I am possibly doing something financially suboptimal, but it’s good to be flat on vacation

Doug Ford shares his view on tariffs with an unnamed US official.

I am possibly doing something financially suboptimal, but it’s good to be flat on vacation

Doug Ford shares his view on tariffs with an unnamed US official.

Taking profit on EUR, AUD, and CADJPY today

Short gold at 2940

Stop loss was 3011 now 2936

Take profit was 2805 now 2843

Time to cover everything. I will take profit on the CADJPY, EURUSD, and AUDUSD here for a couple of reasons.

So I’m pretty much taking everything off here. I could be leaving money on the table, but AUD doesn’t trade that great, and 350 points in 4 days in EURUSD is good enough for a short term trader like me who is about to depart for holidays. Also, we get CPI next week and that could jangle a few nerves as it’s more likely to print strong, not weak. I am going to leave the gold trade simply because the stop is so close, and I don’t want to bail at this level.

My plan is to exit EURUSD either 1.0900/20, or at 11:00 a.m. NY if it doesn’t get there by then. The CADJPY I covered here (102.85). So, there you go.

The payrolls release wasn’t enough to change anything—As expected. The Canadian data was mixed, but I would just like to point out that Canadian data will matter much, much more than usual over the next few months. The rejection in USDCAD has made people forget that this tariff uncertainty is still really, really bad for Canada. The Canadian data takes on much more importance than normal over the next few months as the BoC needs to decide whether to react or stand down … A rapid turn lower in the Canadian data will lead to massive CAD selling because the market loves the theme but hasn’t been able to hold on because of the unexpected reaction in USDCAD.

*TRUMP: GLOBALISTS ARE BEHIND STOCK SELL OFF

That’s an interesting headline. Came out yesterday. The headline reminded me of a chat I had with KK this week. He said that foreign holders of US assets may start to sell aggressively as the policy risks are too large to ignore. Specifically, the risk to sovereign wealth funds of a new tax on their incomes and holdings is growing.

https://www.foreignaffairs.com/united-states/better-tool-counter-chinas-unfair-trade-practices

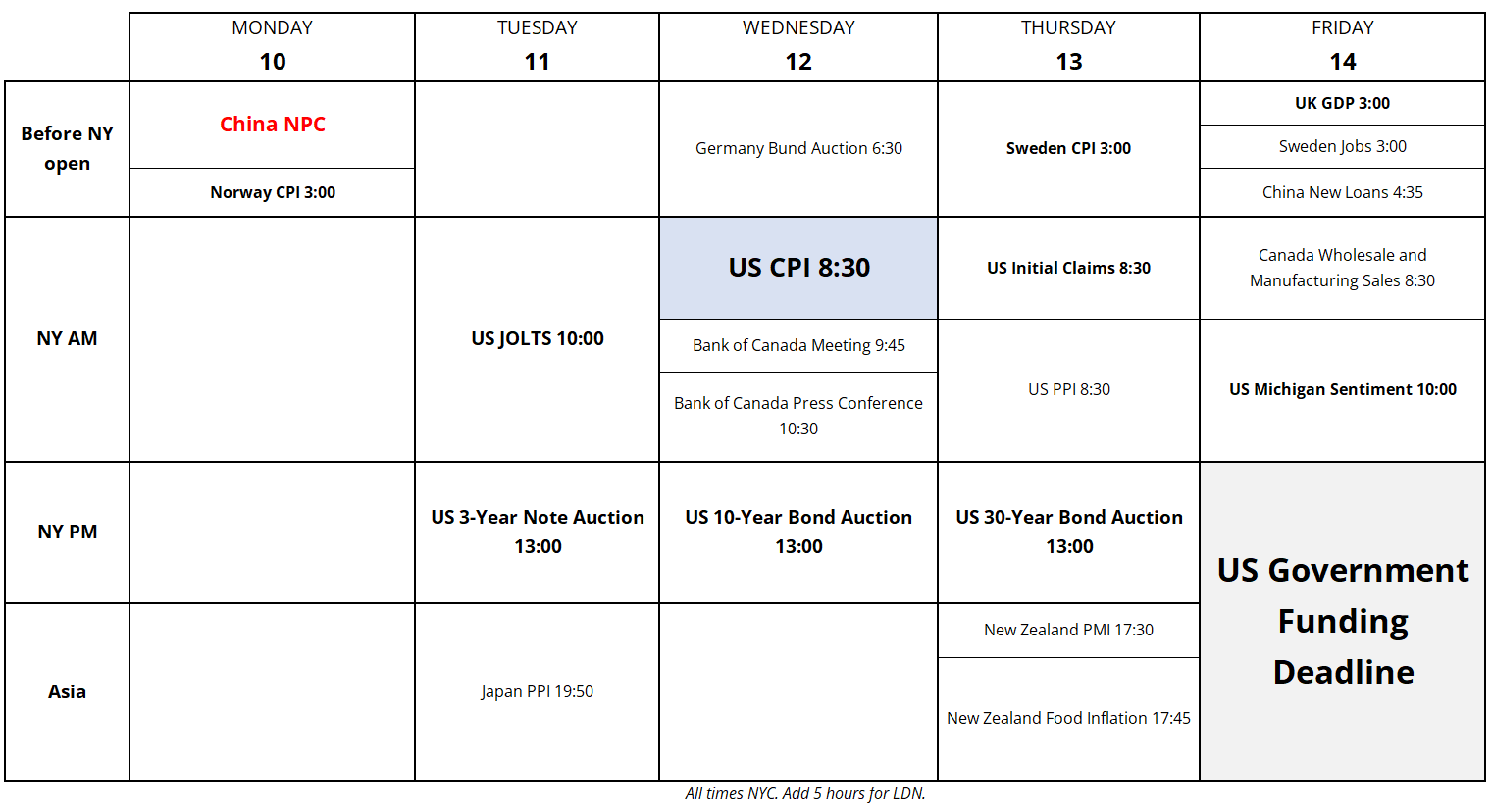

The calendar is pretty light next week, but Wednesday’s CPI and the government funding deadline at the end of the week stand out. The market will have trouble getting excited about the umpteeth government shutdown threat, but this time could be different if the Democrats decide this is the hill they want to die on.

Dead cat bounce in stocks makes it look to me like we’re going to take out the 200-day MAs in S&P and NASDAQ. This has notes of a 2001/2002 vibe, when US tech unwinds and the USD unwind went in tandem, taking turns lurching lower day by day. Like balls falling down stairs.

Alert! I am away for two weeks. Going to do some laps around Lake Ontario with the family.

am/FX returns March 24. Have a hissing weekend.

Doug Ford shares his view on tariffs with an unnamed American official.

https://www.theguardian.com/environment/2025/mar/05/canada-goose-bald-eagle-political-symbolism