An orthodox reaction. Now what?

Ostrich eyes are larger than ostrich brains

An orthodox reaction. Now what?

Ostrich eyes are larger than ostrich brains

Short AUDNZD @ 1.1100

Stop loss 1.1361

Cover 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long 06DEC

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

Thank you for the feedback on my Saturday piece. I am happy when people selectively forward my stuff. If you forwarded my Saturday note to anyone you think might want to trade FX with us, or wants to sign up for am/FX, please connect them with me. I like new clients. Re: my guesstimates, EURUSD and USDJPY did their thing, US 10-year yields are closing in on a potential 4.25/4.27 close, 6045 looks possible for tomorrow’s SPX close, while USDCNH is meh.

There were three types of feedback on my note:

I agree with 3, but that’s a story for January, not now. In the meantime, the short-term path of the USD is extremely complicated as there are multiple crosswinds.

Given all these crosswinds, I think we will chop around for a couple of days and then the USD will trade very weak Wednesday, Thursday, Friday as month-end rebalancing in FX and bonds dominate.

Longtime readers know that Sunday gaps get filled, most of the time. I wrote a section on this in The Art of Currency Trading, and I have covered it on multiple occasions with a special focus on it in 2010, 2011, and 2012 because of all the EUR gaps during the Eurozone Crisis.

Of the 58 gaps higher of 0.5% or more in EURUSD since 2006, 39 were filled on the Monday. It looks likely that the 1.0407 gap will not be filled today, though anything is possible. I looked back at history to see if the failure to fill the gap is bullish for the next few days, because I thought it might be, but it isn’t. The 1-, 2-, and 3-day forward returns for EURUSD after it holds a Sunday gap like this are essentially random. 50/50 win rate with -0.1% average and median return for days 1, 2, and 3 after the Monday close.

For those fading the move lower in the USD, the question becomes: What are you looking for? Are you willing to hold on for Day One tariffs all the way to January? Are you just looking for a retrace to fill the Sunday gap at 1.0407? Or do you think the market has simply read this wrong and we will fizzle and fall back down to make new lows? I feel like tactics are super important here because positioning and flow are going to be potentially painful for USD longs over the next little bit.

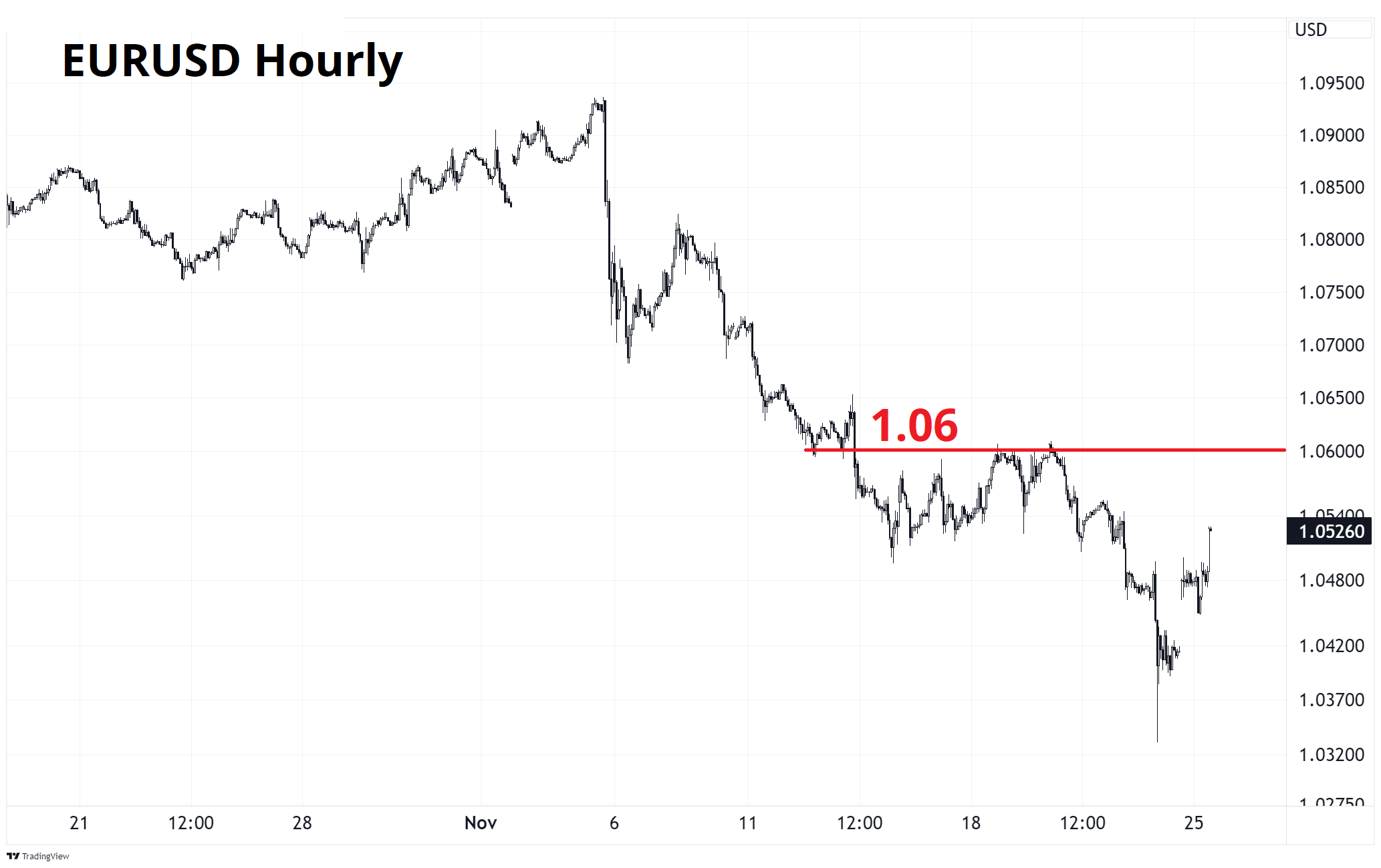

Chartwise, below 1.0595/1.0610 everything is copacetic for EUR shorts but above there becomes a problem.

Good down trends break support and then that support becomes resistance. When the broken support resistance doesn’t hold, the trend is losing its power. You can see that 1.06 was a big break, which we subsequently held as resistance, and then 1.06 held as resistance three times before the final capitulation and blow off to the 1.03 handle. As long as we are below 1.06, EURUSD shorts will feel OK about things, but above 1.06 is going to trigger a huge short squeeze and broad USD unwind.

Here’s the hourly, so you can see the zoomed-in view.

The AUDNZD chart is worth a gander as we made two aggressive probes above 1.1150 and failed fast. That looks like a tradable double top to me, so if you want more leverage on a short AUDNZD position, you could now consider a stop loss at 1.1215 or so.

That said, I’m leaving my stop where it is because there is the possibility of a hawkish 75bp cut tomorrow night where the RBNZ says: “Listen: We don’t have another meeting for three months, so we’re taking out some insurance here, but that could be it for ages because we’re getting close enough to neutral.” That would probably see AUDNZD spike and reverse. The RBNZ meeting is tomorrow night, NY time, so I will write about it more tomorrow.

I do think if the RBNZ goes 50, as expected, AUDNZD will sell off as the market is long and the bearish AUDNZD seasonality trade will feel much safer than it does now, pre-RBNZ.

And if we get below 1.1090, that will be extremely encouraging for the shorts.

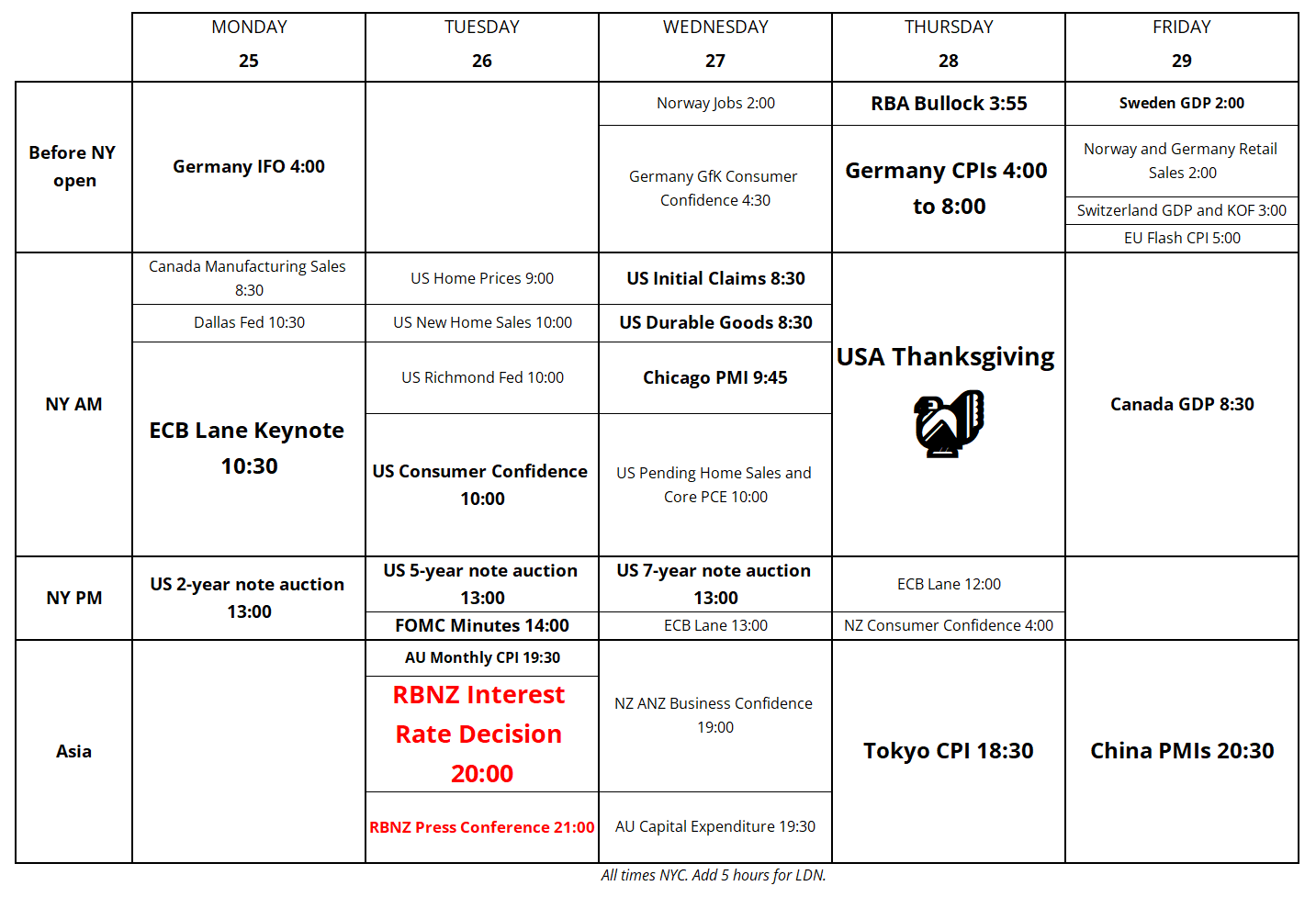

Here is this week’s calendar.

Have a 40-mph day.

Ostrich eye: 2-inch diameter.

Ostrich brain: 1.6-inch diameter.

https://animal-world.com/is-ostrichs-eye-bigger-than-its-brain/