Reboot the Smoot

This movie clip, familiar to anyone born before 1980, feels wildly relevant today:

Mr. Lorensax (Ben Stein) teaches high school economics

The funny thing about finance and economics is that we don’t really advance or learn anything over time, we just cycle through the same things, over and over, in different ways. We buy tulips, railroad stocks, or pets.com, or memecoins, even though they are all the same story in different packaging. We ignore or fail to account for the hidden externalities of industrial pollution (mid-1800s), fossil fuels and tobacco smoke (1900s), or processed food (2000s).

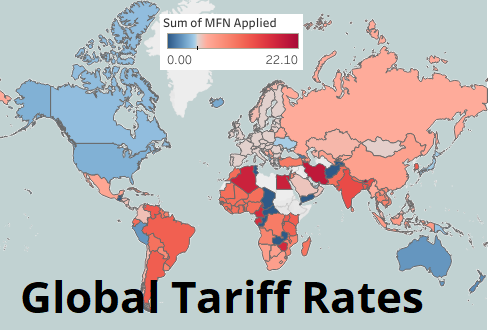

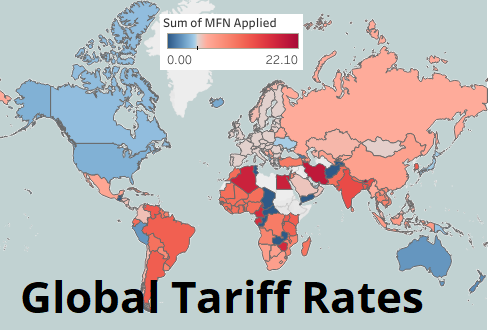

We allow monopolies to form then frantically try to break them up when they become too powerful. We vilify mercantilism and lionize free trade but are forced to rethink these religions when income inequality shatter social cohesion and decades of unreciprocated tariff cuts create an unlevel playing field.

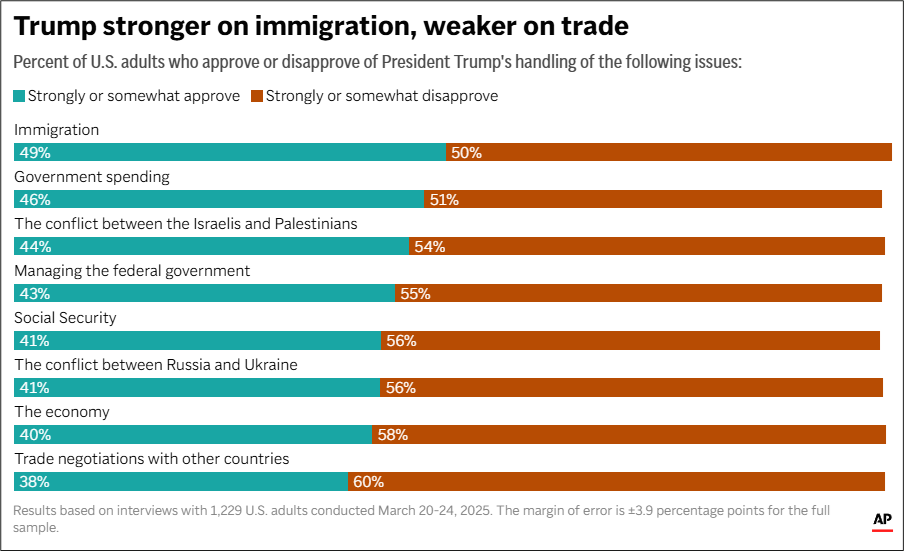

Source

Anyway, here we are.

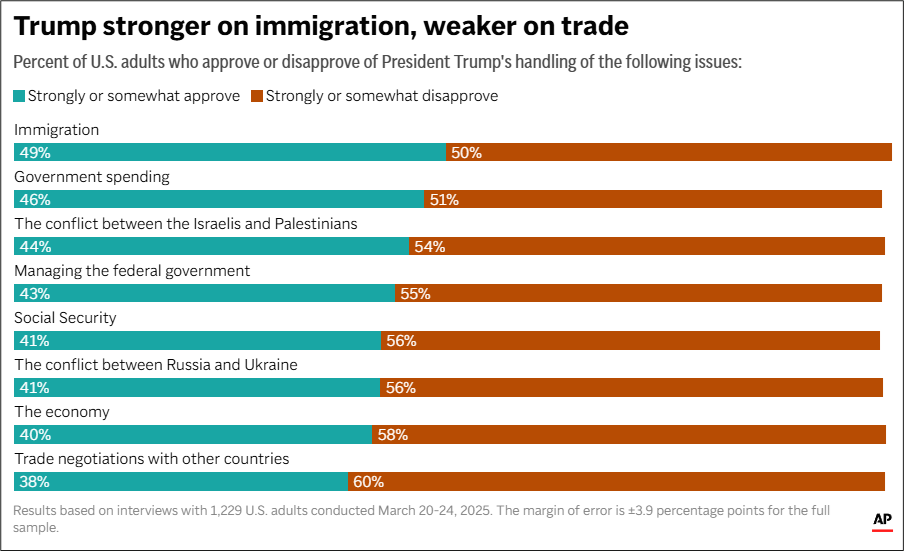

The articles last night seem to indicate that 24 hours before Liberation Day, the decisions had still not been made. If those in power don’t know the outcome one day before the announcement, I don’t think it’s fair to ask us to have any clue. We don’t even know the purpose of the tariffs. Is it revenue? Negotiating to get former allies like Canada and Mexico to tariff China as one team? To rebalance global trade? To create maximum economic pressure and societal disruption north and south of the border before attempting to annex Canada or send troops on incursions into Mexico? That last one sounds hysterical, but my feeling is that a narrow imagination isn’t the right frame of mind right now.

So yeah, who knows? I would love to sound smart and create a big grid of outcomes and predict all the moves like we often do around here, but in this instance, I am going to sit back and watch what comes out and have no prior in mind. The only thing that I firmly believe is that the USD will be lower in a few weeks, regardless of tomorrow’s announcement.

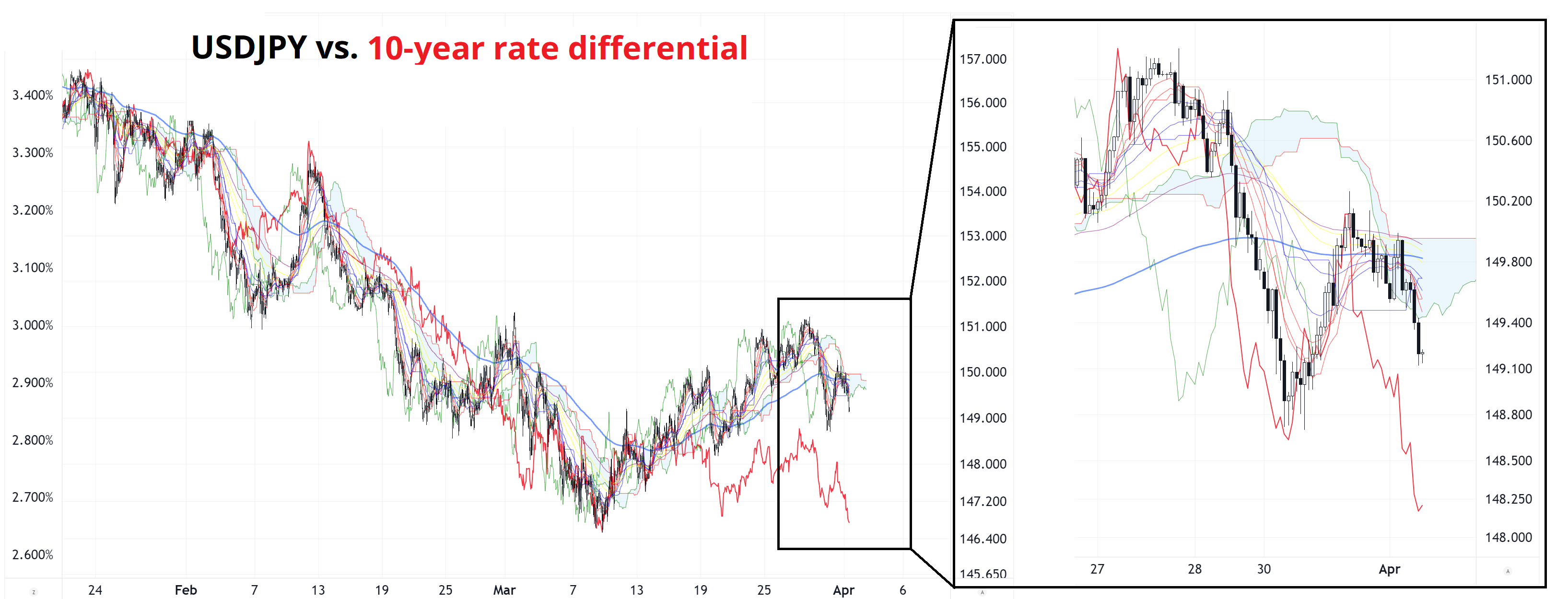

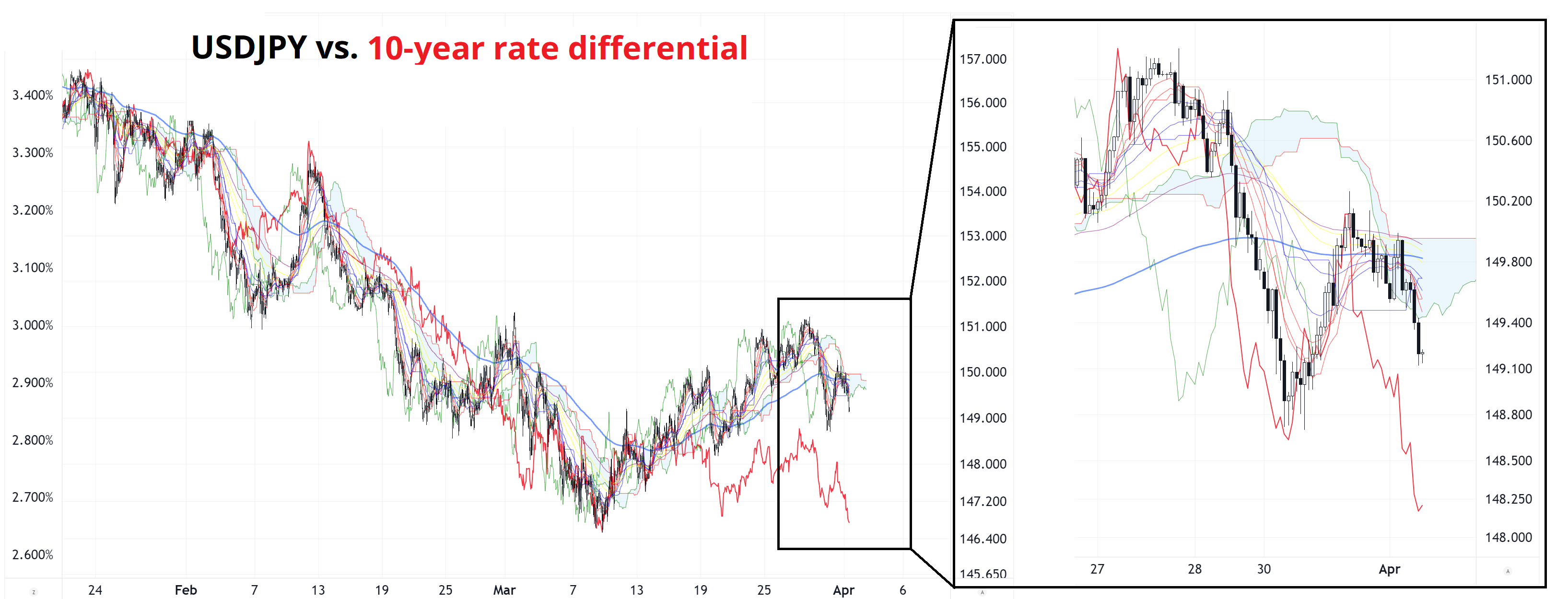

I’m leaving my bid where it is in EURUSD and the parameters in USDJPY are unchanged. I am hoping that yesterday’s eye-watering rally off 148.60 was the end of Japanese fiscal year end yen selling, and we start to converge a bit with levels implied by yield differentials. We broke down through the hourly cloud on Friday, then yesterday’s bounce stayed below it. Now, the top of the cloud is at 150.00, so ideally, we should not go above that.

Final Thoughts

I’ll make it a short one today as it’s really all about tomorrow’s Rose Garden Spectacular. JOLTS is the first hard data test this week. Have a greater than foolish day.

The Spectra FX Positioning and Momentum Report

Close to home

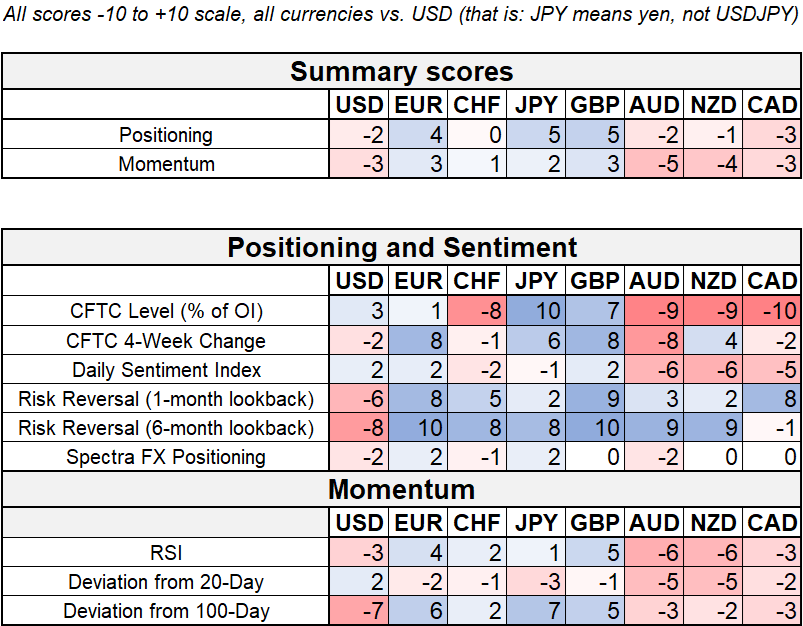

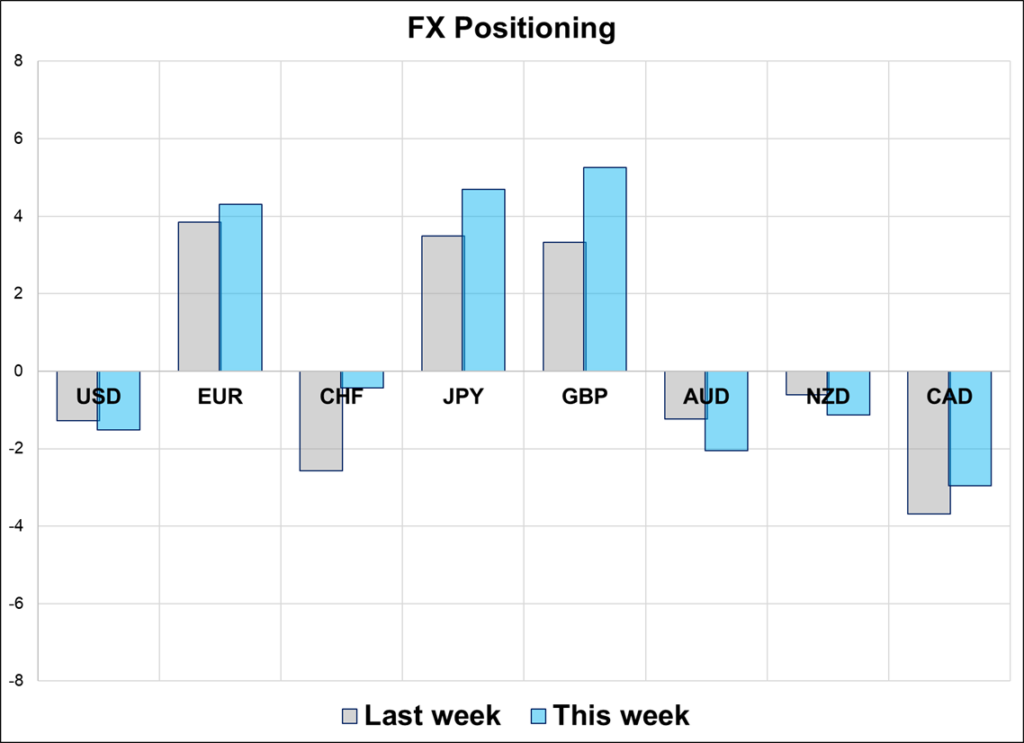

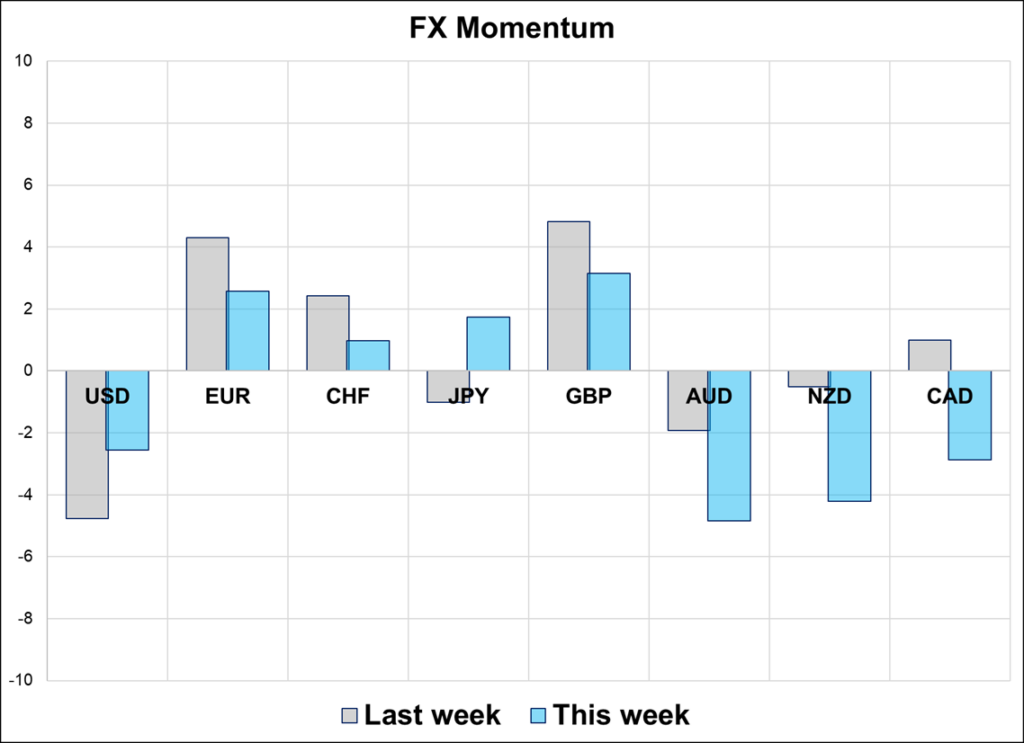

Hi. Welcome to this week’s report. With EURUSD double topping at 1.0950 on March 11th and 18th, long EUR positioning has mostly burnt off. The CFTC remains long JPY and short CAD, while long GBP positioning is picking up moderately. The market is trying to come to terms with a new regime where stocks go down, the USD smirks, and gold goes to the moon.

Two Observations

- Stress in UK assets has subsided again after a zippy move at the start of January. While no outright bullish GBP theme has emerged, we have noticed clients using GBP as a numerator more and more. EURGBP puts, GBPAUD calls, and GBPCAD calls have all been going through. A fizzling of the GBP bearish narrative, and a removal of fiscal risk premium have pushed the risk reversal back towards 3-year highs.

- There is definitely a theme of multi-month macro players buying USDJPY puts for a recession trade, and while the trade hasn’t worked out so far, the position is not particularly vulnerable as it’s all through options and the slow-moving, ultra-patient CFTC. Stronger inflation in Tokyo, and lower US bond yields have created an appetite for JPY calls, but as long as USDJPY is inside the 146.50/151.20 range, excitement levels are low.