There are too many yellow flags in tech. Time to short a few stocks.

BOJ and stocks

Current Views

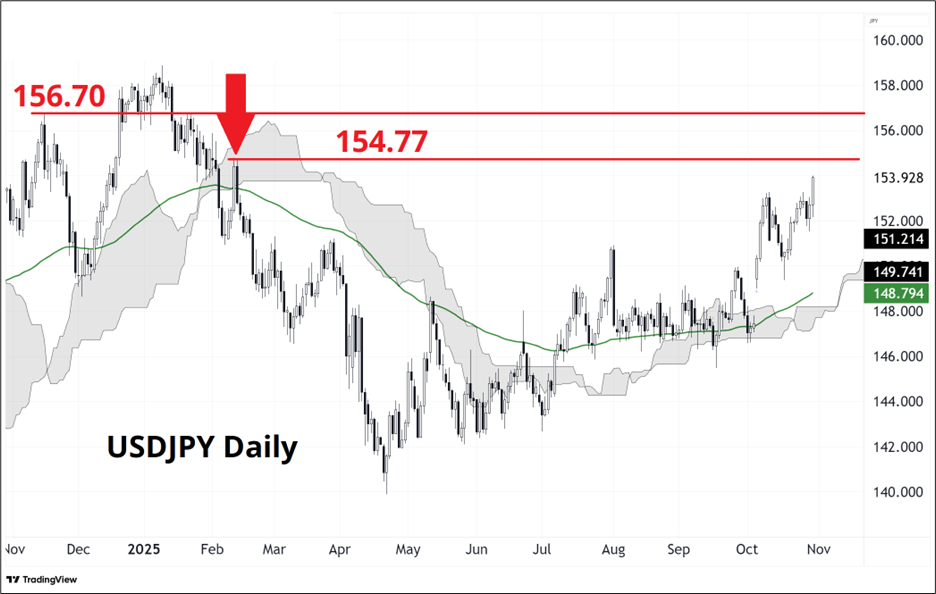

Long USDJPY @ 151.80

Stop was 149.84 now 151.19

Target was 154.84 now 154.64

Don’t feel bad. Two out of three ain’t bad.

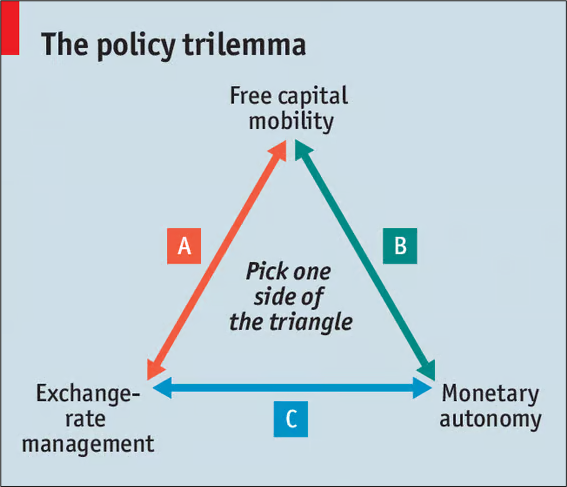

The trilemma continues to be in play for Japan as the desire to both eat the cake and maintain possession of the cake is not possible.

The free capital mobility is there, the monetary autonomy is not, and the exchange rate management is a function that only comes into play at the extremes. Real rates remain at wildly unorthodox levels below zero and with no promise of higher rates in December, the JPY is the release valve again. There is no credible threat of intervention right now as USDJPY trades only modestly above where it was in 2022 and 2023 and below the peaks seen in 2024 and early 2025. 10 yen from the 1-month low is 156.62, so that’s a reasonable place to expect some initial chirping with 157/160 likely to bring more aggressive words, but still no physical intervention.

The 2025 high is 158.86. That level traded in mid-January as the euphoria over the Red Wave and new fiscal stimulus and USD-bullish tariffs was in full force. Scott Bessent put in the lows as his plea for monetary orthodoxy drove USDJPY down to 151.60 and Japan’s rejection of the plea sees us near 154 now. Few will remember this, I suppose, but this is a bit reminiscent of the 2003/2004 period when John Snow would visit Asia, Japan would back off interventions, and then the second he got on the plane to go home, they would start selling JPY again. Kind of like bow your head and say “yes sir, yes sir” until the guy is gone and then you do whatever you want.

Here’s a snippet, in case you are younger than me (which statistically speaking, you probably are)…

As noted yesterday, month end should be RHS cross/JPY given the enormous rallies in NASDAQ and SPX. After looking at the chart a bit more closely, I am moving my TP a bit lower because there is a double top at 154.77 around Valentine’s Day 2025. Note above that there are two tops at 156.70 and that is also the start of the verbal intervention zone, so any bullish strategy is probably capped there over the next two or three weeks.

Finally, note for future reference that the Sunday gap after Takaichi held, retested almost perfectly, and held again. It’s rare for Sunday gaps to remain unfilled so it’s quite the performance by USDJPY. I moved the TP to 154.64 (details always in sidebar).

META

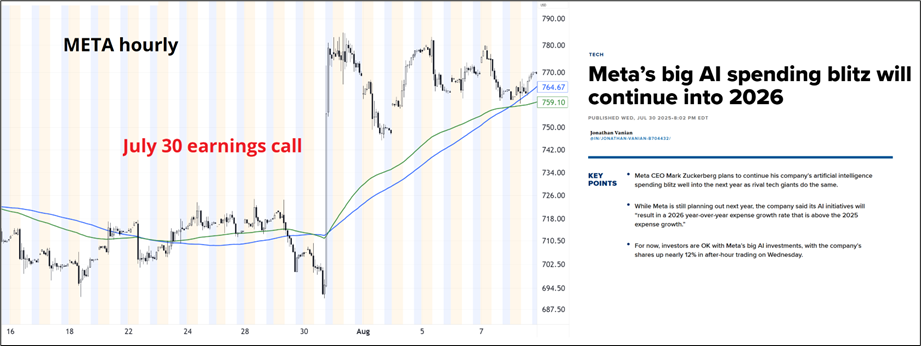

There was a time, about 5 months ago, when bragging about how nuts you’re going on capex was bullish.

The bottom two bullets from that CNBC article are:

- While Meta is still planning out next year, the company said its AI initiatives will “result in a 2026 year-over-year expense growth rate that is above the 2025 expense growth.”

- For now, investors are OK with Meta’s big AI investments, with the company’s shares up nearly 12% in after-hour trading on Wednesday.

“For now” was the key. Last night, META said essentially the same thing (2026 expenses will be high due to capex) and got a different result from the stock market.

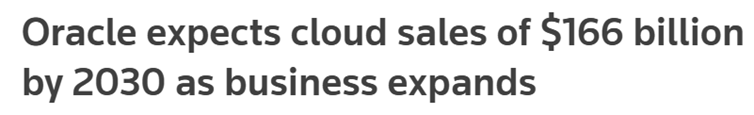

This is a big deal! The market is starting to show some impatience on the realization that $1.5T in capital spending (or whatever the number is) might not yield the revenues to generate pay back. You may have noticed that many tech firms have been making forecasts all the way out to 2030 of late, and I think this is another red flag. Management is starting to feel a bit of heat to show some kind of payoff, but there will be no payoff on any reasonable time horizon and therefore they have been forced to zoom out. Way the heck out.

I could be wrong, but I don’t remember firms in 2018 throwing out 2023 forecasts or firms in 2006 forecasting revenue for 2011. It feels a bit desperate to me. This chart from the Sparkline piece resonates:

Exhibit 7

Rising Capex Firms Underperform

Common knowledge says that you want to be long during a bubble and that stocks only go up and you should buy every dip in the stock market, and this has been correct for 17 years, pretty much. But in the short run, there is a ton of weird stuff going on. The record-low breadth, weakness in crypto, poor response of META to moar capex, and a Fed that maybe isn’t on autopilot anymore all make me cautious, and I am selectively shorting the stocks that I think are least attractive or most overblown. ORCL (see rising CDS there, too), CRWV, and NVDA all look like fair candidates to take a shot from the short side over the next few weeks. ORCL specifically looks to me like it wants to make a round trip…

You can make money both long and short during a boom. The corrections are vicious. I am generally not a fan of buying puts because you can get just as much leverage with outright shorts and you don’t decay. If ORCL goes above $300 or NVDA breaks $221, my gut is wrong here and I will move on with my life. I will never sit here bearish for weeks on end unless the trades are in the money. Opportunistic and tactical shots like this can work out, even if we are ultimately still in a bull market. I am not a professional equity analyst, and my views should be taken as ideas for your own assessment, not investment advice. Trade your own view.

I mentioned the crypto thing, and you might recall this happened in February. Crypto turned lower while QQQ kept chugging. Crypto was the leader (see cyan oval).

Fed

Powell is trying to make it at least seem like the Fed is not on autopilot, but I have a hard time believing him. The whole theatre here seems to be that Powell pretends to care about the inflation target, then the committee votes to cut rates and we move on. Still, you can’t completely dismiss the hawkishness with Schmid voting for no move and the (sparse) economic data holding in just fine.

Oh and there was a China deal last night. They will buy some soybeans.

Currencies

With month end coming, it’s hard to be long USD against EUR, AUD, and friends, but it’s starting to look like we might be in for a full fledged wipeout of the remaining USD shorts. AUDUSD looks particularly vulnerable as the market loaded up again after the strong Aussie CPI. I will consider selling any rally tomorrow.

Final Thoughts

- A nice piece by Cavallo and Llamas on how tariffs are impacting US prices. Via Mike G thanks.

https://www.pricinglab.org/files/TrackingTariffs_Cavallo_Llamas_Vazquez.pdf

- https://www.mercatus.org/research/policy-briefs/mysterium-body-called-fed-how-discretion-obscures-accountability

- Baseball is a connection to my Dad, my childhood, my friends, and my university days. A statistics nerd’s dream. Many of my most vivid memories feature baseball. The 1987 grounder through Manny Lee’s legs still haunts me at times. Thousands pouring into the streets of London, Ontario after winning the WS in 1992 and 1993. The 2019 World Series with my brother, etc. etc. And all the memories of Little League. Those games were everything at the time. BP for hours in the schoolyard, just me and my dad in dusty 30-Celsius heat.

Go Jays.

I’m out tomorrow, I’m going to the game in Toronto. It’s a dream come true for this guy:

Have a bang/bang day.

Physician: Your body has run out of magnesium

Me: 0mg

HT elgitt