November 23, 2022

Recession: For and Against

First: In yesterday’s note, I asked “What is your favorite trade from now until June 2023?” The huge majority answer was “long bitcoin” or something similar. Short crypto vol, long ETH, long SOL, long bitcoin. Out of 16 responses, eight were long crypto. Small sample but still interesting given I’m a legacy fiat guy. The only other pattern was a few people like long a G10 currency vs. short CNH (i.e., EURCNH long, CNHJPY short). Seems totally reasonable.

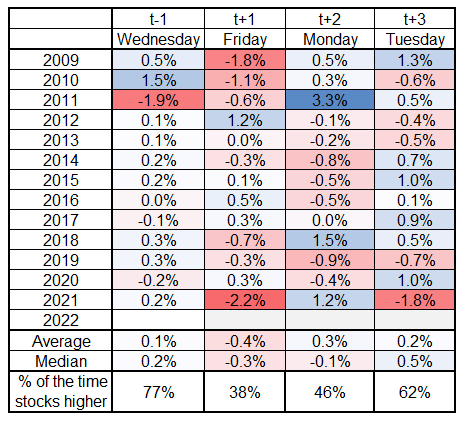

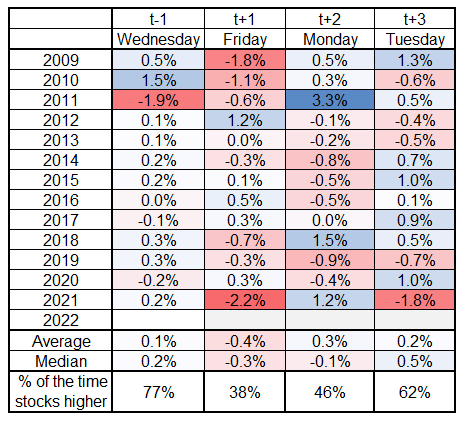

Second: Looking at stocks in the short term, there has been some negative behavior around the Thanksgiving weekend

S&P performance around Thanksgiving

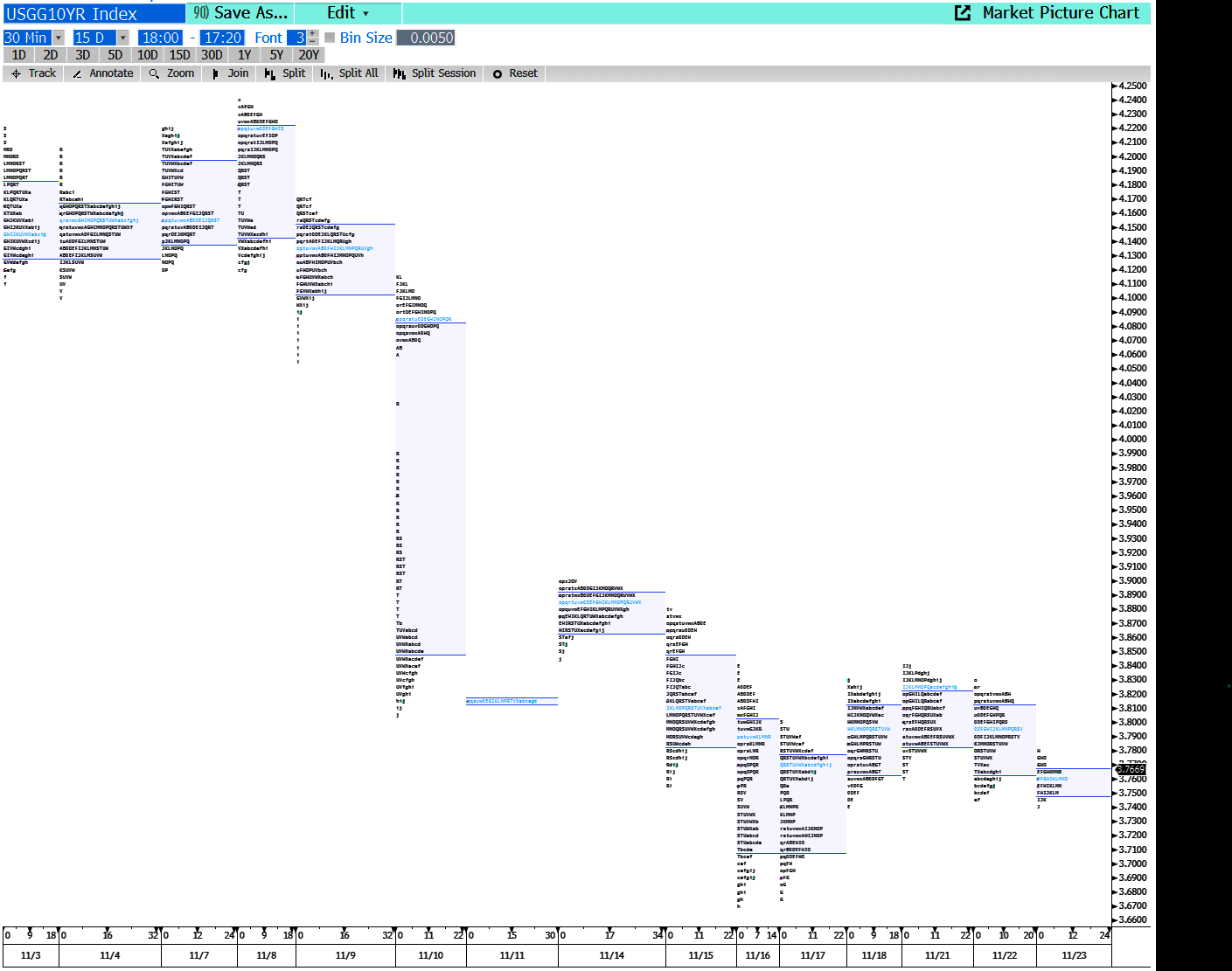

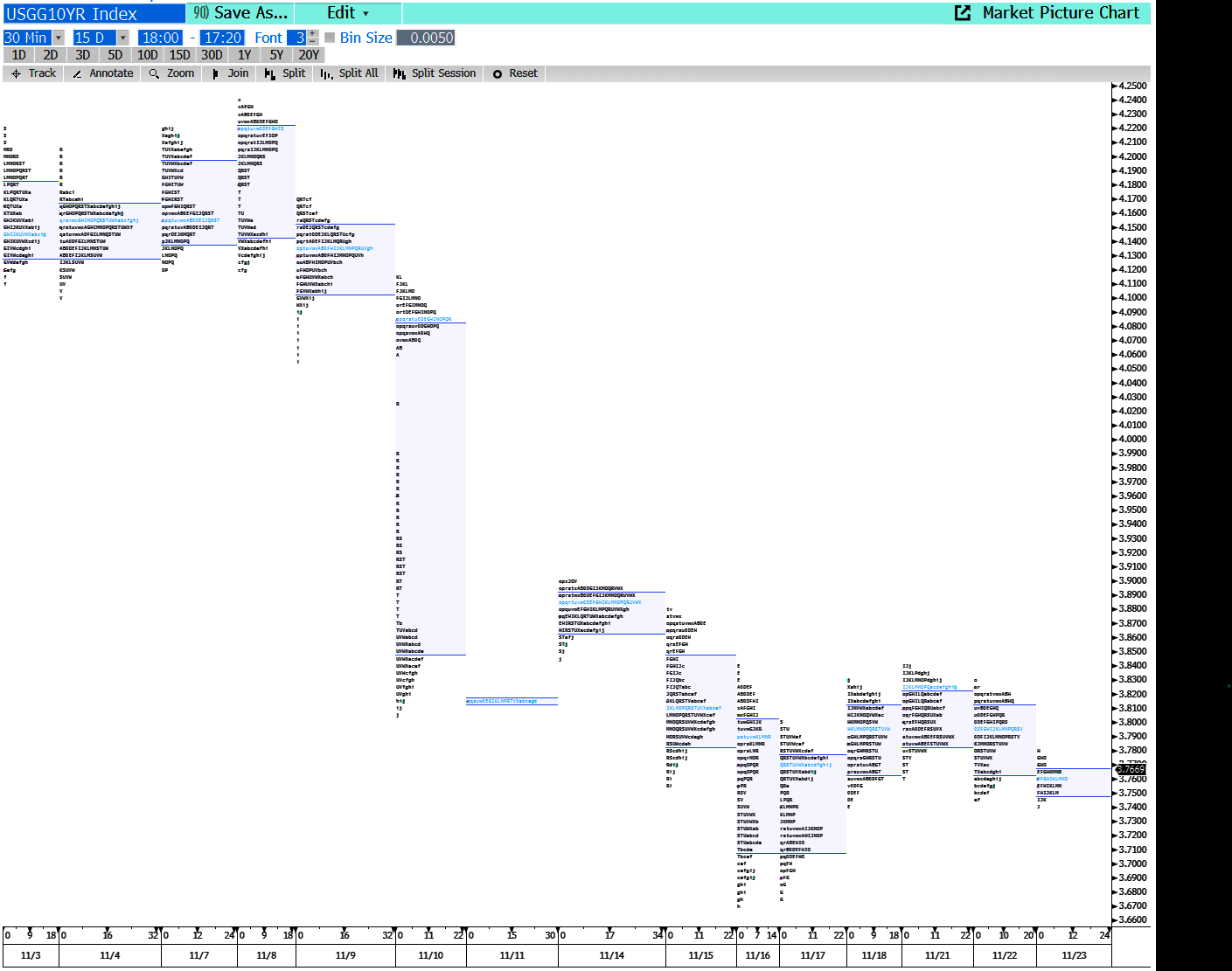

Third, something else to keep an eye on is the path of US yields from here. After CPI, we gapped down from 4.07% to 3.90% and have been etching out a clean range now 3.67/3.90. Yields have been respecting the top of the gap and we have now spent 11 days consolidating. My view is that the next move in yields is lower and if that view is correct, we should not go back above 4.0%.

The market profile of yields (MKTP on Bloomberg, useful guide here) is an excellent way to see this abandoning of the old equilibrium zone (3.90/4.30) and the establishment of a new zone. Each letter on the chart represents a 30-minute period where yields traded at a given level. Here are the past 15 days:

US 10-year yields, 15 days of 30-minute increments

Zooming out, a good short-term target for 10-year yields is 3.50%, that is the old YTD high as of June 2022 and just above the 100-day moving average. Here is the chart.

US 10-year yields, 15 days of 30-minute increments

Thinking about the “inevitable” 2023 recession

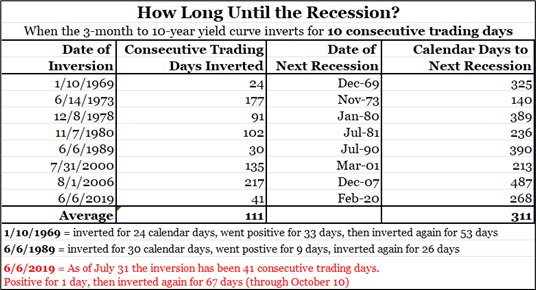

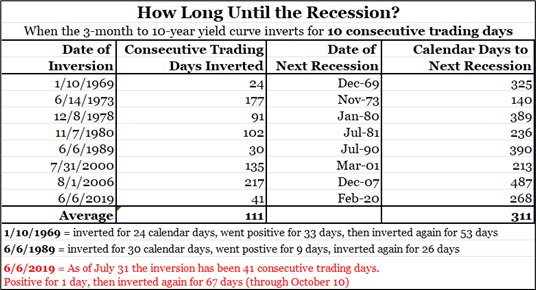

There are some compelling arguments for US recession in 2023. First and foremost are the aggressive and deepening yield curve inversions. Jim Bianco had a good thread on inversions last night; this table stood out to me.

311 days from now is September 30, 2023. The range of lags has been 140 to 487 days which puts the range wide but real: US recession starts sometime between April 12, 2023, and March 24, 2024. Don’t rule out 2023 Fed cuts.

Recessionary signs

- Yield curve shows Fed is restrictive.

- Housing and autos look bad.

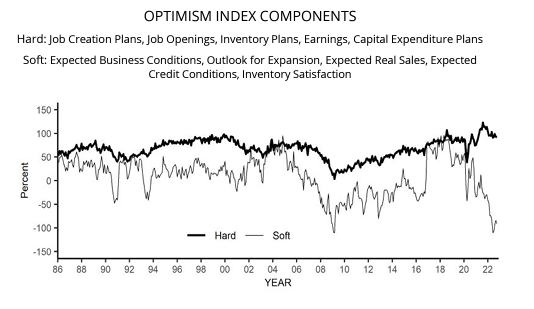

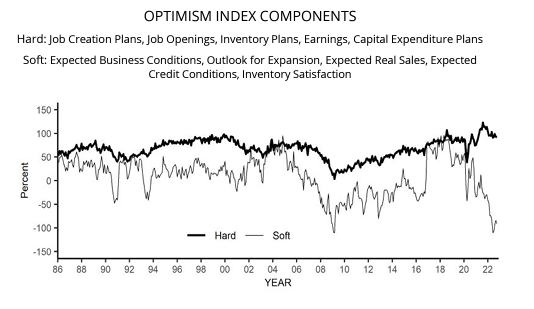

- Soft data looks bad. Here’s the soft vs. hard NFIB Survey data for October.

- Credit card debt is picking up.

- Europe, the UK, and China are not looking great.

- Huge savings from stimmies are almost spent.

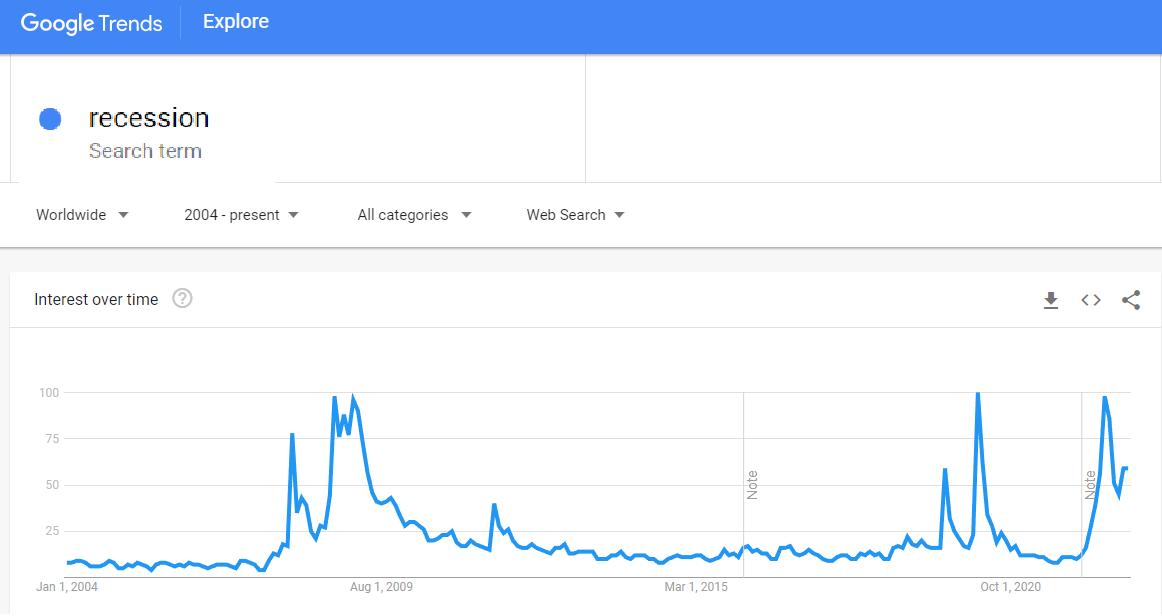

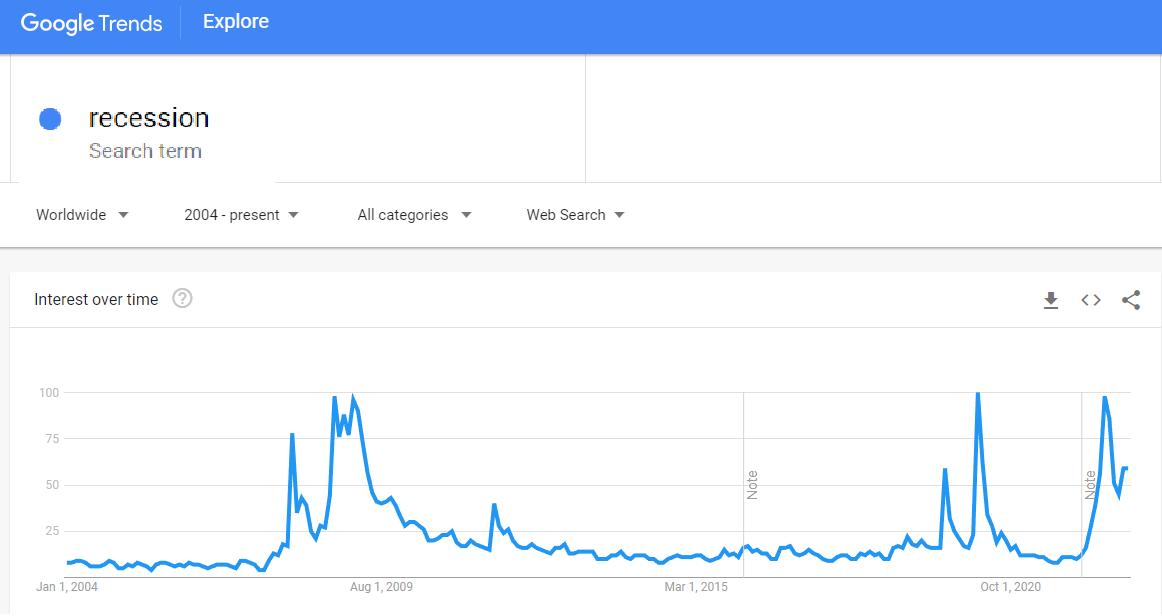

- Recession psychology is widespread. See chart below.

- Lagged impact of rising rates will be felt over time and has barely hit so far. More layoffs coming as consumers tighten belts and tech reels.

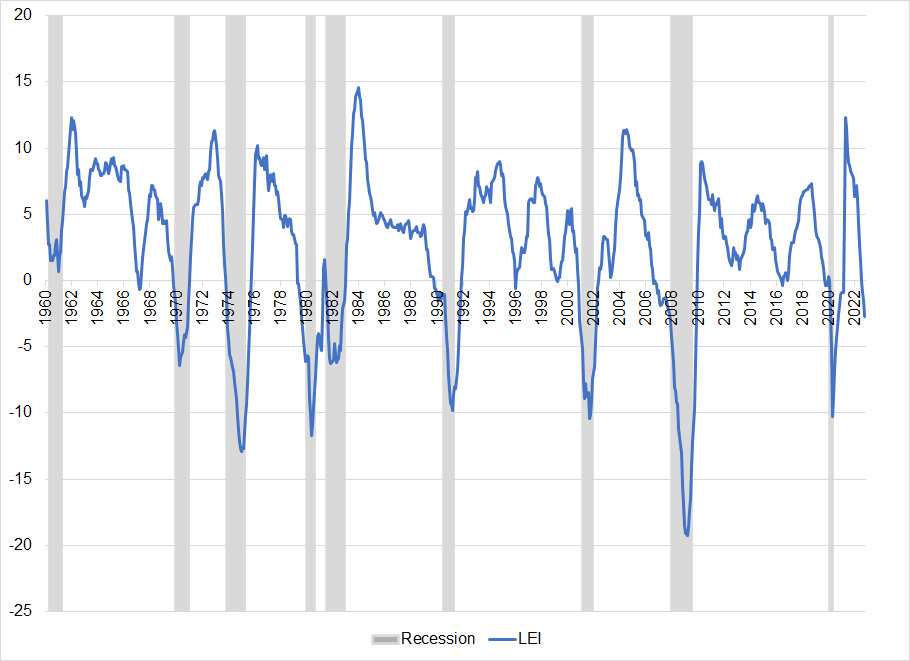

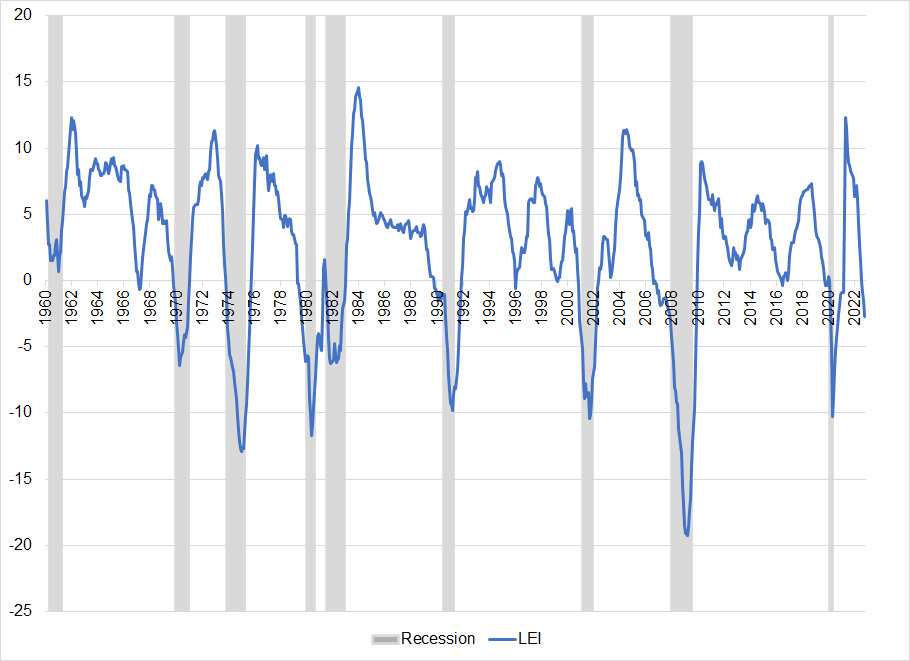

- Conference Board Leading Indicator has never gone to -2.7 without a recession

Conference Board LEI vs. recessions, 1960 to now

Counterarguments

- Fixed residential investment has already rolled over and government and services have picked up the slack.

- US economic weakness in early 2022 has turned to greater strength (GDPNow, etc.)

- Falling inflation supports real growth.

- Housing-related stocks like HD still reporting decent earnings.

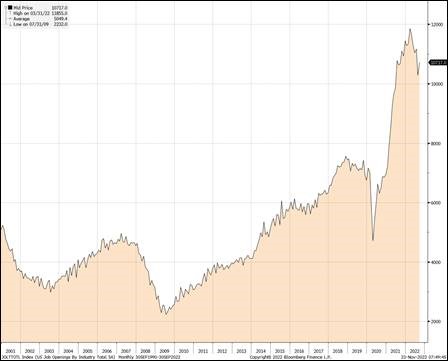

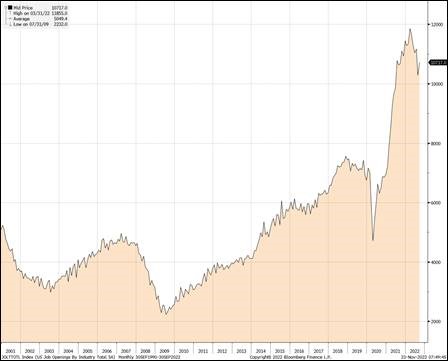

- US job market is strong. The obvious pushback to this is that the jobs market is always strong entering recession. Jobs data lags. But this cycle is unique in that the huge shortage of workers provides a buffer to absorb tech layoffs. This point is huge. Going into the 2001 recession, there were 4.4 million jobs open. Going into the 2008 recession, there were 4.4 million jobs open. Right now, there are 10.7 million jobs open. There is some question of whether the data means exactly what we think it means (see here for example) but with Initial Claims hovering near the lows still, it’s hard to imagine JOLTS is totally wrong.

Yes, there are tech layoffs…

… But tech is a tiny part of the labor market and there are more than 10 million jobs still open

The counterarguments are pretty good. Until US job market slack is absorbed, the long lags between inversion and recession are just about untradable. It’s early to position for recession, even if one might be inevitable. Watch for a turn in Initial Claims, especially after today’s 240k print, as a sign that the job market shortage is being absorbed and it’s game on for recession trades. The best recession trade is short cross/JPY.

What other high-frequency signs are you watching for potential US recession? Please email me.

Final Thoughts

Are we sure that the EU energy crisis is over? Are we sure that China is reopening? I don’t think so.

An interesting thread on two schools of AI ethics. Short read, about 5 minutes.

One of the best Twitter threads I’ve ever read about trading.

good luck ⇅ be nimble