RBNZ

Much as RBA expectations were too hawkish, I think RBNZ expectations are too dovish. Fiscal is pro-growth there now, milk prices at the highs, and inflation expectations are through the roof. The RBNZ 1-year consumer inflation expectation survey printed 5.6% this quarter vs. a bottom of 4.1% in SEP and DEC 2024 quarters.

I also think equities will continue to rally on positive seasonals (see Friday’s am/FX). And the market is still trapped long AUDNZD post-RBA.

Therefore, I like buying 2-day 86.10 calls in NZDJPY. This trade also takes advantage of the miniature Japan pivot that happened last night. While it’s easy to pooh pooh these verbal interventions, they send a clear signal from the authorities and are probably not meaningless. Tonight’s 40-year auction in JGBs will be closely watched. And closely-watched auctions very rarely tail.

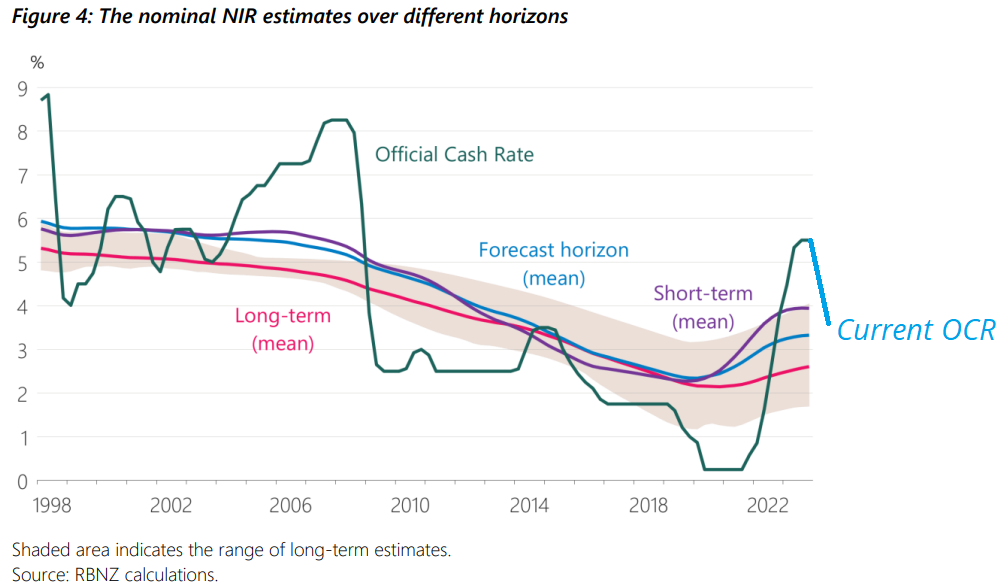

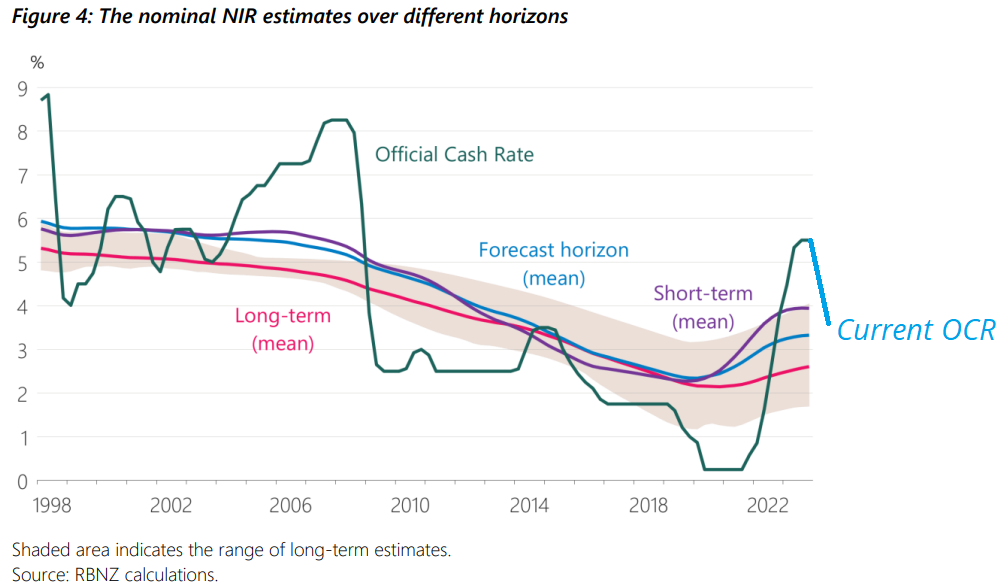

While the RBNZ’s range of nominal neutral rate estimates is so wide as to be functionally useless, we are getting towards the bottom end of that range so there is plenty of room for them to sound neutral/hawkish with ~2 more cuts priced after this one.

A simple short-term combination of hawkish RBNZ and decent JGB auction yields a 2-day NZDJPY call with an 86.10 strike. I am adding that to the sidebar, approximate cost is 36bps off 85.80 spot. If you prefer cash, a stop loss at 85.09 should work.

Last night’s news from Japan, however random it sounds, is a good example of why the bond vigilante trade is so difficult. It’s short carry, and it’s always threatened by government interventions, rule changes, and policymaker hooting and hollering. With the UK also making some noise on changes to issuance, and the Big Beautiful Bill in limbo for a few weeks, it’s going to be tough to stay short bonds for the next little bit. While you can argue these policymaker actions actually confirm there is a big problem with global debt, they also create tactical headwinds for the short duration trade.

https://www.bloomberg.com/news/articles/2025-05-27/japan-finance-ministry-is-said-to-sound-out-market-on-bond-sales

Final Thoughts

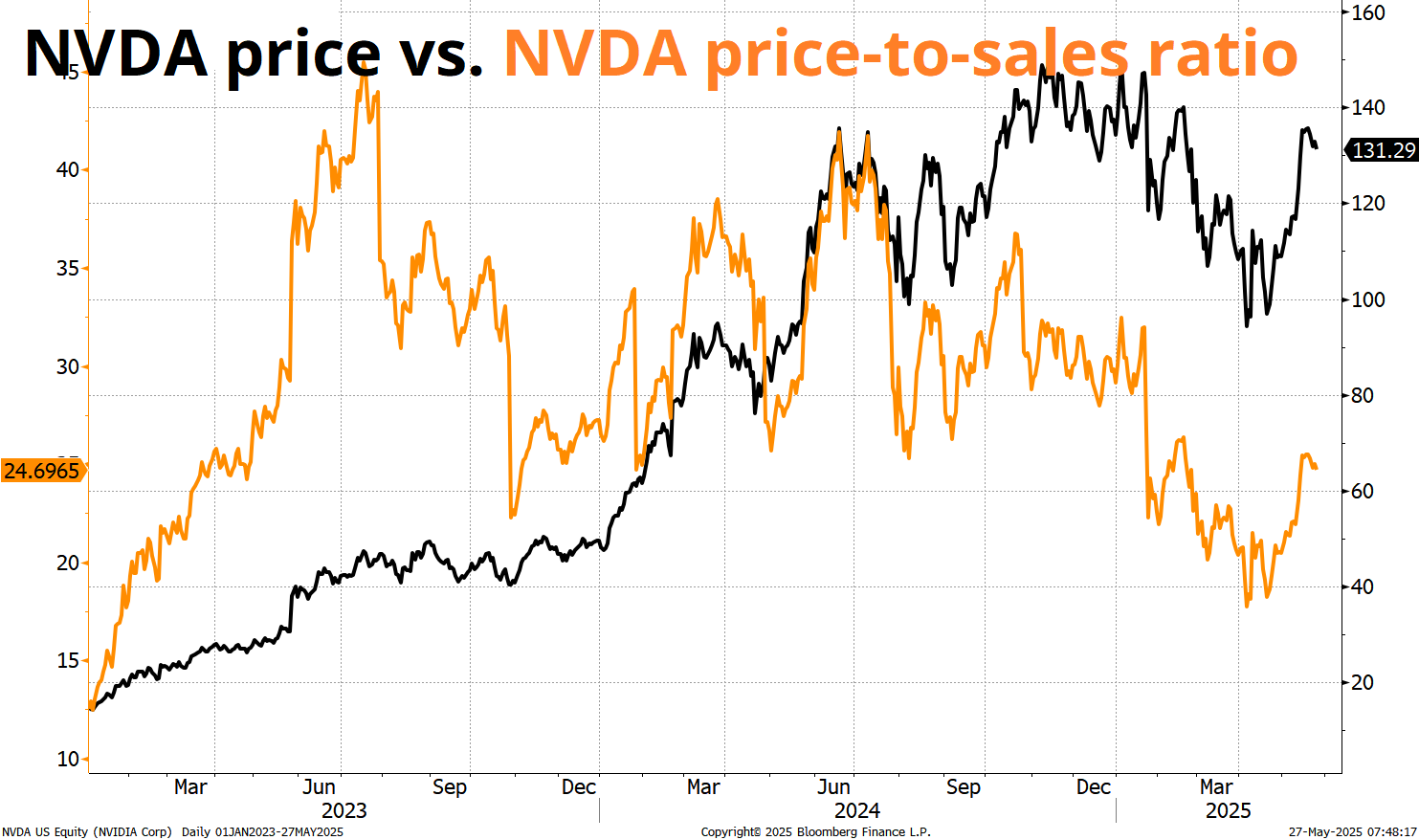

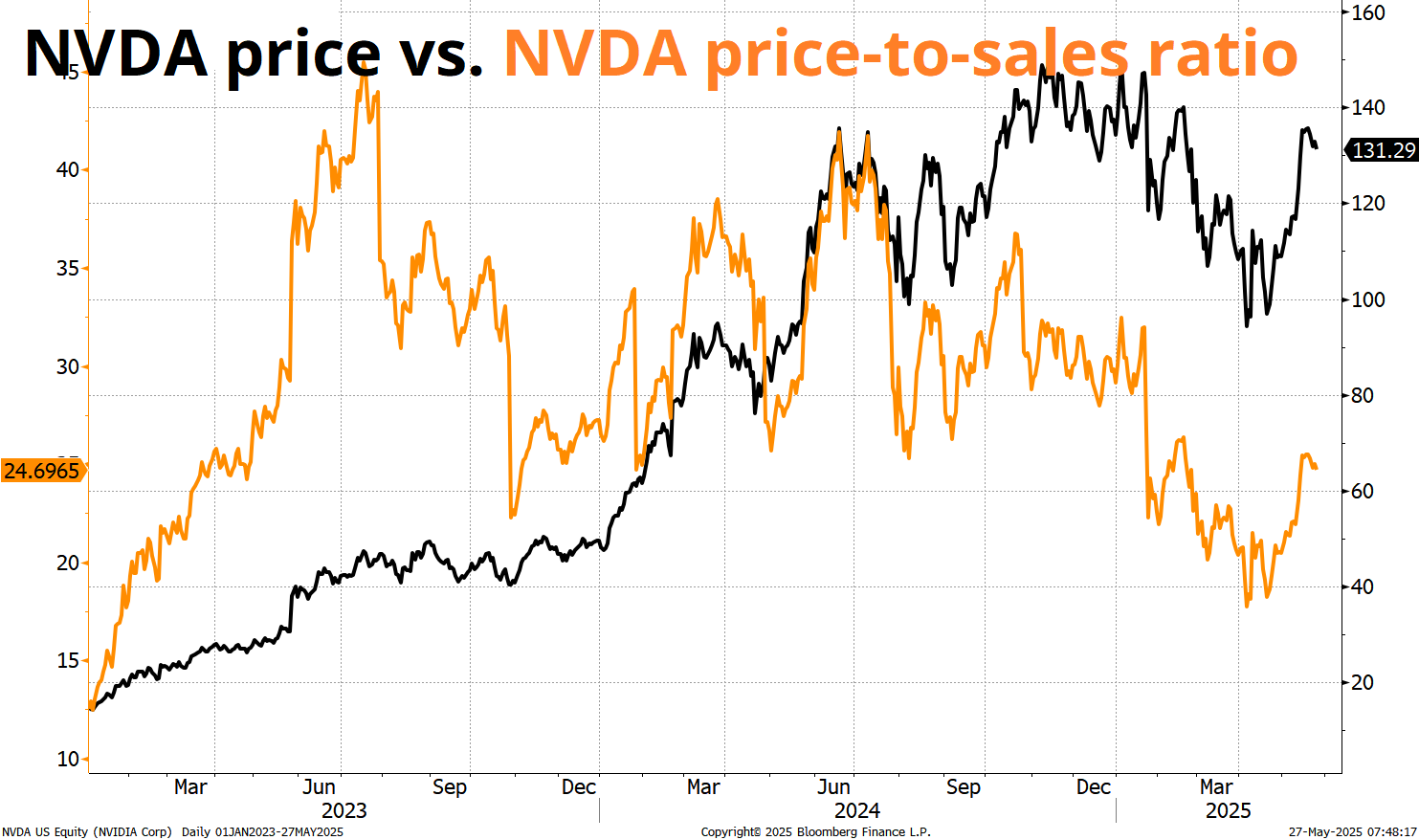

NVDA earnings are going to be super interesting this week as you have the issues around the H20 chips and export controls and so on, but you also have a months-long period of negative sentiment ever since DeepSeek and the price of NVDA is just one or two huge up days away from taking out the all-time highs. Furthermore, while the stock’s valuation in 2023 was comparable to Peak Cisco (40X sales), it’s been growing into its valuation after range trading for a year.

NVDA has been much-hated and with the AI narrative back on track somewhat (see CRWV stock, for example)… The shocker would be strong earnings and NVDA 150+. I’m going to look at NVDA and/or CRWV calls.

This week’s calendar is below.

Have a clever day.

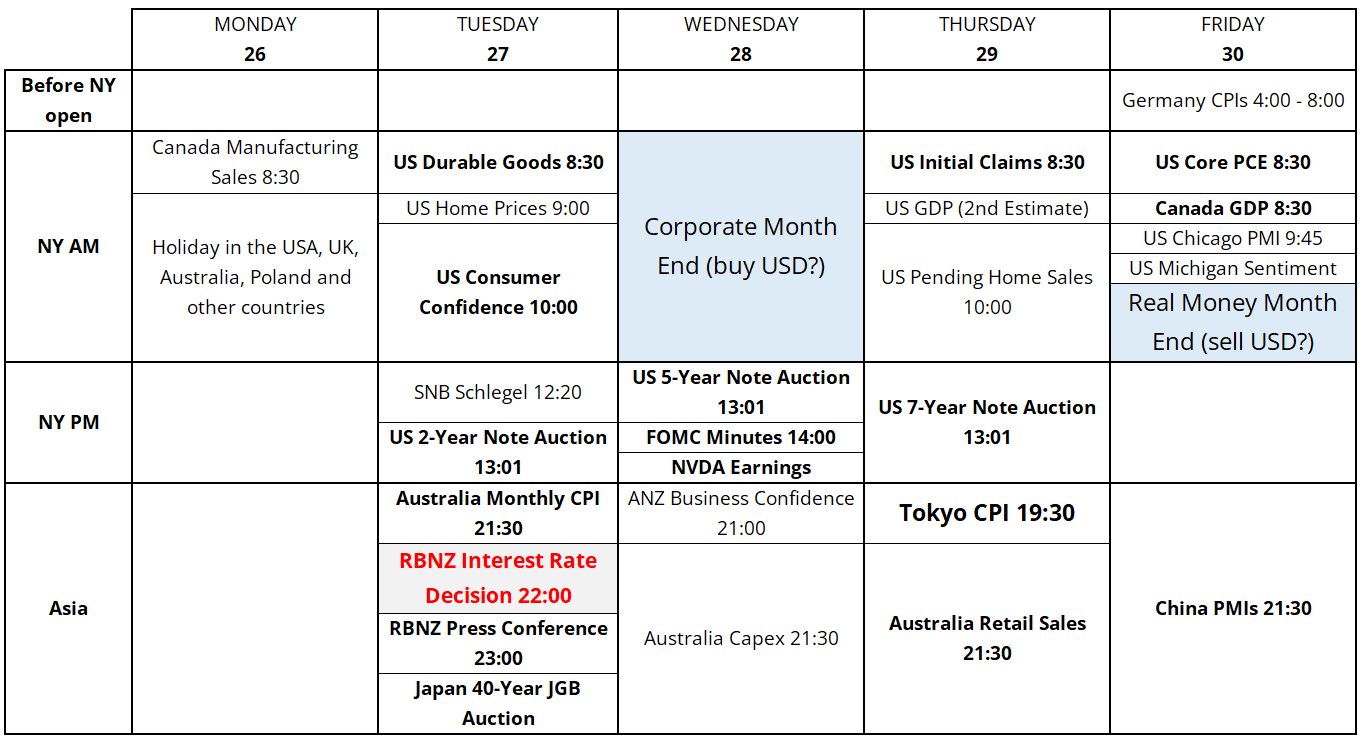

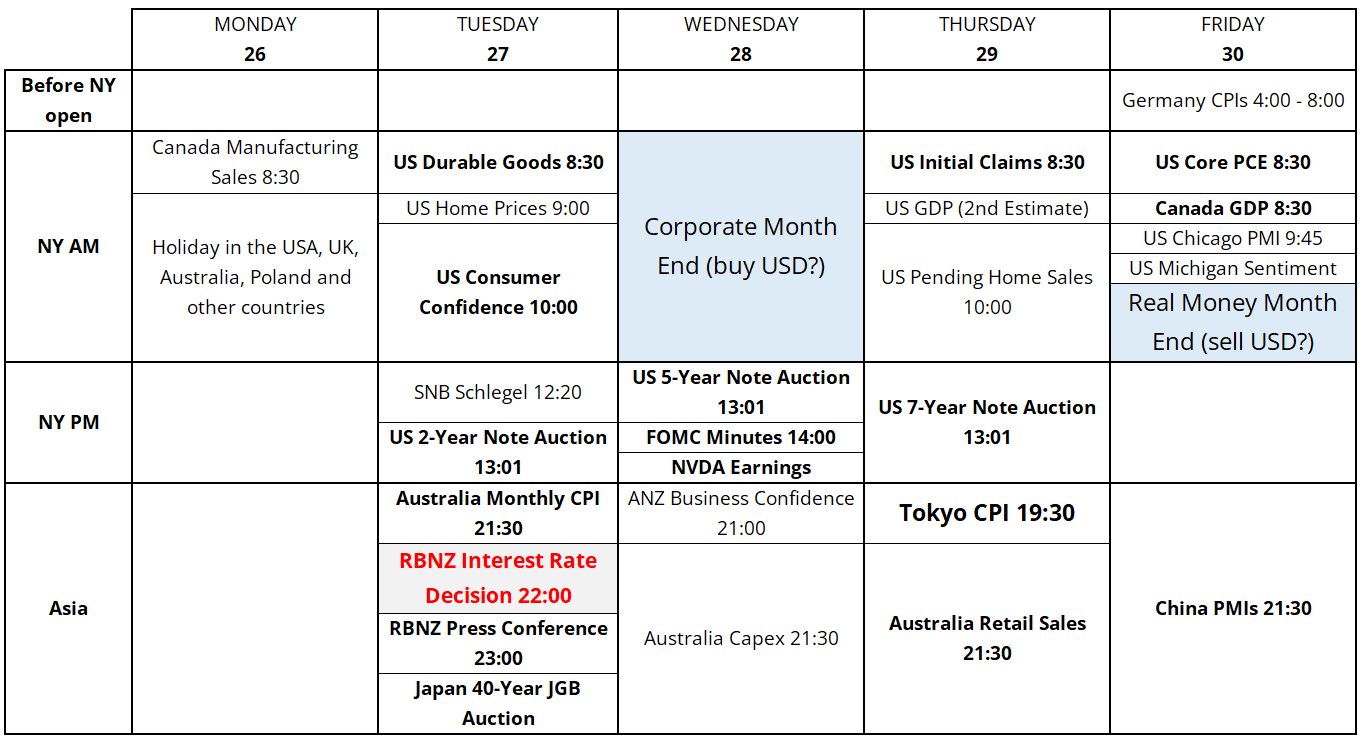

Calendar for the week of May 26, 2025