Momentum unwinds, banking worries, AUD corr, and more

What global fast food chain has the most locations, you ask?

Mixue.

The tea and ice cream shop has over 46,000 locations, including more than 41,000 in China.

Momentum unwinds, banking worries, AUD corr, and more

What global fast food chain has the most locations, you ask?

Mixue.

The tea and ice cream shop has over 46,000 locations, including more than 41,000 in China.

Flat

A couple more days like yesterday, and we’re going to be talking about whether or not the Fed is going to go 50bps, not 25. We’ve got funding pressure, loan fraud, write-downs, KRE down 5%, and VIX at 27. The lesson from March 2023 is that front-end US pricing can get crazy, fast. 2s went from 5% to 3.5% in a few weeks and SOFR was even crazier.

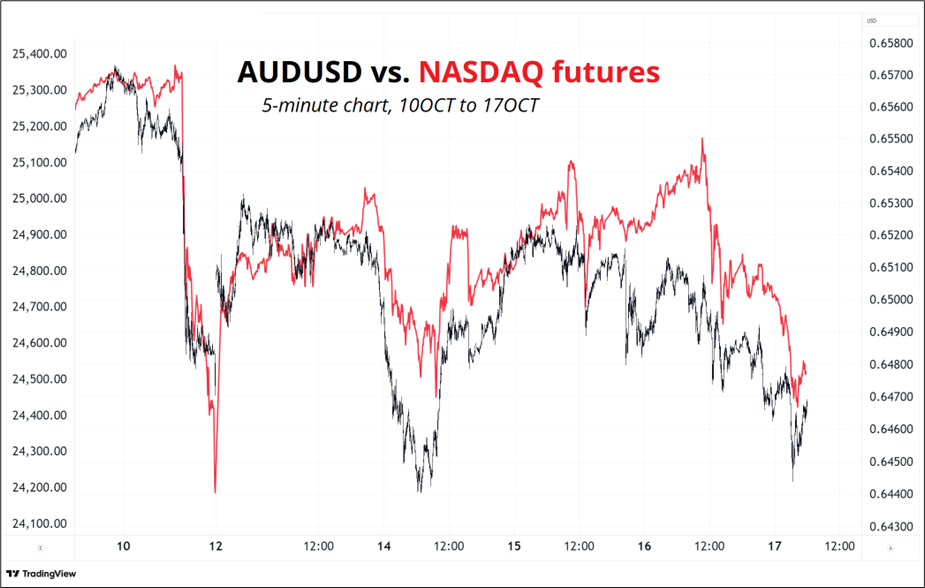

A quick follow up to my piece am/FX: Notes from Singapore. In there, I mentioned that the most in-the-know people we talked to believe that significantly increased FX hedging by Australian Superfunds into year-end 2025 is rather unlikely because the correlation of AUDUSD to US equites remains positive.

Price action in recent days drives this home. The reality is that if Aussie Supers buy AUD, it’s a Texas Hedge, not a hedge. Until the risky asset vs. AUDUSD correlation changes, they either need to have a forward-looking view on a corr flip (doubtful they would take that much career risk) or they need to chill.

Meanwhile, EUR, JPY, and CHF have all been pretty good safe havens and I would expect EUR crosses like EURCAD and EURAUD to be the best pure equity correlation plays in FX. CHF may lose its correlation to equities from here as the SNB is likely to be on the bid as we approach 0.9200. Below 0.9200 could get rather dicey.

There is some question in the market about how aggressive the SNB will be in FX given the Trump administration is watching, but they most likely intervened already in 2025 and there is no reason they won’t do so again. FX intervention is the only functional monetary policy tool they have, and they will use it if they need to. Another perfect touch of 0.9220 this morning.

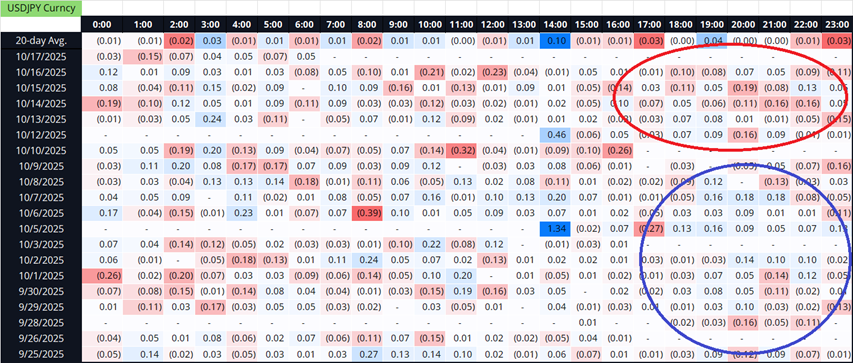

USDJPY is getting interesting as we await the final word on Takaichi’s government. The most interesting change of market behavior is that since the election, the Japan time zone has been a significant net seller of USDJPY. Japanese buying of JPY has been the missing link for ages as NISA flows continued outbound and Lifers refused to rotate to now-juicy JGBs. Japanese investors are selling USDJPY consistently for the first time in recent memory. Here’s the hourly heatmap (note how the buying (blue) turned to selling (red)).

We are left with one of the weirdest-looking hourly charts I can remember for any currency pair. Sunday gaps in FX tend to fill by Monday NY afternoon, so you don’t see many charts that look like this in currencies. The relentless fall in the rate spread, along with a steady march higher in USDJPY for 6 months is also mind bending. No reasonable human being could have predicted this trajectory for USDJPY.

With Japan finally selling … and specs burnt out from losing money short USDJPY … Maybe now USDJPY can finally dump. CHFJPY puts anyone? With the SNB lurking and Japanese investors selling USDJPY, CHFJPY lower might make sense again for the first time in a long time. I know it’s rude to even type out those six letters C H F J P Y at this point. Just consider it.

While gold would be a fair way to fade this week’s cover of The Economist, I chose long BNDW, the global bond ETF.

Below I show the updated trade tracker for the past twelve months. Big reversal in ARGT and huge rally in INTC both helped. If you are unfamiliar with The Economist as a reverse indicator, please see here:

https://www.spectramarkets.com/amfx/the-magazine-cover-indicator/

![]()

Nutty.

Have a fruity weekend.

Trading calendar for the week of October 20, 2025

What global fast food chain has the most locations, you ask?

Mixue

The tea and ice cream shop has over 46,000 locations, including more than 41,000 in China.

McDonald’s and Starbucks are close behind, with ~ 43k and 40k global locations each.