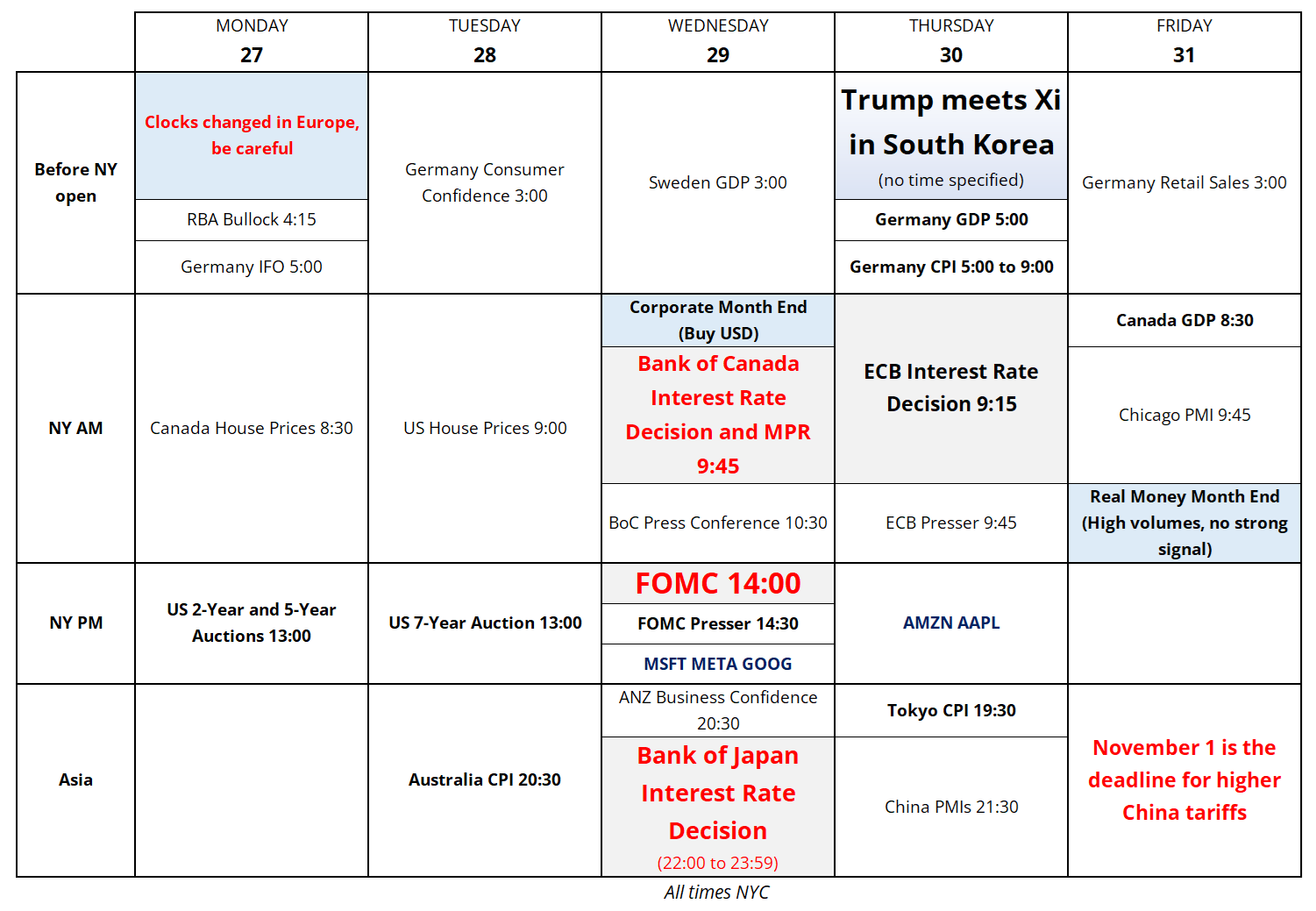

- The calendar is below and it is JAMMED. After the drought comes the monsoon. Let the blessed data and events rain down!

- The podcast with Alf is ready !

Great weekend.

Waken greeted.

Naked, we’re get!

Trading Calendar for the Week of October 27, 2025

—

[1] They’re not.

[2] Editor note: “The Grinch” is capitalized because that’s a specific character. References to “grinches” in general, are not capitalized.