An amazing result.

Losing teams

An amazing result.

Losing teams

Flat

Freddi9999 looks a lot smarter than Brent Donnelly this morning as my call on the election was horrendous. This has not been a strong year for me, I will be adding it to my list of worst years ever, somewhere in there with 2002, 2007, and 2013. This is life. Apologies to those who went with my USDJPY idea, it is virtually dead, and I removed it from the sidebar, so I don’t have to stare at the ashes of a bad idea for the next 30 days. The trade is not dead, but it’s close enough.

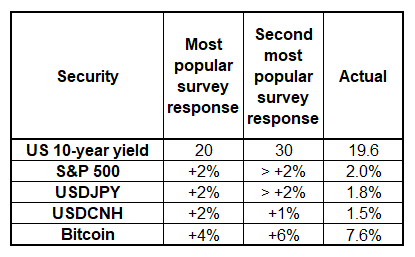

Here’s how the performance of the main asset classes compares to the am/FX survey results. The market moved just about exactly as expected across the board. The only real surprise out there is the poor performance of gold and silver. You could blame the USD move, but the USD/gold correlation has not been strong. We could have just as easily had gold up, USD up.

There is a theory out there that Trump will bring on Elon Musk and amazing governmental efficiency will result, and deficits will be tamed, and they will care about the debt, etc. It’s an OK theory, I guess? Anyway, the common knowledge was exactly wrong in 2016 so I am open to it being correct (Trump will massively expand deficits) or incorrect (Trump will surprise with smaller deficits somehow).

With regard to the dollar, there is no obvious limiter on things for now as yields moon and we are not close to levels that the MOF would get involved or monetary policy feedback loops would kick in. If USDCAD gets above 1.4000, you could start to argue it will encourage a less dovish Bank of Canada, and if USDJPY gets near 158, the BOJ and MOF will probably start to squawk.

If you run a small pod, you could hire a young PM with some market making experience to trade only headlines for the next year or two. Two buck stop loss and a five-million-dollar target. 2017/2018 were amazing years for headline trading as trade war noise was cacophonous almost daily. NI TRUMPTWEETS, etc.

Nowhere will headlines create more madness than USDCNH. Despite a lot of late USD call buying in USDCNH, it’s a tad unhinged relative to normal. Chinese authorities gave instructions to onshore banks to sell 700 points ago, and here we are 7.2050. The big intervention and presumed DO NOT PASS zone is 7.35/7.40, but you never know what a managed currency pair might do if the authorities change their mind on its role in the policy mix.

The CNH has been a stability play as the authorities in China have been using monetary policy and some fiscal to fix the gigantic hole in the real estate balance sheet. If they decide that it should be a release valve to offset US tariffs, that would be a new chapter.

Note that while it’s a bit circular because the trade war impacted the USD across the board, USDCNH was moving up and down with the dollar index throughout the trade war and much of the USDCNH drop in 2017/2018 was simply the result of synchronized global growth and dollar weakness as the world sat smack in the exact middle of the USD smile. Trading USDCNH always involves taking a view on broad USD performance. To isolate CNH specifically, you need to take a much more complicated approach because even trading the CFETS basket doesn’t really cut the mustard most of the time. That basket is too inversely correlated to the broad USD because the basket components have higher betas than CNH itself.

Expect PBoC to get serious about intervention above 7.30. They capped it 7.32/7.38 three separate times in 2022, 2023 and 2024. Through 7.40 will trigger a major market reappraisal as that would show that the PBoC has dramatically changed its strategy. For a bit of perspective, here is the chart back to early 2022, along with interest rate differentials.

Selling S&P futures at 9:29 a.m. with a 35-handle stop loss would be the mirror trade of 2016.

Worth considering.

Have a winning day.

Powell can stick to wait-and-see. RBNZ might say they’re done cutting.