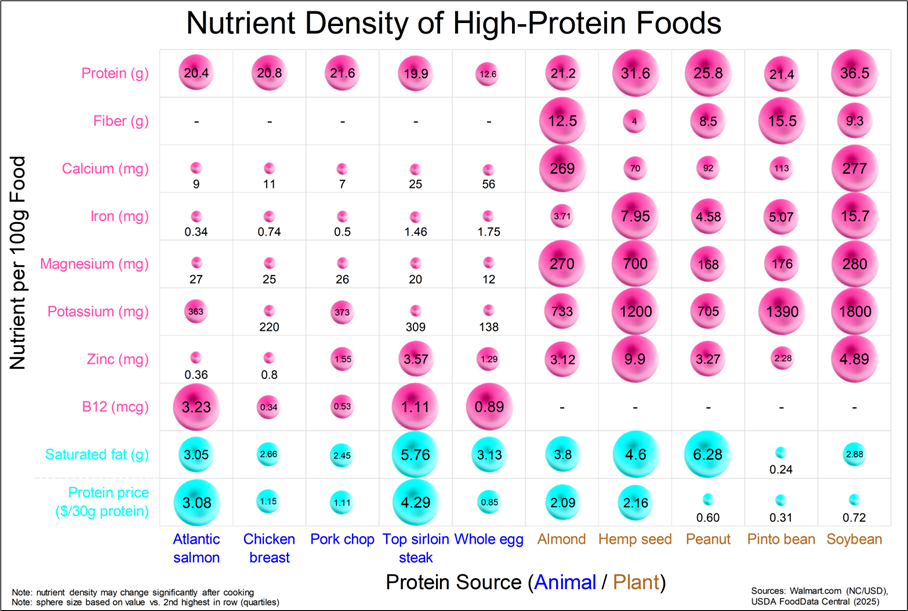

People are not raging bearish—but they ain’t exactly bullish

Larger version of this image on final page

People are not raging bearish—but they ain’t exactly bullish

Larger version of this image on final page

Flat

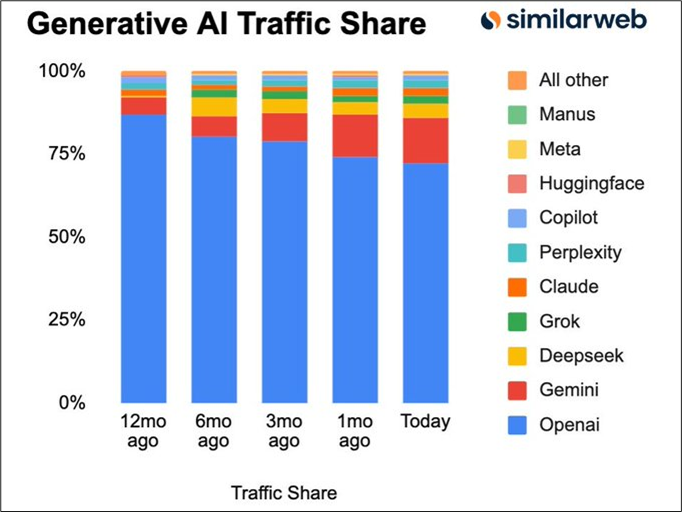

I conducted a survey late last week in an attempt to gauge the current state of AI market sentiment. I will publish the results below, but first I wanted to mention that Ben Hunt and Rusty Guinn’s new venture, Perscient, hosted a webinar on the current state of the AI and AI capex narrative.

Perscient aggregates and compiles unstructured data from millions of newspaper, MSM (tv, radio, etc.) and online media articles into useable data and narrative storyboards to help you see the relative intensity of various market narratives over time. They use the data to produce insights about various market and other narratives and offer the data and dashboards to clients. I am a subscriber, and will start to feature the output in am/FX over time (once I’m more familiar with the data and the interface). Whether or not you are interested in this new, unique source of data, you might find the webinar interesting. I did.

Click here for Perscient webinar

To learn more about Perscient, see here https://www.perscient.com/ or you can reach out directly to me and I’ll connect you to Ben and Rusty!

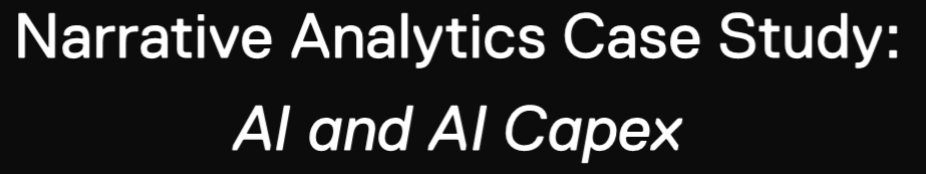

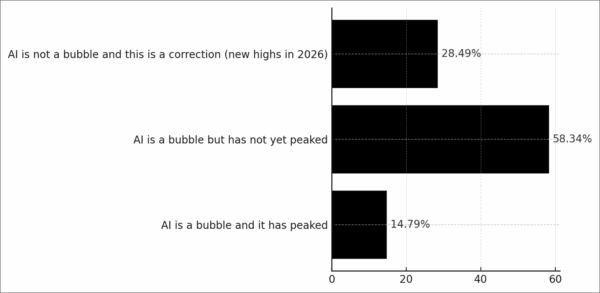

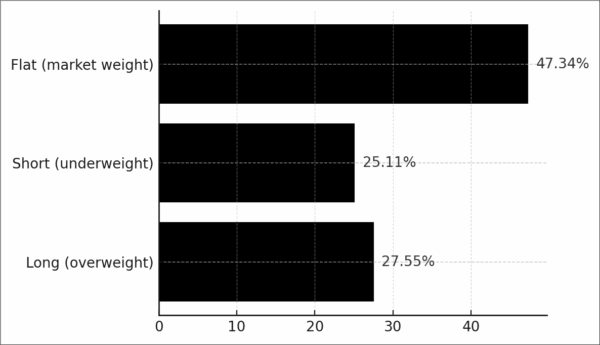

Excellent response rate on the survey as 1,109 people completed my AI into 2026 survey on Friday. Probably worth factoring in that the survey was taken after a major swoon in the AI equity complex, and so could skew a bit more bearish than if I had done the same survey a month ago. Sentiment is mixed, but leans skeptical.

Which best summarizes your view on AI and current market moves?

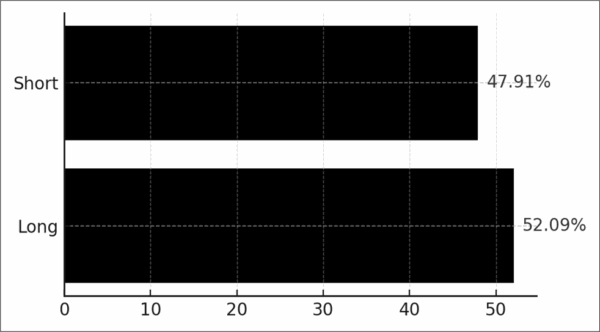

Are you currently long or short (overweight/underweight) NASDAQ?

On a 3-year time horizon — Would you rather be long or short OpenAI at a $500B valuation?

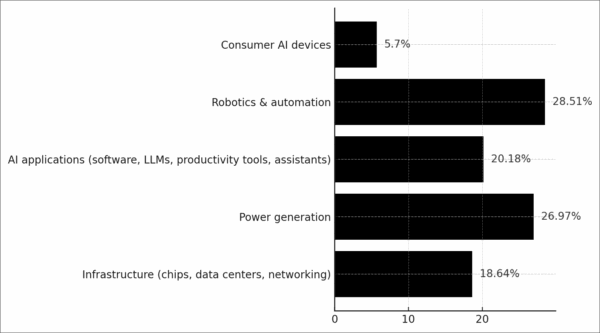

Which AI sector do you believe will generate the greatest shareholder value by 2030?

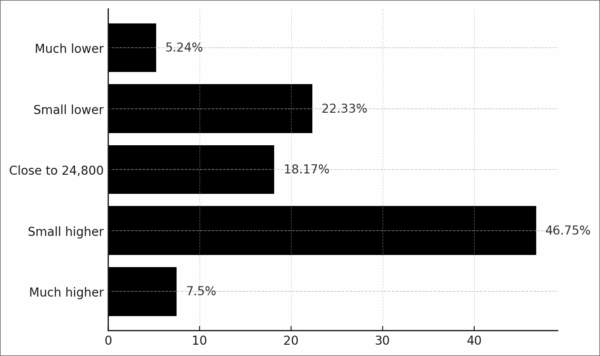

Where do you think the NASDAQ (NQ) ends the year relative to its current level of 24800?

On a 1-year time horizon would you rather be long or short NVDA ($183)?

Takeaways:

My view is that META earnings release on October 29th was an inflection point where the market pivoted from ALL AI CAPEX GOOD to HOW WE GONNA MAKE MONEY? Sam Altman’s repeat fumbles and defensiveness shone a light on the mathematics of promising $1.1T, and now we are in a different market.

That doesn’t mean everything has to collapse, it just means differentiation is now upon us. Strong companies spending reasonable amounts of free cash flow on AI are still in favor, but debt-financed capex with no clear payoff is not.

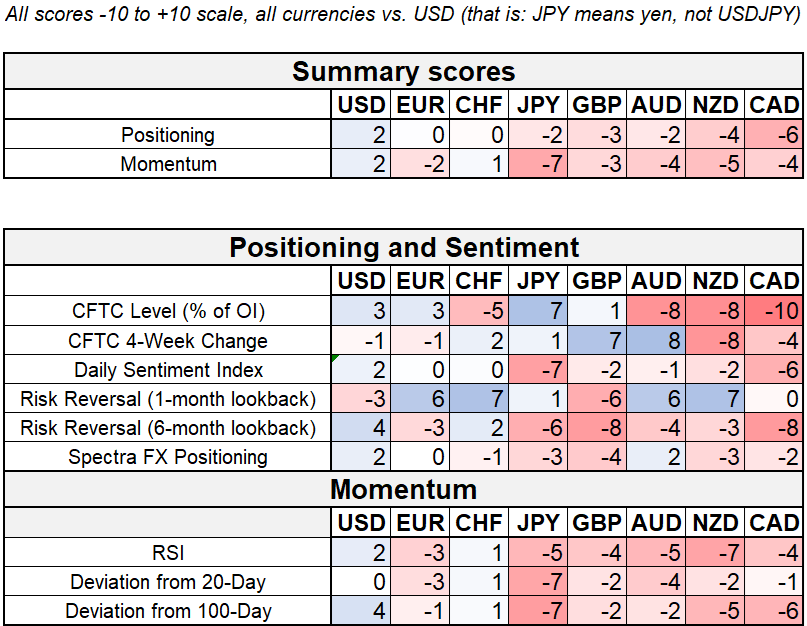

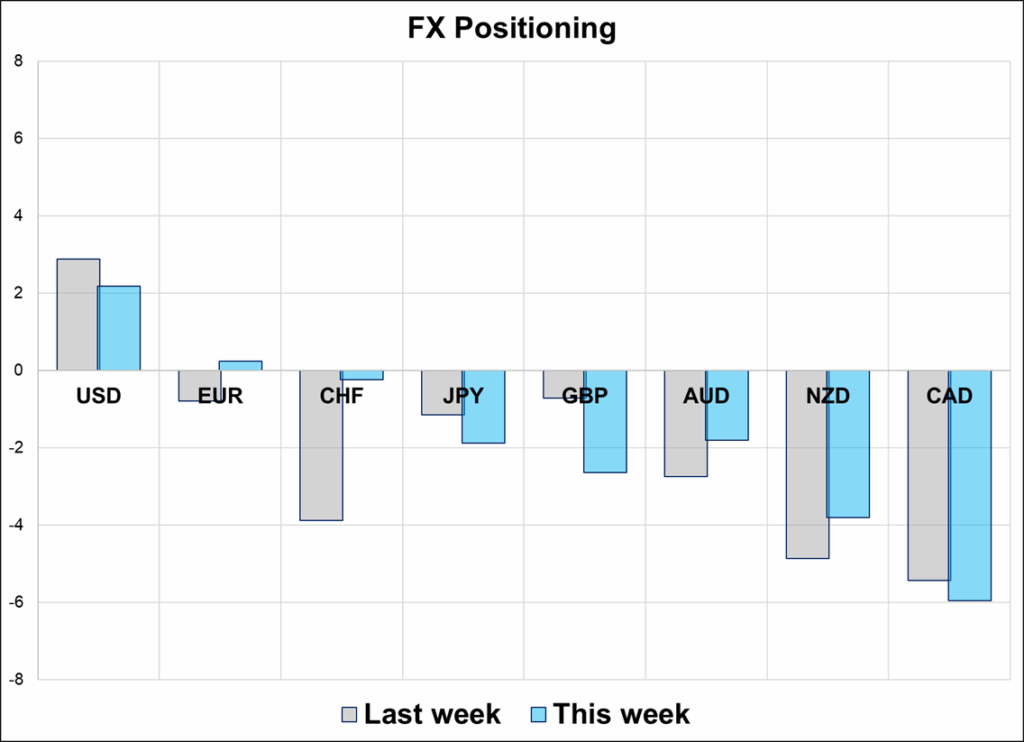

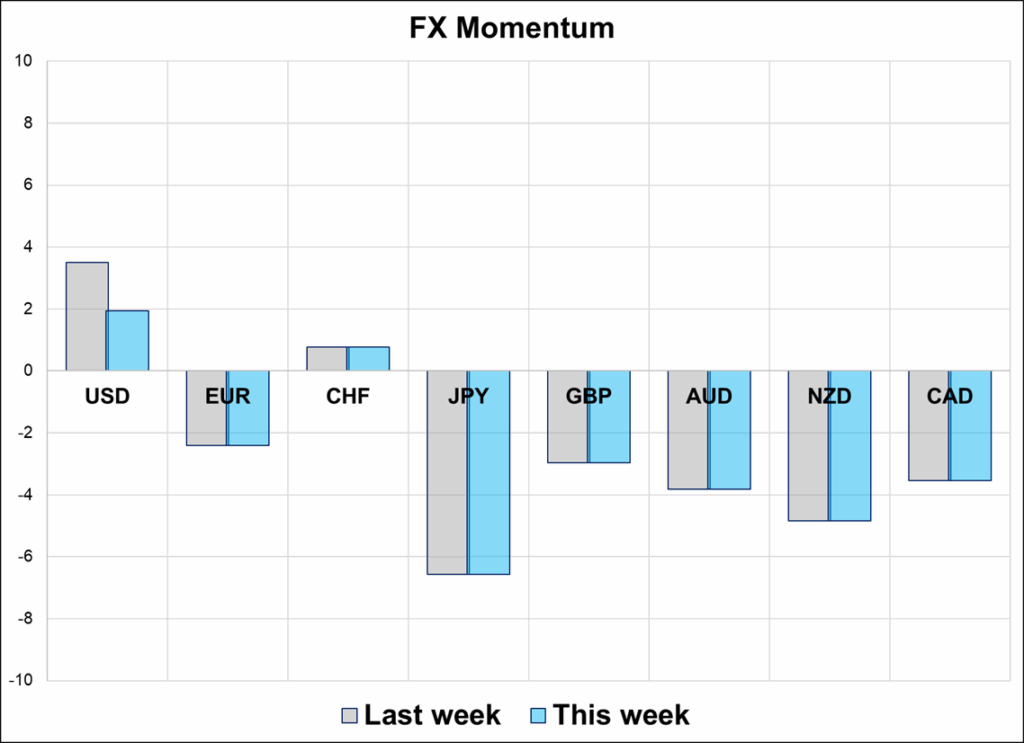

Positioning remains fairly static with small USD longs still the story and NZD and CAD shorts the primary weapons of choice. These positions are getting a bit stale, I think, as the bearish Kiwi story is tired and USDCAD made a major short-term peak at 1.4135. Momentum remains mildly USD-positive.

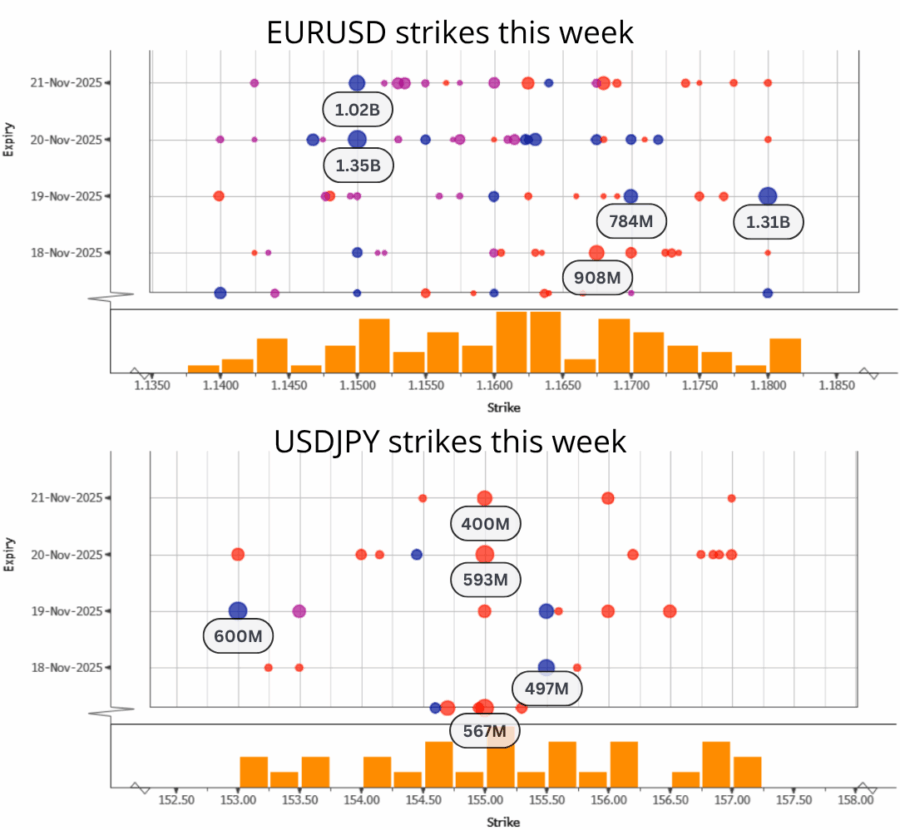

The options market shows a blob of large EURUSD strikes at 1.1500 this week into NFP, and a bunch of smaller stuff 1.1600/50. Please see below. The USDJPY options story continues to be tepid, with some stuff at 155.00, but nothing to write home about.

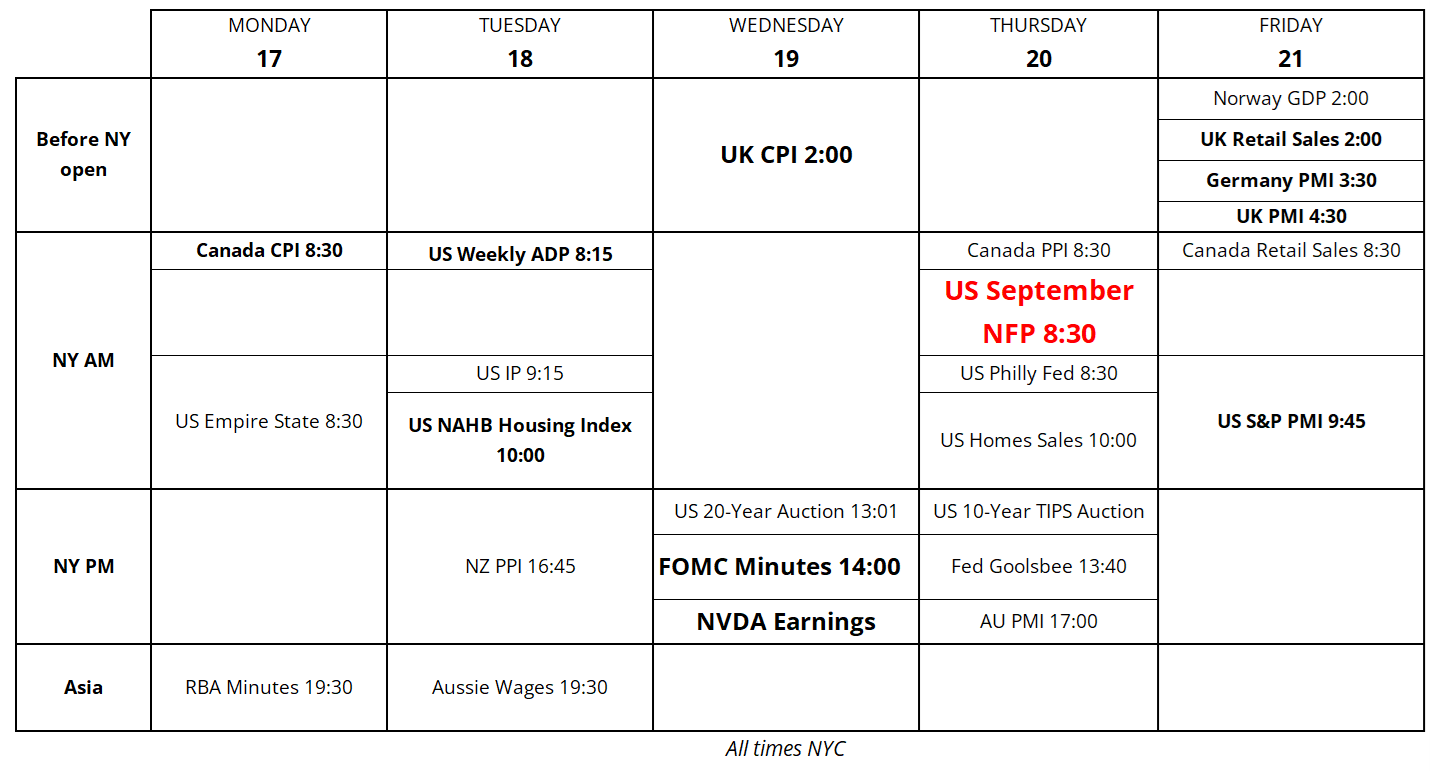

Here’s this week’s calendar with NFP and NDVA the top events. I would be careful with weekly ADP tomorrow as the number looks noisy and unreliable as it seems to contradict ADP’s own monthly release. There was a big reaction to weekly ADP last week, but I think that’s unlikely to repeat.

1. A reasonable editorial from Kevin Warsh.

2. Bitcoin broke all the lines on my charts from last week and is how holding below them all. Purple is the big pivot from early in 2025 that was also support in June. Green is a four-touch trendline that touched August 2024, September 2024, and twice in April 2025 around Liberation Day. Red is a narrowing wedge that broke. Despite all this, I am having trouble shaking my bullish bias in crypto as the DATs are all trading close to 1:1, sentiment is horrible, it’s impossible to even come up with a bullish narrative, and I am bullish NQ. Charts are telling me I am wrong, so I’ll wait for a recapture of 98400 and stand aside for now. I do have some depreciated MSTR and MARA calls left that I can pray for.

3. I miss baseball.

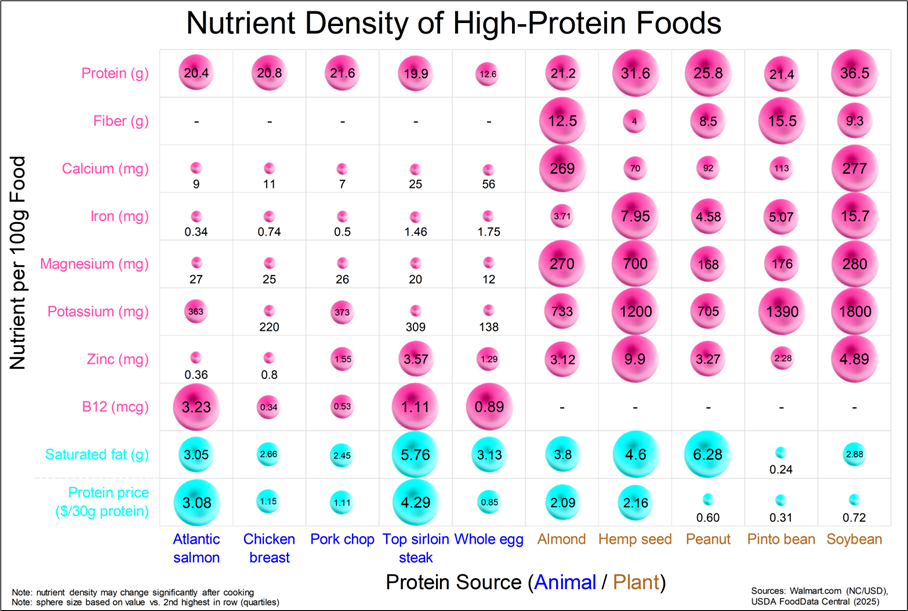

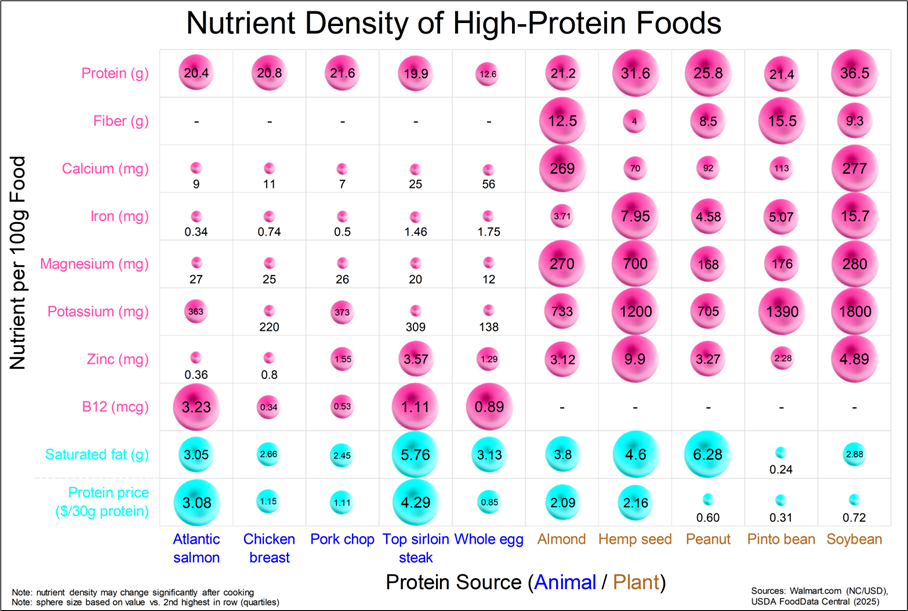

https://www.reddit.com/r/dataisbeautiful/comments/1oxqgds/oc_nutrient_density_of_highprotein_foods/

Vegetarians may want to take a B12 supplement!

The importance of vitamin B12 for individuals choosing plant-based diets