Get excited

The annual salary of a Roman centurion in the reign of Augustus was 38.6 ounces of gold.

At $4,000/ounce, that is about what a U.S. Army captain with 10 years of service gets paid (~$154k).

Get excited

The annual salary of a Roman centurion in the reign of Augustus was 38.6 ounces of gold.

At $4,000/ounce, that is about what a U.S. Army captain with 10 years of service gets paid (~$154k).

Long USDJPY @ 151.80

Stop 149.84. Target 154.84.

Short AUDUSD @ 0.6486

Stop 0.6576. Target 0.6357.

Short EURUSD @ 1.1585

Stop 1.1711. Target 1.1409.

Short EURCHF @ 0.9228

Stop 0.9285 Target 0.9111.

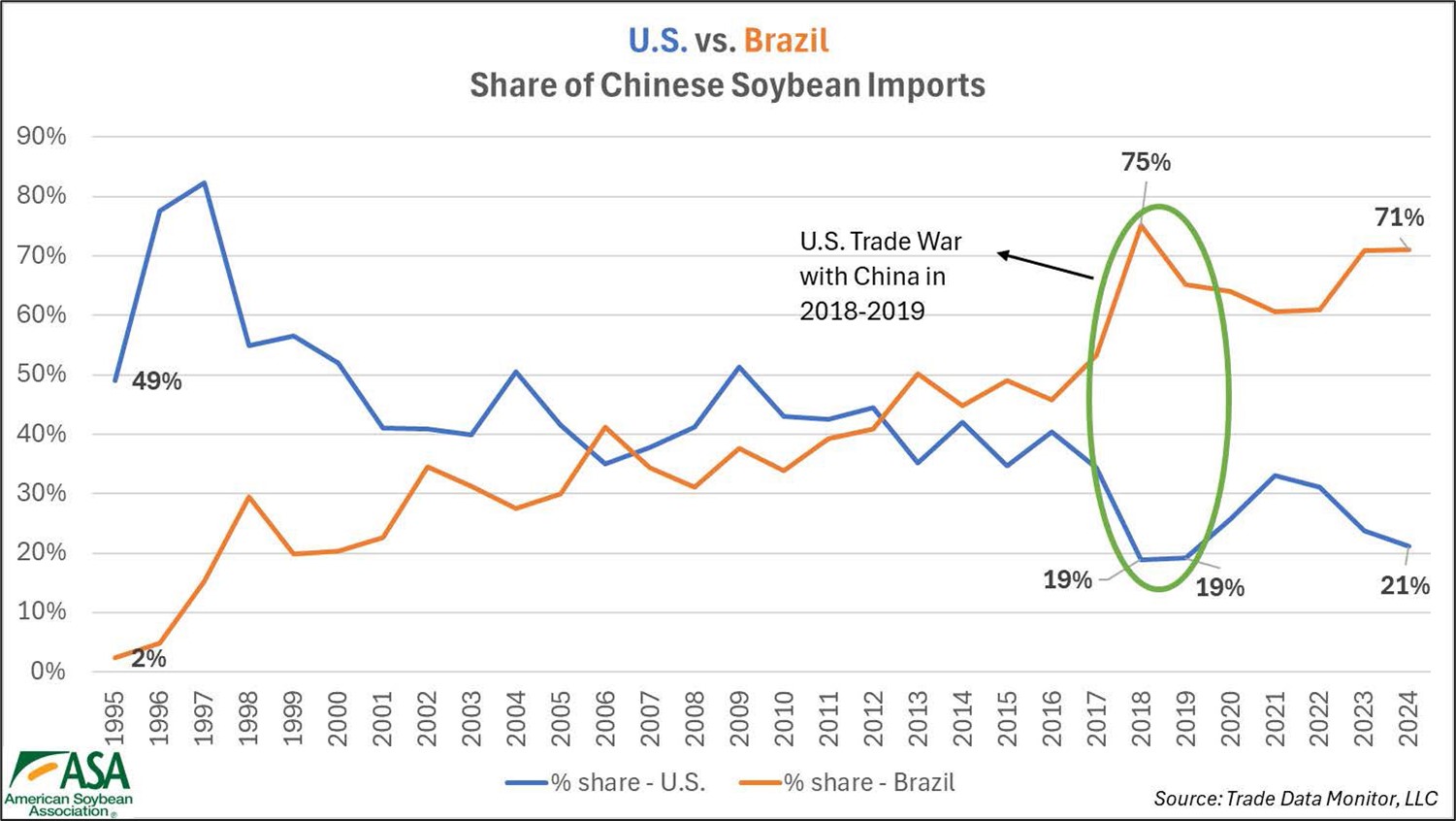

The final result of the weaker-than-expected CPI was muddied by the latest China détente, and I suppose you could argue we are in the same place we were a week ago. The tail risk of a complete breakdown in the China/US talks is not necessarily off the table as these frameworks to agree to an agreement have fallen apart in the past. For now, it’s full steam ahead as the US simultaneously trumpets a new trade deal and investigates why China didn’t comply with the one signed 7 years ago. You are forgiven if you cannot take any of this seriously. Reading a headline that says “China will buy soybeans” in 2025 is Onion-like.

Rhetoric:

Reality (via American Soybean Association):

There is pretty much no correlation between the public statements and the real-world actions of the two governments, but for now we have a de-escalation into the most bullish seasonal period of the year for stocks and so the rally continues. Buybacks will begin again in earnest and as I showed last week, the first eight days of November are crazy, crazy bullish for stocks. And we are going into megacap earnings. So, there is no obvious reason to fade this China/US “news”, no matter how cynical you feel about it.

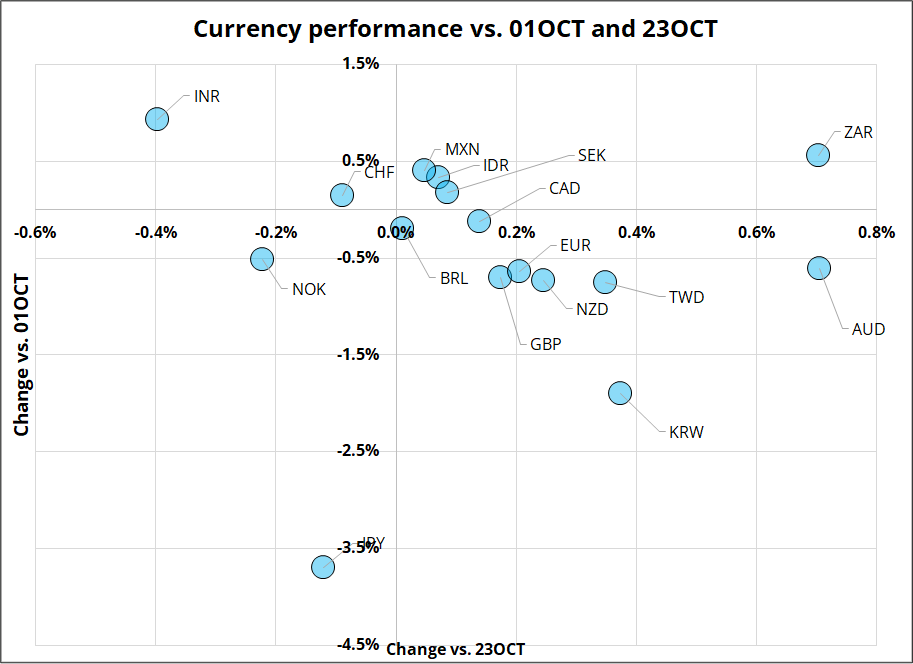

Meanwhile, gold and silver continue their momo unwinds, and FX is pretty quiet. You can see a mild beta to global trade and equities in the overnight price action as AUD outperforms and JPY and CHF do not. Here are the changes in the majors vs. October 1 and vs. last Thursday’s close. You can see if you look at the y-axis that almost all the blue dots fall in a -1%/+1% range, indicating that things have not moved much since the start of October. Only JPY and KRW have moved by more than 1% (both weaker). You can also see that ZAR and AUD have outperformed since last Thursday, while INR has struggled, and everything else is close to unchanged. Funny that ZAR and AUD, which used to be the most gold-sensitive currencies, are strongest even as gold returns toward Earth.

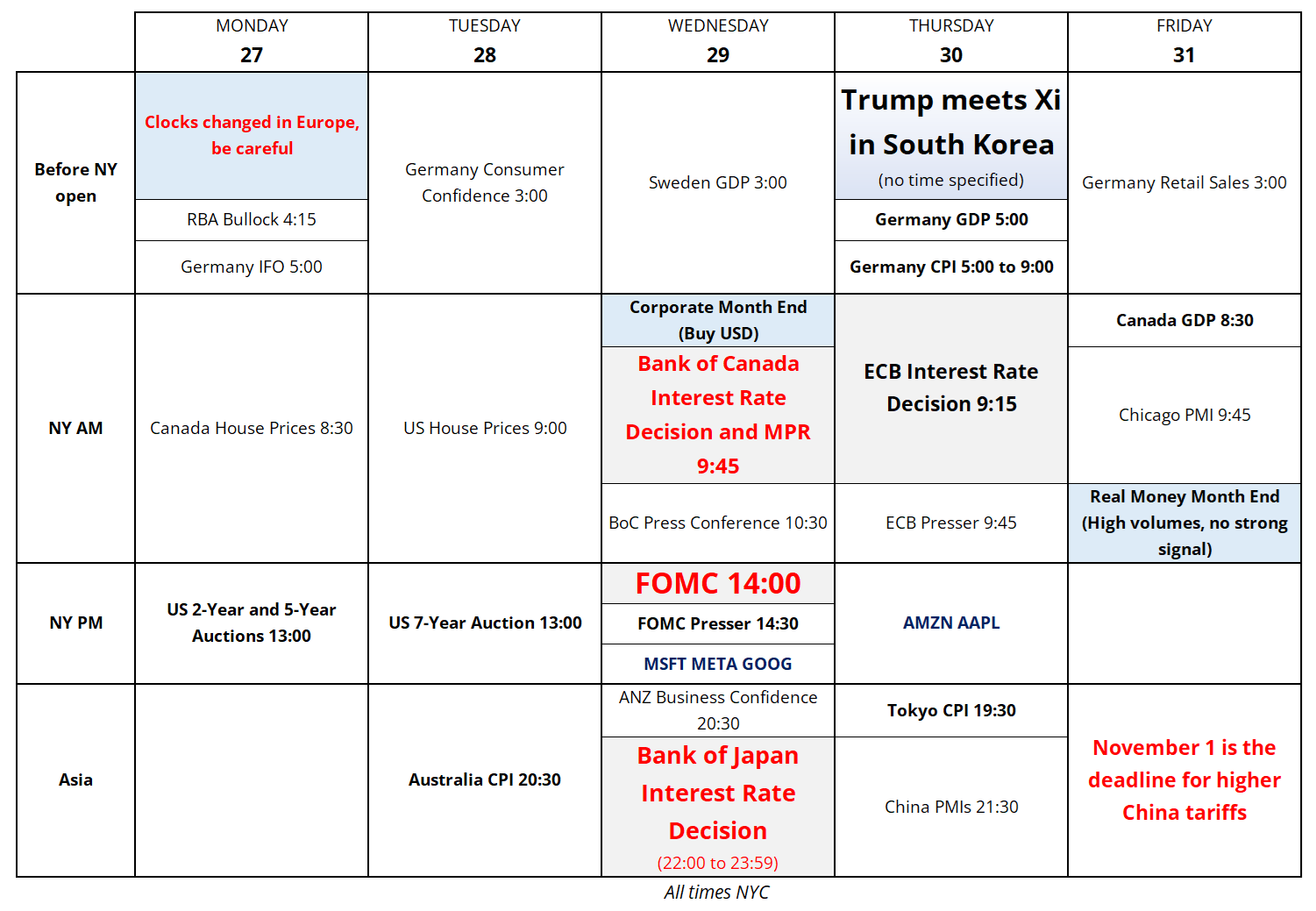

This week’s calendar is posted after the end of today’s main text, and you can see there are some big events including bond auctions, megatech earnings, and BoC, FOMC, and BOJ. I continue to believe that we will see a surge in demand for dollars between today and Wednesday as corporates come to market and USD sellers will go back to the sidelines. I don’t see FOMC as a major event given they are on autopilot having abandoned the old 2% inflation target.

There is not a ton of mystery around the BOJ, either, and the market has learned its lesson that 25bps of BOJ hikes once/year don’t matter for USDJPY when US 10-year yields are moving 10bps/day. The Bank of Canada is perhaps the most interesting of the central bank meetings as we’ve got 85% priced in, but they could pass if they feel like it given the strong data of late. Most experts view the bounce in the Canadian data as temporary given the September jobs data is always wrong and the CPI data includes a ton of one-offs.

I am continuing to ride the USD longs from last week, with mixed results so far. The AUDUSD, EURUSD, and EURCHF are all OTM while the USDJPY is working. If you have not considered the EURGBP DNT, it’s still a positive EV trade here.

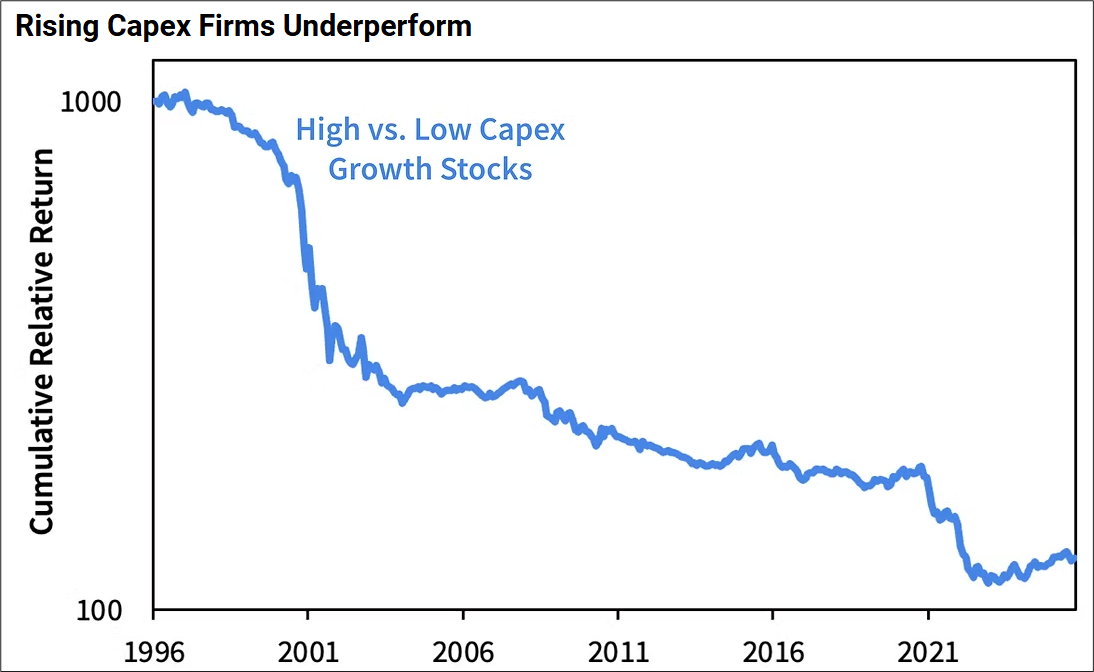

A flurry of great research on the current state of the AI Capex narrative came out in the last few days. Here are some pieces you might enjoy.

This chart stood out.

I am always on high alert for anything that might signal AI Capex has peaked so I will be listening to the conference calls after the close Wednesday and Thursday (MSFT, META, GOOG, AMZN).

Have a golden week.

Trading Calendar for the Week of October 27, 2025

The annual salary of a Roman centurion in the reign of Augustus was 38.6 ounces of gold.

At $4,000/ounce, that is about what a U.S. Army captain with 10 years of service gets paid ($154,400).